Argus Modeling: Mastering Financial Insights

Do you know? Over 75% of customer real estate (CRE) professionals i.e., investors, brokers, and property managers like you struggle with, a lack of transparency into property data and performance, difficulties evaluating risk, and inefficient processes.

Argus Modeling aims to solve these problems. It is a software platform that provides you with details on your financial performance. It evaluates your income, expenses, lease terms, tenant credit, and more – everything you need to effectively manage your portfolio.

According to a comprehensive report by Argus Modeling, their software has garnered acclaim from more than 7,000 clients and is trusted by over 200 universities and colleges worldwide. This journey spans over three decades, during which Argus Modeling has dedicated its expertise to the development of commercial Argus real estate (CRE) software.

Argus also provides powerful financial analysis to help you identify risks and opportunities.

Here’s how:

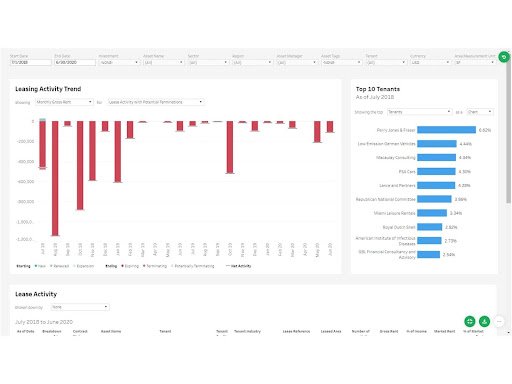

Image Source: Trends on market rents (monthly gross rent) in your area

- Track trending market rents and vacancy rates in your area.

- Get alerts on lease expirations, tenant credit issues, or budget overages.

- Conduct a “what-if” analysis to determine how different scenarios might impact your cash flow and returns.

What is Argus Modeling?

Argus Modeling is a financial analysis software that forecasts the financial performance of commercial real estate assets. It is often used by commercial real estate (CRE) professionals to make data-driven decisions.

For example, investors can analyze sales data, to predict how many units of a property will sell next quarter.

Why is Argus Modeling important?

Traditional tools like Excel are not proficient enough to understand the impact on property values and investor ROI, as they cannot perform financial analysis with large amounts of data.

Argus, on the other hand, is a financial analysis tool that allows users to create cash flow analyses from scratch.

The tool brings value in underwriting of commercial real estate properties by:

- Accurately projecting a property’s future income and expenses.

- Accommodating a broad range of risks and scenarios.

- Automating complex financial analyses and calculations

- Saving time and reducing error.

More About Argus Modeling

Argus Modeling is a critical process in the commercial real estate (CRE) industry which requires meticulous input of lease and financial data, a task which can be time-intensive.

In order to streamline this process and improve accuracy, Argus Modeling offers an automated underwriting process.

The Altus Group, creators of Argus software, introduced Argus API in December 2019, which acts as an integration gateway, bridging Argus solutions with other customer applications, systems, and cloud-based data. This addresses the need for consistent data across different CRE systems, demonstrating the importance of Argus Modeling in maintaining accuracy and efficiency within the industry.

The Argus API is a cloud-based tool that improves data quality and saves time. This interface allows users to export or upload data into their Argus database without accessing the Argus application. It enables seamless updates of production data across different systems. Users can make real-time changes to models, redo calculations, and get updated results via an API call, effectively circumventing the Argus application.

