10 Best Document Fraud Detection Software in 2026: Combat Fraud in Banking and Finance

Financial institutions process thousands of documents daily, from loan applications to identity verification forms. With each document representing potential risk, banks lose an average of $23.14 for every dollar of fraud, according to the LexisNexis Risk Solutions report.

Traditional manual verification simply can’t keep pace with sophisticated attacks, so many teams now rely on intelligent document processing to automate early checks.

Critical Questions for Financial Institutions:

- How much time does your team spend manually reviewing suspicious documents when they could focus on serving genuine customers?

- What’s the real cost of false positives in your current fraud detection process?

- Have you measured the impact of delayed fraud detection on customer trust and regulatory compliance?

Financial institutions need more than basic verification tools. Modern document fraud detection software combines advanced AI capabilities with industry-specific validation rules to spot sophisticated fraud attempts. The following sections examine how these solutions protect your organization’s assets and reputation while streamlining operations.

What is Document Fraud Detection Software?

Document fraud detection software helps businesses identify fake documents before processing them. These systems check contracts, invoices, and identification papers for signs of tampering. Companies install this software to prevent financial losses from fraudulent submissions.

The technology works by examining digital files for unusual patterns or alterations. Most systems can process hundreds of documents per hour automatically. Businesses in finance, insurance, and government use these tools regularly.

Detection software saves companies from costly fraud schemes. Manual document review cannot match the speed and accuracy of automated systems.

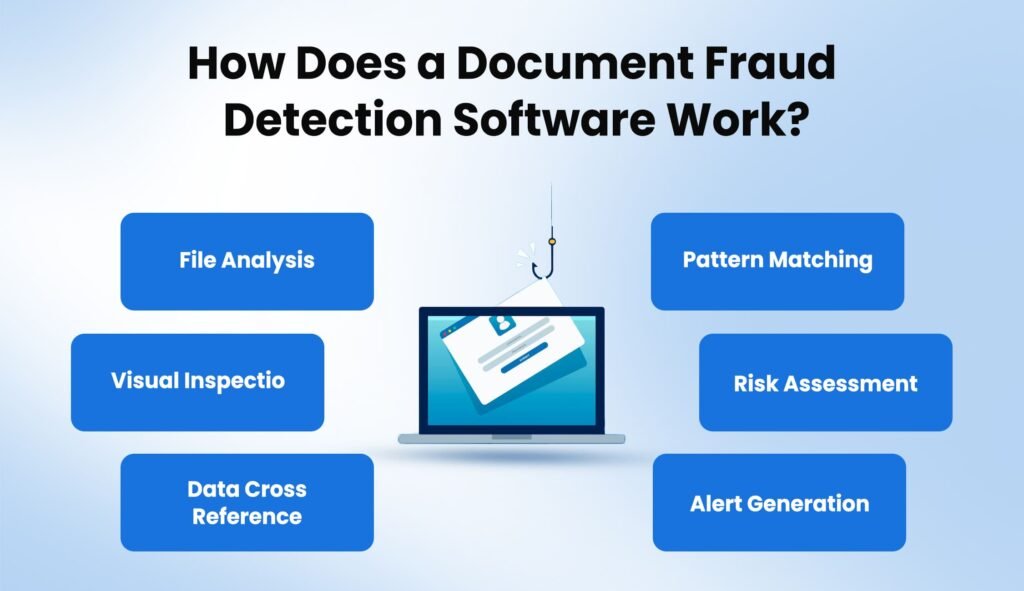

How Does a Document Fraud Detection Software Work?

Document fraud detection follows a systematic process that analyzes multiple elements simultaneously.

- File Analysis: Software inspects digital file structures for hidden edits.

- Visual Inspection: Systems scan text for inconsistent fonts and spacing, applying data capture techniques to pull key fields.

- Data Cross-Reference: Information is compared against trusted records.

- Pattern Matching: Models flag suspicious patterns based on known fraud tactics and document classification rules.

- Risk Assessment: Probability scores highlight anomalies.

- Alert Generation: High-risk items are escalated for human review.

Most checks finish within seconds, and each round of analysis improves machine-learning accuracy.

What to Look for in Document Fraud Detection Software?

