Expense Fraud Detection: How To Spot Risky Claims With KlearStack AI

Expense fraud detection sits at the meeting point of finance, risk, and employee trust. The Association of Certified Fraud Examiners estimates that a typical organization loses around 5% of yearly revenue to fraud, and asset misappropriation schemes such as inflated or fake expense reimbursements appear in most occupational fraud cases. Expense reimbursement schemes are listed as a common pattern inside that broader asset misappropriation bucket. Expense fraud therefore, is not a rare edge case; it is part of everyday financial risk.

At the same time, the nature of expense fraud is changing fast. The ACFE highlights that anti-fraud controls are tied to quicker detection and lower losses, yet many control gaps remain.

Recent coverage of AI-generated receipts shows that fake documents already make up around 14% of fraudulent expense documents on some platforms, up from almost zero only a year earlier.

A long-running ACFE survey also notes that organizations lose roughly 5% of revenue to fraud across categories, reinforcing the financial weight of these issues. When you combine these figures with the fact that most fraud cases involve asset misappropriation schemes like exaggerated expense claims [EisnerAmper], it becomes clear that traditional checks based on visual review and random audits are no longer enough.

As a CFO, controller or audit head, questions quickly surface.

- Are your current controls catching only obvious fraud while missing smarter patterns across receipts, cards, and travel data?

- Do you have a clear view of how expense fraud detection fits into your wider anti-fraud strategy, or is it treated as a small side process?

- And when AI-generated receipts are already in the mix, can your team still rely on manual checks and policy text alone?

This article examines expense fraud detection from a finance leader’s perspective. We start with technology-based detection, move through manual and process-based controls, cover prevention and training, and then look at where gaps appear, especially as AI changes how fraudsters operate.

Finally, we show how KlearStack fits quietly into this picture as the document intelligence layer that helps your existing tools catch more fraud, without turning your program into a loud sales pitch.

Key Takeaways On Expense Fraud Detection

- Expense fraud detection now needs document AI, rules, and human judgement working together.

- Good setups read receipts, cards, and travel data as one story, not isolated records.

- Manual audits still matter but should focus on risk signals rather than random samples.

- Training and policy help reduce grey areas but cannot replace strong detection logic.

- AI-generated receipts demand checks that look past the image and into underlying data.

- KlearStack gives expense tools clean, linked data from receipts, invoices, and related documents.

- This document layer lets finance leaders push their current expense stack much further, without large process shocks.

