AP Automation Cost: Pricing Models and ROI Analysis for 2025

AP automation cost varies significantly based on invoice volume and required features. As per Mineraltree that manual invoice processing costs between $12-$40 per invoice, while automated solutions can reduce this to as low as $1-$2 per invoice.

Companies processing thousands of invoices monthly face mounting pressure to reduce operational expenses.

Finance teams need clear cost breakdowns before investing in AP automation solutions. Automated document processing resolves bottlenecks to improve supplier relationships. Manual processing creates delays that impact early payment discounts and cash flow management.

- How much should your organization budget for AP automation implementation?

- What hidden costs might affect your total investment in automated invoice processing?

- Which pricing model delivers the best return on investment for your company size?

Understanding AP automation cost helps finance leaders make informed technology investments. The right solution reduces processing time while improving accuracy rates through intelligent document processing capabilities. Cost analysis should include both upfront implementation expenses and ongoing operational savings.

Key Takeaways

- Manual invoice processing typically costs $12-$40 per invoice while automation reduces costs to $1-$2 per invoice

- Company size directly impacts pricing with entry-level solutions starting at $8,000 annually for small businesses

- Invoice volume, required features, and system integration complexity are primary cost drivers

- Mid-tier companies spending $15,000-$35,000 annually see average ROI improvements within 12-18 months

- Implementation and training costs add 10-20% to initial solution investment

- Hidden costs include data migration, custom workflow setup, and ongoing support requirements

- Volume discounts become available for companies processing over 1,000 invoices monthly

What is AP Automation Cost?

AP automation cost refers to the total investment required to implement and maintain automated accounts payable systems. This includes software licensing, implementation services, and ongoing support expenses. Organizations evaluate these costs against current manual processing expenses to determine ROI potential.

The investment covers multiple components beyond basic software licensing. Accounts Payable AutomationSetup costs include data migration from existing systems and staff training programs. Ongoing expenses involve monthly or annual subscription fees plus any transaction-based charges.

- Cost Components Breakdown:

Software licensing represents the largest expense category for most implementations. Monthly subscription models range from basic plans to full-featured enterprise solutions. Transaction-based pricing charges fees per processed invoice or document.

- Implementation and Setup Investment:

Professional services help configure workflows and integrate existing systems. Training programs teach staff how to use new automated processes. Data migration transfers historical records and vendor information to the new platform.

- Ongoing Operational Expenses:

Support and maintenance fees keep systems running properly. Software updates and feature additions may require additional licensing costs. Regular training sessions help staff adapt to new features and best practices.

Understanding total cost of ownership helps organizations budget appropriately for AP automation projects.

Comparing costs against current manual processing expenses reveals potential savings opportunities. This analysis guides decision-making around solution selection and implementation timing.

Cost Per Invoice: Manual vs Automated Processing

Manual invoice processing costs vary widely based on staff wages and processing complexity. Research indicates processing one invoice manually requires 30-60 minutes of staff time. When factoring in wages, benefits, and overhead costs, each invoice costs $12-$40 to process completely.

Automated systems dramatically reduce per-invoice processing costs through technology improvements. Machine learning algorithms extract data from invoices without human intervention. OCR technology reads different document formats and layouts automatically.

Manual Processing Cost Factors:

- Staff Time Investment: Finance staff spend significant time entering invoice data manually

- Error Correction Overhead: Mistakes require additional time to identify and fix

- Approval Workflow Delays: Paper-based approvals slow down processing cycles

Automated Processing Advantages:

Processing costs drop to $1-$2 per invoice with proper automation implementation. Smart data extraction eliminates manual entry requirements. Automated approval workflows reduce processing time from days to hours.

Volume Impact on Pricing:

Higher invoice volumes typically result in better per-unit pricing from vendors. Companies processing over 1,000 invoices monthly qualify for volume discounts. Enterprise clients often negotiate custom pricing based on annual processing volumes.

The cost difference becomes more significant as invoice volumes increase. Small businesses processing 100 invoices monthly save approximately $1,500-$3,500 monthly through automation. Larger organizations processing thousands of invoices see proportionally higher savings opportunities.

AP Automation Pricing by Company Size

Entry-level companies with 1-20 employees typically invest $8,000-$15,000 annually in AP automation solutions. These packages include basic invoice processing and simple approval workflows. Small business plans focus on core functionality without advanced reporting features.

Mid-tier organizations employing 20-100 staff members require more robust solutions. Annual investments range from $15,000-$35,000 for these implementations. Additional features include multi-location support and advanced analytics dashboards.