Table 1: Suitable Argus Modeling Software for Commercial Real Estate Professionals.

| Features | ArgusEnterprise | ArgusEstate Manager | ArgusValueInsight | ArgusVoyanta | ArgusIntegration Solutions |

| Forecasting and Scenario Analysis | Comprehensive platform for commercial real estate analysis and valuation | Management of property portfolios, leases, and finances. | Advanced insights into property valuations and market trends. | Data analysis and reporting for commercial real estate portfolios. | Solutions to integrate Argus software with other systems. |

| Funding Modeling and Investment Structures | Optimizing capital allocation and investment decision-making. | Tracking and managing real estate assets and financials. | Evaluating investment opportunities and capital allocation. | Analyzing property data for investment and valuation insights. | Integrating Argus tools with other software in real estate processes |

| Cash Flow Projections | Analyzing cash flows and valuations for property assets. | Managing cash flows and property financials. | Providing insights into cash flow trends and property values. | Visualizing and understanding property cash flow data. | Integrating Argus software within existing workflows. |

| Data Consolidation and Auditability | Ensuring data accuracy and compliance with audit standards. | Centralizing property information for reporting and compliance. | Offering accurate property data for valuation and analysis. | Streamlining data from different sources for real estate analysis. | Enhancing data accuracy and consistency across systems. |

| Development Feasibility and Appraisals | Assessing property values and development feasibility. | Analyzing property development potential and valuations. | Offering property valuation data for development assessments. | Providing insights into property development feasibility. | Integrating Argus tools with other systems for development projects. |

| Project Budget and Cash Flow Management | Monitoring project budgets and financials for real estate. | Handling project budgets, costs, and financial tracking. | Offering insights into project budgeting and financial performance. | Managing project budgets and financials for real estate portfolios. | Integrating Argus software into project management processes. |

| Property Portfolio Consolidation and Reporting | Reporting and analyzing property portfolio performance. | Managing property portfolios and generating reports. | Offering insights and analysis of property portfolio performance. | Reporting on property portfolio data and performance. | Integrating Argus tools for streamlined portfolio reporting. |

| Integration Modules | Enabling seamless integration with other real estate systems. | Integrating Argus tools with existing real estate software. | Integrating Argus solutions with other property systems. | Integrating Argus tools within existing real estate workflows. | Enabling integration between Argus software and other systems. |

| Sensitivity Analysis and Scenario Testing | Analyzing property valuations under different scenarios. | Assessing property performance under various scenarios | Providing insights into property values across different scenarios. | Analyzing property data and valuations in varying scenarios. | Enabling sensitivity analysis and scenario testing using Argus software. |

Table 1: Suitable Argus Modeling Software for Commercial Real Estate Professionals.

| Features | ArgusEnterprise | ArgusEstate Manager | ArgusValueInsight | ArgusVoyanta | ArgusIntegration Solutions |

| Forecasting and Scenario Analysis | ✔️✔️ Very Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice |

| Funding Modeling and Investment Structures | ✔️✔️ Very Suitable Choice. | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice |

| Cash Flow Projections | ✔️ Suitable Choice | ✔️Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice |

| Data Consolidation and Auditability | ✔️Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice |

| Development Feasibility and Appraisals | ✔️✔️ Very Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️Suitable Choice |

| Project Budget and Cash Flow Management | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️Suitable Choice | ✔️ Suitable Choice | ✔️Suitable Choice |

| Property Portfolio Consolidation and Reporting | ✔️✔️ Very Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice |

| Integration Modules | ✔️✔️ Very Suitable Choice | ✔️✔️ Very Suitable Choice. | ✔️ Suitable Choice | ✔️✔️ Very Suitable Choice | ✔️ Suitable Choice |

| Sensitivity Analysis and Scenario Testing | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice | ✔️ Suitable Choice |

Benefits of Argus Modeling

The benefits of Argus modeling include accurate financial forecasting, evaluation of investment scenarios, comprehensive portfolio views, and streamlined due diligence processes for investors and lenders.

- Accurate and Realistic Financial Forecasting: Argus modeling utilizes detailed market data and property-specific information to precisely project a property’s future income and expenses, accommodating various scenarios and risks.

- Evaluation of Different Investment Scenarios: Investors and lenders can employ Argus modeling to analyze diverse investment scenarios like lease expirations, rent escalations, or tenant occupancy changes, aiding informed decisions and optimizing returns.

