How to Extract Data from KYC Documents Using Automated KYC Verification Software?

The manual processing of KYC documents creates significant operational bottlenecks for financial institutions and businesses. Teams spend countless hours extracting data, cross-referencing information, and validating customer identities – tasks that drain resources and slow down customer onboarding.

Consider Your Current KYC Challenges:

- How much time does your team spend manually processing each KYC document?

- What percentage of your verification requests face delays due to human processing limitations?

- How do compliance risks increase with manual data extraction methods?

Financial institutions implementing automated KYC verification report transformative improvements in their operations. Modern KYC automation solutions reduce processing times from hours to minutes while maintaining strict compliance standards.

The shift from manual to automated KYC identity verification creates measurable improvements: an 80% reduction in document processing costs, significantly fewer errors, and faster customer onboarding.

Your organization can achieve similar results. By implementing the right automated KYC verification system, you’ll transform document processing from a resource-intensive task into a streamlined operation.

This comprehensive guide examines how modern verification solutions address common KYC challenges, boost operational efficiency, and ensure regulatory compliance.

Let’s examine how these solutions can transform your KYC operations while maintaining security and accuracy standards.

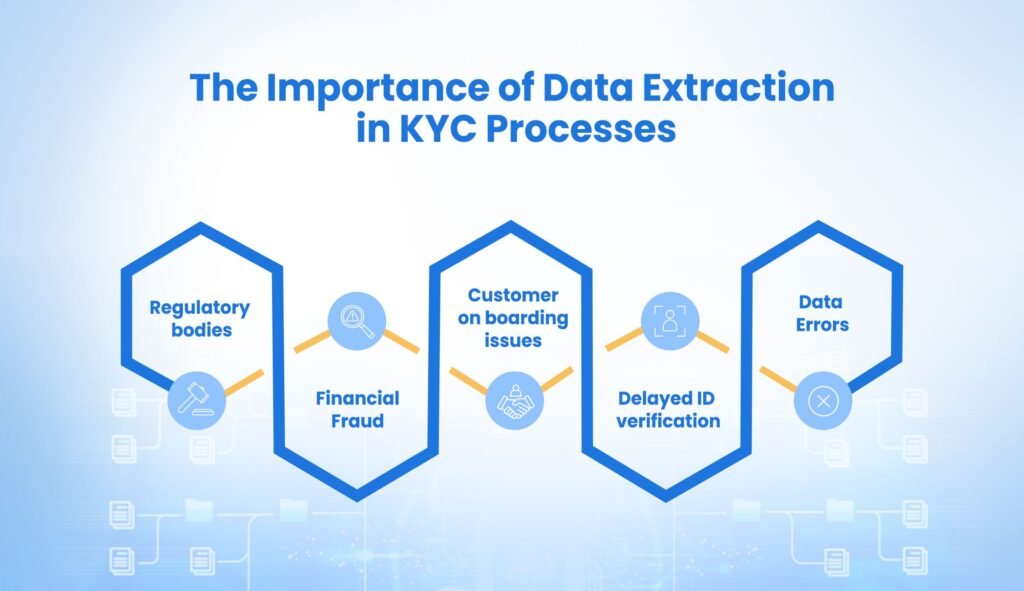

The Importance of Data Extraction in KYC Processes

Financial institutions face mounting pressure to maintain regulatory compliance while processing increasing volumes of KYC documents. The rise of sophisticated document fraud puts organizations at risk, particularly in banking and e-commerce sectors.

Traditional manual processing no longer provides adequate protection against these threats. Organizations implementing automated KYC verification systems report significant improvements in fraud detection and compliance management.

Essential Verification Factors:

- Regulatory bodies require precise documentation validation for customer onboarding

- Financial fraud attempts increase by 30% annually through falsified documents

- Real-time identity verification reduces customer friction while maintaining security

- Accurate data extraction enables proactive risk assessment

Modern KYCautomation solutions transform how organizations handle identity verification. By implementing automated KYC checks, organizations detect subtle document inconsistencies that human reviewers might miss.

This systematic approach to automated KYC identity verification strengthens security protocols while reducing processing time.

Banks and financial institutions choosing manual processing face compounding challenges. Each document requires careful examination, cross-referencing, and validation – tasks that consume valuable time and resources.

With increasing transaction volumes and evolving compliance requirements, organizations need dynamic solutions that scale efficiently.