- Small Business Pricing Structure:

Basic plans target companies processing fewer than 500 invoices monthly. Pricing often includes per-user licensing with limited document processing volumes. Entry-level solutions may charge additional fees for premium features like custom reporting.

- Mid-Market Investment Levels:

Companies in this segment need scalable solutions that grow with business needs. Pricing models often combine user licensing with transaction-based charges. Integration capabilities with existing ERP systems become important cost considerations.

- Enterprise Pricing Considerations:

Large organizations with 100-500 employees invest $35,000-$100,000 annually in AP automation. Enterprise solutions include advanced workflow customization and dedicated support teams. Volume discounts and custom pricing arrangements are common for these implementations.

- Factors Affecting Size-Based Pricing:

Geographic distribution impacts implementation complexity and costs. Multi-currency processing adds technical requirements that increase pricing. Compliance requirements in regulated industries may require specialized features that affect overall investment levels.

Companies should evaluate pricing against current manual processing costs to determine value. Size-appropriate solutions prevent over-investment in unnecessary features while ensuring adequate functionality for business needs.

Key Factors That Influence AP Automation Cost

Invoice volume directly impacts both software licensing costs and implementation complexity. Solutions often include tiered pricing based on monthly processing volumes. Higher volumes typically qualify for better per-invoice rates but may require more robust infrastructure.

Feature requirements significantly affect total investment levels through data automation needs and workflow complexity.

Basic data extraction costs less than advanced approval workflows with multi-level authorization. OCR capabilities, payment processing integration, and reporting dashboards add to overall solution costs.

1. Technology Integration Complexity:

Existing ERP system integration affects implementation costs substantially. Simple integrations with popular accounting software cost less than custom API development. Legacy system connections often require additional consulting services and development work.

2. Customization and Workflow Requirements:

Standard workflows meet most basic processing needs without additional costs. Custom approval hierarchies and specialized routing rules require development services. Industry-specific compliance features may need tailored configuration work.

3. Training and Change Management:

Staff training programs are essential for successful implementations. Basic training is often included in implementation packages. Advanced training for power users and administrators may require additional investment.

4. Geographic and Compliance Considerations:

Multi-location deployments increase complexity and costs. International operations may need currency conversion and tax compliance features. Regulatory requirements in industries like healthcare or finance add specialized functionality needs.

5. Vendor Support and Service Levels:

Basic support is typically included in subscription pricing. Premium support with dedicated account management costs more but provides faster response times. Professional services for ongoing optimization represent additional investment opportunities.

Understanding these factors helps organizations budget accurately for AP automation projects. Prioritizing essential features while planning for future growth ensures appropriate investment levels.

AP Automation as a Business Investment

AP automation delivers measurable returns through reduced labor costs and improved processing times. Organizations typically see ROI within 12-18 months of implementation. The investment pays for itself through faster invoice processing and reduced manual effort requirements.

Labor cost savings represent the most significant return category. Automating data entry eliminates hours of manual work weekly. Staff can focus on higher-value activities like vendor relationship management and financial analysis.

1. Quantifiable Return Categories:

Processing speed improvements reduce payment cycle times significantly. Faster processing allows companies to capture early payment discounts more frequently. Improved cash flow management provides additional financial benefits beyond direct cost savings.

2. Error Reduction Benefits:

Manual processing errors create costly corrections and vendor relationship issues. Automated systems reduce data entry mistakes through technology validation. Fewer errors mean less time spent on exception handling and dispute resolution.

3. Compliance and Audit Advantages:

Digital records improve audit trail documentation and regulatory compliance. Automated approval workflows create clear accountability chains. Real-time reporting helps finance teams monitor processing performance and identify improvement opportunities.

4. Strategic Business Impact:

Faster processing improves supplier relationships through reliable payment timing and automated invoice processing workflows. Better cash flow visibility helps with financial planning and decision-making. Automated reporting provides insights that support strategic business initiatives.

5. Long-term Value Creation:

Scalable systems grow with business needs without proportional cost increases. Technology investments position companies for future growth and expansion. Improved processing capabilities support acquisition integration and business development activities.

Companies should evaluate AP automation as a strategic technology investment rather than just an expense reduction initiative. The right solution creates value through improved operations and better financial management capabilities.

Why Should You Choose KlearStack to Reduce AP Automation Cost?

The AP automation market is filled with solutions that promise cost savings but deliver complex implementations and hidden fees. KlearStack takes a fundamentally different approach to addressing the real cost challenges finance teams face.

