Insurance policies contain a wealth of information such as unique identifiers, names or entities, policy type, amount paid, coverage limit, etc. Companies operating in this field must extract and arrange these data in a structured format. It helps with the easy accessibility of multiple information, risk management, fraud detection, claim processing, and more. It also aids the company to provide personalized services to customers. Insurance data extraction helps the insurance company extract data from the number of insurance documents and arrange them in a structured format.

What is Insurance Data Extraction?

Insurance data extraction is a process for collecting data points from various sources, such as insurance forms, invoices, contracts, and health reports. It plays a pivotal role in document management in the insurance industry. Data extraction can be done manually or automatically.

However, manual data extraction in the insurance industry can be prone to errors and consume time. This results in slowing down processes of claim settlement, claims processing, policy issuance ,etc. Additionally, with manual entry, there are chances of errors in data entry, calculation, and documentation. It poses a significant risk for the insurance industry and its customers.

An Automated AI-enabled data extraction technology mitigates these risks, efficiently works, and derives accurate information in minimal time, enhancing the experience of insurers and customers.

Manual Data Extraction vs Automated Data Extraction in Insurance

- Manual data extraction in the insurance industry involves human intervention to insert insurance data into the system. A dedicated workforce is essential for this work. Manual data extraction is suitable for small-scale industries and small volumes of documents. The manual technique requires attention to detail, proper documentation, and a group of professionals.

- Automated data extraction uses software and tools to identify, extract, and validate crucial data from various insurance documents. It involves Artificial intelligence, Machine learning, OCR, NLP, RPA, etc., to perform the process. Insurance document automation works on large volumes of data in less time.

Primary Documents for Insurance Data Extraction

Insurance data encompasses various documents crucial for insurers, insurance datasets, and databases. Here are some of the primary documents for insurance:

1. Insurance Application

Insurance application is one of the major documents that insurance companies ask prospective customers to fill. These applications ask for crucial information such as personal details, financial information, statements etc. Insurance companies with the application gather information and evaluate the customer’s suitability for the insurance policy.

2. Identity Proof

Identifu proof is an crucial doument in for insurance data extraction. Identity proof helps companies identify theft or fraud. Examples of identity proof for insurance are the Aadhar card, PAN card, driving license, passport, bank passbook, birth certificates, voter ID card, electricity bill, proof of income, etc.

3. Policy Contract

The policy contract is a detailed document that mentions all the terms and conditions of the insurance. It’s the evidence of the insurance contract. In the policy contract, the insurer promises to pay the sum of money and its future delivery. Only in it do individuals taking the insurance promise to pay the installments of premiums on the scheduled date.

4. Premium Receipt

The premium receipt is proof that the insured has paid his/her amount to the insurer. It’s an important document in the insurance industry for both customers and insurance companies. Companies extract data from these receipts in their systems to ensure the safety of the documents.

5. Nomination Details

In some insurance, like life insurance and health insurance, nomination details are crucial. Insurers must keep nomination details at easily accessible places to process the claim without any delay, ensuring the best experience for the nominee.

6. Medical Records

Individual medical records are crucial for insurance companies to provide underwriting and claim assessment. The records act as evidence of medical history, involving multiple information related to individuals’ health, including diagnoses, treatments, medications, and test results.

7. Claim Forms

Claim forms are an important document for insurance data processing as they contain essential details of loss or damage. They are used to report insurance claims. The claims forms should be processed faster to accelerate the insurance claim process for individuals.

8. Communication Records

The company also needs to track communication with the insured or prospective customers. Communication through email, SMS, or letters involves important information like claim status, policy updates, or general queries.

Automated data extraction helps extract all this information without human intervention, easing the process.

Common Challenges in Data Extraction for the Insurance Industry

Some of the common challenges in data extraction for the insurance industry are as follows:

1. Variety of Data Types and Documents

An insurance policy company must identify and extract a variety of data from multiple documents, such as policy number, policyholder name, premium, coverage limit, effective date, expiration date, claim history, payment history, risk factors, and more. Processing meaningful data efficiently from the large volume of data and document types is challenging.

2. Accuracy and Security

Insurance data involves crucial information that needs to be accurate to process claims, manage premiums, and perform other activities efficiently. Moreover, policy companies are something individuals trust for their future. Offering them security is vital for the insurance industry.

3. Compatibility of Data Extraction Tool

One major challenge for insurance data extraction is the compatibility of tools with the company’s existing system. Most insurance companies follow a pattern for data gathering and processing. New tools can be prone to transform the system. However, few tools integrate with the existing system of insurance companies and enhance the data extraction process.