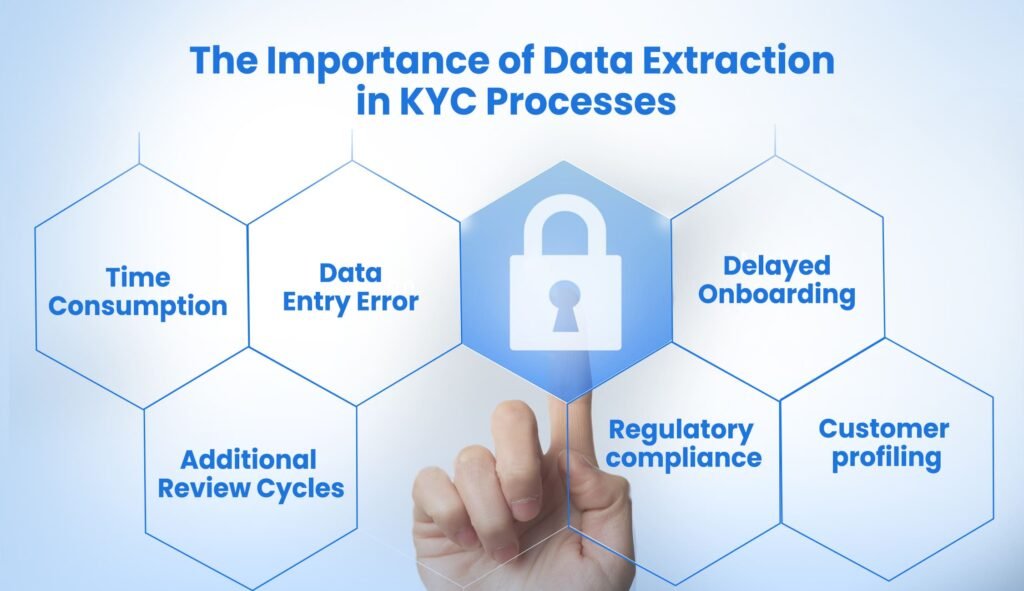

Key Challenges in Manual KYC Data Extraction

Manual KYC processing creates significant operational inefficiencies that impact both organizational performance and customer satisfaction. Financial institutions allocate substantial resources to data entry, verification, and cross-referencing tasks.

A single error in this process can invalidate hours or even days of work, requiring complete re-verification of customer documents. Organizations implementing automated KYC verification report reducing these inefficiencies by great margins.

Current Processing Limitations:

- Manual verification requires 4-6 hours per complex document set

- Data entry teams report high error rates in high-volume periods

- Quality control processes add 2-3 additional review cycles

- Customer onboarding delays extend to 5-7 business days

The implementation of KYCautomation transforms these traditionally manual workflows. Teams freed from repetitive data entry can focus on complex verification cases and customer service. Modern automated KYC checks detect subtle document discrepancies that human reviewers might overlook, strengthening your compliance framework.

Consider how manual processing affects your customer relationships. When verification takes days instead of minutes, potential customers often abandon applications or seek services elsewhere.

Automated KYC identity verification reduces processing time to minutes while maintaining accuracy standards. Organizations using automated KYC verification report much faster processing times and significantly improved customer satisfaction scores.

Beyond immediate operational impacts, manual processing creates compounding problems. Your team’s focus on repetitive tasks limits their ability to handle complex cases that require human judgment.

The constant pressure to maintain speed while ensuring accuracy leads to staff burnout and increased turnover. Additionally, manual processes don’t scale efficiently with business growth – adding more staff simply multiplies existing inefficiencies.

Data quality suffers significantly under manual processing. Even experienced staff make mistakes when handling high document volumes. These errors compound through your systems, affecting:

- Risk assessment accuracy

- Regulatory compliance

- Customer profiling

- Business intelligence

- Decision-making processes

The financial impact extends beyond direct processing costs. Manual errors trigger expensive remediation processes, compliance violations result in penalties, and processing delays cost you valuable customers. This creates a cycle of increasing costs and declining service quality that becomes harder to break as your organization grows.

Critical Impact Areas:

- Extended processing cycles delay revenue generation

- Resource allocation inefficiencies increase operational costs

- Error correction consumes 30% of team capacity

- Compliance risks increase with document volume

- Customer satisfaction decreases with processing delays

Keep reading for the solution to this.