When evaluating document fraud detection software, financial institutions need to understand the core capabilities that differentiate basic solutions from advanced ones. Top-tier tools combines multiple verification layers that go beyond simple template matching.

The foundation of these tools lies in their ability to perform simultaneous checks across multiple parameters. Modern systems analyze structure, content consistency, and metadata authenticity in milliseconds.

A recent banking security report shows that multi-layered analysis detects 94% of fraudulent documents before they enter processing workflows.

Essential Capabilities include:

- Advanced OCR with strong OCR accuracy

- Real-time pixel and font consistency checks

- Multi-language support and cross-border validation

- Automated audit trails for compliance

- Machine-learning models trained on vast authentic and fraudulent samples

- Secure API integration with core systems

- Custom rule engines and data automation for institution-specific needs

Financial institutions implementing robust document fraud detection software report processing efficiency improvements of up to 80%. The technical architecture must support high-volume processing while maintaining accuracy. Banks processing over 50,000 documents daily confirm that AI-powered document fraud detection software reduces verification time from minutes to seconds.

Top 10 Document Fraud Detection Sofware Tools in 2026

1. ABBY FineReader PDF

Check out how document fraud detection software from ABBYY can help you with you fraud detection needs. Here are some Key Features:

Key Features:

- Optical Character Recognition (OCR): Advanced OCR technology to extract text from various document formats (PDF, scanned images, etc.) with high accuracy.

- Document Comparison: Compares documents side-by-side to identify differences, which can highlight alterations or forgeries.

- Metadata Analysis: Examines document metadata (author, creation date, etc.) to detect inconsistencies or manipulations.

- PDF Manipulation: Allows users to edit, annotate, and redact PDF documents, enabling closer inspection.

- Automated Document Conversion: Convert scanned documents into searchable and editable formats.

Pricing:

- Subscription-based pricing, varies depending on the plan (Standard, Corporate, etc.).

- Perpetual licenses also available.

- Pricing ranges from approximately $199 for a standard license up to several thousand dollars for enterprise solutions.

- Free trials are available.

2. Experian CrossCore

Experian CrossCore’s document fraud detection software offers a wide variety of specific features that can help you with your automated fraud detection. Some of the highlights are:

Key Features:

- Identity Verification: Verifies the authenticity of IDs and other personal documents against a variety of databases.

- Transaction Analysis: Monitors transactions and flags suspicious patterns or anomalies.

- Biometric Verification: Utilizes facial recognition and other biometric methods to confirm identity.

- Device Intelligence: Identifies devices used in fraudulent activities based on their unique signatures.

- Link Analysis: Detects connections between individuals or entities potentially involved in fraud.

Pricing:

- Customized pricing based on the modules used and the scale of the operation.

- Typically caters to large businesses and financial institutions.

- You’ll need to contact Experian for a quote.

3. IBM Security Trusteer

IBM’s Security solution offers a very trusted document fraud detection software. Known for its reliability the key features on display are:

Key Features:

- Real-Time Fraud Prevention: Detects and prevents fraudulent activity in real-time, especially in online channels.

- Behavioral Biometrics: Analyzes user behavior to identify anomalies and signs of account takeover.

- Device Risk Assessment: Identifies high-risk devices and browsers.

- Session Monitoring: Tracks user sessions to flag suspicious activities.

- Integration: Seamlessly integrates with existing security infrastructure.

Pricing:

- IBM doesn’t publicly list prices, requiring a consultation with their sales team.

- Enterprise-focused, and priced accordingly.

4. LexisNexis Risk Solutions

LexisNexis Risk solutions are known for their speed and accuracy. Their document fraud detection software is very capable and offers the following:

Key Features:

- Identity Verification: Verifies identities using multiple data sources and analysis techniques.

- Document Authentication: Analyzes documents to detect forgeries or tampering.

- Data Breach Monitoring: Monitors for leaked personal data and potential fraud risks.

- Fraud Analytics: Uses machine learning and data analytics to identify patterns of fraud.

- KYC & AML Compliance: Helps businesses comply with “Know Your Customer” (KYC) and Anti-Money Laundering (AML) regulations.

Pricing:

- Tailored pricing based on the specific products and services used.

