Data Extraction in Banking: Manage High Volumes of Data Securely and Efficiently

Banks process huge volumes of data daily. This data usually comes from many forms of banking-related documents. Processing this data manually is cumbersome, requires human and monetary resources, and is a very time-consuming process. Also, the information in these documents is sensitive and confidential, a lot of this information has legal significance. The manual process poses a high risk of errors, this can have many diverse consequences.

All of these issues can be taken care of by using automated software for data extraction in banking. It uses advanced technologies for data extraction and is much more efficient.

This blog will explore many aspects of automated financial data extraction, its features, and its benefits. We will also get a step-by-step guide for data extraction from bank documents.

What is Data Extraction from Banking Documents?

Data extraction from banking refers to automatically collecting data from different resources such as bank statements, cheques, transaction records, etc. After pulling out the required data, it is organized into a structured format, making further analysis and decision-making easier.

Data extraction in banking is important as the volume of documents is huge. Automated data extraction from financial documents saves time and reduces errors significantly.

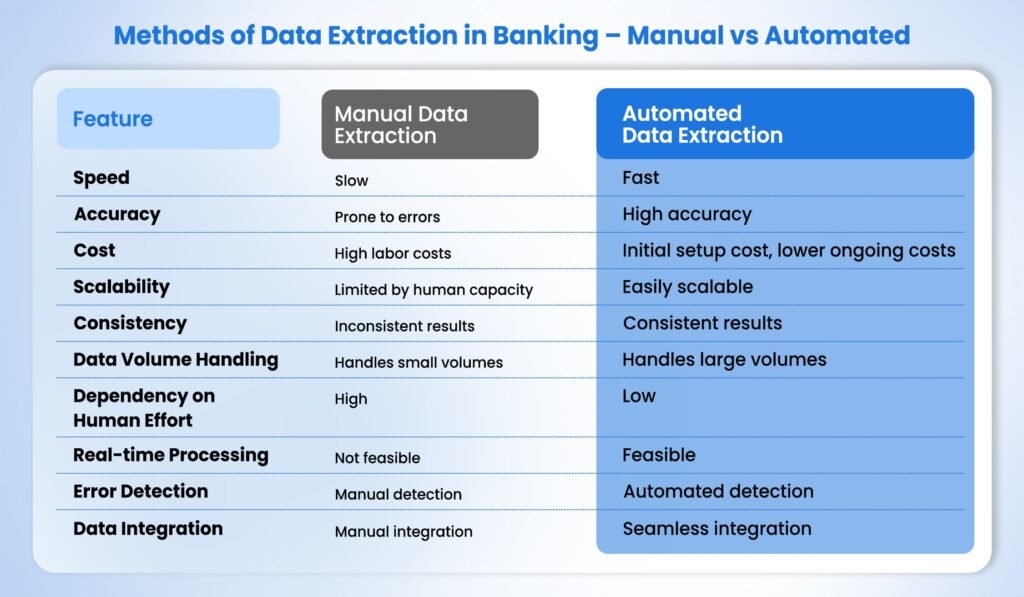

Methods of Data Extraction in Banking – Manual vs Automated

Data Extraction in Banking – Manual

Data extraction in banking using manual methods is the process of entering information into the system manually. This is where a dedicated resource is required to look into the documents for a particular piece of information and then type that information into the system.

When the data is entered manually there is always room for errors. Also, this process is highly time-consuming, error-prone, costly, and less efficient overall. These have diverse negative implications.

Data Extraction in Banking – Automated

An automated process of data extraction is when automated software is used to capture information from banking documents. This process is entirely automated, right from capturing the information, feeding it into the system, processing it, and seamlessly integrating it into the financial management systems. Advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR) are used which ensure accuracy and efficiency.

There is minimal human intervention required. Due to this, the probability of errors is reduced and efficiency increases manyfold.

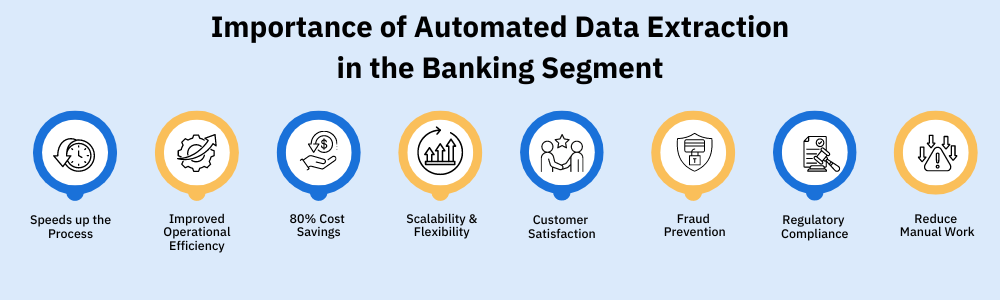

Importance of Automated Data Extraction in the Banking Segment

The use of intelligent data extraction software in banking is highly recommended as it solves some pressing problems that arise out of manual data processing. Here’s why automated financial data extraction software should be used:

1. Speeds up the Process:

As the volume of banking documents is large, automated data extraction saves a lot of time and resources for banking organizations.

