How to extract data from a credit note?

A credit note is a document that requires careful analysis to ensure that the business does not suffer any losses. The data extraction from a credit note is of vital importance and requires careful consideration. Any errors here could result in financial losses for the business.

Manual data entry often leaves scope for human errors and this in return harms the monetary health of the business. The man hours required for data entry and correction of errors consume a lot of resources. All of these lead to hampered productivity and wastage of resources.

Automated Software for document processing is designed to eliminate all of these issues. It uses advanced technologies for data extraction from credit notes. It saves time and resources, enhancing the overall efficiency.

In this blog, you will learn methods of data extraction from credit notes and the benefits of using automated software for this purpose. You will also understand how you can automate the data extraction process of your credit notes with KlearStack with the detailed step-by-step guide.

What is Credit Note Data Extraction?

Credit note data extraction is the process of entering the data of the credit note into the system for further use. This entry can be done manually or by using automated software and tools available. The data extraction from a credit note is a process that requires a careful approach. If any error occurs here, it leads to financial loss for the business. Businesses are increasingly moving towards automated business data capture due to its unmatched efficiency.

Methods of Credit Note Data Extraction – Manual vs Automated

Credit Note Data Extraction – Manual

Data extraction from credit notes using a manual method is the process of entering information into the system manually. When the data is entered manually there is always room for errors. These errors could significantly impact the accuracy of financial statements.

Methods of Credit Note Data Extraction – Automated

An automated process of credit note data extraction is when automated software is used to capture information from the document. This process is entirely automated, and advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR) are used. There is no human intervention required. Due to this, the probability of errors is reduced and efficiency increases many folds.

How does Credit Note Data Extraction Software work?

Data extraction software automates the entire process of data extraction from credit notes. By using technologies such as AI, ML, and OCR, these software ensure accuracy and precision while extracting data. The need for human intervention is significantly reduced. It speeds up the entire process, reducing errors and making sure that correctness is maintained at all times.

Here is how credit note data extraction software works:

1. Pre-processing

This is the first step where the scanned or photographed credit note is enhanced to make it ready for further processing. All the noise and disturbances are removed. The quality is made better to ensure that further processes happen seamlessly and accurately.

2. Document Classification

This is the next step where the document is classified as per its relevant category based on the information provided in the document. The model is trained to identify a document and classify it as per its type, such as an invoice, receipt, or credit note. This ensures that further processing is done correctly as per rules applicable to particular document types.

3. Automated Capture & Digitization

Here the information is converted into a machine-readable text version. This conversion of information into digital format is done via the OCR technology. This step forms the base of information processing.

4. Intelligent Data Extraction and Analysis

In this step, all the relevant information is extracted for further processing. ML is used for extracting the key information. Once all the information is pulled out, it is then analyzed. This analysis is done to ensure the accuracy and completeness of the data.

5. Validation & Integration

Here all the information that is extracted and analyzed in the step above, is validated. This means that the information is checked to ensure its usability in other systems. The information is validated against the existing database to ensure it meets the predefined rules. If any errors are found, it is flagged for review. Post successful validation, data is integrated into ERP systems.

6. RESTful API Integration

Through the RESTful API (Application Programming Interface) integration a Credit Note OCR can interact and exchange data with many other applications over internet. Through APIs, different systems can connect and integrate OCR capabilities via a standard method. Because of this human intervention is significantly reduced, as data gets transferred automatically.

Benefits of Using Automated Data Extraction from Credit Notes

1. Faster Application of Credits

The manual data entry is time-consuming and can several days. Automation helps you to get the data instantly. This allows quicker application of credits to customer accounts. It also helps you keep track of the credit amount your business is due to receive. This improves accuracy in financial statements.

2. Reduced Risk of Errors

When data is entered manually, the chances of committing mistakes are higher. These errors in data can lead to overpayments or under-credits. Automation significantly cuts down on errors, typos, or missed information. This ensures the correct amount of credits is addressed to the customers. If a credit note is received by the business, it ensures accurate information is captured and no losses occur to the business.