4. Scalability

The demand for insurance policies is rapidly increasing. This requires the insurance industry to increase operational efficiency. However, manual data extraction and small-scale tools are not as effective in fulfilling insurance companies’ increasing demand. AI-empowered, automated insurance data processing tools help increase the insurance companies’ scalability.

5. Cost

Installing a robust data extraction system can be costly for insurance companies operating on a small scale or with tight budgets. However, with the balance in cost and benefit, data extraction can be proven as the solution for the insurance industry.

Major Tools and Technologies for Data Extraction From Insurance Documents

1. Optical Character Recognition (OCR)

Optical character recognition (OCR) scans the documents and converts them into machine-readable text to extract crucial information. OCR works with various document types, including images and PDFs.

2. Artificial Intelligence and Machine Learning

Artificial intelligence, AI, machine learning, and ML are vital in insurance data extraction. These new technologies help in automating data extraction processes by learning from patterns and improving accuracy. The techniques keep learning and offer more accuracy with time.

3. Natural Language Processing (NLP)

NLP enables the computers to interpret human language and facilitate the extraction of useful information from unstructured documents such as claim forms, application etc and conversation like emails, SMS, or letters. NLP understands the importance of information and embed them in the system at the relevant place.

4. Intelligent Document Processing (IDP)

IDP combines OCR, AI, ML, and NLP to extract the data from various document sources efficiently. With Intelligent document processing, the insurance industry can automate the data extraction process, classification, and entry from various structured and unstructured documents.

5. Cloud Storage Solution

Cloud storage solution enables to store a large number of unstructured data on cloud. This is the solution for giant insurance companies dealing with a large volume of data. Cloud storage solution is managed and hosted by a third party provider, enabling seamless data management.

Benefits of Automation of Insurance Data Extraction

Automation in insurance data extraction offers a range of benefits to enhance the efficiency and effectiveness of insurance companies. Some of the key advantages are:

- Improved accuracy and reduced errors

- Reduces labor costs associated with manual data entry and verification

- Faster processing times lead to quicker response times for customer inquiries and claims.

- Enables the identification of unusual patterns that may indicate fraudulent activities.

- Easily manages large volumes of data in a centralized place.

Best Practice for Data Extraction in Insurance Industry

Intelligent Document Processing (IDP) is an efficient solution for the insurance industry. It enables the company to automate data extraction from large volumes of documents by ensuring accuracy and safety. It transforms the data extraction process and reduces repetitive work such as data entry and classification. Various intelligent document processing tools are available in the market.

KlearStack is one of the leading data extraction tools, equipped with 99% accuracy, 50+ language understanding, OCR, AI, and ML. It is a software that allows document ingestion from various sources, including Google Drive, AWS S3 Bucket, Gmail, API, etc. With Klerastack, extracting data for the insurance industry is easy.

Step by Step Guide for Insurance Data Extraction with KlearStack

Here is the guide to process insurance policy documents with KlearStack to speed up the process and ensure accuracy.

