What is Accounts Payable Invoice Processing?

When suppliers hit pause on raw materials or stop services due to delayed payments, your business operations face immediate disruption. For many organizations, this scenario isn’t hypothetical – it’s a recurring challenge that stems from inefficient accounts payable invoice processing.

Think About This:

- What’s the true cost of delayed vendor payments beyond the obvious late fees?

- How many hours does your AP team spend on manual data entry instead of strategic financial planning?

- Why do modern businesses still process invoices like it’s 1990?

The traditional accounts payable invoice processing approach demands excessive time – often weeks to complete a single payment cycle. This outdated method creates a bottleneck that modern businesses can’t afford.

Most AP teams know they need change, but implementing accounts payable automation process isn’t limited to digitizing papers. It should transform your entire payment workflow.

Best AP automation solutions have transformed what used to be a weeks-long effort into a simplified operation that takes hours. By examining current accounts payable invoice processing best practices and understanding how technology reshapes payment workflows, you’ll discover practical ways to prevent payment delays, maintain vendor relationships, and give your AP team the tools they need to succeed.

What is Accounts Payable Invoice Processing?

Every financial transaction with suppliers sets off a sequence of tasks in your accounting department. Accounts payable invoice processing forms the backbone of this operation – it’s the systematic method your team uses to handle incoming bills, validate payment information, and ensure timely disbursement to vendors.

Essential Components:

- Invoice receipt and invoice data extraction: Converting paper or PDF documents into structured data

- Verification protocols: Matching invoice details with purchase orders and delivery receipts

- Approval workflows: Moving documents through designated checkpoints

- Payment scheduling: Setting up disbursement timelines based on terms

The traditional approach to accounts payable invoice processing often creates unnecessary complexity. When AP teams manually input data, match documents, and route approvals, they’re increasing the risk of errors and delayed payments.

Best AP automation transforms this process by removing manual touchpoints. Modern accounts payable automation process implements AI-powered tools that capture invoice data instantly, reducing processing time from weeks to hours.

This shift enables your AP team to focus on strategic tasks like vendor relationship management and cash flow optimization.

Quick Implementation Facts:

- Digital automation reduces processing costs

- AI-based validation catches errors before they impact vendor payments

- Mobile approval apps speed up processing

- Real-time visibility helps track every invoice’s status

By implementing current accounts payable invoice processing best practices, organizations create a predictable, efficient payment system. This approach doesn’t just modernize your AP department – it transforms how your entire business handles financial obligations.

Importance of Accounts Payable Invoice Processing

Accounts payable teams often rely on accounts payable invoice processing to verify the accuracy of supplier invoices. This ensures that the amounts, terms, and other invoice data on the invoices match the agreed-upon terms and purchase orders.

But, how does this facilitate the business’ financial operations?

- Strengthens supplier-vendor relationships

Best AP automation and accounts payable invoice processing helps prevent overpayments, underpayments, and disputes. This in turn, supports effective financial management and vendor relationships through a streamlined accounts payable automation process.

- Ensures that payment obligations are met on time

Effective accounts payable invoice processing ensures that payment obligations to suppliers and vendors are met on time. This helps in preventing any disruptions in the supply chain and maintaining smooth cash flow operations.

- Enables effective budgeting and forecasting

Businesses can precisely track their expenses, identifying where and how their funds are allocated. Following accounts payable invoice processing best practices provides detailed insight into spending patterns, allowing for a more accurate budgeting process, and allocating resources effectively.

- Identify Cost Patterns

Through the systematic analysis of processed invoices, businesses can identify recurring cost patterns, potential areas of overspending, or irregularities in pricing. This information is instrumental in making informed decisions to optimize expenditure and eliminate unnecessary or excessive costs.