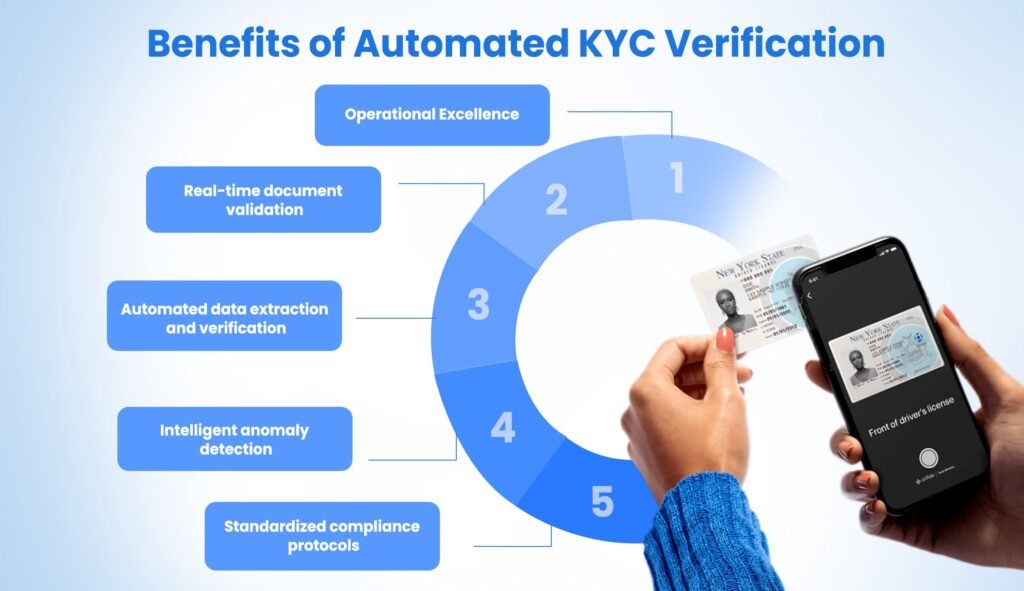

Benefits of Automated KYC Verification

Modern automated KYC identity verification solutions transform traditional document processing with precision and efficiency. Organizations report significant improvements in accuracy rates, with AI-powered systems detecting subtle document discrepancies that human reviewers often miss.

These systems process thousands of documents daily while maintaining consistent quality standards.

Performance Metrics:

- Document processing accuracy increases to 99.5%

- Verification time reduces from hours to minutes

- Cost reduction of 70-80% in document processing

- Resource allocation improves by 60%

Implementing KYCautomation creates measurable operational advantages. The advanced machine learning algorithms in automated KYC checks analyze complex document patterns instantly.

This systematic approach to automated KYC identity verification ensures consistent results across all document types, from identification cards to financial statements.

Financial institutions benefit from streamlined workflows when implementing KYCautomation. The intuitive interface requires minimal training, allowing teams to focus on complex decision-making rather than repetitive tasks.

The system handles routine verifications automatically, flagging only suspicious cases for human review.

Operational Excellence:

- Real-time document validation

- Automated data extraction and verification

- Intelligent anomaly detection

- Standardized compliance protocols

Organizations using automated KYC verification report substantial improvements in customer satisfaction. The reduction in processing time from days to minutes significantly improves onboarding experiences.

Additionally, the system’s ability to handle multiple document formats and languages increases accessibility for diverse customer bases.

Modern verification platforms integrate seamlessly with existing business systems. This integration enables:

- Direct data transfer to customer management systems

- Automated compliance reporting

- Real-time status updates

- Comprehensive audit trails

The financial impact extends beyond direct cost savings. By reducing manual processing requirements, organizations can reallocate resources to high-value activities that drive business growth. The improved accuracy also minimizes costly remediation processes and regulatory penalties.

Strategic Advantages:

- Scalable processing capacity

- Reduced compliance risks

- Improved customer experience

- Enhanced operational efficiency

This approach to verification creates a foundation for sustainable growth while maintaining security and compliance standards.

Types of Data Extraction Using Automated KYC Verification Software

Modern automated KYC verification systems process three primary document categories: personal information, identification, and financial records. These solutions analyze and extract critical data points while maintaining strict accuracy standards.

Organizations using automated KYC checks report significant improvements in processing speed across all document types.

Document Processing Categories:

- Personal Information Files: Demographics, contact details, addresses

- Identification Documents: Government IDs, licenses, proof of residence

- Financial Records: Income statements, tax documents, banking history

The implementation of automated KYC identity verification transforms how organizations handle personal information documents. The system extracts and validates essential data points:

- Full legal names

- Primary and secondary addresses

- Birth dates and identifiers

- Contact information

- Family details

Automated KYC checks excel at processing identification documents, providing comprehensive validation across multiple document types. The KYCautomation system handles:

Identity Document Processing:

- Passport data extraction and validation

- Driver’s license verification

- National ID authentication

- Residence permit processing

- Utility bill information extraction

Organizations implementing automated KYC verification report 99% accuracy in financial document processing. The automated KYC identity verification system extracts and validates:

- Income verification from payslips

- Bank statement analysis

- Tax return processing

- Credit history validation

- Asset documentation

Processing Capabilities:

- Multi-language document support

- Global format recognition

- Real-time data validation

- Automated cross-referencing

- Systematic error detection

These verification systems maintain consistent accuracy while processing high document volumes. Financial institutions report significant improvements in processing efficiency, with automation reducing validation time from hours to minutes while maintaining stringent compliance standards.