3. Simplified Discount Capture

In many cases, the credit note mentions the discounts being offered. The correct capture of this information is essential to avoid missing out on valuable savings. This task of precise data capture is seamlessly achieved by automated software.

4. Fraud Protection

Using automated software ensures that the data is exactly captured as mentioned in the credit note. Here there is no human intervention, and hence no possibility of fraudulent activities arises. Automated systems help avoid fraud and maintain streamlined financial flows.

5. Better Insights into Returns

This data can help the business study the trends and patterns of credit notes received and given. It helps to better understand the processes and have insights-driven decision-making procedures. As data archiving is also supported, one can easily refer to any document as and when needed. This valuable information also helps businesses improve product quality and optimize inventory management.

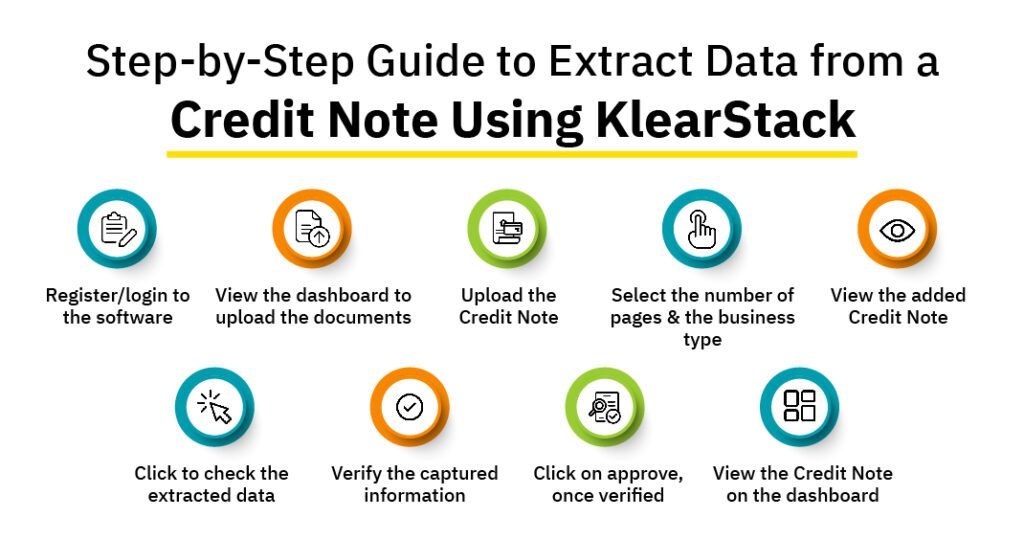

Step-by-Step Guide to Extract Data from a Credit Note using KlearStack

Step 1: Register/login to the software

Once you successfully register with KlearStack as a user, you will get access to the login credentials. Upon entering these, read the terms and conditions carefully, and tick the check box. After this, you can log in to the dashboard, where all the wonders of data extraction start!

Step 2: View the dashboard to upload the documents.

Once logged in, you will see the dashboard from where different documents can be uploaded. From here, you can add and process various documents, including credit notes, purchase orders, invoices, and over 12 other document types.

KlearStack also has an excellent feature that allows bulk processing of the documents, which means you can upload multiple documents and it will process all of those simultaneously giving you speedy and meticulous results.

Click on the credit note section to proceed to the next step.

Step 3: Upload the Credit Note

Click on the ‘Add new’ tab in the top right corner of the screen. KlearStack allows you to upload documents in different formats such as Electronic PDF, Word, Excel, JPG, BMP, TIFF, PNG, scanned PDF, and ZIP.

Step 4: Select the number of pages and the business type.

If your credit note has multiple pages, and you wish to process only a few of those with relevant information, then you can select the number of pages you wish to process from your credit note. KlearStack can process multiple pages at one go, relieving you of the task of uploading pages one by one.

Also, here you have an option to select if the credit note is for a B2B or B2C transaction. This ensures better categorization and storage of your data and streamlines your further process of data collection when it comes to final reporting.

Step 5: View the added Credit Note.

