End Manual Document Compliance using Vertical AI

Shift supply chain and loan compliance from bottleneck

to AI-enabled confidence and operational excellence.

Loved by All!

Awards and Recognitions

Contest 2020, Tokyo

Challenge 2019

Contest 2019, India

Weekend 2019

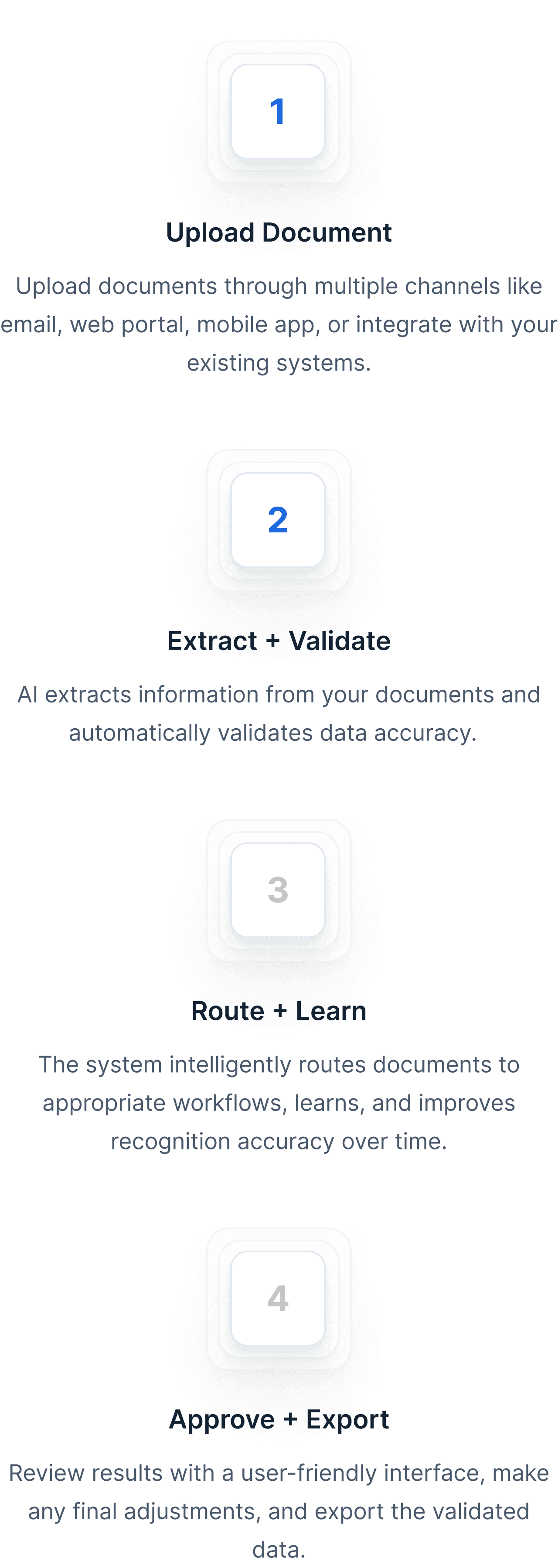

Collect invoices and delivery notes from emails, uploads, and FTP. All in one place.

Right In

Managing high volumes of purchase orders, invoices, and delivery notes is overwhelming and error-prone. KlearStack automates data extraction and verification, effortlessly handling massive document volumes with precision.

Slowing Down

Designed to handle everything from small batches to enterprise-scale document volumes, KlearStack grows with your business. Experience consistent performance even as your data processing needs expand.

Quicker

Instantly extract structured data from complex documents like invoices, POs, and receipts. KlearStack’s AI-driven engine ensures rapid and accurate data capture with minimal manual effort.

Business

KlearStack’s AI continuously learns from user feedback and new document types, improving accuracy over time. This adaptive intelligence ensures better performance as your business scales.

with KlearStack AI

While we don’t showcase testimonials, we’re the top choice for leading BFSI and logistics companies.

document processing workflow in just 7 Days!

![Complete Guide to Bank Check Extraction using OCR: Benefits and Solution [2025]](https://lightgrey-antelope-914579.hostingersite.com/wp-content/uploads/2025/06/KlearStack-Feature-Image.png)