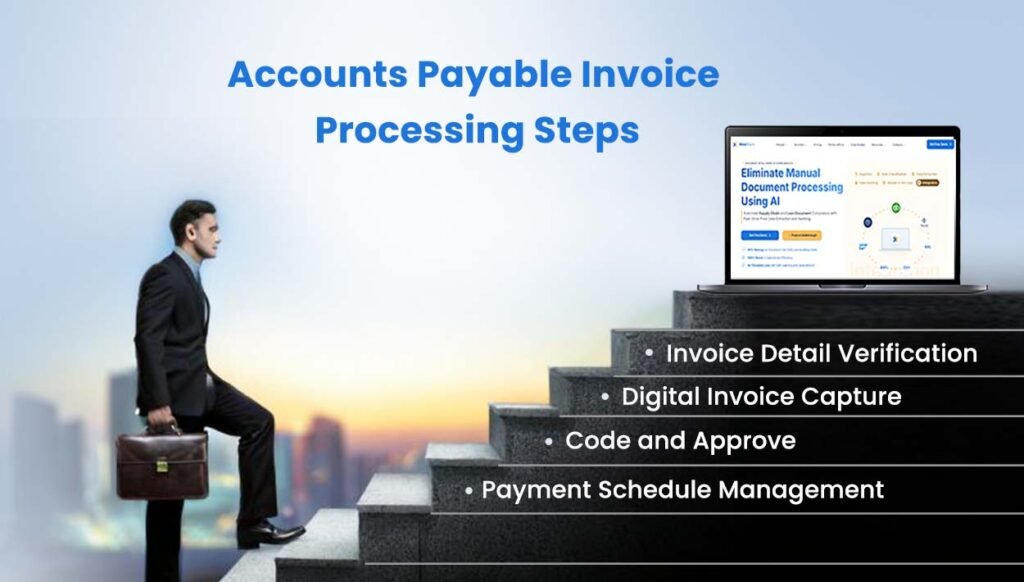

Accounts Payable Invoice Processing Steps

Let us know the steps for accounts payable invoice processing in details:

Step 1: You Receive an Invoice and Verify the Accuracy of Its Details Learning how to process invoices in accounts payable begins when documents arrive, and specific details need verification.

These are:

- Agreed-upon prices

- Billed items

- Invoice terms This thorough review helps prevent potential overpayments, discrepancies, or unauthorized charges. It maintains the company’s financial accuracy and builds trust with suppliers.

Step 2: Scan and Record the Invoice into the Company’s System The accounts payable invoice process starts with converting vendor invoices into digital format. This step makes all invoices digitally available and easily accessible, providing secure financial record backup.

Through invoice automation, it improves AP operations while maintaining reliable transaction records.

Step 3: Accounts Payable(AP) Department will Approve Invoice Details & Assign Accounting Codes for Ease of Tracking Once invoices pass verification, they move to the designated AP Department.

These authorized individuals perform the following tasks:

- Assess the validity of the expenses.

- Assign appropriate accounting codes for invoice tracking and categorization.

- The automated accounts payable process speeds up approvals and ensures precise cost allocation in financial records.

Step 4: Invoice Payments are Scheduled to Avoid Late Fees After receiving approvals, the accounts payable invoice process continues with settling invoices within agreed payment terms.

By following scheduled payment dates, the company:

- Avoids late fees

- Maximizes early payment discounts

- Improves financial standing with vendors

To make invoice processing efficient and ensure timely payments, suppliers recommend adopting Intelligent Document Processing (IDP).

IDP solutions, are AI-based Optical Character Recognition (OCR) technology, enabling data scanning.

It uses Artificial Intelligence (AI) and Machine Learning (ML) to process and analyze data, improving overall accounts payable invoice processing efficiency.

Best AP automation solutions like KlearStack make invoice processing faster and more accurate. The integration of IDP with accounts payable automation process creates a streamlined workflow, following accounts payable invoice processing best practices.

Benefits of Automating Invoice Processing in Accounts Payable

The automated accounts payable process offers significant advantages. Let’s examine these benefits through KlearStack, an advanced accounts payable invoice processing solution.

- Time Optimization: KlearStack minimizes manual data entry through invoice automation, allowing your team to prioritize strategic financial tasks.

- Error Reduction: Following accounts payable invoice processing best practices, KlearStack ensures accurate and timely supplier invoice handling while minimizing manual mistakes.