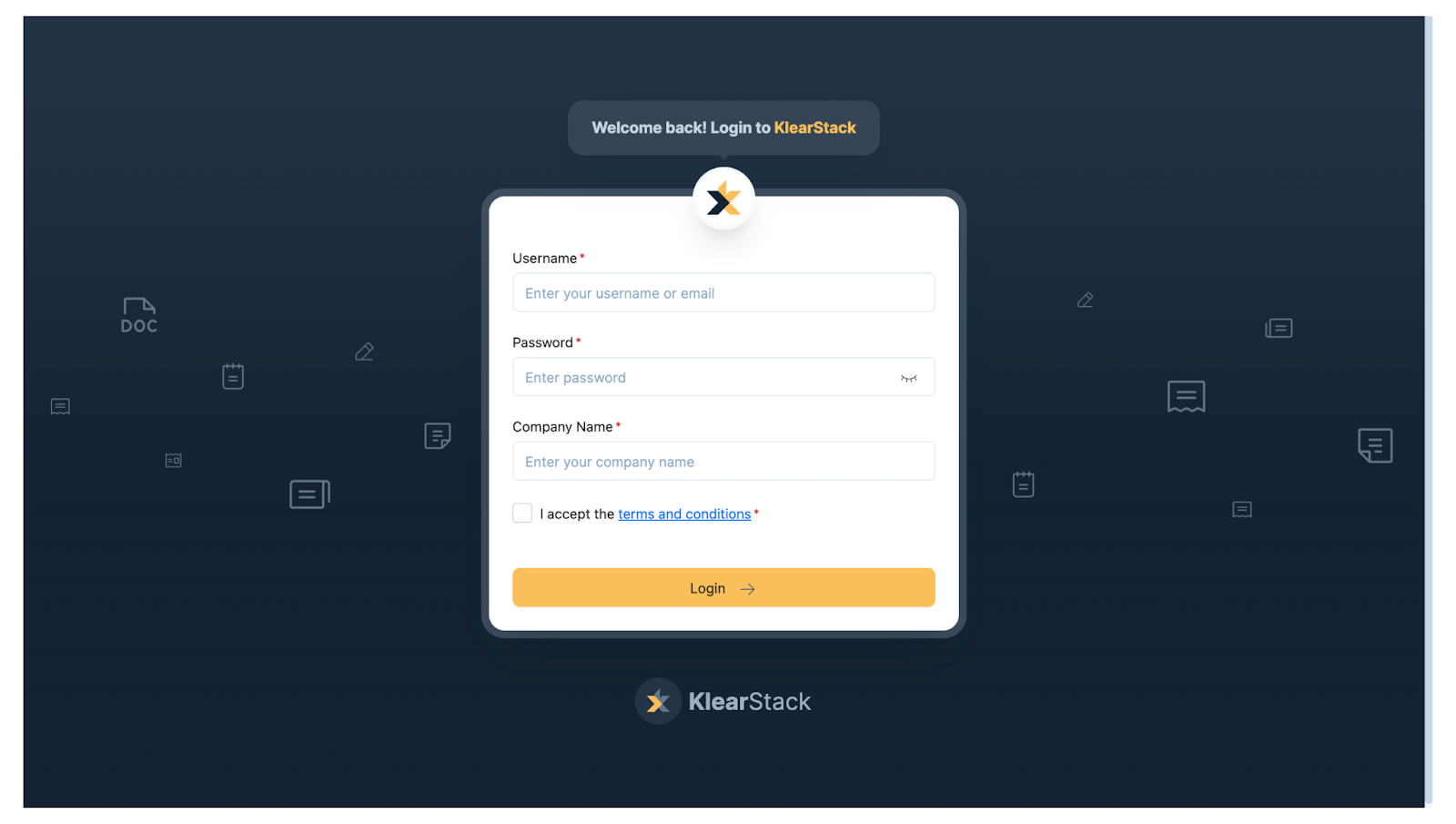

Step 1: Register/login to the software

The first and foremost step is to register with the software. Once you have registered, you’ll receive login credentials. Use the credentials to log in with KlearStack and access its dashboard.

