15 Best Invoice Reconciliation Software Solutions in 2025

According to a recent report by Ardent Partners, businesses that implement invoice reconciliation software see a 60% reduction in processing costs.

Financial departments spend hours manually matching invoices with purchase orders and payment records. This slow process leads to payment delays and financial inaccuracies.

- How much time does your team waste on manual invoice verification?

- Are payment discrepancies affecting your vendor relationships?

- Could your financial reporting be more accurate with proper reconciliation?

Invoice reconciliation software helps solve these problems. These digital tools automate the matching process between invoices, purchase orders, and payment records.

Many businesses now see this technology as essential for their financial operations.

Key Takeaways

- Invoice reconciliation software reduces manual matching by up to 80% according to recent industry data.

- Most solutions offer automated three-way matching between purchase orders, invoices, and receipts.

- The best software includes exception handling for flagging discrepancies that need human review.

- Integration capabilities with ERPs and accounting platforms are essential features.

- Mobile access allows for approval workflows from anywhere, improving processing time.

- AI-powered extraction increases data accuracy and reduces input errors.

- Most solutions provide audit trails for compliance and better financial controls.

What is Invoice Reconciliation Software?

Invoice reconciliation software compares and matches invoices with purchase orders and payment records. The software checks if the details align across all documents. This includes prices, quantities, terms, and payment status.

These systems help finance teams spot discrepancies quickly. They flag items that need attention and allow for faster corrections. The automation reduces the need for manual checking of each document.

Modern systems use advanced techniques to extract data from documents. They can process various formats including PDFs, scanned documents, and digital invoices. This makes the reconciliation process much faster than traditional methods.

How Invoice Reconciliation Works?

The basic process starts with document capture. The system imports invoices, purchase orders, and receipts into a central database. This happens either through direct uploads or integration with existing systems.

Next comes the matching phase. The software compares line items, totals, tax amounts, and other data points across documents. It uses rules to determine what constitutes a match.

When discrepancies appear, the system flags them for review. Users receive notifications about items needing attention. They can then investigate and resolve the issues within the platform.

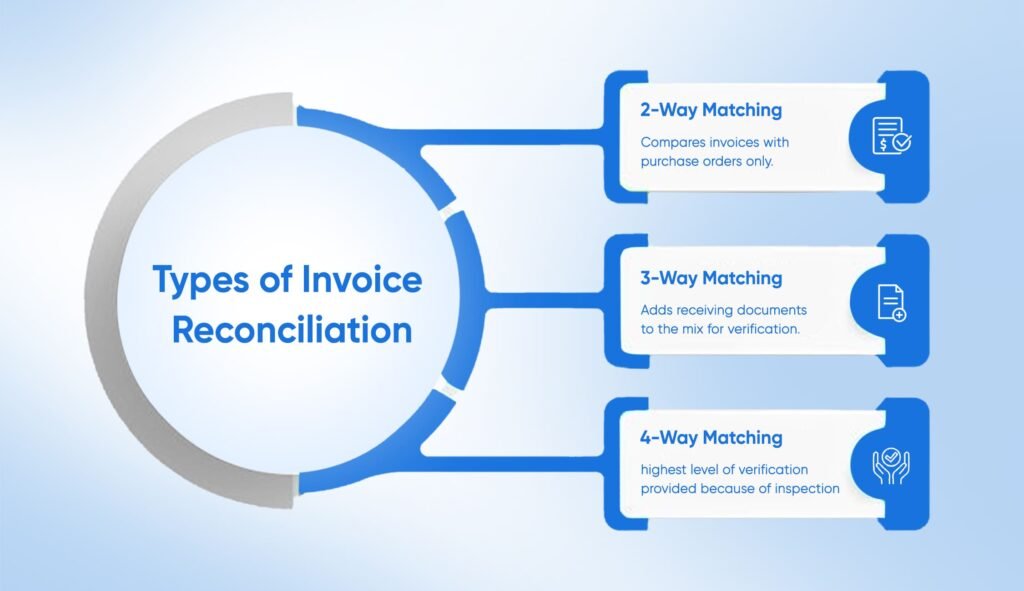

Types of Invoice Reconciliation

Two-way matching involves comparing invoices with purchase orders only. This simpler approach works for businesses with less complex procurement processes.