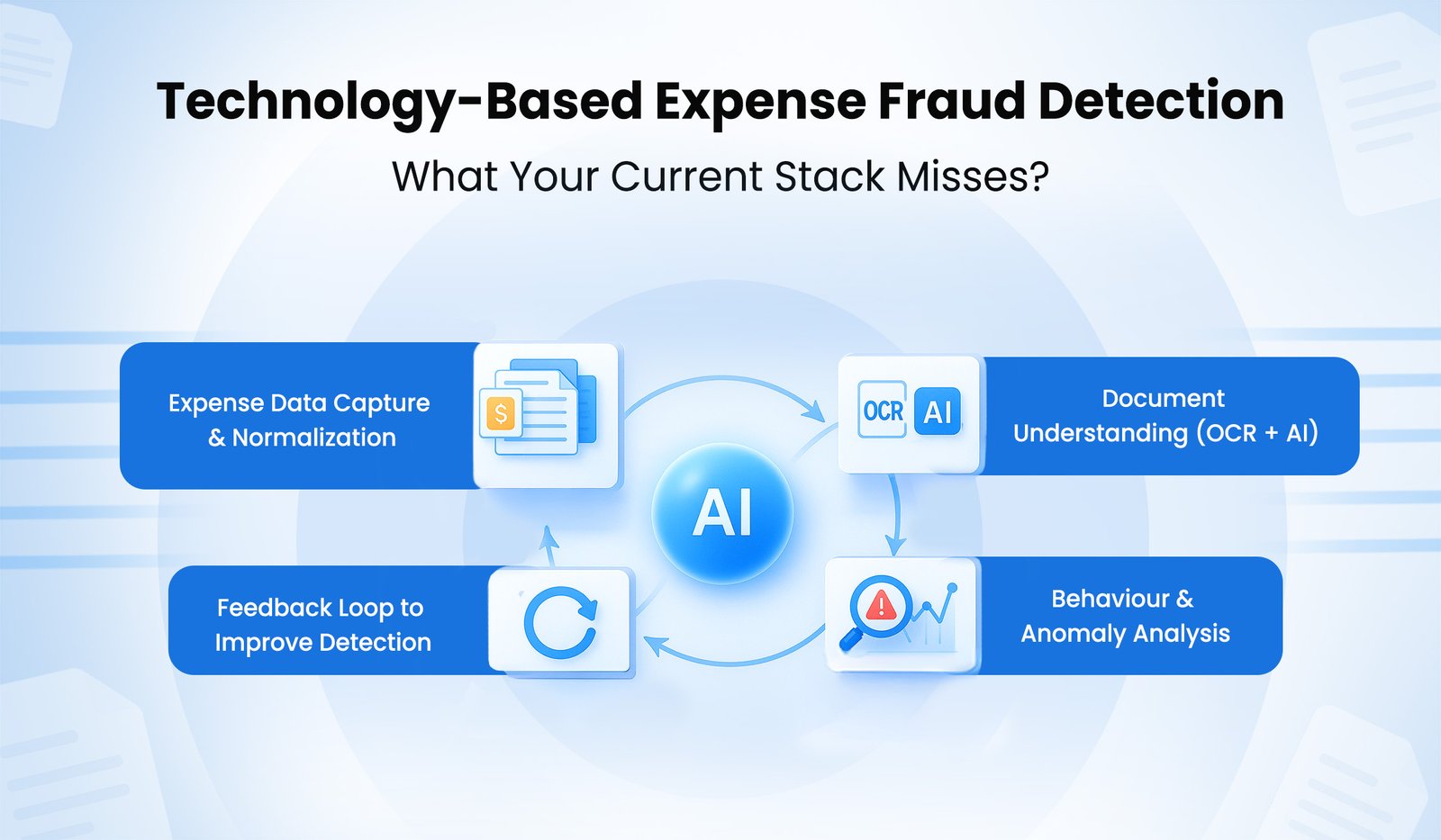

Technology-Based Expense Fraud Detection: What Your Current Stack Misses?

Technology-based expense fraud detection brings together software, data, and AI to scan every claim, not just the noisy ones. Many companies already use automated expense management software, yet fraud still slips through because the detection layer often stops at simple policy checks and surface-level matching. This section breaks down what a stronger technology stack should look like and where typical gaps appear.

The key layers involved in technology-based expense fraud detection are:

- Expense data capture and normalisation

- Document understanding for receipts and invoices

- Behaviour and anomaly analysis

- Feedback loops that teach the system from confirmed fraud

Each layer adds a different view on risk. When they stay isolated, fraud hides between them. When they work together, your team can see both single risky claims and slow-building abuse patterns.

Expense Data Capture And Normalisation

Expense data capture starts when employees submit claims through mobile apps, web forms, or email. Card feeds and travel booking tools also push entries into the same expense platform. The system then standardises currencies, dates, and merchant fields so downstream checks can compare like with like.

However, many tools stop at basic field-level clean-up. They do not normalise merchants that appear with small spelling changes, nor do they link expenses back to purchase orders, sales orders, or invoices. For finance leaders, this means fraud patterns that cross modules still require heavy manual effort to find.

A stronger capture and normalisation layer should:

- Map related records, such as PO, SO, invoice, and expense claim, into one view

- Tidy merchant names into stable identities for risk scoring

- Keep original document images alongside structured fields for later review

Document Understanding For Receipts And Invoices

Document understanding is where OCR and document AI read the fine print that often hides fraud. Instead of only checking total amounts, systems can read merchant fields, tax details, item lines, and payment methods from receipts and invoices.

Once this data is available, finance teams can run checks across:

- unusual tax treatment for a given country or category

- item lines that do not match the stated trip purpose

- receipts that look different but share the same hidden structure

KlearStack fits strongly at this stage by turning varied receipt layouts into consistent, high-quality data. We read fields from receipts, invoices, and related documents without rigid templates. That means fraud detection logic is not limited to one or two fixed formats but can work across real-life messiness.

Behaviour And Anomaly Analysis

Behaviour and anomaly analysis uses AI models to learn what normal spending looks like for each role, route, cost centre, and vendor group. Instead of checking every claim against a static policy, the system compares it against thousands of similar cases.