2. Reduce Manual Work:

It reduces human effort and intervention to a great extent. This leads to a much lower scope of errors and banking staff to complete other strategic tasks.

3. Efficiency:

As the automated extraction is faster and less error-prone, the overall efficiency increases. The process becomes streamlined and timely results are ensured.

4. Cost-Effectiveness:

The costs incurred on employing human resources for and due to errors are avoided, which reduces the overall operational expenditures.

5. Scalability:

The automated data extraction ensures standard quality output throughout the process and can handle large volumes of documents easily.

6. Customer Satisfaction:

As there is a major reduction in processing time and number of errors, high customer satisfaction levels are maintained.

7. Fraud Prevention:

Automated data extraction detects discrepancies and helps find and amend fraudulent activities.

8. Regulatory Compliance:

With automated data extraction software, all the required data is collected in time. Since the rate of errors is very low, not much time is invested in its correction. This ensures timely and correct reporting, which helps banks stay compliant with regulatory requirements.

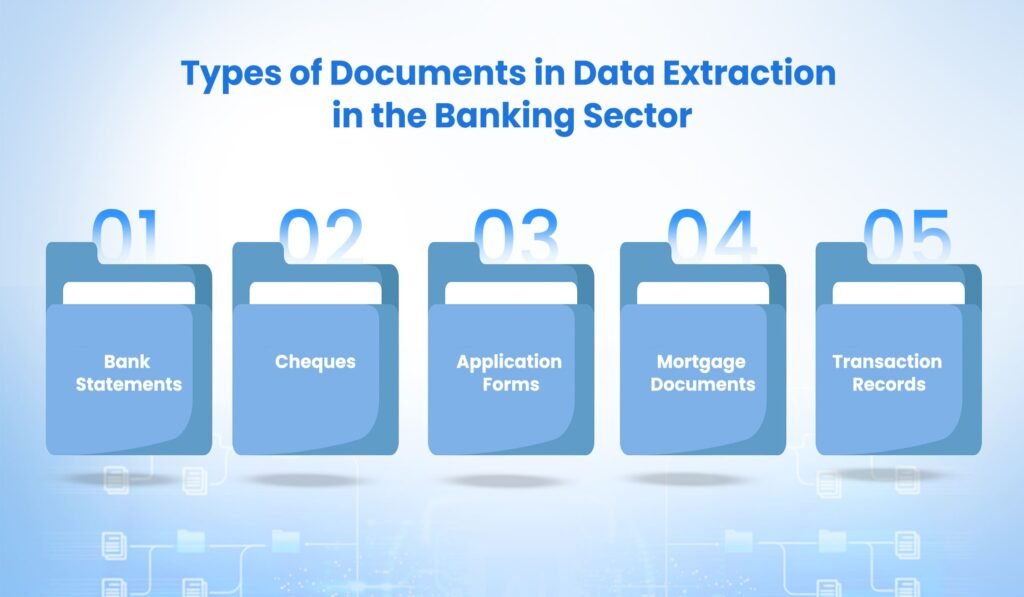

Types of Documents in Data Extraction in the Banking Sector

Banks handle a variety of documents daily, and almost all of these require data extraction. A few of them are listed below:

1. Bank Statements:

This is a document that has detailed records of all the transactions happening in a customer’s account over a while. Extracting data from bank statements helps banks study customer spending patterns, verify transaction details, make final reports, and avoid fraud.

2. Cheques:

A cheque is used to order a bank to pay a sum from one account to another account that may belong to a person or an organization. The data extraction from the check ensures correct and quick payment processing, reduces manual data entry errors, and helps in maintaining accuracy in financial records.

3. Application Forms:

It includes different types of applications and forms, such as loan applications, account opening forms, KYC compliance documents, etc. These are information-heavy documents and require accurate data extraction for regulatory compliance. Automated software ensures correct and speedy data extraction which improves customer experience.

4. Mortgage Documents:

Mortgage documents are legal documents that act as a security of repayment of loan by the borrower. If the borrower is not able to pay back the loan, the lender gets the right to sell the mortgaged property. Extracting data from mortgage documents helps banks to properly manage loan terms, interest rates, repayment schedules, and property details. This also ensures compliance with legal requirements.

