A Complete Guide to Automated Invoice Processing & its Workflow

Accounts payable teams frequently face the challenge of handling invoices. These invoices arrive in diverse formats, including paper documents, digital PDFs, scanned files, and emails.

Accounts payable teams constantly deal with invoices in various formats—paper documents, PDFs, scanned images, and emails. Processing these invoices manually leads to errors, inefficiencies, and wasted time.

What’s the solution? Automated invoice processing.

In this blog, we’ll explore:

- Why KlearStack is the ideal solution

- What automated invoice processing is

- How it works

- Its benefits

- How to choose the right software

What is Automated Invoice Processing?

Automated Invoice Processing is the use of AI-powered software to handle invoices without manual intervention. It extracts, verifies, and processes invoice data seamlessly within an ERP system, reducing errors and improving financial efficiency.

Key Features of Automated Invoice Processing:

- Extracts data from invoices, PDFs, or scanned images

- Matches invoices to purchase orders

- Verifies invoice data for accuracy & compliance

- Routes invoices for review and approval

- Automatically records payment details

Must-Read Articles

What is Accounts Payable Invoice Processing?

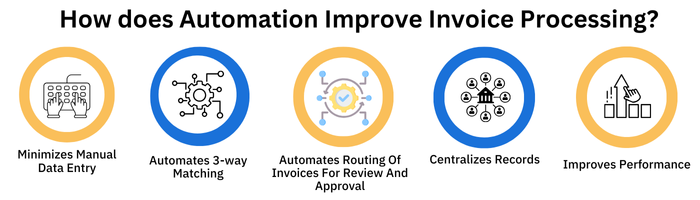

How does Automation Improve Invoice Processing Overall?

| Feature | Manual Process | Automated Process |

|---|

| Data Entry | Time-consuming, error-prone | AI-powered, 99% accuracy |

| Matching Invoices | Prone to mismatches | Auto 3-way matching |

| Approval Process | Delayed approvals | Auto-routing for approval |

| Storage & Retrieval | Requires physical storage | Centralized digital repository |

| Processing Speed | 5–10 days per invoice | <24 hours per invoice |

Minimizes Manual Data Entry

Automation eliminates the need for manual data entry, reducing errors and saving valuable time for the accounts payable team.

Automates 3-way Matching

Invoices, purchase orders, and receipts are often misaligned manually. Automation instantly verifies that an invoice matches the corresponding purchase order and receipt, ensuring seamless reconciliation.

Automates Routing Of Invoices For Review And Approval

Invoices are automatically routed to the appropriate personnel for review and approval, speeding up decision-making and ensuring compliance.

Centralizes Records

Automation centralizes all invoice records in one digital repository, simplifying access, retrieval, and audit trails.

This reduces physical storage costs and improves data accessibility, saving both time and money.

Improves Performance

Overall, automation enhances efficiency, reduces processing times, and enables accounts payable teams to perform at their best, focusing on strategic financial management.

Automation improves invoice processing efficiency, allowing finance professionals to focus on value-added tasks.

