Financial Services Compliance Software: Automate Regulatory Management & Risk Mitigation in 2025

If your financial institution is still managing compliance manually, you’re not just risking inefficiency. You’re exposing your organization to regulatory penalties, reputational damage, and operational disruption. Using financial services compliance software like KlearStack can fix that.

According to the study conducted by Forrester Consulting, global financial institutions now spend over $205 billion annually on financial crime compliance. Another report by Navex Global states that 19% of risk and compliance professionals have seen their organization face legal or regulatory action.

Manual processes are no match for today’s fast-changing regulatory landscape. Rules shift overnight, and compliance expectations span multiple frameworks like AML, KYC, GDPR, FATCA, and more.

This is where financial services compliance software steps in. Not only do they simplify the workload, but they also protect your institution from costly gaps, human error, and compliance fatigue.

This guide will explore how modern compliance software helps financial services leaders automate regulatory reporting, cut compliance costs, and stay audit-ready.

What is Financial Services Compliance Software?

Financial services compliance software is specialized technology that automates regulatory obligations, manages risks, and ensures adherence to legal requirements.

It centralizes data and provides reporting capabilities while maintaining complete audit trails. Plus, streamlines compliance processes like Anti-Money Laundering (AML) monitoring and Know Your Customer (KYC) verification to prevent violations and penalties.

What’s more, these platforms integrate with core systems, flag suspicious activities in real time, and adapt to evolving laws.

Key Features of Financial Services Compliance Software

The best financial services compliance solutions offer features tailored to the unique needs of banks, credit unions, investment firms, and insurance companies. When evaluating platforms, look for these:

- Regulatory change management: The software should automatically track regulatory updates across frameworks such as AML, FATCA, GDPR, SOX, and Basel III. It must notify compliance teams of relevant changes. And adjust internal policies or workflows to maintain ongoing compliance.

- Risk assessment & management: A strong platform includes built-in risk scoring engines and analytics that monitor customer behavior, transaction patterns, and business activities. It helps identify and prioritize potential risks like fraud, sanctions exposure, or money laundering — often before they escalate.

- Policy management: The system should centralize all compliance-related policies and procedures. It must offer features like version control, approval workflows, and audit-ready documentation. And ensure policies are mapped to relevant regulations and remain up to date.

- Training and awareness: Effective compliance software provides tools for delivering training programs, tracking completions, and ensuring staff attestations. This helps organizations maintain a strong culture of compliance and meet regulatory expectations for ongoing employee education.

- Monitoring and reporting: The platform should continuously monitor transactions and compliance activities in real time. It must also generate regulatory reports such as SARs, CTRs, and FATCA filings with minimal manual intervention. This improves accuracy and reduces reporting time.

- Incident management: The software should allow teams to log, track, and resolve compliance-related incidents or policy violations. It must assign accountability, document each step of the investigation, and ensure timely resolution with complete audit trails.

| Struggling with regulatory compliance inefficiencies and audit preparation? With KlearStack, you can automate everything from KYC document verification to real-time transaction monitoring and regulatory reporting. |

Benefits of Implementing Financial Services Compliance Software

Investing in financial services compliance software yields significant returns in both qualitative and quantifiable ways. Let’s break down the key benefits institutions can expect:

- Reduced risk of non-compliance: By automating checks and enforcing policy adherence, compliance software significantly lowers the risk of regulatory violations. Unlike manual processes, the system doesn’t skip steps or miss red flags. Fewer breaches mean fewer fines, less legal exposure, and no unwanted headlines.

- Time and cost savings: Compliance software handles repetitive tasks — like data entry, monitoring, and reporting — in seconds, not hours. This allows skilled compliance teams to focus on high-value work such as investigations and risk strategy. In fact, 65% of compliance professionals say automation reduces both the complexity and cost of compliance (Thomson Reuters Risk & Compliance Survey).