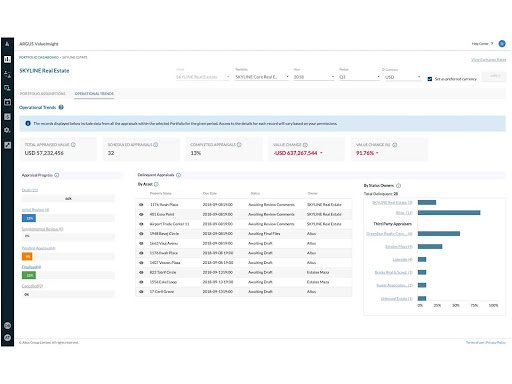

- A Comprehensive View of Property Portfolios: With Argus modeling, investors and lenders gain the capability to assess their entire property portfolio from a single vantage point, facilitating performance evaluation, improvement identification, and data-driven choices.

- Streamlined Due Diligence Processes: Argus modeling automates intricate financial analysis and calculations, saving time and minimizing errors during due diligence, which benefits investors and lenders by simplifying the process.

- Enhanced Risk Management: Argus modeling allows investors and lenders to factor in potential risks and uncertainties, enabling better risk management strategies and informed decision-making.

- Scenario Planning: Users can create multiple scenarios with varying assumptions, helping them understand the potential outcomes of different strategies and market conditions.

- Data-Driven Insights: Argus modeling generates data-driven insights that guide investors and lenders in identifying trends, opportunities, and areas for improvement across their property portfolios.

- Valuation Accuracy: By incorporating detailed property and market data, Argus modeling provides more accurate property valuations, assisting in making an informed purchase, sale, or refinancing analyses.

- Strategic Decision-making: The insights gained from Argus modeling empower users to make strategic decisions about acquisitions, dispositions, and overall portfolio management.

These additional benefits highlight the versatility and value that Argus modeling brings to investors, lenders, and real estate professionals.

