Data Extraction in Tax & Accounting: Automation for Faster and Secure Approach

Have too many documents to go through and can’t compromise on accuracy? Wondering how to manage multiple clients’ tax-related requirements? Can’t keep a trail of documents and their details?

Efficient Data extraction in Tax accounting is the answer to all these questions. With tax rules getting more complicated and data volumes increasing, it’s essential to find a faster, better, and more secure way to handle data extraction. Automated Software for data extraction can make your life easier.

In this blog, you will learn about the importance of data extraction, its benefits, and how can it be achieved with KlearStack’s feature-rich software.

What is Data Extraction in Tax & Accounting?

Data extraction in tax and accounting refers to pulling data from documents like tax returns, tax deduction forms, invoices, and more. This process can be performed either manually or with the help of advanced data extraction software.

With the high volume of these documents, manual processing risks inaccuracies. Automated software for data extraction is the solution to stay compliant and ensure accurate data for further processing.

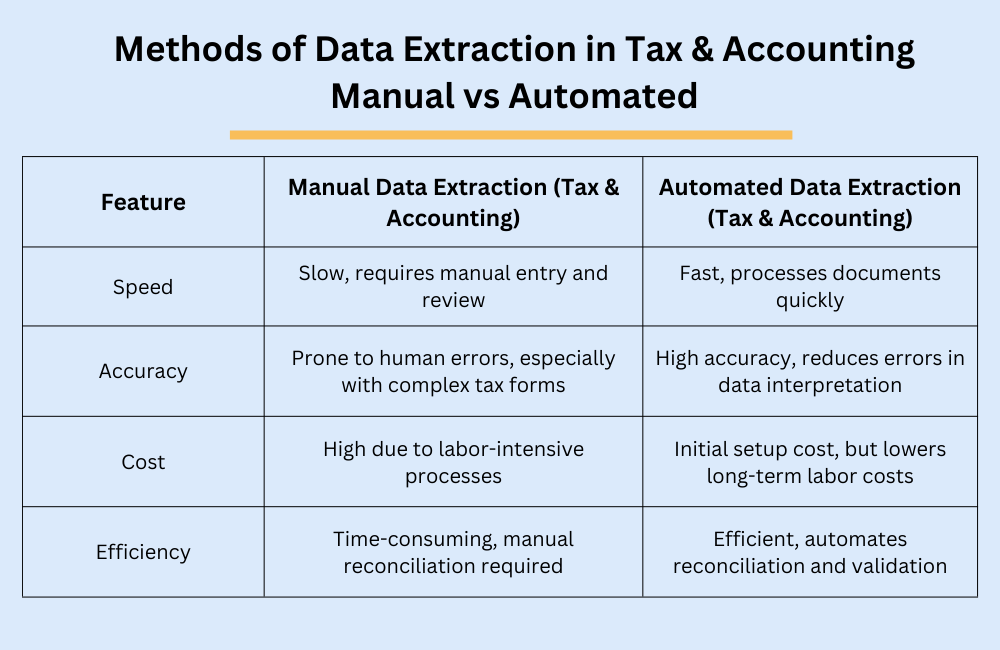

Methods of Data Extraction in Tax & Accounting (Manual vs Automated)

There are two methods of Data Extraction in Tax & Accounting, Manual and Automated. Manual vs automated tax audit data extraction is a comparison worth noting, it helps in understanding the benefits provided by automated software.

Data Extraction in Tax & Accounting – Manual vs Automated

Data extraction in Tax & Accounting using manual methods is the process of entering information into the system manually. This is where a dedicated resource is required to look into the documents for a particular piece of information and then type that information into the system.

An automated process of data extraction is when automated software is used to capture information from documents. This process is entirely automated, right from capturing the information, feeding it into the system, processing it, and seamlessly integrating it into the financial management systems. Advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR) are used here.

Solve Your Tax and Accounting Data Extraction Problems with Automated Data Extraction

Data extraction is an important activity in tax and accounting processes. Automated data extraction makes it easy to manage vast amounts of financial data accurately. By leveraging automated tools, professionals can streamline data handling, minimize errors, and ensure compliance with regulatory requirements. Here is how it can help you:

1. Increase Efficiency in Handling Large Volumes of Data

Manual processing of large volumes of data is time-consuming and labor-intensive. Automated data extraction tools streamline the process, saving time and reducing workload.

2. Reduce the Risk of Errors

Manual data entry is prone to errors. Automated data extraction ensures high accuracy, minimizing the risk of errors.

3. Get Reliable Data for Accurate Tax Filing

Inaccurate data can result in incorrect tax filings and potential penalties. Reliable data extraction tools ensure accurate and compliant tax filings.

4. Improve Management of Financial Data

Managing and integrating data from various sources manually is challenging and inefficient. Automated tools provide seamless integration and management of financial data.

5. Better Compliance with Regulations

Staying compliant with constantly changing tax regulations is difficult and stressful. Automated data extraction tools help ensure compliance with up-to-date regulatory requirements.

6. Save Costs on Professional Services

Hiring professionals for manual data entry and processing is costly. Automated tools reduce the need for manual labor, lowering operational costs.

7. Simplify Data Consolidation

Consolidating data from multiple sources manually is complex and error-prone. Automated data extraction simplifies and accurately consolidates data from various sources.

8. Secure Data Handling

Ensuring the security and confidentiality of sensitive financial data is critical. Advanced automated tools provide robust security measures to protect data.

9. Meet Tight Deadlines Efficiently

Manual data processing is slow, making it difficult to meet deadlines. Automated data extraction speeds up the process, helping meet tight deadlines efficiently.