- Improved security and data privacy: Compliance software enforces encryption, access controls, and suspicious activity monitoring. This ensures data privacy preferences are respected, boosting customer trust. Most solutions are also certified for standards like SOC 2 and ISO 27001.

- Increased operational efficiency: Automated KYC accelerates customer onboarding, leading to faster conversions and improved customer satisfaction. Alerts and case management unify compliance, fraud, and operations teams on a single platform. This reduces silos and miscommunication.

- Audit and examination readiness: When regulators request proof of compliance, the software can instantly generate audit-ready reports. Many platforms offer a built-in “audit pack,” saving hours of manual prep. This level of readiness reduces exam intensity, builds regulator confidence, and gives leadership peace of mind.

Manual vs Automated Compliance: A Comparitative Overview

| Aspect | Manual compliance (Before) | Automated compliance (After) |

| Regulatory updates | Relies on spreadsheets and emails; delays in tracking changes | Real-time alerts on regulatory updates with automatic policy adjustments |

| Data collection | Fragmented data across departments; difficult to consolidate | Centralized data from multiple systems in real-time |

| Transaction monitoring | Spot checks are done randomly or periodically | Continuous monitoring of all transactions for suspicious patterns |

| Audit preparation | Weeks of scrambling to gather documents and logs | “One-click” audit packs with logs, reports, and policy sign-offs ready |

| Policy management | Static documents stored in files; version control issues | Dynamic policy portals with updates, approval flows, and audit trail |

| Incident management | Incidents logged in Excel or email with no unified dashboard | Centralized case management system with automated alerts and escalation workflows |

| Time and cost | High labor costs; compliance officers stuck in repetitive admin work | Reduced FTE hours, lower operational cost, and compliance teams focus on strategic decision-making |

| Risk exposure | High — due to missed steps, human error, and lag in action | Lower — due to proactive alerts, real-time compliance, and continuous risk scoring |

Types of Financial Services Compliance Software Solutions

“Compliance software” is an umbrella term encompassing a variety of specialized solutions. Depending on your institution’s focus and pain points, you may need one or several of the following types of compliance software:

1. Anti-Money Laundering (AML) software

This software monitors financial transactions to detect suspicious activity such as money laundering. It helps institutions comply with AML regulations like BSA and FATF. It also automates the filing of Suspicious Activity Reports (SARs).

2. Know Your Customer (KYC) verification software

This software automates customer identity verification using OCR, biometrics, and watchlist screening. It supports risk profiling and ensures compliance with KYC and Customer Due Diligence (CDD) regulations. Ongoing monitoring helps detect changes in customer risk status over time.

3. Communication surveillance software

This monitors emails, chats, and voice calls to detect signs of misconduct, insider trading, or regulatory violations. It helps financial institutions comply with regulations like MiFID II and FINRA. Alerts are triggered based on keywords, patterns, or unusual behavior in communications.

4. Vendor risk management software

This software evaluates third-party vendors for compliance, financial stability, and security risks. It maintains records of due diligence, certifications, and performance metrics over time. Financial institutions use it to strengthen vendor oversight and meet regulatory expectations for third-party governance.

5. Data privacy software

This software manages customer consent, processes data access requests, and enforces retention or deletion policies. It helps financial institutions comply with privacy regulations like GDPR, CCPA, and PDPA. Built-in controls reduce the risk of data breaches and strengthen customer trust.

How Financial Services Compliance Software Works

Financial services compliance software runs in a continuous loop — pulling data, scanning for risks, raising alerts, and adapting to new rules. Here’s how it works, step by step:

1. Integration with core systems: The software connects to systems like banking, payments, trading, and CRM tools via APIs or batch uploads. It pulls real-time or scheduled data to create a unified view for compliance monitoring.

2. Data collection and monitoring: The software continuously collects data from connected systems and checks it against regulatory rules and risk models. It scans transactions, screens names against sanctions lists, monitors communications, and verifies required processes. Rule-based logic and machine learning flag any suspicious or non-compliant activity in near real-time.