Three-way matching adds receiving documents to the mix. The system checks that goods or services were actually received as ordered. This provides stronger financial controls.

Four-way matching includes inspection documents. This highest level of verification ensures that received goods meet quality standards. Complex manufacturing operations often require this approach.

Top 15 Invoice Reconciliation Software Solutions for 2025

Here are the 15 best invoice reconciliation software solutions available today. Each offers unique features to help businesses improve their financial processes.

1. KlearStack

KlearStack provides AI-powered invoice reconciliation with superior data extraction capabilities. The platform handles complex invoice formats without templates.

The software uses advanced algorithms to match invoices with purchase orders and receipts. It processes documents with up to 99% accuracy.

Users appreciate the quick implementation and minimal setup requirements. The system starts delivering results within days of deployment.

Why Should You Choose KlearStack?

KlearStack simplifies invoice reconciliation through intelligent document automation. It directly addresses common reconciliation issues like manual matching errors and slow payment processing.

Key Solutions Offered:

- Template-free invoice processing.

- Self-learning algorithms continuously improving accuracy.

- Real-time visibility into financial reconciliation processes.

KlearStack’s Proven Advantages:

- Achieve up to 99% accuracy in invoice reconciliation.

- Increase operational efficiency by up to 500%.

- Reduce invoice processing costs by up to 85%.

With KlearStack, your business achieves accurate financial records effortlessly. Ready to improve your invoice reconciliation process?

2. Stampli

Stampli focuses on communication during the invoice reconciliation process. It centralizes all conversations about specific invoices within the platform.

The software learns from user actions to improve its matching algorithms. It becomes more accurate over time as it processes more company-specific documents.

Mobile capabilities allow approvers to review and act on invoices from anywhere. This reduces bottlenecks in the approval workflow.

3. Beanworks

Beanworks offers specialized invoice reconciliation with strong approval workflow features. The platform automates coding, matching, and approval routing.

The system provides real-time visibility into the status of all invoices. Users can quickly see which items need attention and why.

Integration with popular accounting systems makes implementation straightforward. The software works well with QuickBooks, Sage, and other common platforms.

4. QuickBooks

QuickBooks includes invoice reconciliation as part of its broader accounting solution. The system matches invoices with bank transactions and purchase orders.

The software suits small to medium businesses that want an all-in-one approach. Users can manage the entire financial process within one platform.

Recent updates include improved AI-powered matching algorithms. These reduce the need for manual intervention in routine cases.

5. Xero

Xero provides invoice reconciliation tools within its cloud accounting platform. The software automatically suggests matches between invoices and bank transactions.

The system uses bank feeds to keep financial data current. This helps ensure the matching process works with the most recent information.

Users value the intuitive interface and mobile capabilities. The platform makes it easy to review potential matches and confirm or correct them.

6. Sage

Sage offers invoice reconciliation across several of its accounting and ERP products. The software provides both automated and manual matching options.

The system includes robust reporting on reconciliation status. Users can quickly identify bottlenecks or recurring issues in their processes.

Advanced versions include supplier statement reconciliation. This adds another verification layer by comparing vendor-provided statements with internal records.

7. Tipalti

Tipalti specializes in accounts payable automation with strong reconciliation features. The platform handles invoice processing, matching, and payment execution.

The software supports global operations with multi-currency and multi-entity capabilities. It can reconcile invoices across different business units and currencies.

Users appreciate the built-in compliance features. The system helps ensure that reconciliation meets relevant accounting standards.

8. FloQast

FloQast focuses on the month-end close process, including invoice reconciliation. The software helps ensure all transactions are properly matched and recorded.

The system provides checklists and status tracking for reconciliation tasks. This helps teams stay organized during busy closing periods.

Integration with major ERP systems makes data flow smoothly. The platform connects with NetSuite, Oracle, SAP, and others.

9. BlackLine

BlackLine offers specialized reconciliation tools as part of its financial close software. The platform helps match invoices, payments, and other financial documents.

The system provides detailed audit trails for all reconciliation activities. This supports compliance requirements and helps with financial controls.