- Primarily geared towards large businesses and government agencies.

- Contact LexisNexis for a quote.

5. Adobe Acrobat

Abode Acrobat is not a new name in the industry. Acrobat Pro is a very dynamic document fraud detection software (integrated) – that offers the following features:

Key Features:

- PDF Creation and Editing: Extensive PDF creation and editing tools, including text and image modification.

- Document Comparison: Highlights differences between document versions.

- Digital Signatures: Adds and verifies digital signatures for document integrity.

- Redaction: Removes sensitive information for security and compliance.

- Metadata Management: Views, edits and removes document metadata.

Pricing:

- Subscription-based model through Adobe Creative Cloud.

- Individual and business plans are available.

- Around $25 per user per month for a single-app subscription.

- Free trials are available

6. Onfido

Next on our list of document fraud detection software tools is Onfido. Onfido has proved to be a wise choice for companies due to the following features:

Key Features:

Document Verification: Checks document authenticity using AI and machine learning, with checks for ID tampering and forgery.

Facial Biometrics: Matches photos on IDs to live selfies, also checks for liveness.

Address Verification: Confirms addresses using various sources.

Global Coverage: Wide range of documents are supported, in many countries.

Automated Verification: Enables automatic verification for faster process.

Pricing:

- Pricing is on a customized basis, based on volume, and types of checks.

- They offer both pay-as-you-go plans and customized packages.

- You’ll need to contact Onfido directly for an accurate quote.

7. Jumio

Jumio is an established name in the document industry. Their document fraud detection software offers many features like Biometric verification and AML Compliance. Some of the key features are:

Key Features:

- ID Verification: Real-time verification of government-issued ID documents.

- Liveness Detection: Ensures that the person is physically present during the verification process.

- Facial Biometrics: Matches a selfie to the photo on the submitted ID.

- AML Compliance: Supports KYC/AML compliance requirements.

- Global Coverage: Supports verification in many countries and regions.

Pricing:

- Jumio has customized pricing based on volume and specific checks.

- They have tiered pricing, from pay-as-you-go to subscription plans.

- Contact Jumio sales for a quote.

8. Tungsten Automation (formerly Kofax Capture)

Kofax is a very reputed and trusted solution for document scanning. Rebranded as Tungsten Automation, its document fraud detection software has the following features:

Key Features:

- Document Capture and Scanning: Captures documents from various sources, like scanners, email, and network folders.

- OCR Technology: Extracts data from scanned documents using advanced OCR.

- Data Extraction and Validation: Extracts and validates key fields from documents.

- Workflow Automation: Automates document processing workflows.

- Integration: Connects to business systems for smooth data transfer.

Pricing:

- Pricing is typically project-based, depending on scope, features and volume.

- Customized for the company’s needs.

- You will need to contact Kofax sales for a quote.

9. FICO Falcon Fraud Manager

The final pick on our list for best document fraud detection software tools in 2025 is from FICO. An excellent Fraud detection and management tool that offers:

Key Features:

- Real-Time Fraud Detection: Uses predictive analytics and machine learning to detect fraud in real time.

- Behavioral Analysis: Monitors user behavior and flags unusual patterns.

- Transaction Risk Assessment: Assesses the risk of individual transactions.

- Case Management: Provides tools to manage and resolve fraud cases.

- Customizable Rules: Allows users to define rules and policies for fraud detection.

Pricing:

- Large enterprise focused and therefore pricing is customized and not publicly available.

- You will need to contact FICO directly for details.

10. KlearStack

KlearStack’s document fraud detection software stands out with its comprehensive approach to document verification and fraud prevention. Financial institutions implementing advanced document fraud detection software benefit from its multi-layered authentication system that processes documents with 99% accuracy from day one.