- Cost Efficiency: By implementing best AP automation practices, KlearStack reduces operational expenses through automated data capture and digital processing.

- Enhanced Visibility: Understanding how to process invoices in accounts payable becomes simpler as KlearStack provides clear invoice status tracking, supporting informed payment planning.

- Regulatory Adherence: The accounts payable invoice process includes detailed audit tracking and standardized procedures, helping maintain industry compliance and reduce risk exposure.

- Vendor Relations: The accounts payable automation process through KlearStack ensures consistent, accurate payments, building reliable supplier partnerships.

- Environmental Impact: Digital transformation with KlearStack supports sustainable practices by eliminating paper usage and reducing physical storage needs.

- Scalable Operations: The accounts payable invoice process adapts smoothly to increasing invoice volumes, supporting your business expansion.

- Analytics-Based Planning: KlearStack provides detailed performance metrics, helping identify optimization opportunities and guide financial strategy.

Financial service providers can optimize their accounts payable invoice process through systematic analysis, identifying efficiency improvements and strategic opportunities.

Why Should You Choose KlearStack?

KlearStack stands out in accounts payable invoice processing by addressing specific challenges that finance teams face daily. Our solution works with multiple document types – from basic invoices to complex financial statements – providing accuracy rates that exceed 99%.

Smart Processing Highlights:

- Multi-format document handling: PDF, scanned images, emails

- Intelligent data capture across varied invoice layouts

- Real-time validation against your business rules

- Integration with existing accounting systems

The accounts payable automation process through KlearStack adapts to your unique workflows. Our AI-driven system learns from your corrections, improving accuracy with each processed document.

This makes us the best AP automation choice for organizations seeking reliable, intelligent processing.

Advanced Capabilities:

- Automated three-way matching

- Exception handling alerts

- Custom validation rules

- Multi-currency support

By following accounts payable invoice processing best practices, KlearStack reduces manual intervention. The system validates line items, tax calculations, and payment terms automatically, flagging discrepancies for quick resolution.

Payment Processing Features:

- Automated approval workflows

- Payment scheduling automation

- Vendor portal access

- Audit trail maintenance

Our commitment to accounts payable invoice processing excellence shows in our customer success stories. Organizations report cutting their processing time from weeks to hours, with significant cost reductions in their AP operations.

Want to see KlearStack live in action? Book a Free Demo Call Now!

Conclusion

Modern accounts payable invoice processing demands more than digital document storage – it requires intelligent automation that adapts to your business needs.

Organizations implementing accounts payable automation process report significant improvements:

- Processing times drop from weeks to hours

- Error rates decrease significantly

- AP teams gain time for strategic financial planning

Best AP automation focuses on transformation. When teams shift from manual processing, they create space for planned vendor relationships, proactive cash flow management, and data-driven financial decisions.

Companies following current accounts payable invoice processing best practices find themselves better positioned to scale operations, maintain compliance, and support business growth.The choice between maintaining traditional methods and embracing automation should focus on securing your organization’s financial future. By implementing intelligent document processing solutions, you’re not only optimizing current operations but preparing your business for tomorrow’s challenges.

FAQs on Invoice Processing in Accounts Payable

Invoice processing in accounts payable refers to the systematic handling of supplier invoices within a business. It involves tasks such as verification, approval, payment scheduling, and recording in the company’s financial records.

Invoice processing involves four steps–

Step 1: Invoice receipt and verification

Step 2: Record keeping

Step 3: Approval

Step 4: Payment processing and scheduling

These ensure accurate and timely management of financial transactions.

The accounts payable process involves the end-to-end management of the company’s short-term financial obligations to suppliers and vendors. It encompasses tasks such as invoice processing, payment management, expense tracking, and regular reconciliation of accounts. These tasks maintain financial accuracy and transparency.

The four key functions of accounts payable include–

1. Invoice processing

2. Record-keeping

3. Payment management

4. Vendor relationship management

These four functions ensure the efficient management of financial transactions. This would mean timely payments and strong supplier-vendor relationships.