5. Transaction Records:

This document has details of all the day-to-day transactions of an account holder. Extracting data from transaction records aids in monitoring account activities, and detecting and preventing fraud in time. It also becomes helpful in ensuring accurate reporting and regulatory compliance.

Some more banking-related documents are:

- Credit Card Applications and Statements which have Details of credit card usage, spending patterns, and repayment history.

- Financial Reports Include income statements, balance sheets, cash flow statements, and other financial performance metrics.

- Risk Assessment Reports which help evaluate potential risks and their impact on the bank.

- Audit Reports which have findings and recommendations from internal and external audits done for the banking organization.

- Contracts and agreements between the bank and customers or other parties.

- Legal Notices like court orders, subpoenas, and other legal communications.

- Customer Correspondence such as emails, letters, and other communications with customers.

Challenges Faced While Extracting Data in the Banking Sector

Data extraction in the banking sector also has its own set of challenges, a few of those are:

1. High Volume of Transactions:

Daily, banks handle vast volumes and a variety of documents. If no robust financial data extraction tools are available, processing data from these documents becomes time-consuming and makes it difficult to maintain accuracy and efficiency.

2. Data Quality and Accuracy:

The banking-related documents have sensitive and critical information, so ensuring accuracy and quality becomes mandatory here. Any error causes financial losses and regulatory penalties. This further becomes difficult as many times data received is in an unstructured format.

3. Integration with Legacy Systems:

Many banking organizations have legacy systems in place that were not designed to integrate easily with modern data extraction technologies. Integrating these systems for with modern data extraction tools is expensive and requires a lot of other resources.

4. Data Sensitivity and Security:

Since banking documents have personal information, this data becomes highly sensitive and has to be protected from unauthorized access and breaches. Ensuring proper security measures for data privacy and protection during the data extraction process is extremely important, and balancing security with efficiency is difficult in most cases.

5. Regulatory Compliance:

Banks have strict regulatory requirements that govern how they handle and report data. Making sure that their data extraction process complies with regulations and standards is necessary to avoid penalties. But this can pose a challenge as regulations keep changing constantly.

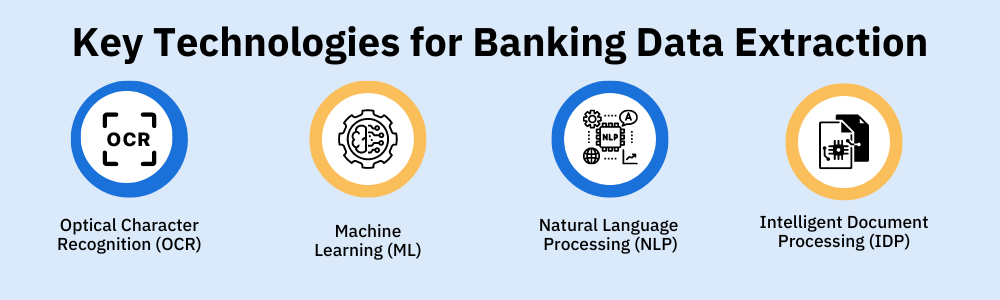

Key Technologies for Banking Data Extraction

Several advanced technologies are utilized for efficient data extraction in the banking sector:

1. Optical Character Recognition (OCR):

OCR extracts text value from PDF financial statements and it also converts the information from scanned paper documents, or images into machine-readable text. With OCR it becomes easy to automate data entry, human efforts are reduced and it leads to a reduction in errors.

2. Machine Learning (ML):

Machine learning includes algorithms that can identify patterns and learn from them. Due to this, its capabilities significantly improve over time and it enhances the accuracy and efficiency of data extraction processes.

3. Natural Language Processing (NLP):

NLP helps in data extraction by understanding the human language. Due to this accurate data can be extracted which helps in further processing of the documents.

4. Intelligent Document Processing (IDP):

IDP utilizes OCR, ML, and NLP to automate the entire data extraction process, right from scanning to routing data as required. It reduces human intervention significantly, makes the process faster, and improves efficiency.

5. Robotic Process Automation (RPA):

Many tasks are repetitive, and RPA automates these tasks using software robots. It handles large volumes of tasks without compromising on speed or quality of the output.

6. Artificial Intelligence (AI):

AI uses many technologies to perform tasks that usually require human intelligence. It can carry out tasks requiring learning, reasoning, and problem-solving. It can also detect erratic data and identify trends. It is super effective for getting data to be used for deeper analytics.