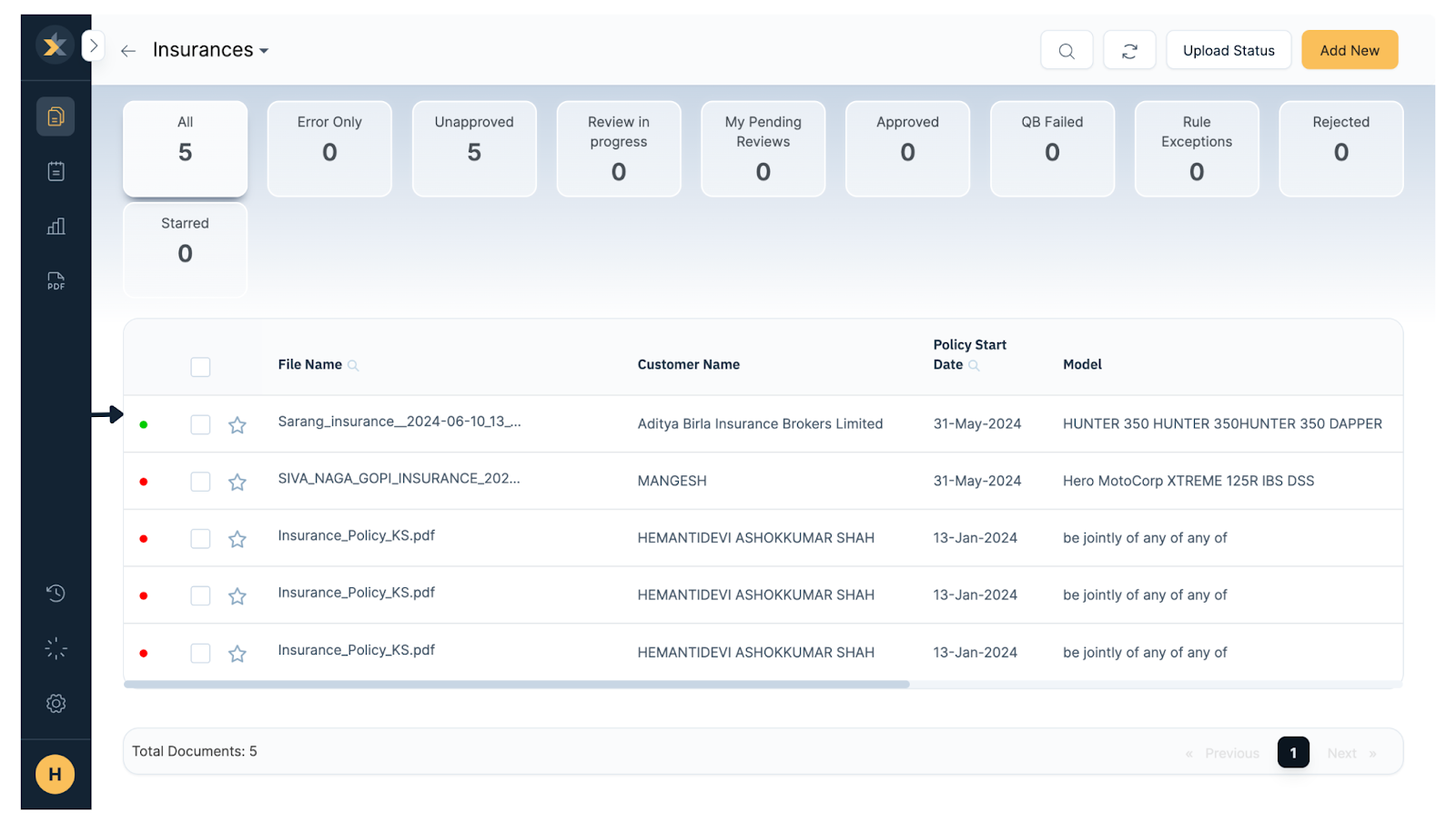

Step 2: View the dashboard

You can view and upload several document types in the dashboard, from invoices, insurance, receipts, and more. You can also create a customized document type based on your use cases. Navigate the insurance section in the dashboard and tap on it to upload the document.

Step 3: Add the Insurance policy document

Click on the “Add new” button at the top right corner to upload the document. KlearStack supports different document types, including PDF, Word, Excel, JPG, BMP, TIFF, PNG, scanned PDF, and ZIP.. You can upload the insurance document at your convenience.