Advanced Detection Capabilities:

- Real-time tampering detection across multiple document formats

- Cross-document information validation

- PDF modification tracking and verification

- Automated inconsistency detection within documents

- Multi-point image authenticity verification

Comprehensive KYC Authentication

Modern document fraud detection software performs thorough verification through:

- Government API integration for instant identity validation

- Business KYC processing with GST number authentication

- Real-time payment record validation

- Advanced signature verification algorithms

- Multi-document information matching

Multi-Document Cross-Verification

KlearStack’s document fraud detection software excels at comparing information across documents:

- Vehicle loan document validation (matching customer details across insurance and invoices)

- Trade document verification with automated cross-referencing

- Business document authentication with multi-point checking

- Employee expense validation with duplicate detection

- Historical data comparison for date tampering identification

Fraud Prevention Success Stories

Financial institutions using KlearStack’s document fraud detection software report:

- Detection of duplicate expense submissions within milliseconds

- Identification of modified dates on digital receipts

- Prevention of fraudulent invoice submissions

- Catching PDF modifications made with free editing tools

- Verification of document authenticity across departments

Technical Excellence

KlearStack delivers superior document fraud detection software through:

- Day-one accuracy rates reaching 99%

- Enterprise-grade security protocols

- 24/7 responsive customer support

- Regular system updates and improvements

- Seamless integration capabilities

Ready to strengthen your document verification process? Contact KlearStack for a personalized demo and see how our document fraud detection software can transform your fraud prevention strategy.

Our team will analyze your specific needs and demonstrate how our solution addresses your unique challenges.

Book a Free Demo Now!

Features of Document Fraud Detection Software

1. Multi-Format Support: Handles PDF files, images, scanned documents, and digital forms efficiently.

2. Real-Time Processing: Analyzes documents instantly upon upload or submission to business systems.

3. Pattern Learning: Continuous improvement via automated data extraction and feedback loops.

4. Risk Scoring: Assigns fraud probability ratings to help prioritize review efforts and resource allocation.

5. Integration Capabilities: Connects with existing business software including CRM, ERP, and workflow management systems.

6. Audit Tracking: Maintains detailed logs of all document reviews and decisions for compliance purposes.

7. Custom Rules: Allows businesses to set specific detection criteria based on industry requirements and risk tolerance.

8. Batch Processing: Handles large document volumes simultaneously for efficient bulk verification and analysis.

These features combine to create comprehensive fraud protection. Businesses can customize settings to match their specific document types and security needs.

Benefits of using Document Fraud Detection Software

Document fraud detection software delivers measurable value to businesses through automated verification and protection capabilities. These benefits directly impact operational efficiency and financial security.

1. Fraud Prevention: Stops fraudulent documents before they cause financial damage to business operations.

2. Processing Speed: Automates document verification tasks that normally require manual review by staff members.

3. Accuracy Improvement: Provides more consistent fraud detection than human reviewers working independently.

4. Cost Reduction: Eliminates expenses related to fraud investigations, legal proceedings, and financial recovery efforts.

5. Risk Mitigation: Reduces liability exposure from accepting fraudulent documents and associated legal consequences.

6. Compliance Support: Helps businesses meet regulatory requirements for document verification and due diligence processes.

7. Operational Efficiency: Frees staff time from manual verification tasks for higher-value business activities.

8. Customer Experience: Speeds up legitimate document processing while maintaining security standards for customers.

Early fraud detection prevents costly incidents while maintaining smooth business operations. Most organizations see immediate improvements in both security and processing efficiency after implementation.

Conclusion

The implementation of document fraud detection software represents a necessary investment in your institution’s security infrastructure. Financial organizations using advanced tools report significant improvements.

Success in fraud prevention extends beyond software implementation. It requires a strategic approach combining:

- Regular system updates and optimization

- Continuous staff training on new fraud patterns

- Integration with broader security frameworks

- Proactive monitoring and response protocols

The financial impact of fraud continues to evolve, but so do prevention technologies. Document fraud detection software provides the technological backbone for protecting assets, maintaining compliance, and ensuring operational efficiency.

By choosing the right solution and implementing it strategically, your institution can maintain a strong defense against emerging fraud threats while improving operational efficiency.

Reach out to KlearStacks to know more about AI fraud detection solutions.

FAQ’S on Document Fraud Detection Software in 2026

Document fraud in banking and finance involves falsifying or altering documents like loan applications, invoices, or identity proofs to deceive financial institutions for monetary or legal benefits.

The benefits of using automated document fraud detection include: Real-Time Detection, Reduced Errors, and Enhanced Compliance

Yes, you can request a demo of document fraud detection software by contacting the software provider through their website or customer support.