What is 3 Way Matching in Accounts Payable? Importance, Benefits and Comparison with 2 Way Matching.

Processing hundreds of invoices while maintaining accuracy? It’s a task, and not an error free one for the record. For accounts payable (AP) teams, this is a daily activity. Manual invoice processing often leads to payment discrepancies, missed deadlines, and costly duplicate payments. A bundle of issues that can disturb too many processes.

Think about these questions:

- How much time does your AP team spend cross-referencing purchase orders, receiving reports, and invoices?

- What’s the real cost of payment errors and fraud risks in your current verification process?

- Could your AP team handle twice the invoice volume without adding headcount?

3 way matching in accounts payable is a syncronised verification method that can validate payments easily. The accounts payable 3 way match process compares 3 documents — the purchase order, receiving report, and vendor invoice. For verifying accounts payable invoice processing – the ap three way match system is perfect. It can prevent fraud and ensure accurate payments, in a timely fashion.

Key Takeaways

- 3 Way matching in accounts payable keeps payments on hold until the PO, goods receipt, and invoice align.

- It cuts duplicate or fake invoices, closing gaps that let fraud slip through.

- Automated variance checks surface price or quantity errors early, so staff fix issues fast.

- By removing hand checks, AP teams clear larger invoice stacks without extra hires.

- Accurate matches improve supplier trust, opening chances for early-pay discounts.

- Clear audit logs satisfy finance leaders and reduce stress during compliance reviews.

What Is 3 Way Matching in Accounts Payable?

3 Way matching in accounts payable is a control that confirms a vendor bill agrees with two earlier documents before money moves. It compares the purchase order (PO), goods receipt note (GRN), and vendor invoice so payments cover only what was ordered and delivered.

Key documents checked:

- Purchase Order (PO): Lists agreed items, quantities, and prices.

- Goods Receipt Note (GRN): Confirms the business actually received those items.

- Vendor Invoice: States the amount the supplier expects to be paid.

How the check runs:

- AP reviews the PO to verify it was approved and priced correctly.

- The team matches invoice lines against the PO for item, quantity, and price agreement.

- They then match both documents to the GRN to confirm delivery details.

- If everything aligns, the invoice moves to payment; any mismatch pauses payment until corrected.

By setting these three checkpoints, companies block duplicate bills, pricing errors, and fake invoices before cash leaves the account.

Why Is 3 Way Matching Important in Accounts Payable?

A single missed mismatch can cost thousands, so three-document matching adds an extra layer of certainty to every payment run. It guards cash, supports audits, and keeps vendor ties healthy.

Core pay-off points:

- Fraud control: Matching three sources makes it harder for fake invoices to slip through.

- Cost protection: The company pays only for received goods or services, cutting overpayments.

- Higher accuracy: Fewer entry errors mean cleaner ledgers and less rework.

- Faster throughput: With clear matches, AP teams spend less time resolving disputes.

- Stronger vendor trust: Consistent, correct payments help suppliers prioritize future orders.

These benefits grow as transaction volumes rise, turning 3 Way matching into a vital safeguard for modern AP teams.n. Its importance grows as organizations scale their operations.

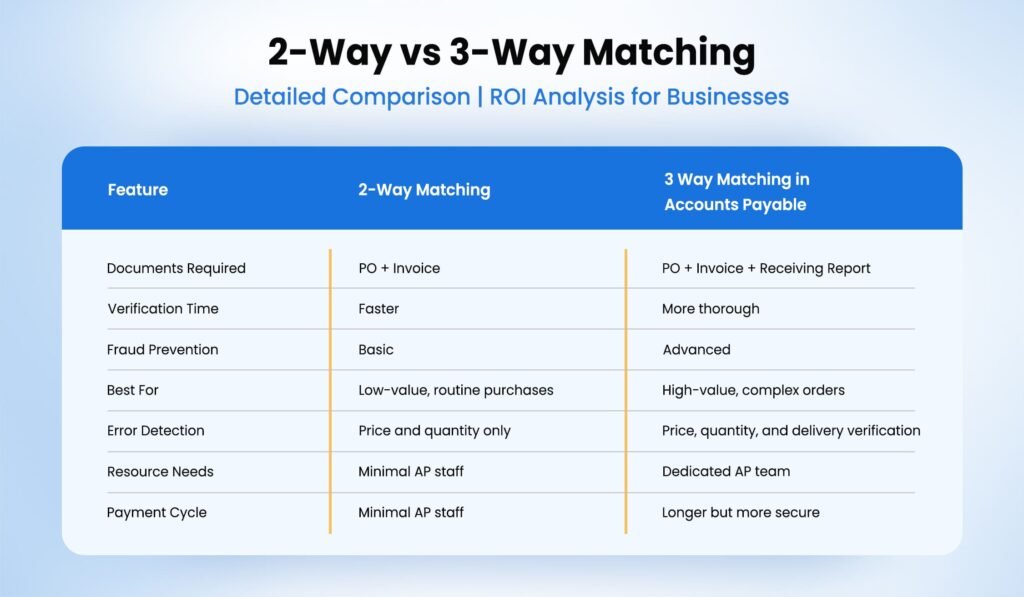

2-Way vs 3-Way Matching: Which Fits Your Accounts Payable Flow?