10. Have Scalability to Handle High Volumes of Data

Scalable automated solutions handle large volumes of data accurately and efficiently.

11. Consistent Data Standardization

Data from different sources is inconsistent, making integration difficult. Automated tools standardize and integrate data, ensuring consistency.

12. Stay Ahead of Regulatory Pressures

Constantly changing regulations require up-to-date compliance. Automated tools help stay compliant with the latest regulations.

13. Streamline Data Collection from Multiple Sources

Manually collecting data from various sources is tedious and inefficient. Automated data extraction tools streamline data collection from multiple sources.

14. Quick Delivery of Insights

Automated tools expedite data processing, enabling quick and accurate insights.

15. Have Faster Reconciliation Processes

Reconciliation of data manually is time-consuming and error-prone. Automated tools.

16. Get Advanced Analysis with Technological Tools

Manual processes make it difficult to analyze data efficiently. Automated tools enable efficient data analysis, providing valuable insights.

Scan the Tax and Accounting Documents Seamlessly

There are many documents that require scanning and data extraction in the Tax and Accounting Industry. A few of them are listed below:

1. Tax Returns (Form 1040, 1065, 1120, etc.)

These are the documents for filing taxes that have detailed income, deduction, and credit information.

2. Tax Deduction Forms (Form W-2, Form 1099, etc.)

These forms are used to report various types of income and the corresponding tax withholdings.

3. Invoices

These are records of transactions between businesses and their clients, detailing amounts due for goods or services provided.

4. Receipts

Receipts are proof of purchase documents used for tracking expenses and substantiating tax deductions.

5. Bank Statements

Monthly records from banks detailing all transactions and balances for account reconciliation.

6. Payroll Records

Payroll records are documents detailing employee wages, taxes withheld, and other payroll-related information.

7. Financial Statements (Balance Sheets, Income Statements, Cash Flow Statements)

These are key reports that provide a snapshot of a company’s financial health and performance over a specific period.

8. Expense Reports

Expense reports are detailed reports of business-related expenditures used for budgeting and reimbursement purposes.

9. Purchase Orders

Purchase Orders are the documents issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services.

10. Audit Trails and Logs

These are records that track changes and access to financial data to ensure accuracy and compliance during audits.

Step-by-Step Guide to Data Extraction from Tax and Accounting Documents

KlearStack is a feature-packed software that makes use of cutting-edge technologies to deliver quick and accurate output. Here is the step-by-step guide for you:

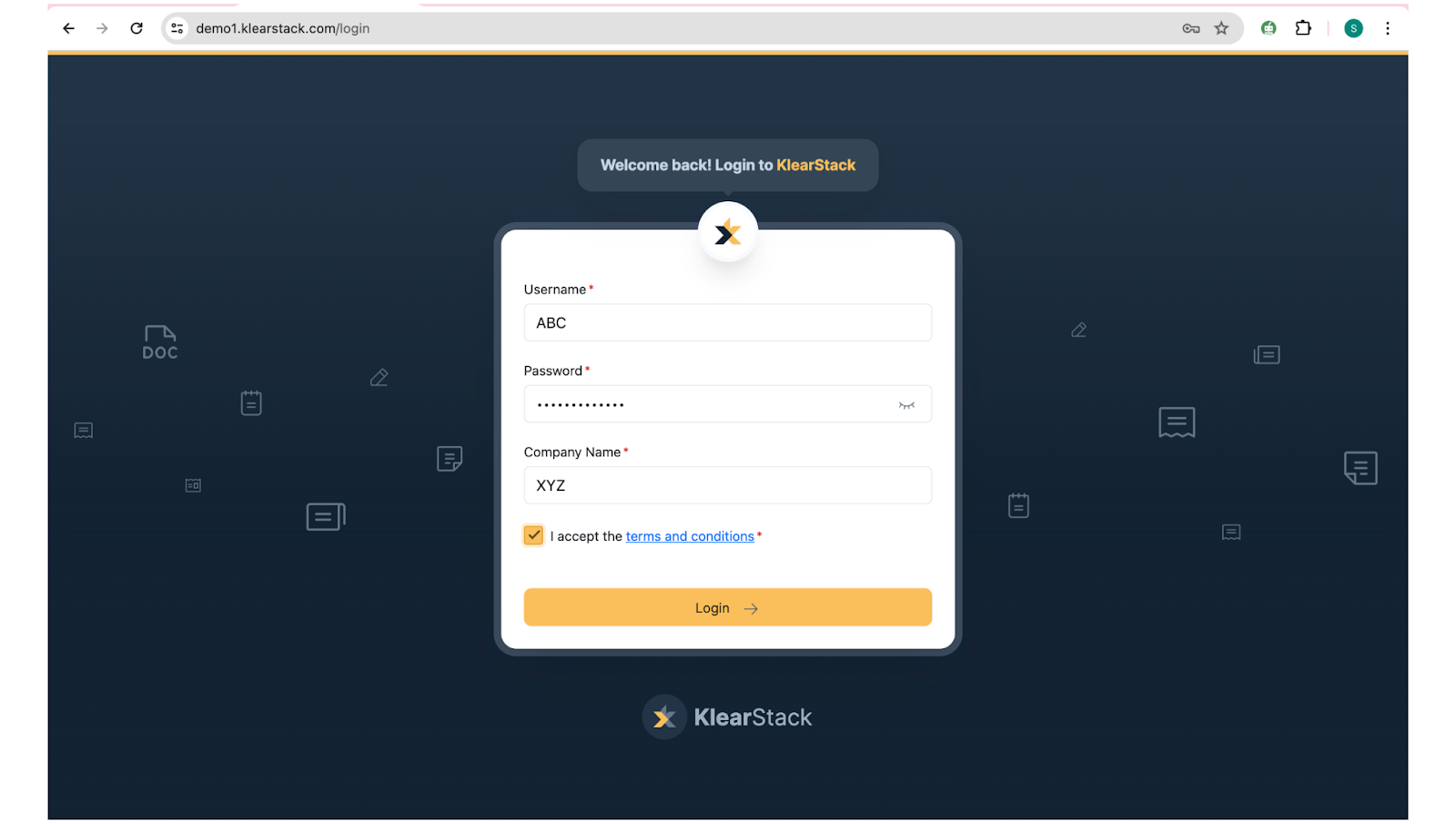

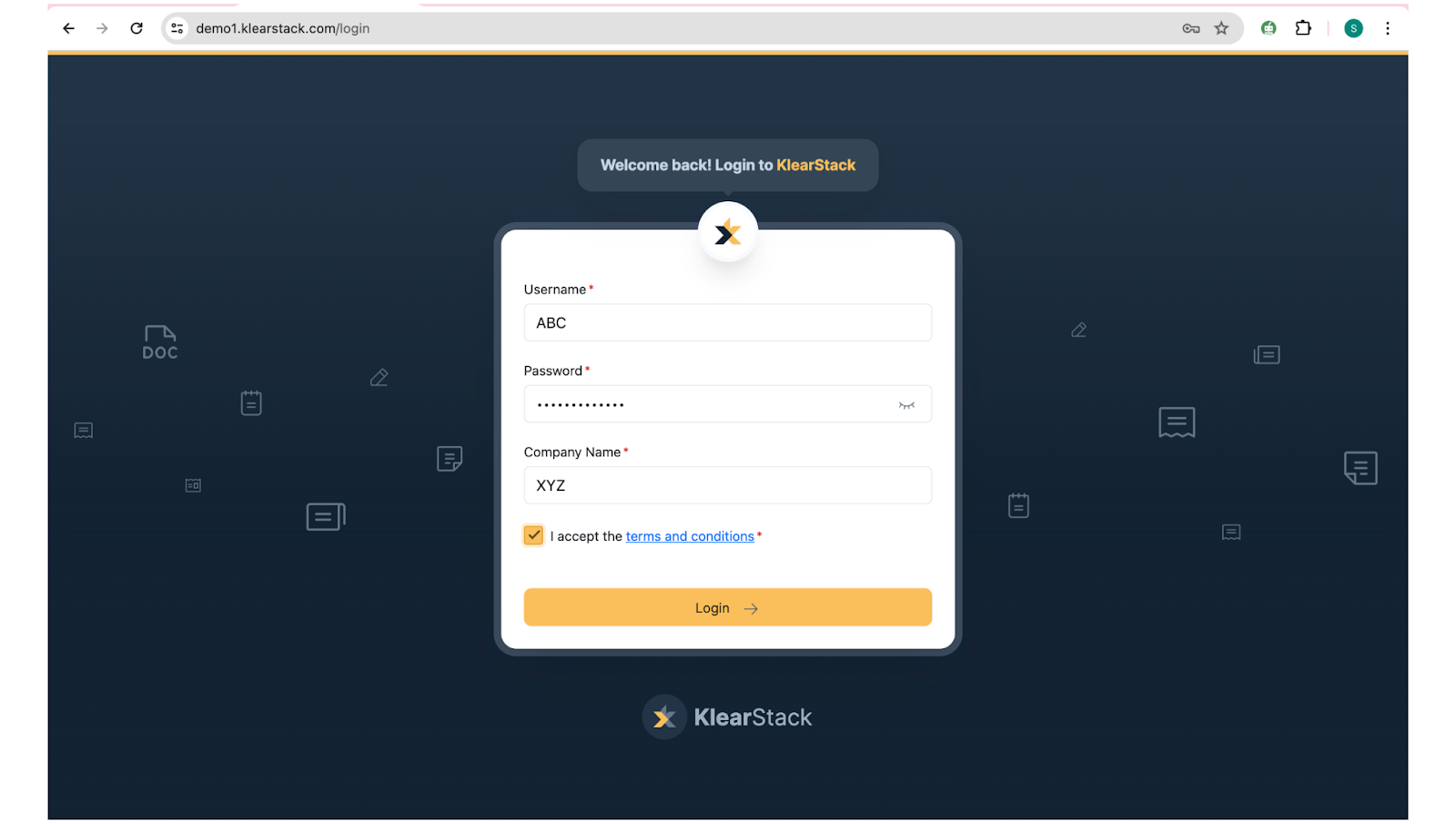

Step 1: Register/login to the software

Once you successfully register with KlearStack as a user, you will get access to the login credentials. Upon entering these, read the terms and conditions carefully, and tick the check box. After this, you can log in to the dashboard, where all the wonders of data extraction start!