7. Cloud Computing:

Cloud computing provides computing resources over the internet. It allows banks to store and process large volumes of data. With it, enhanced security features, regular updates, and easy integration with other cloud services also become accessible, ensuring reliable and efficient data extraction.

Tired of Errors and Delays in Banking Document Processing?

KlearStack Eliminates These Issues for You!

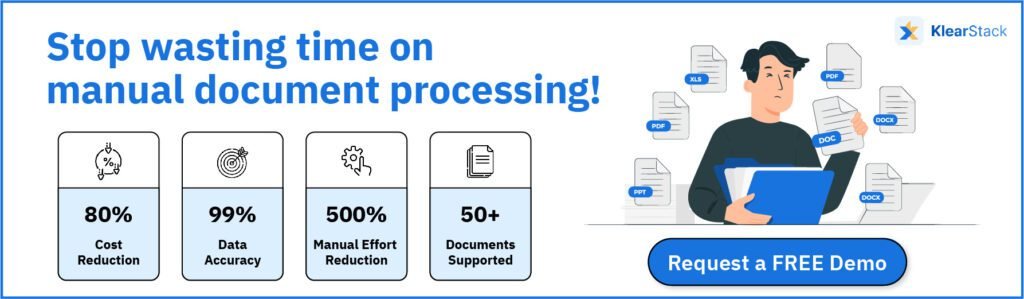

Errors and delays in banking document processing due to human processes are detrimental. KlearStack is here to make your workflow efficient. Our advanced solution delivers 80% savings on document data entry and auditing costs while boosting operational efficiency by 500%. Now you need not worry about the outdated templates with our self-learning and generative AI. It simplifies and accelerates your processes.

KleatStack uses advanced technologies such as OCR, AI, and ML to efficiently handle and process large volumes of banking data. These features make KlearStack an ideal choice for your banking data extraction needs:

1. Template-less Solution

KlearStack’s template-less technology reads and adapts to any new design or layout without needing retraining. This eliminates the need for manual template creation, saving both time and money.

2. Multi-lingual Support

KlearStack supports over 50 languages, including English, Hindi, Marathi, French, German, Chinese, and Japanese. Accurate document extraction ensures language barriers do not hinder international transactions.

3. Bulk Credit Notes Processing

Easily process multiple documents at once with KlearStack’s batch-processing feature. This saves time and boosts productivity by allowing simultaneous uploads instead of sequential processing.

4. Line-item Data Extraction

Extract essential items from documents with precision. Important fields are accurately extracted, ensuring vital information is captured correctly.

5. Multi-page Data Extraction

KlearStack efficiently extracts relevant details from documents with multiple pages. This feature ensures that no information is missed, even in extensive documents.

6. Straight-Through Processing (STP)

Automate the data extraction process with KlearStack, eliminating the need for human intervention. This reduces errors and enhances overall efficiency.

7. Seamless Integration

Integrate data into any financial management system. Automation negates the need for manual data entry, saving time and resources.

8. Document Classification

Automatically sort and categorize documents based on their content. Advanced algorithms organize documents into predefined categories, improving information retrieval.

9. Automated Document Splitting

KlearStack automatically classifies and separates documents that might be attached. This simplifies the analysis process by segregating documents into specific categories.

10. Rich Document Audit Engine

Set up rules for extracted data with KlearStack’s audit engine. The system verifies data against these rules, highlighting any inconsistencies for further review.

11. Rules-based Workflows

Establish rules for processing documents based on criteria such as entity name, total value, or other such. The system routes relevant information to team members according to the defined workflow.

12. Self-learning AI

KlearStack’s AI continuously learns and improves from experience, enhancing its capabilities over time without the need for explicit programming.

Want to check our accuracy, Book A Demo call now

See the Difference Accuracy Makes – Book Your Demo Call Today!

Curious about how effectively our data extraction solution can transform your banking operations? Experience firsthand the precision and efficiency of our technology by scheduling a demo call with our experts. See our technology in action, ask questions, and discover how we can help you achieve greater efficiency, accuracy, and compliance in your banking operations.

Frequently Asked Questions (FAQs) on Data Extraction in Banking

Bank data extract is pulling information from various banking documents, like statements and cheques, in an automated way. This makes the data easier to organize and analyze.

Data extraction in finance means taking important details from financial documents and records and organizing them so they’re easy to review and use for reports.

Banking data extraction includes getting information from bank statements, checks, loan applications, mortgage papers, and transaction records. This helps banks manage their data efficiently.

This software automates the process of extracting data from bank statements, making it faster and reducing mistakes, which helps banks handle their statements more effectively.