Over time, this analysis can highlight:

- Employees whose spending pattern slowly drifts away from their peer group

- Vendors that appear unusually often for certain teams or locations

- Expense categories that spike in value after policy changes

These models do not replace rules; they add another lens. Rules keep basic policy in place, while behaviour analysis shows early hints of new fraud tactics that have not yet been written into policy documents.

Feedback Loops For Smarter Detection

Feedback loops close the gap between detection and learning. When reviewers tag a claim as fraud, error, or acceptable exception, that label should feed back into both rules and AI models.

The key steps involved here are:

- Reviewers tag outcomes during case handling rather than only in later reports

- The system keeps a simple library of confirmed fraud patterns, linked to documents

- Models retrain on this labelled data so future high-risk claims move to the front of the queue

For CFOs, this feedback loop is what makes expense fraud detection feel less like a one-off software rollout and more like a living control framework.

KlearStack supports this by keeping a reliable record of document fields and versions so your rules and AI models have clean inputs as they evolve.

Manual And Process-Based Expense Fraud Detection

Manual and process-based expense fraud detection still plays a strong role, especially when context and judgment matter. Technology can highlight patterns, but people carry crucial knowledge about clients, deals, and real-life exceptions. The goal is not to replace this judgment but to aim it at the right claims.

Most finance teams already use some mix of manual audits, layered approvals, and exception reports. Yet these often feel reactive rather than planned. The table below summarises how common controls contribute to detection and where they can fall short.

| Manual Control Type | Primary Use In Detection | Strength For Leaders | Risk When Used Alone |

| Periodic manual audits | Review samples of claims for misuse patterns and weak documentation. | Deep understanding of schemes and behaviours in high-risk areas. | Low coverage and late findings; hard to scale with growing volumes. |

| Multi-step approvals | Let managers and finance review claims before reimbursement. | Close link between spend, project context, and business need. | Approver fatigue; risk of routine “approve all” behaviour. |

| Exception dashboards | Surface claims above thresholds or with certain policy flags. | Clear visual of risk across categories, teams, and merchants. | Quality depends on rules; new fraud patterns may sit outside filters. |

| Internal hotline or tip process | Allow staff to report suspicious claims or patterns. | Access to informal knowledge that systems cannot see. | Relies on trust and culture; may surface only clear or extreme cases. |

For C-suite leaders, the aim is to keep these controls but change where they focus. Reviews should centre on claims that technology marks as high risk, not on random picks or only large amounts. This keeps detection sharp without overloading approvers.

Designing Review Flows For Busy Approvers

Busy leaders want clear signals, not long reports. When you redesign review flows around expense fraud detection, it helps to:

- Give each approver a short daily queue of high-risk claims with reason codes

- Show related documents and card transactions in one place for quicker judgment

- Log decisions and comments so audit and AI models can learn from outcomes

When paired with KlearStack’s document view, approvers can see the actual receipt, related invoice, and PO details together. This lowers the chance of approving a claim simply because the summary screen looked normal.

Prevention And Training For Expense Fraud Detection

Prevention and training do not remove the need for expense fraud detection, but they decide how often your detection rules fire. Clear standards, simple policies, and practical examples reduce grey areas where small personal spending can turn into regular misuse.

Policy documents should be written in plain language with side-by-side examples of acceptable and unacceptable claims. Employees benefit from knowing what happens when mistakes occur versus when deliberate fraud is found. That clarity helps honest staff feel safe asking questions rather than hiding errors.

Employee training works best when aligned with real data. Instead of generic slides, finance teams can use anonymised patterns from detection reports:

- Common red flags that appear before confirmed fraud cases

- Categories where small claims frequently fail checks

- Examples of AI-generated receipts and why they raised suspicion

Corporate card design also matters. Cards restricted to specific categories and regions limit the room for personal spending. When card data feeds directly into document AI and detection rules, finance leaders gain a traceable link from transaction to receipt to approval.

Expense Fraud Detection Gaps That Open The Door For AI-Generated Receipts

AI-generated receipts change the threat model for expense fraud detection. Earlier, fraudsters needed editing skills and time to modify real receipts. Now, almost anyone can create a realistic image with a short text prompt. Visual checks alone no longer give enough comfort.

Several gaps make it easier for AI-generated receipts to slip through.