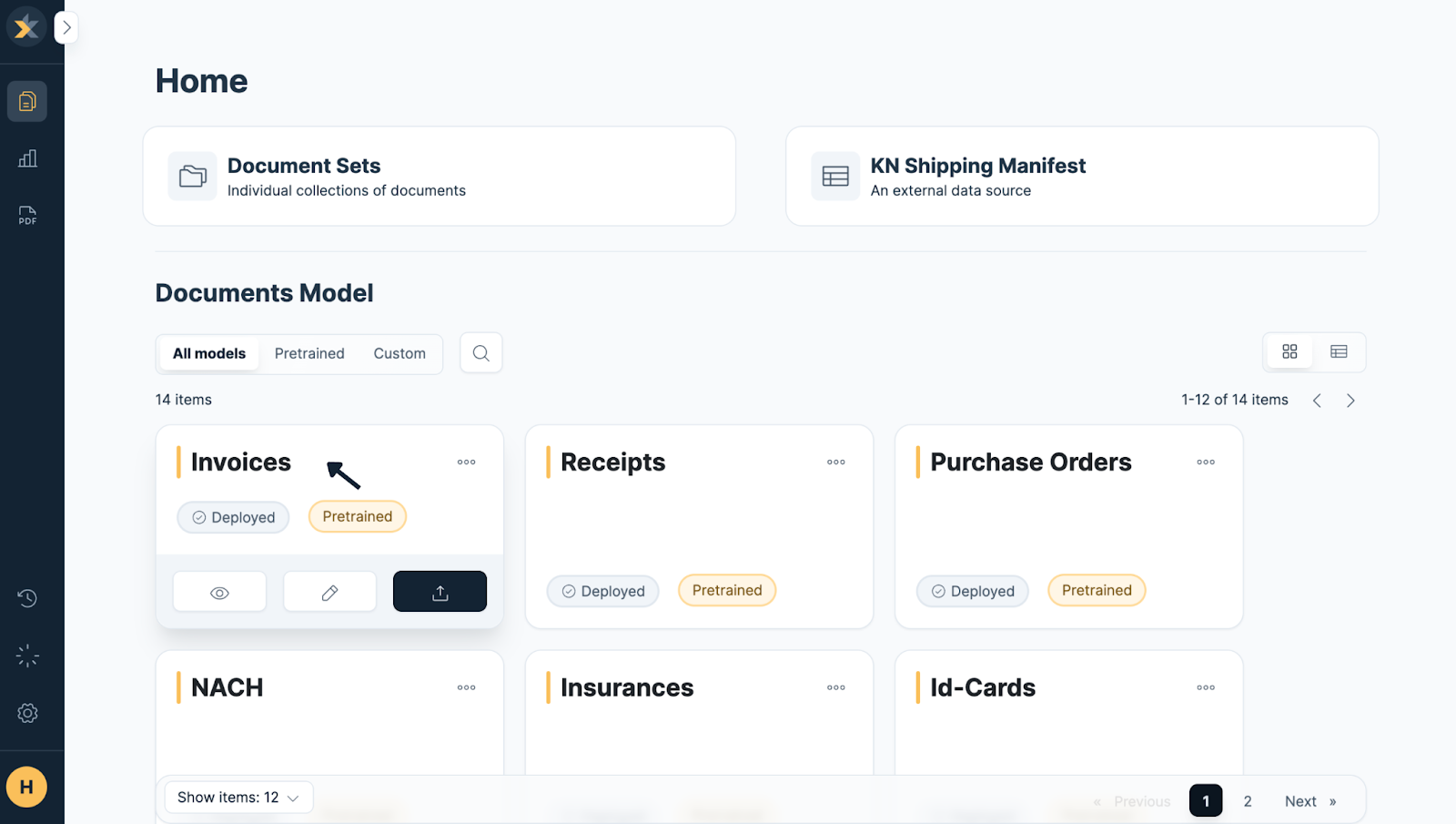

Step 2: View the dashboard to upload the documents.

Once logged in, you will see the dashboard from where different documents can be uploaded. From here, you can add and process various documents, including tax forms, purchase orders, receipts, and over 12 other document types.

KlearStack also has an excellent feature that allows bulk processing of the documents, which means you can upload multiple documents and it will process all of those simultaneously giving you speedy and meticulous results.

From here select your tax-related document, here we will go with a tax invoice.

Step 3: Upload the tax-related document.

Click on the ‘Add new’ tab in the top right corner of the screen. KlearStack allows you to upload documents in different formats such as Electronic PDF, Word, Excel, JPG, BMP, TIFF, PNG, scanned PDF, and ZIP.