3. Reporting and audit generation: The software generates reports for regulators like SARs, KYC logs, and transaction summaries. It tracks every action — approvals, alerts, policy changes — for audit evidence. You can export detailed records in the required formats during inspections.

4. Risk management and alerts: The software scores risks based on rules or AI models. It monitors transactions, user behavior, and third-party activity to detect threats. When risks cross a threshold, it sends real-time alerts to compliance teams for action.

5. Continuous updates: The software regularly updates its rules and workflows to reflect changing regulations. It pulls updates from regulatory feeds and applies them automatically. This keeps your compliance program current without manual intervention.

| Ready to automate your AML and KYC compliance processes? Get in touch with KlearStack for a personalized demo and see how we can cut your compliance costs and stress dramatically. |

Regulatory Frameworks Covered by Compliance Software

Financial services compliance software typically supports a wide range of global and regional regulations. Some of the major frameworks include:

- Dodd-Frank Act: U.S. regulation focused on risk oversight and consumer protection in financial markets.

- Basel III: Global banking standard that sets capital, liquidity, and leverage requirements.

- Anti-Money Laundering (AML): Regulations to detect and prevent money laundering and terrorist financing.

- Know Your Customer (KYC): Requirements for verifying customer identity and assessing risk before onboarding.

- MiFID II: EU regulation improving transparency, investor protection, and market integrity in financial trading.

- GDPR (General Data Protection Regulation): Privacy law that applies to financial institutions processing EU customer data.

ROI Analysis: Measuring Compliance Software Success

To justify investing in financial services compliance software, institutions need to calculate ROI based on real, measurable outcomes. Here’s a simple framework:

| Factor | How to measure it |

| Compliance cost reduction | Compare pre- and post-software spend on manual compliance tasks, headcount, and third-party audits. |

| Penalty avoidance | Estimate potential fines or legal costs avoided by catching issues early or maintaining audit readiness. |

| Operational efficiency gains | Measure time saved on processes like KYC, monitoring, reporting, and training. Translate into FTE cost savings. |

| Audit preparation time savings | Quantify hours/days saved per audit cycle due to centralized documentation and automation. |

You can build a simple ROI calculator based on:

- Annual Savings = (Manual Compliance Cost Saved + Penalties Avoided + FTE Time Saved)

- ROI (%) = [(Annual Savings – Annual Software Cost) / Annual Software Cost] x 100

Example:

- Manual compliance cost saved: $250,000

- Penalties avoided: $100,000

- Time saved (valued in salaries): $150,000

- Annual software cost: $120,000

ROI = [(250,000 + 100,000 + 150,000 – 120,000) / 120,000] x 100 = 316.7%

Getting Started with Compliance Software Selection: KlearStack

Embarking on the journey to automate your compliance? A great first step is to partner with experts who understand both the technology and the financial services industry. This is where KlearStack comes in.

Here’s how KlearStack Helps:

- Banking industry expertise: KlearStack’s solutions are purpose-built for financial institutions. The platform has experience supporting banks, credit unions, and fintechs across regions.