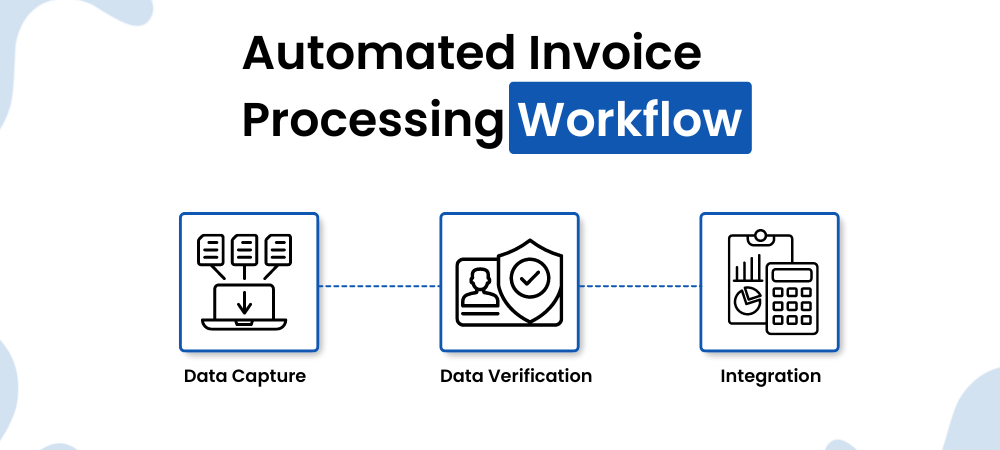

Automated Invoice Processing Workflow

Automated Invoice Processing is based on the workflow of manual invoice processing. However, it gets rid of repetitive tasks, tedious data entry, and potential errors.

Let’s take a look at how it works:

Step 1: Data Capture

- Invoices from multiple sources (email, scanned, PDFs) are collected.

- Optical Character Recognition (OCR) extracts key invoice details.

- Data is stored in a central repository for easy access.

Step 2: Data Verification

- The system validates vendor details, invoice numbers, and amounts.

- Inaccuracies are flagged for manual review.

- Verified invoices move to approval and payment stages.

Step 3: Integration with ERP

- The system syncs with ERP & accounting software for real-time updates.

- Payment records and audit trails are maintained for compliance.

How to Choose the Right Automated Invoice Processing Software?

Choosing a foolproof automated Invoice Processing Software can be overwhelming. Once you find the right one for your business, everything else becomes much easier.

Here are the key considerations you should be mindful of when choosing the right platform:

- Usability

Go for software that is easy to use and navigate. This reduces the time and effort spent on the transition of switching from manual invoicing to automated invoice processing. - Security and Scalability

As your business grows and expands, the software you opt for should also adjust automatically to the growth. Also, ensure that the software is secure and protects sensitive data. - Easy Integration

The software should easily integrate with your company’s existing ERPs. This ensures data validity and eliminates the risk of misplacement. - Needful Support

Opt for a software program that provides on-time support when needed. A good supporting partner ensures end-to-end training and upkeep.

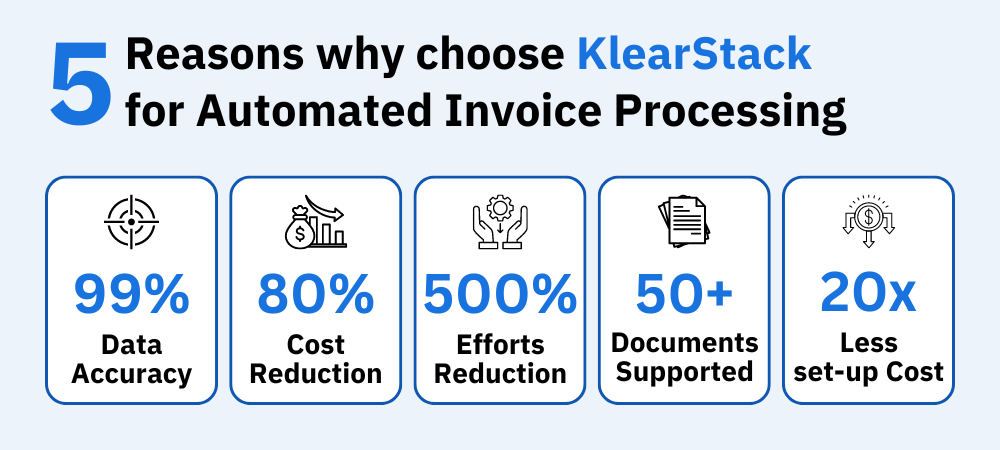

Why choose KlearStack?

KlearStack, an automated AP software, makes your monthly invoice processing a hassle-free process.

- Eliminate manual paperwork.

- Process 1000+ invoices, receipts, and bank statements a day.