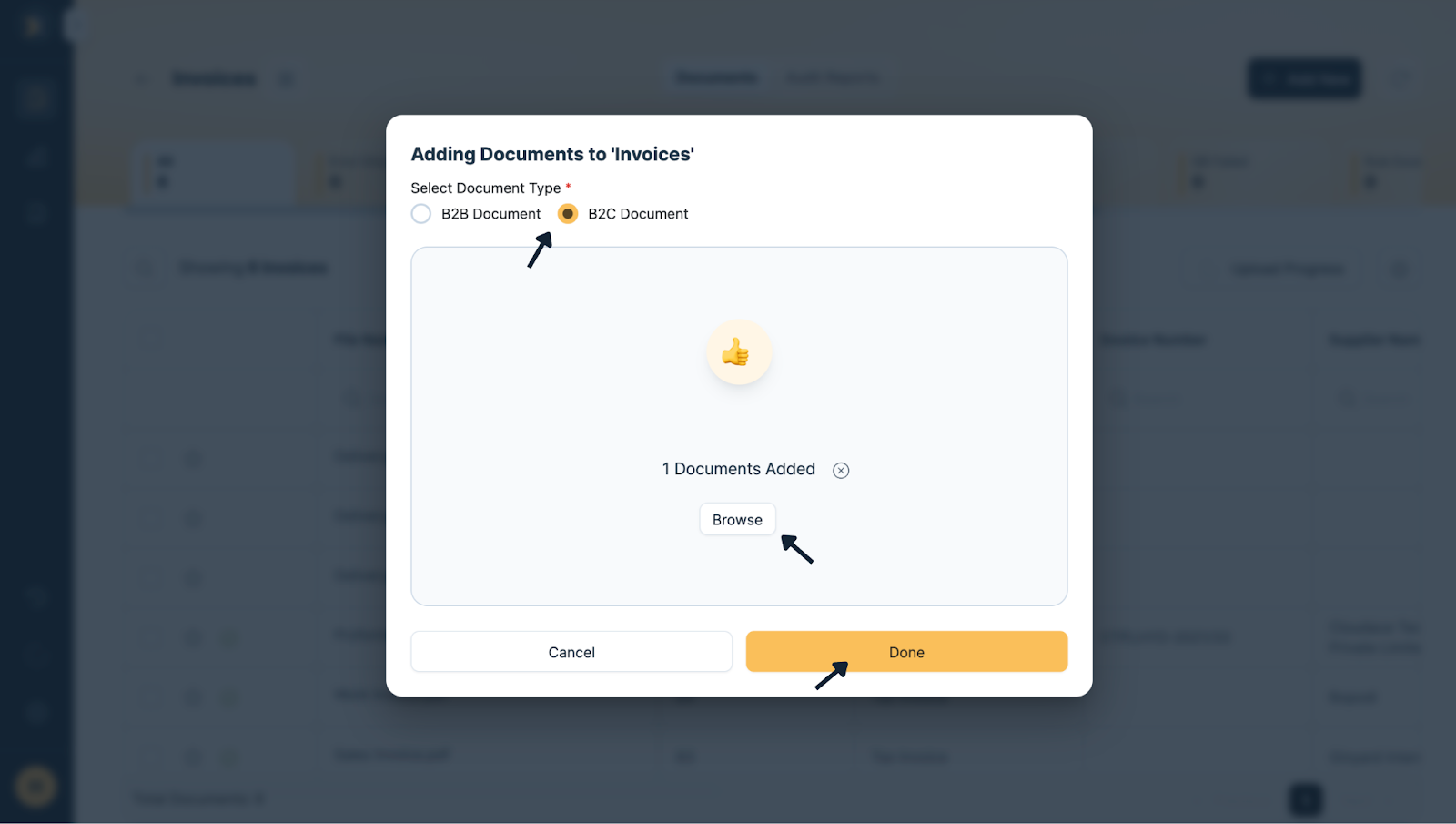

Step 4: Select the business type.

Here you can browse your document and upload from sources available. You also have an option to select if the document is for a B2B or B2C transaction. This ensures better categorization and storage of your data and streamlines your further process of data collection when it comes to final reporting.

Click on Done to proceed.