Quick choice guide: use two-way matching when speed matters and risk is low; choose 3 way matching in accounts payable when transaction value, regulation, or fraud exposure rises.

Selection points to weigh:

- Transaction size and frequency

- Available AP headcount or automation tools

- Industry or audit rules that demand extra checks

- Supplier track record and relationship complexity

- Tolerance for payment errors versus speed needs

Pick the method or mix of methods that balances risk control with processing speed for your specific payables workload.

Benefits of 3 Way Matching in Accounts Payable

Strong controls keep cash safe. 3 way matching in accounts payable adds that control by forcing every invoice to agree with its purchase order and goods receipt before money moves.vantage will contribute towards your financial prowess.

- Fraud prevention: Comparing the PO, GRN, and invoice shuts out fake or duplicate bills before payment leaves your account.

- Cost savings: Your business pays only for goods or services that were ordered and received, trimming over-payments.

- Improved accuracy: Systematic checks catch pricing or quantity errors early, so ledgers stay clean.

- Faster invoice processing: With fewer discrepancies to investigate, AP teams clear invoices more quickly and meet due-date targets.

- Better vendor relationships: Consistent, on-time, and correct payments build trust and often lead to more favourable terms.

Implementation tips:

- Start the three-document match on high-value orders first.

- Document each verification step and train staff on exception handling.

- Track processing time, error counts, and discount capture to measure gains.

- Refine matching rules as supplier patterns and business needs evolve.

When done well, 3 way matching changes payables from reactive clean-up to proactive control. The result is tighter cash management, fewer surprises, and stronger supplier ties.

Automating 3 way Matching in Accounts Payable: Scaling Without Headcount

Manual 3 way matching in accounts payable takes good amount of time and resources. AP teams often spend hours comparing documents. This means: processing delays and missed discounts.

Automation replaces this with speed and precision. Easiest way to improve efficiency.

How Automation Transforms AP Matching:

- Instant document comparison and validation

- Real-time exception flagging

- Automated routing for approvals

- Digital audit trail creation

- Customizable matching rules

The accounts payable 3 way match becomes even better because of automation. Modern AP systems extract data from purchase order (POs), receiving reports, and invoices automatically. This reduces manual data entry by 90%

It also speeds up processing times from days to minutes.

What is three way matching in accounts payable look like in automated systems? The ap three way match process runs continuously in the background. It compares documents as they arrive.

Your team only needs to review exceptions, focusing on resolving remnant issues. No need to stress about routine matching.

Automated matching improvises how AP teams operate. It allows them to process more invoices without adding staff. Your organization gains accuracy, speed, and better control over the payment process.

Why Should You Choose KlearStack for 3 Way Matching in Accounts Payable to Enhance Invoice Processing

Why Should You Choose KlearStack?

The accounts payable 3 way match process transforms with KlearStack’s template-less, AI-powered document processing. Our solution achieves 99.9% accuracy through a multi-stage approach that uses advanced OCR accuracy methods, making document verification effortless for AP teams.

Smart Processing Capabilities:

- Pre-processing stage enhances document quality automatically

- Intelligent classification identifies document types instantly

- Self-learning AI adapts to new layouts without manual training

- Three-layered validation ensures data accuracy

- Business rules engine customizes to your requirements

The 3 way matching in accounts payable becomes truly automated with KlearStack’s straight-through processing. Our AI extracts data from invoices, purchase orders, and receiving reports regardless of format variations, while continuously learning from each processed document.

Advanced Technology Benefits:

- Deep learning models handle changing document layouts

- Natural Language Processing for intelligent field extraction

- Computer Vision technology for superior accuracy

- Automated reconciliation checks

- Complete audit trail maintenance

What sets KlearStack apart? While others rely on templates, our solution offers seamless integration through RESTful APIs with your existing systems — SAP, QuickBooks, and more.

The ap three way match workflow maintains data security and compliance while reducing manual intervention.

Implementation Excellence:

- Rapid deployment with minimal setup

- Open APIs for flexible integration

- Secure document handling

- Continuous AI learning and adaptation

- 24/7 dedicated support

Want to see KlearStack live in action? Book a Free Demo Call Right Away!

Final Thoughts

3 way matching in accounts payable is a verification method that balances thoroughness with efficiency. The accounts payable 3 way match process offers clear advantages: reduced payment errors, stronger fraud prevention, and improved vendor relationships.

Deciding what is three way matching in accounts payable worth comes down to transaction complexity and volume. By implementing this process — especially through automation — AP become more equipped and salient.

Your choice between what is 2 way and 3-way matching in accounts payable will depend on your organization’s specific needs. 2-way matching suits simple and routine purchases.

The ap three way match provides the dynamic verification needed for complex transactions.

By choosing the right verification method and automating where possible, your AP team can handle increasing transaction volumes while maintaining high accuracy rates.