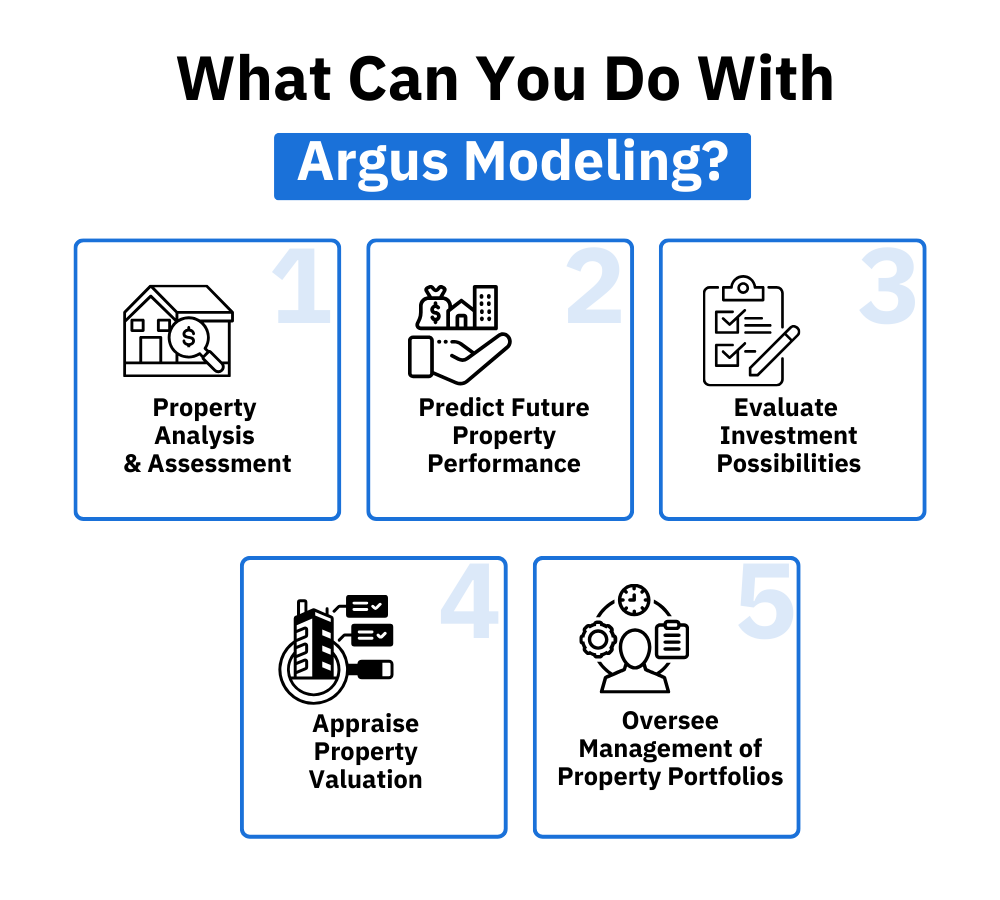

What Can You Do With Argus Modeling?

Argus modeling gives you a lot of useful tools for financial analysis.

Here are some of the main things you can do with Argus:

- Conduct Property Analysis and Assessment: Argus modeling facilitates calculating potential returns and assessing risks associated with different real estate investments. By inputting data such as rental rates, occupancy rates, and operation expenses, Argus modeling can create a detailed depiction of a property’s financial performance.

- Predict Future Property Performance: Argus modeling uses historical data and market trends to forecast potential revenue and expenses for years to come. This predictive analysis allows investors and property managers to make intelligent decisions based on future expectations, not just current circumstances.

- Evaluate Investment Possibilities: Investing in real estate presents countless possibilities. Argus modeling helps cut through the complexity by offering tools to evaluate different investment paths. By running ‘what if’ scenarios, you can understand how changes in variables like rental rates or occupancy levels might affect your returns.

- Appraise Property Valuation: Argus modeling also aids in determining fair property values. By considering a multitude of factors (such as cash flows, sale prices, and growth rates), it offers an objective way to value properties, aiding in negotiations and transactions.

- Oversee Management of Property Portfolios: If you’re managing multiple properties, Argus modeling can help you track and analyze multiple properties for better portfolio management, allowing you to see which investments are performing well and which could use a little nudge.

Conclusion

Argus Modeling is a game-changer in the real estate industry, enhancing financial forecasting, scenario evaluations, and due diligence processes.

While you continue to focus on strategic decisions and optimizing returns, let KlearStack, a seamless document processing solution, help you automate the manual underwriting process and take your operational efficiency to the next level.

Integrate the power of Argus Modeling with KlearStack’s streamlined document processing for a holistic solution that empowers your business to thrive in a data-driven world.

Get started with KlearStack’s free trial version, today!

FAQs: Argus modeling

Argus Modeling is a software that provides predictive analytics of commercial real estate assets. It is often used by commercial real estate (CRE) professionals to make data-driven decisions.

Argus Software is a software company that specializes in developing software solutions for real estate professionals, particularly in the field of commercial real estate and property management. Their software offerings typically include tools for property valuation, investment analysis, portfolio management, lease management, and more. These software solutions are designed to help commercial real estate professionals make informed decisions about their properties and investments.

Argus is a software platform developed by Argus Software, specializing in commercial real estate. It is widely used by CRE professionals for property valuation, investment analysis, and financial modeling. The platform provides various tools that allow users to assess the financial performance of real estate assets and make informed decisions.

The benefits of Argus modeling software include accurate financial forecasting, evaluation of investment scenarios, comprehensive portfolio views, and streamlined due diligence processes for investors and lenders.

The Argus modeling tool is used to automate complex financial analyses, thus saving time and reducing error. Users can input property-related data such as rental income, market trends, and financing details. The software then processes this data to generate comprehensive financial models. This helps them understand the potential returns and risks associated with their real estate investments.