Users value the exception handling and workflow capabilities. The software routes issues to the right team members for resolution.

10. SAP

SAP includes invoice reconciliation within its broader ERP and financial management solutions. The software provides automated three-way matching capabilities.

The system handles high volumes of invoices across complex organizational structures. It works well for large enterprises with multiple business units.

Recent updates focus on machine learning to improve match rates. The software learns from historical data to better handle exceptions.

11. Zoho

Zoho offers invoice reconciliation as part of its financial management suite. The software automates the matching of invoices with purchase orders and receipts.

The system provides customizable matching rules. Users can define what constitutes a match based on their specific business needs.

The platform includes helpful dashboards that show reconciliation status. These visual tools help teams focus on items needing attention.

12. Zarmoney

Zarmoney provides simplified invoice reconciliation for small to medium businesses. The software helps match invoices with payments and purchase orders.

The system offers a straightforward interface that requires minimal training. Users can quickly become productive with the platform.

Automated bank feeds help keep financial data current. This improves the accuracy of the reconciliation process.

13. Upflow

Upflow combines invoice reconciliation with accounts receivable management. The platform helps ensure that customer payments match issued invoices.

The software provides clear visibility into payment status. Users can quickly identify which invoices remain unpaid or partially paid.

The system includes communication tools for following up on discrepancies. This helps resolve issues faster.

14. Bill.com

Bill.com offers invoice reconciliation with strong payment execution capabilities. The software matches invoices with purchase orders and handles payment processing.

The system uses AI to extract data from invoices automatically. This reduces manual entry and improves accuracy.

Users appreciate the approval workflows that incorporate reconciliation. The platform ensures proper matching before payments proceed.

15. Concur

Concur includes invoice reconciliation within its expense and AP management solution. The software matches invoices with purchase orders and approval records.

The system handles complex approval hierarchies effectively. It routes exceptions to the right decision-makers based on company policies.

Mobile capabilities allow for on-the-go reconciliation tasks. Approvers can review matches and exceptions from anywhere.

Why Should You Choose KlearStack for Invoice Reconciliation?

Invoice reconciliation requires accurate data extraction from various document types. Your current systems might struggle with different invoice formats. KlearStack makes this process simple through AI-powered document processing.

Solutions That Matter:

- Template-free processing that works with any invoice format

- Self-learning AI that improves with each document processed

- End-to-end automation reducing manual data entry

Processing Speed: Handle thousands of invoices daily without adding staff. Multi-Format Support: Process any invoice type without template training. Accuracy Guarantee: Achieve up to 99% extraction accuracy across all documents.

Your finance team needs reliable data for proper reconciliation. KlearStack extracts invoice data with high precision. The system learns from each document it processes, improving accuracy over time.

Key Processing Capabilities:

- Intelligent field extraction from varying layouts

- Automated data validation across documents

- Secure document handling meeting compliance standards

Good invoice reconciliation starts with accurate data extraction. KlearStack reduces your document processing time by 80%.

Ready to transform your invoice reconciliation process? Book a Free Demo Call!

Conclusion

Invoice reconciliation software provides essential tools for modern finance departments. These systems improve financial accuracy through automated matching processes. They help businesses avoid payment errors and improve vendor relationships.

- Reduces processing costs by 60-80% compared to manual methods

- Shortens payment cycles from weeks to days

- Improves data accuracy for better financial reporting

- Frees staff from routine matching to focus on exceptions

The right solution depends on your specific business needs and existing systems. Consider integration capabilities, volume requirements, and special process needs when selecting software.

FAQ on Invoice Reconciliation Software

Invoice reconciliation software automatically matches invoices with purchase orders and receipts. It confirms payment accuracy and finds discrepancies quickly. Most systems use rules or AI for matching.

It cuts manual processing costs by 60-80%. It prevents duplicate payments and identifies pricing errors. It also helps avoid late payment penalties.

Yes, most solutions connect with popular accounting systems. They work with QuickBooks, SAP, Oracle, and other platforms. Implementation typically takes 2-8 weeks.

Look for automated three-way matching capabilities. Check for exception handling workflows. Consider analytics, mobile access, and integration options.