Weak Document Checks At Intake

If your expense system only checks whether a receipt image exists and matches the total amount, AI-generated receipts pass with ease. They mimic logos, layouts, and fonts well enough for a quick glance.

Stronger intake checks should:

- Read the full receipt using document AI, not just the total field

- Compare merchant names and addresses against known lists and locations

- Look for template patterns that repeat suspiciously across employees or periods

Isolated Systems With No Cross-Checks

Fraud becomes harder when each receipt must align with multiple independent data sources. When expense tools do not talk to card platforms, ERPs, or travel systems, AI-generated receipts gain a free path.

Cross-checks that help here include:

- Matching receipt dates and amounts with underlying card transactions

- Checking travel claims against itinerary and booking records

- Linking high-risk merchants with prior fraud cases or disputes

KlearStack strengthens these checks by providing the same clean document data to each system rather than keeping it trapped inside separate modules.

Limited Visibility For C-Level Leaders

When C-level leaders see only aggregated spend dashboards, they miss how AI-driven fraud behaves at the claim level. Trends may look stable even as fraud slowly rises in specific teams or regions.

To close this gap, leaders benefit from:

- Summary views that highlight high-risk patterns by team, merchant, and route

- Quick drill-downs from those patterns into linked documents and decisions

- Periodic briefings that connect detection data with broader fraud and control themes

Expense fraud detection then becomes part of the wider risk conversation, not a narrow back-office concern.

How KlearStack Supports Expense Fraud Detection Across Documents

KlearStack adds value to expense fraud detection by focusing on documents rather than replacing existing expense platforms. We sit between incoming receipts and your downstream systems, turning messy files into structured, connected data that detection logic can actually use.

First, KlearStack reads receipts, invoices, travel confirmations, and related documents without relying on fixed templates. Our document AI extracts key fields such as merchant, date, tax, item lines, payment method, and currency from almost any layout.

That lets your expense engine and card platform work with detailed, consistent fields instead of raw images.

This results in several benefits for expense fraud detection:

- Fraud rules and AI models use reliable document fields, not partial or hand-typed data

- Duplicate and recycled receipts are easier to spot across teams and periods

- Expenses can be linked to POs, SOs, and invoices, reducing double-billing risk

- Approvers see the full document context instead of a narrow claim summary

Next, KlearStack keeps a clear audit trail. When reviewers mark a claim as fraud, error, or acceptable exception, that decision sits alongside the original documents and extracted data.

Your data science teams, audit partners, or external providers can then use this labelled history to refine fraud rules and models.

We designed KlearStack to support the expense fraud detection stack you already have. You keep your preferred expense system and card provider.

We handle the hard document work in the background so your controls, policies, and people can act with better information.

When you are ready, you can book a free demo call to see how this document layer fits into your expense and procurement workflow.

Conclusion On Expense Fraud Detection

Expense fraud detection today is about more than spotting odd taxi receipts. For finance leaders, it touches revenue protection, culture, and trust in reported numbers. Strong programs mix document AI, rules, and human review, then back them with policy and training that employees understand.

The main business gains from such a setup include:

- Lower hidden spend from falsified or padded claims across travel and general expenses

- Faster, more focused audits that concentrate on real risk rather than broad samples

- Better alignment between finance, procurement, and internal audit on spend controls

- Greater comfort for executives who sign off on accounts built on cleaner expense data

By adding KlearStack as the document intelligence layer in this stack, you turn unstructured receipts and invoices into dependable inputs for every other tool.

That gives your organization a realistic path to stronger expense fraud detection without disrupting how people already work.

FAQs

Expense fraud detection is the process of spotting false or inflated employee expenses. It uses document AI, rules, and review workflows to find risky claims before reimbursement. The focus is on both single incidents and repeating patterns.

AI studies past expense behaviour and learns what looks normal for each role or team. It then highlights claims that differ sharply from those patterns, even when they still follow written policy. Reviewers spend more time on the claims that genuinely look risky.

Yes, when they look past the receipt image and into the data behind it. Document AI reads fields such as merchant, tax, and item lines, then compares them with other systems. Repeated templates, unrealistic merchants, or mismatched trips raise alerts.

Start by bringing receipts, card data, and expense reports into one view. Then add document AI such as KlearStack to extract reliable fields from all receipts and invoices. From there, build layered rules and targeted audits that focus on high-risk claims rather than random checks.