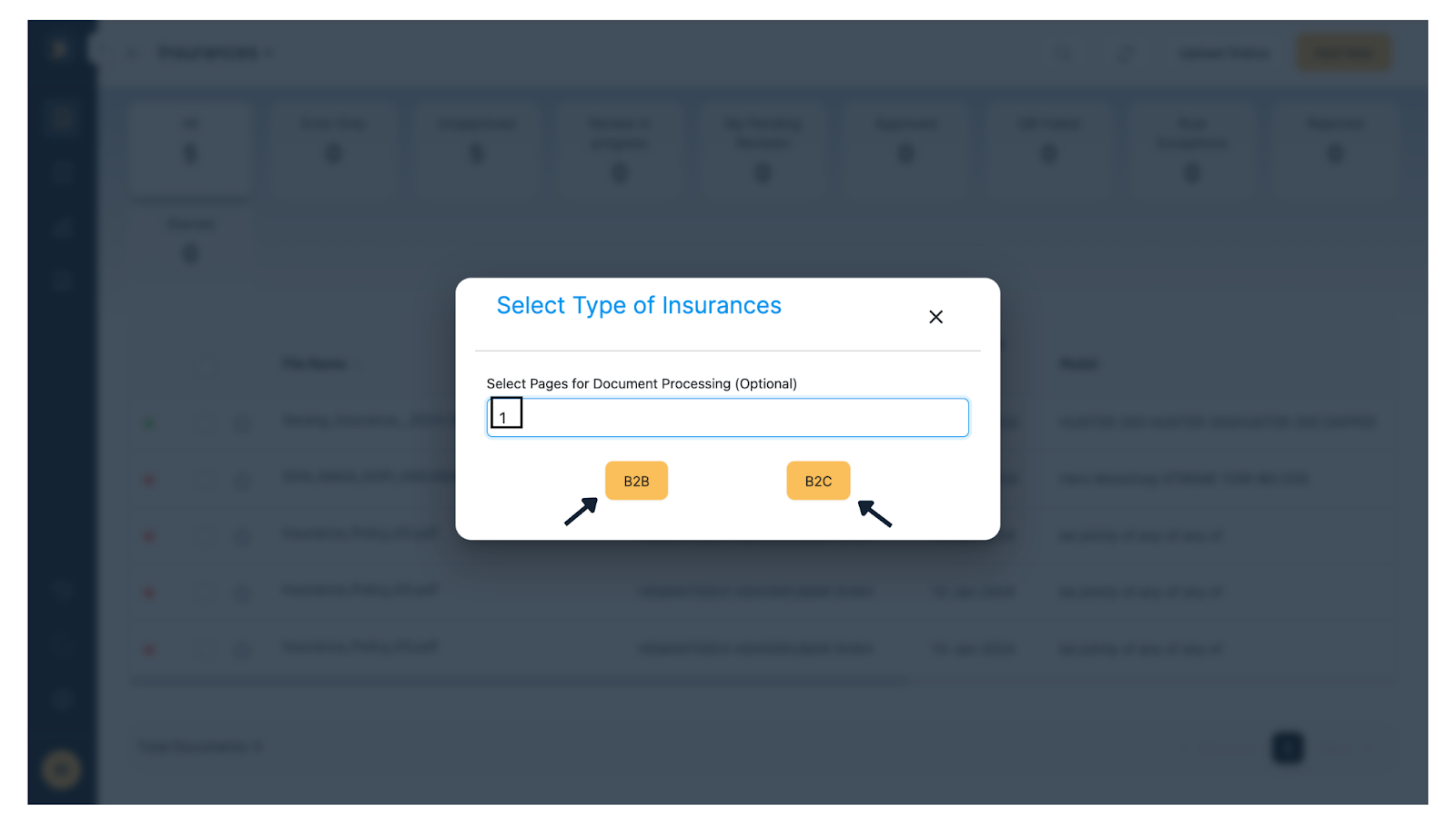

Step 4: Select Type of Insurances & Number of Pages

Select the type of Insurance whether it’s B2B or B2C. You also require to select the number of pages you want to process from uploaded documents. KlearStack can process multi page documents.