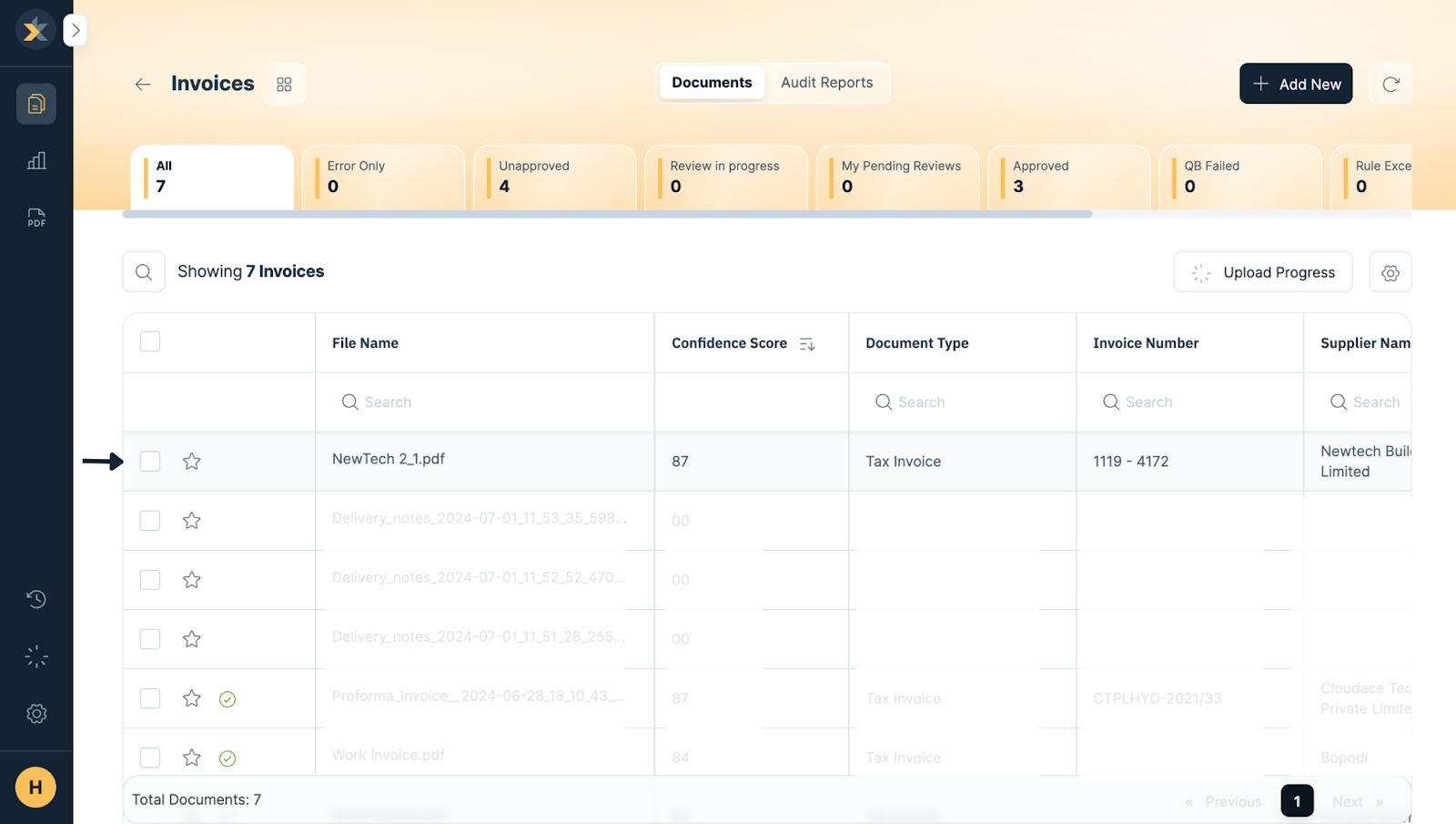

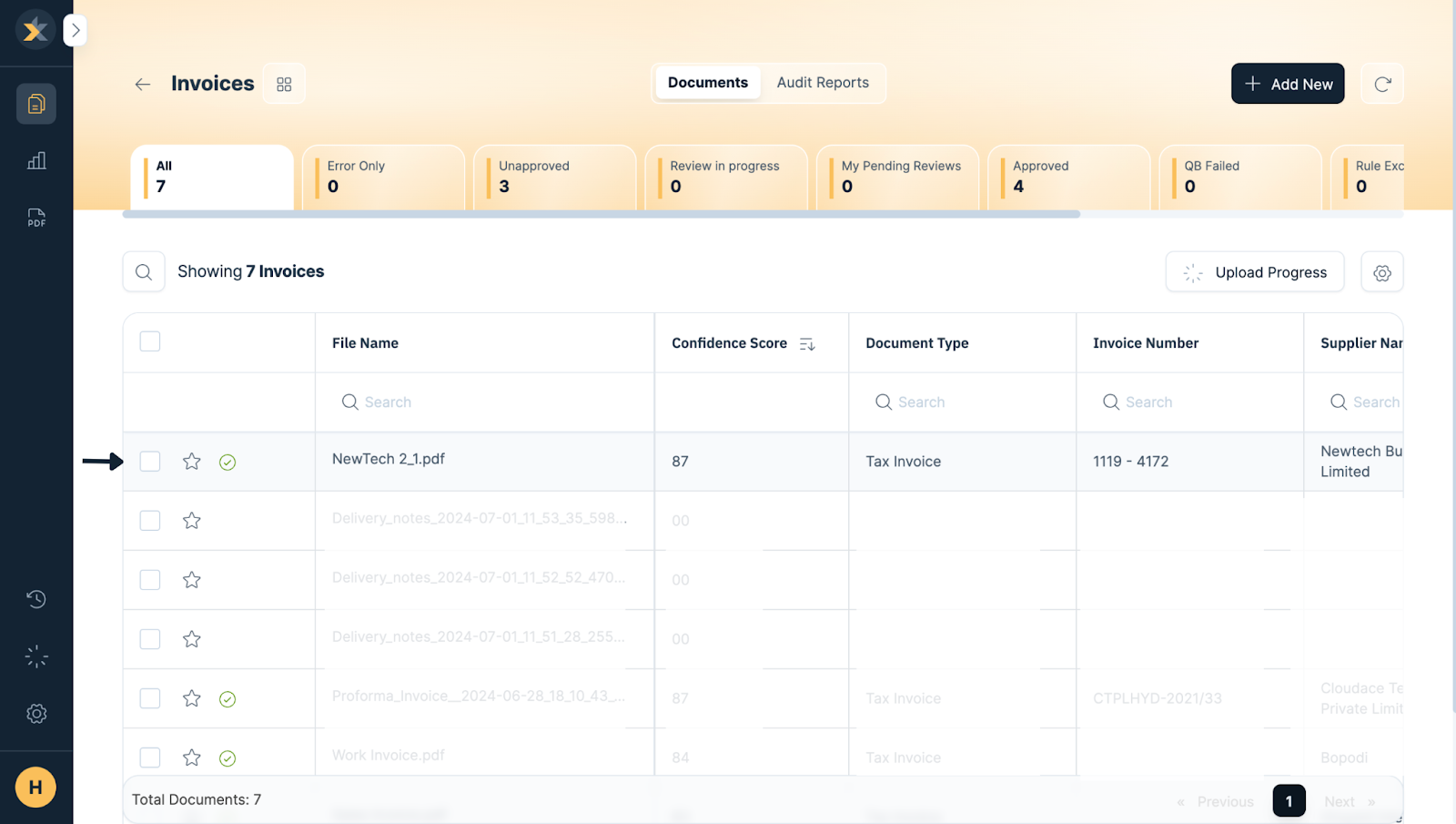

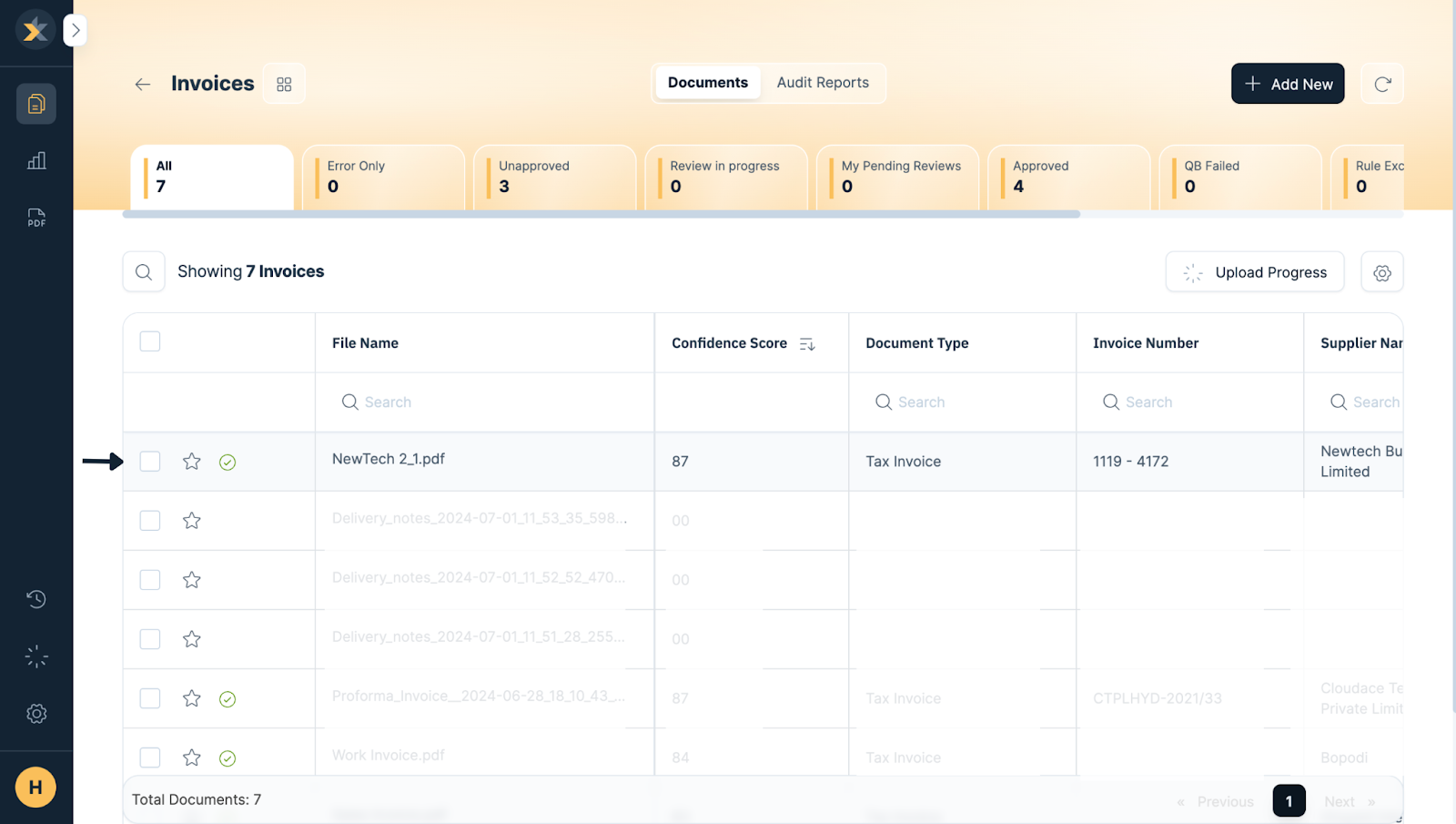

Step 5: View the added document.

Your most recently uploaded document will appear on top. Uploaded documents with their extracted data appear here, providing a quick snapshot of all necessary information at any given time