- Reduce operational costs by 70%

- Make the AP process 99% error-free and touchless.

| Aspect | Other Automated Invoice Processing Software | KlearStack Automated Invoice Processing |

| Customization and Flexibility | Limited customization options. | Highly customizable to match specific workflows. |

| Integration with ERPs | May require additional development. | Seamless integration with various ERPs and accounting systems. |

| Accuracy | Accuracy varies. Manual corrections are required. | Reduces up to 99% errors. |

| Costs and ROI | Costs vary. ROI takes longer to achieve. | 70% cost-effective. Quicker ROI |

| 3-Way Matching Automation | May not offer | Offers 3-way automation. Prevents discrepancies. |

With Klearstack, you don’t have to worry about templates, setup costs, or subscriptions.

Say NO to templates. Easy setup. Cancel anytime.

Book a demo session with KlearStack today!

How to Integrate KlearStack’s Automated Invoice Processing?

In just 9 easy steps, you can now integrate KlearStack’s Automated invoice processing software into your ERP for hassle-free invoicing. Here’s how it is done:

Step 1: Assessment

Assess your organization’s invoice processing needs. Identify pain points, goals, and specific requirements. Note down the areas that need automation.

Step 2: Request Demo

Book a demo and explore the features and functionalities of KlearStack’s solution.

Step 3: Customization

Configure templates, approval hierarchies, and integration points. KlearStack’s invoice processing software can completely be customized to your organizational needs.

Step 4: Integration

Seamlessly integrate with your ERP and accounting systems

Step 5: Go-Live

Start processing live invoices.

Step 8: Monitoring

Continuously monitor the system’s performance, and fine-tune settings and workflows for optimal results.

Step 9: Benefits

Process 1000+ invoices and enjoy benefits like 99% accuracy and 70% cost savings.

Automated Invoice Processing: Use case

Transforming Manual Invoice Processing with KlearStack AI

A Fortune 100 manufacturing enterprise faced challenges with manual document processing, particularly in handling bilingual invoices. This involved labor-intensive tasks like data extraction, classification, validation, and data entry into Excel and SAP, leading to slow turnaround times, high operational costs, inaccuracies, and vendor dissatisfaction.

Challenges

- Slow transaction turnaround time.

- High operational costs.

- Increased data entry errors.

- Dissatisfied vendors due to delays.

- Unexpected penalty charges for late payments.

Solution – KlearStack AI

The enterprise adopted KlearStack AI, leveraging advanced OCR technology and machine learning models. KlearStack automated the end-to-end document processing within SAP S4/HANA, eliminating manual intervention.

Automation Steps

- Step 01: Data extraction without templates.

- Step 02: Validation through KlearStack AI rule engine.

- Step 03: Validated data forwarded to SAP via RESTful API.

- Step 04: Data is processed with configurable review, exception handling, and approval workflows within the KlearStack SAP extension. This results in automatic accounting entries.

Results

- Approximately 2x increase in productivity.

- Achieved over 95% field-level accuracy, with 80% straight-through processing.

- Improved operational agility.

- Savings of about 1,000 personnel hours per month.

- 90% reduction in penalty charges for late vendor payments.

The adoption of KlearStack AI led to remarkable improvements, enhancing efficiency, accuracy, and cost savings for the manufacturing enterprise.

KlearStack is a globally recognized, award-winning solution trusted by leading brands and Fortune 100 companies across diverse industries.

In the past, it streamlined:

- Banking: Enhanced KYC, automated accounts payable, and expedited loan processing.

- Trade: Revolutionized trade finance with efficient document processing.

- Inventory Management: Automated data tasks, ensuring error-free reconciliations.

KlearStack’s past applications brought speed, accuracy, and efficiency to diverse industries, allowing organizations to focus on strategic initiatives and customer service.

Conclusion

By automating invoice processing, You can save valuable time which can be utilized on other high-priority tasks. It can be a game-changer if you want to optimize your financial strategy.

Streamlining workflow will not only help you save resources but also help you make better decisions and achieve financial excellence.

KlearStack helps you clear the big stack of invoices and automates the entire invoicing processing for you. You need not worry about organizing and maintaining physical documents and potentially misplacing them.

KlearStack helps you:

- Reduce inaccuracies up to 90%

- Reduce costs by up to 70%

- Customize your templates and integration points

- Seamlessly integrate it into your ERP and accounting system

- Prevent discrepancies

Book a demo session with KlearStack today!