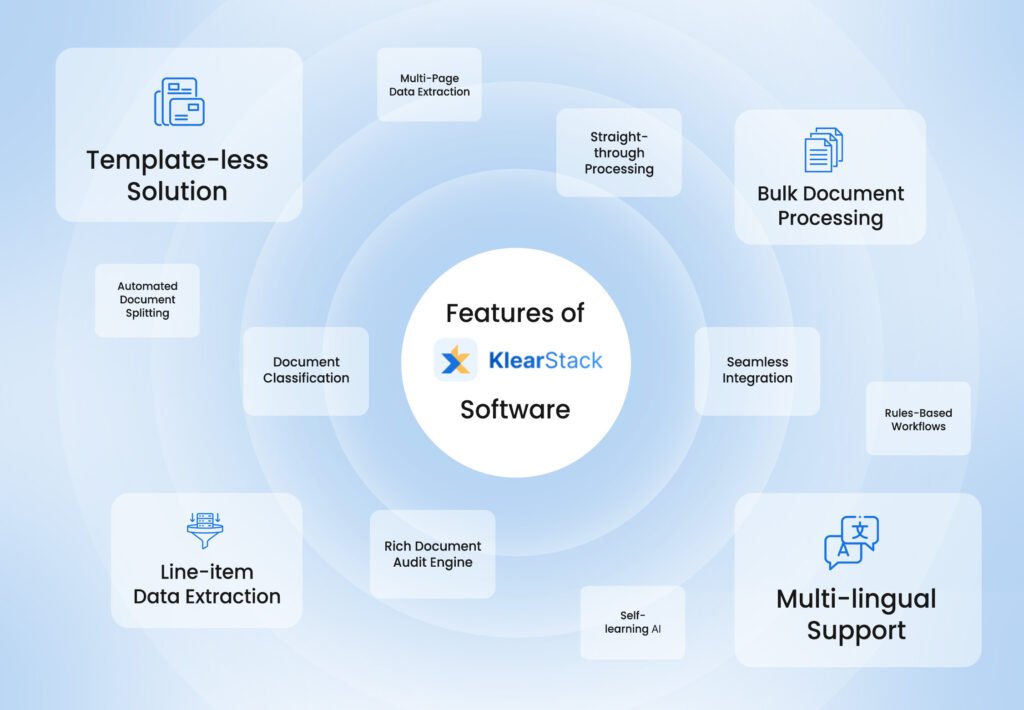

- Comprehensive feature set: KlearStack’s AI engine automatically verifies customer IDs, extracts data, and risk-scores customers in minutes. It continuously monitors transactions and customer behavior, flagging suspicious patterns and potential fraud in real-time.

- Cost reduction: It helped banks reduce auditing costs by up to 80% through the automation of document handling and data entry.

- Seamless integration: KlearStack’s platform is API-first, ensuring it can connect with your existing core banking or CRM systems. It also supports batch data imports and offers connectors for common databases.

- User-friendly design: The dashboard gives a clear overview of compliance KPIs. And the alert management console is streamlined for quick investigations. No need for extensive training – if you know compliance, you can navigate KlearStack with ease.

- Dedicated support and advisory: The support team includes compliance specialists. They can assist with mapping your requirements, configuring rules, and optimizing your processes to align with best practices.

In a nutshell, KlearStack understands the pressure you’re under to meet regulatory demands while controlling costs. The mission is to relieve that pressure by automating the grunt work and equipping you with superior intelligence to manage risk. Book a demo today.

Conclusion

Managing compliance manually is risky. The stakes are too high, with regulatory expectations mounting and enforcement actions accelerating.

That’s why financial services compliance software has become a necessity in 2025’s complex regulatory environment. It turns compliance from a constant headache into a largely automated function that still maintains rigorous oversight.

So, don’t wait for the next regulatory fine or operational meltdown to prompt action. Because you’re empowering your teams to focus on higher-value activities that drive the business forward.

FAQs on Financial Services Compliance Software

Financial compliance software typically costs $50,000–$100,000/year for smaller firms, while large institutions may pay several hundred thousand. Pricing depends on users, modules, or transaction volume.

Most institutions see ROI within 12 to 24 months, with early benefits like labor savings and process efficiency often visible in the first 6 months.

Modern compliance software integrates with banking systems via APIs, file transfers, or database connections. It pulls in data (like transactions or customer info) and can push back insights like risk scores in real time.

Yes, robust compliance software like KlearStack can handle multiple regulations like AML, GDPR, and sanctions simultaneously through dedicated rule sets and modules

Implementation typically takes 8–12 weeks for mid-sized banks using cloud-based solutions. Larger or more complex setups with custom integrations can take 6–9 months, often rolled out in phases.