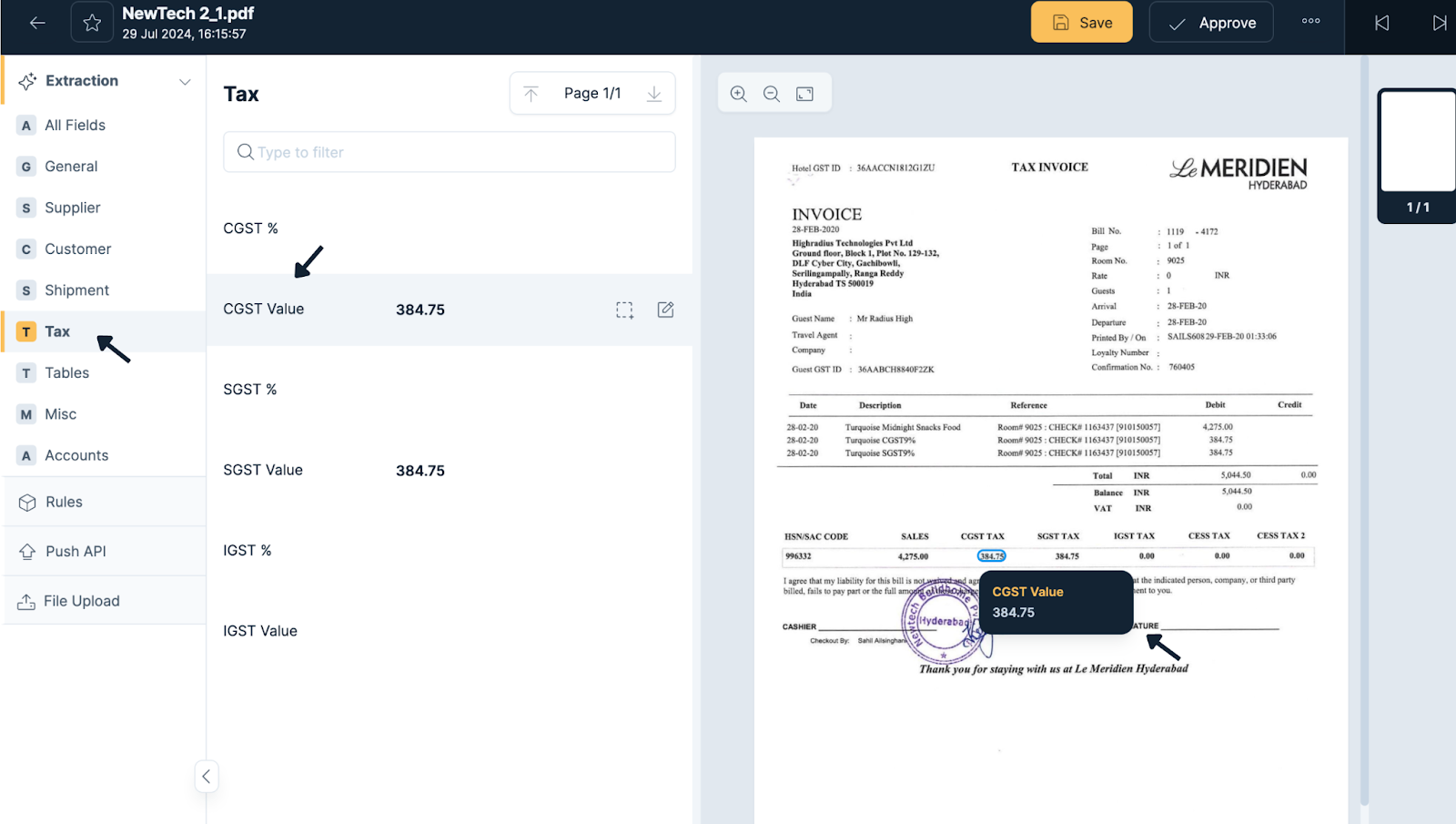

Step 6: Click to check the extracted data.

For detailed information you can click on the uploaded document, you will see all the fields on one part of the screen and the uploaded document on the other. Here you can scroll and check all the extracted data.

On the right-hand side, you can click on ‘Tax’ to see extracted data from tax-related fields.

If you wish to understand where the information has been picked from, simply click on that particular field and it will get highlighted on the uploaded document. If the information is incorrect, you can edit it here. This will retrain the model for future receipts from this entity.

Step 8: Click on approve

Once you’ve verified the details are correct, click on “Approve.” The models are trained to capture data quickly and accurately.

Step 9: View the document on the dashboard.

Once approved, go back to the dashboard and you will see your document there with the approval sign. Here you will be able to see all the documents and data extraction done from each.

Let’s Get your Tax and Accounting Data Extraction Sorted With KlearStack

These are the features that make KlearStack a perfect choice for all your data extraction needs:

1. Template-less Solution

KlearStack’s template-less technology reads and adapts to any new design or layout without needing retraining. This eliminates the need for manual template creation, saving both time and money.

2. Multi-lingual Support

KlearStack supports over 50 languages, including English, Hindi, Marathi, French, German, Chinese, and Japanese. Accurate document extraction ensures language barriers do not hinder international transactions.

3. Bulk Credit Notes Processing

Easily process multiple documents at once with KlearStack’s batch-processing feature. This saves time and boosts productivity by allowing simultaneous uploads instead of sequential processing.

4. Line-item Data Extraction

Extract essential items from documents with precision. Important fields are accurately extracted, ensuring vital information is captured correctly.

5. Multi-page Data Extraction

KlearStack efficiently extracts relevant details from documents with multiple pages. This feature ensures that no information is missed, even in extensive documents.

6. Straight-Through Processing (STP)

Automate the data extraction process with KlearStack, eliminating the need for human intervention. This reduces errors and enhances overall efficiency.

7. Seamless Integration

Integrate data into any financial management system. Automation negates the need for manual data entry, saving time and resources.

8. Document Classification

Automatically sort and categorize documents based on their content. Advanced algorithms organize documents into predefined categories, improving information retrieval.

9. Automated Document Splitting

KlearStack automatically classifies and separates documents that might be attached. This simplifies the analysis process by segregating documents into specific categories.

10. Rich Document Audit Engine

Set up rules for extracted data with KlearStack’s audit engine. The system verifies data against these rules, highlighting any inconsistencies for further review.

11. Rules-based Workflows

Establish rules for processing documents based on criteria such as entity name, total value, or other such. The system routes relevant information to team members according to the defined workflow.

12. Self-learning AI

KlearStack’s AI continuously learns and improves from experience, enhancing its capabilities over time without the need for explicit programming.

Want to know how KlearStack can help you meet tax deadlines while ensuring data security and accuracy?

KlearStack is an advanced data extraction software designed to streamline your tax and accounting processes. Our solution include automation techniques to ensure efficient and accurate data handling. We provide data extractionand integration solutions, all backed by robust security measures for sensitive financial data. Stay ahead with the latest trends and techniques in data extraction. It also makes multi-client management easy. Book a demo call now to troubleshoot your problems and increase efficiency by 500% while having 80% savings on document data entry and auditing costs.

Frequently Asked Questions (FAQs)

Extraction in accounting is the process of pulling out the financial data from various sources like invoices, receipts, and bank statements for further analysis and reporting.

Data processing in accounting means gathering, organizing, and reviewing financial data to produce clear and accurate financial reports, or for its use in for other purposes.

KlearStack – Best Overall for its advanced automation in data extraction and processing, specifically designed for handling complex tax and accounting documents with high accuracy and efficiency.

NanoNets – Offers machine learning-based data extraction capabilities, making it ideal for extracting structured data from various document types.

DocSumo – Extracts data from invoices, receipts, and other financial documents, providing precision and integration with accounting software.