Your most recently uploaded credit note will appear on top. Uploaded documents with their extracted data appear here, providing a quick snapshot of all necessary information at any given time.

Step 6: Click to check the extracted data.

For detailed information you can click on the uploaded credit note, you will see all the fields on one part of the screen and the uploaded credit note on the other. Here you can scroll and check all the data while comparing it with the credit note on the other side.

Step 7: Verify the captured information.

If you wish to understand where the information has been picked from, simply click on that particular field and it will get highlighted on the uploaded credit note. If the information is incorrect, you can edit it here. This will retrain the model for the future.

Step 8: Click on approve, once verified.

Once you’ve verified the details are correct, click on “approve.” The models are trained to capture data quickly and accurately.

Step 9: View the Credit Note on the dashboard.

Once approved, go back to the dashboard and you will see your credit note there with the approval sign. Here you can see all the documents and data extraction done from each.

Features of KlearStack’s Bill of Lading OCR

1. Template-less Solution

KlearStack offers a template-less solution where it can read and adapt to any new design or layout. The model does not need retraining for each variant. This saves time and money which otherwise would have been spent on manual template creation.

2. Multi-lingual Support

KlearStack is equipped to read 50+ languages such as English, Hindi, Marathi, French, German, Chinese, Japanese, etc. The document extraction from any of the supported languages is done accurately. This ensures that language does not act as a barrier between documents exchanged during overseas transactions.

3. Bulk Credit Notes Processing

This software allows you to process multiple credit notes at once. You need to not upload one after the processing of the other is completed. This batch-processing feature saves time and increases productivity.

4. Line-item Data Extraction

This is an essential feature due to which important items from a credit note get extracted. There are many fields such as invoice no., credit amount, order details, etc which form an essential part of the credit note. Extraction of these is vital and this feature ensures the accuracy of extraction.

5. Multi-page Data Extraction

The model is trained to ensure that in case a document has multiple pages, relevant details from all these pages should be recorded carefully. Due to this feature, it is ensured that no piece of information is overlooked.

6. Straight-Through Processing (STP)

KlearStack allows for complete automation of the credit notes, without any human intervention required in the entire process. This reduces the risk of errors and increases overall efficiency.

7. Seamless Integration

The data can be seamlessly integrated into any financial management system. There is no need to enter the data into the systems manually, this automation saves time and resources for the organization

8. Document Classification

This involves the automated sorting and categorizing of documents based on their content. By using advanced algorithms, systems can identify and organize documents into predefined categories, making information retrieval more efficient.

9. Automated Document splitting

Due to this feature, the documents are classified and separated with ease. If there are any other documents attached with credit note like an invoice or receipt, the model will segregate them into specific categories making the further process of analysis much smoother.

10. Rich Document Audit Engine

In KlearStack’s feature-rich audit engine, you can establish rules that the extracted data must meet. The system then verifies all extracted data against these rules. If any inconsistencies are detected, they are highlighted for further review.

11. Rules-based workflows

This feature enables you to establish rules for various documents based on specific criteria such as supplier name, total value, or product type. Documents are then processed according to these rules. The system sends relevant information to team members based on the defined workflow.

12. Self-learning AI

The AI used in the KlearStack model learns from experience and improves itself over time without needing to be explicitly programmed.

Schedule a demo with us to know more!

KlearStack offers a simple solution for extracting credit note data. Our system ensures accurate extraction and categorization of your data, making it ready for immediate use. You can upload credit notes in any format—whether semi-structured or unstructured, and our expert models will seamlessly handle data extraction. You will also benefit from our support for over 50 languages. Curious about how KlearStack achieves this? You’re invited to test our system with a demo using any credit note format, structured or unstructured. Experience firsthand the exceptional capabilities of KlearStack in processing information from documents effortlessly. Simplify your data extraction process with KlearStack—we’re ready for this blind test.

FAQs on How to extract data from a credit note?

The process of identifying and capturing relevant information from a credit note document is called data extraction from a credit note.

Key details such as supplier name, invoice number, item descriptions, quantities, and amount information get extracted from a credit note.

Two types of data extraction methods are – manual and automated data extraction software