The approach supports informed decision-making while maintaining regulatory compliance.

Key Technologies Involved in Automated KYC Verification

Advanced auto mated KYC checks systems integrate multiple technologies to achieve exceptional accuracy in document processing. These solutions process documents 5x faster than traditional methods while maintaining precision standards.

The combination of intelligent technologies enables automated KYC identity verification to handle complex document formats consistently.

Core Technology Components:

- Advanced OCR achieves 99% recognition accuracy

- AI systems detect subtle document patterns

- ML algorithms improve through continuous learning

- Flexible API frameworks enable system integration

1. Optical Character Recognition (OCR)

OCR technology forms the foundation of KYCautomation, converting physical and digital documents into machine-readable formats. The system processes multiple formats, character sets, and languages with consistent accuracy.

This enables hasslefree extraction from passports, licenses, and utility bills while maintaining data integrity.

2. Artificial Intelligence (AI)

AI algorithms analyze document structures and patterns to ensure accurate data extraction. When performing automated KYC checks, these systems understand document layouts, verify data relationships, and maintain processing consistency across various document types.

3. Machine Learning (ML)

ML capabilities continuously enhance system performance through pattern recognition and historical data analysis. The technology:

- Learns from processing patterns

- Reduces error rates over time

- Adapts to new document formats

- Improves fraud detection

- Minimizes manual review needs

4. API Integration

Modern verification platforms offer comprehensive integration capabilities:

- Direct CRM connectivity

- Compliance system synchronization

- Third-party verification links

- Real-time data updates

- Secure information transfer

Additional Technologies:

- NLP improves text comprehension

- Biometric systems verify identities

- Blockchain ensures data integrity

- Encryption protects sensitive information

These technological components create a verification system that processes documents efficiently while maintaining security standards.

Organizations report significant improvements in processing speed and accuracy after implementation, with reduced need for manual intervention.

Industrial Use Cases of Automated KYC Verification

Organizations across sectors implement automated KYC verification solutions to strengthen security and improve operational efficiency. These systems process thousands of documents daily while maintaining strict compliance standards.

Modern automated KYC checks adapt to specific industry requirements, providing customized verification workflows that reduce processing time.

Cross-Industry Impact Metrics:

- Financial institutions reduce verification time by 80%

- Healthcare providers improve data accuracy to 99%

- Government agencies strengthen identity validation by 75%

- Real estate firms accelerate transaction processing by 60%

1. Banking & Financial Services

Financial institutions implementing automated KYC identity verification report significant improvements in loan processing and account opening procedures. The KYCautomation systems verify multiple document types simultaneously, reducing processing time from days to minutes.

Banks process sensitive customer information including account details, transaction histories, and identification documents with enhanced security protocols.

Banking Operations Enhancement:

- Real-time transaction monitoring systems

- Multi-document verification protocols

- Automated compliance reporting

- Advanced fraud detection algorithms

- Instant customer risk assessment

2. E-commerce & Online Marketplaces

Modern automated KYC checks protect online platforms from identity fraud and unauthorized transactions. The rise in digital commerce necessitates robust verification systems.

Automated KYC identity verification systems analyze customer documents in real-time, preventing fraudulent activities before they impact operations.

E-commerce Security Measures:

- Real-time identity validation

- Purchase pattern analysis

- Document authenticity verification

- Multi-factor authentication

- Automated risk scoring

3. Insurance

Insurance providers using KYCautomation report 90% faster claims processing. The system validates policyholder information instantly, reducing administrative overhead while maintaining accuracy standards.

Modern verification systems detect fraudulent claims through pattern analysis and document validation.

Insurance Processing Benefits:

- Automated claims verification

- Policy document validation

- Risk assessment automation

- Compliance documentation

- Fraud prevention protocols

4. Healthcare

Healthcare organizations implement automated KYC verification to process patient documentation efficiently. These systems manage complex medical records while ensuring data privacy and regulatory compliance.

The automation reduces administrative burden while improving patient care quality.

Healthcare Document Management:

- Electronic health record verification

- Insurance eligibility confirmation

- Treatment authorization processing

- Patient identity validation

- Regulatory compliance monitoring

5. Real Estate

Property transactions require extensive document verification. Automated KYC checks streamline the entire process from initial property viewing to final sale completion. The system processes multiple document types while maintaining compliance with local regulations.