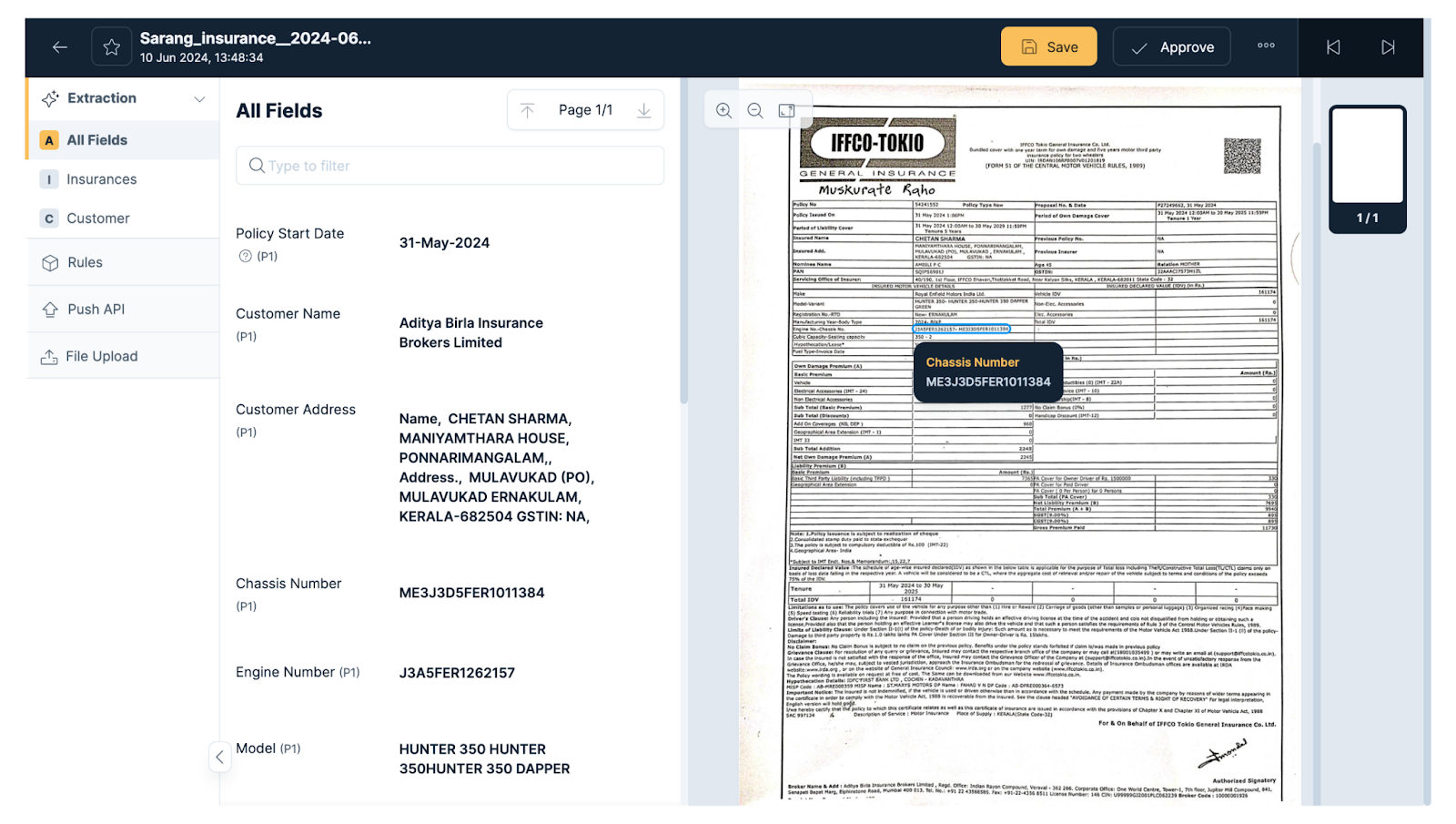

Step 5: View and verify the information

Once you upload the document successfully, the software extracts the information. View this information and verify its accuracy. If there is any misinformation, KlearStack enables you to correct it manually. Tap on the specific area to edit it.

Step 6: Manage the data in one place

Through the KlearStack dashboard, you can manage all insurance policy documents in one place. You can see the document type, extracted information, and more to manage them efficiently.

Step 7: Use the Processed Data Conveniently

Now when the system has processed the data, you can access it and use it for different purposes. Klearstack also has the secure RESTful APIs, that enables you to integrate your existing system with Klearstack, automating the entire process.

Using RESTful APIs of Klearstack, you can upload documents for processing. KlearStack instantly processes those and pushes the extracted and audited results to your existing system using another API. There are also APIs with which clients can automate pushing the external data to KlearStack. KlearStack then uses this data for automated reconciliation against the data extracted from documents.

Key Benefits of Automated Data Extraction in Insurance Industry With KlearStack

1. High Accuracy with Self-Learning Abilities

AI-enabled KlearStack data extraction solution extracts data from documents with up to 99% accuracy. In addition, it compares original documents to identify missing information and continuously improve.

2. Template-free data extraction

The KlearStack data extraction process is not bound to any template. This means it can process any document seamlessly without relying on certain patterns.

3. Integrations with Exciting System

KlearStack is an open RESTful API with pre-built connectors for SAP, QuickBooks, and other ERP (Enterprise resource planning) systems to ensure seamless integration with any system.

4. Security and Support

Data extraction technology understands that data is crucial and that its security is essential. KlearStack works with top-notch data security and offers continuous support for any issues.

5. Bulk Processing

KlearStack is compatible with bulk document processing. With multiple pages at once, a number of pages can be processed, enabling the insurance company to speed up the process.

Want to Know More about How KlearStack can Help with Insurance Data Extraction? Schedule a Demo!

Kleartstack helps process the various document types, including insurance policies, in over 50 languages. Want to know how it’s possible? Schedule a free demo of KlearStack software exclusively for you and your use cases. Come-up with your queries or your desire to learn about KlearStack in detail.

In the demo call, you will talk with experts, explore the tool, understand its use cases, and learn how it can enhance your business experience.

FAQs Related to Insurance Data Extraction

Insurance data is collected from various sources, including policy applications, claims forms, customer interactions, market research, and data partnerships.

The primary data sources for insurance are:

Insurance application form

Identity proof

Policy contract

Premium receipt

Nomination details

Medical records

Claim forms

Communication records

Insurance Data mining is a process for identifying a pattern in large datasets associated with insurance documents and extracting crucial information.

Various types of data are collected by an insurance company, including personal information like name, date of birth, parents name, occupation, health information, financial information, geographic information, policy information, claim information, and others.