Core Cost Advantages:

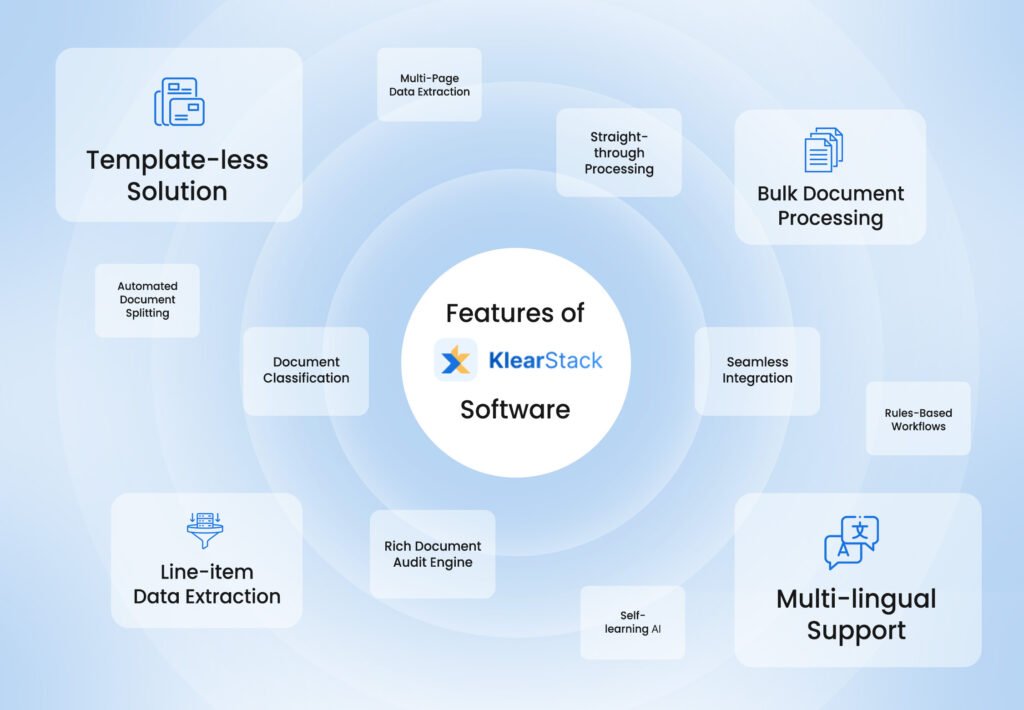

Most AP solutions require extensive template configuration, adding weeks to deployment timelines and thousands in professional services costs. KlearStack’s template-free architecture processes invoices immediately:

- Zero setup delays – Process documents from day one without configuration

- No template maintenance costs – System adapts to new formats automatically

- Reduced implementation fees – Pre-built integrations eliminate custom development

Measurable Performance Impact:

Finance teams report consistent outcomes across different organizational sizes:

- Processing accuracy reaches 99% across diverse document formats

- Staff time reduction of 80% compared to manual processing methods

- ROI achievement within 12 months through combined labor and error reduction savings

Technology Investment Protection:

Your automation investment should grow with your business rather than require costly replacements:

- Scalable processing capacity handles volume increases without system changes

- Custom model development addresses unique industry document requirements

- Enterprise security standards meet compliance needs without additional software

Ready to evaluate actual cost performance rather than vendor promises?

Book a Free Demo Call and compare KlearStack’s approach to your current processing expenses.

Conclusion

AP automation cost analysis reveals significant savings opportunities for organizations of all sizes. Manual processing expenses of $12-$40 per invoice drop to $1-$2 with proper automation implementation. Companies processing high invoice volumes see the greatest return on their technology investments.

Organizations should evaluate AP automation as a strategic investment in operational improvement rather than simply an expense reduction initiative. The right solution creates lasting value through improved financial operations and business growth support.

FAQs on AP Automation Cost

AP automation costs range from $1-$2 per invoice compared to manual processing costs of $12-$40 per invoice. The exact cost depends on solution features and processing volume.

Invoice volume, required features, and system integration complexity are the primary cost drivers. Company size and customization needs also significantly impact total investment levels.

Most organizations achieve ROI within 12-18 months through reduced labor costs and faster processing times. Higher invoice volumes typically result in faster payback periods.

Implementation costs include data migration, staff training, and system integration services. These typically add 10-20% to the base software licensing investment but are essential for successful deployment.