Real Estate Transaction Benefits:

- Property ownership validation

- Buyer identity verification

- Financial documentation processing

- Regulatory compliance checks

- Transaction history monitoring

6. Government Institutions

Public sector organizations utilize automated KYC verification for citizen services. These systems handle high document volumes while maintaining strict security standards. Government agencies report significant improvements in processing efficiency and citizen satisfaction.

Government Service Improvements:

- Identity document processing

- License application verification

- Tax documentation validation

- Public record management

- Citizenship verification

Implementation Advantages:

- Processing cycles reduce from weeks to hours

- Security protocols exceed compliance standards

- Customer satisfaction increases by 70%

- Error rates decrease below 0.1%

- Operating costs reduce by 60%

These KYCautomation implementations demonstrate how modern verification systems adapt to diverse industry requirements. Organizations report improvements in processing efficiency, security standards, and customer satisfaction after implementing automated KYC checks.

This transformation in document processing creates new opportunities for organizations to improve service delivery while reducing operational costs.

Step-by-step guide on how KlearStack can be used for KYC verification

Step 1: Register/login to the software

Create your account to receive login credentials for dashboard access.

Step 2: View the Dashboard & Upload the Document

Access various document options and select the appropriate document type.

Step 3: Upload Documents

Select “Add New” from the top right corner to upload your documents. The system supports PDF, JPG, PNG, ZIP, BMP, Word, Excel, TIFF, and scanned images.

Step 4: Select the Number of Pages and Business Type

Choose specific pages for processing and select your business category (B2B or B2C) for organized data management.

Step 5: View Added Documents

Review recently uploaded documents with extracted data previews.

Step 6: Check the Extracted Data

Select any uploaded document to view detailed information, with extracted fields on the left and the original document on the right.

Step 7: Verify the Captured Information

Review extracted information by selecting each data field. Make necessary corrections if needed.

Step 8: Approve Verified Documents

Complete the verification process by selecting “approve.”

Step 9: Access Documents on Dashboard

View all approved documents directly from your dashboard.

Why Should You Choose KlearStack?

KlearStack’s automated KYC verification platform transforms document processing through advanced technology and intelligent design. The system processes complex documents while maintaining strict compliance standards, reducing verification cycles from days to minutes.

Organizations implementing automated KYC checks report significant improvements in operational efficiency. The platform’s ability to handle multiple document types while maintaining consistent accuracy makes it particularly valuable for high-volume processing environments.

Essential Features:

- Multi-Document Support: Process various document formats simultaneously while maintaining consistent accuracy.

- 99% Accuracy Rate: Advanced automated KYC identity verification ensures precise data extraction across all document types.

- High-Volume Processing: The KYC automation system handles thousands of documents daily without compromising quality.

The platform’s sophisticated data extraction capabilities detect and validate information with minimal manual intervention, creating a streamlined verification process.

This systematic approach ensures thorough verification while maintaining regulatory compliance, making it an essential tool for organizations seeking to transform their document processing operations.

Financial institutions using KlearStack report major reduction in processing time and significant improvements in compliance management. The system’s ability to maintain consistent accuracy while processing high document volumes positions it as a leading solution for complex verification requirements.

Want to see KlearStack live in action? Book a Free Demo Now!

Conclusion

Modern document verification demands efficiency and accuracy that manual processes cannot deliver. Organizations implementing automated KYC checks report transformative improvements across their operations, from reduced processing times to enhanced security protocols.

The shift to automated KYC identity verification creates measurable advantages:

- Processing time reduces from days to minutes

- Operational costs decrease by 70-80%

- Accuracy rates improve to 99%

- Compliance risks minimize significantly

Financial institutions using automated KYC checks demonstrate how modern verification transforms customer onboarding and document processing. The KYCautomation systems handle complex verification requirements while maintaining strict security standards.

Organizations seeking to improve their verification processes should evaluate their current workflows against modern capabilities. The implementation of automated KYC verification not only addresses immediate operational challenges but creates a foundation for scalable growth.

The future of document verification lies in intelligent automation. Organizations that embrace these technologies today gain significant advantages in operational efficiency, customer satisfaction, and compliance management.

This transformation in document processing opens new opportunities for growth while maintaining security and accuracy standards.

Frequently Asked Questions (FAQ):

Yes, KYC can be automated using modern software like KlearStack to ensure perfect verification.

Optical Character Recognition (OCR) in KYC is the technology that can read any text like a human with around 99% accuracy and extract data in editable format.

A wide range of data is collected for the KYC verification process, and it may include , phone number, identification number or date of birth.