Enterprise Lending Document OCR: OCR in Loan Processing Automation for 2025

Introduction

A heap of documents – we are talking in terms of thousands here. When banks have to take care of such huge volumes of paper – manual data entry is horrifying. Many lending organizations face 40-60% longer processing times for the same. Automation with lending document OCR changes this.

Questions to Consider when using OCR in Loan Processing:

- How much time does your team spend manually processing loan documents?

- What percentage of your lending decisions face delays due to document bottlenecks?

- How does your current document processing affect customer satisfaction rates?

The integration of lending document OCR transforms traditional document processing methods. Financial institutions implementing OCR in loan processing report 80% faster document handling times.

Modern OCR technology in commercial lending adapts to various document types, from loan applications to financial statements.

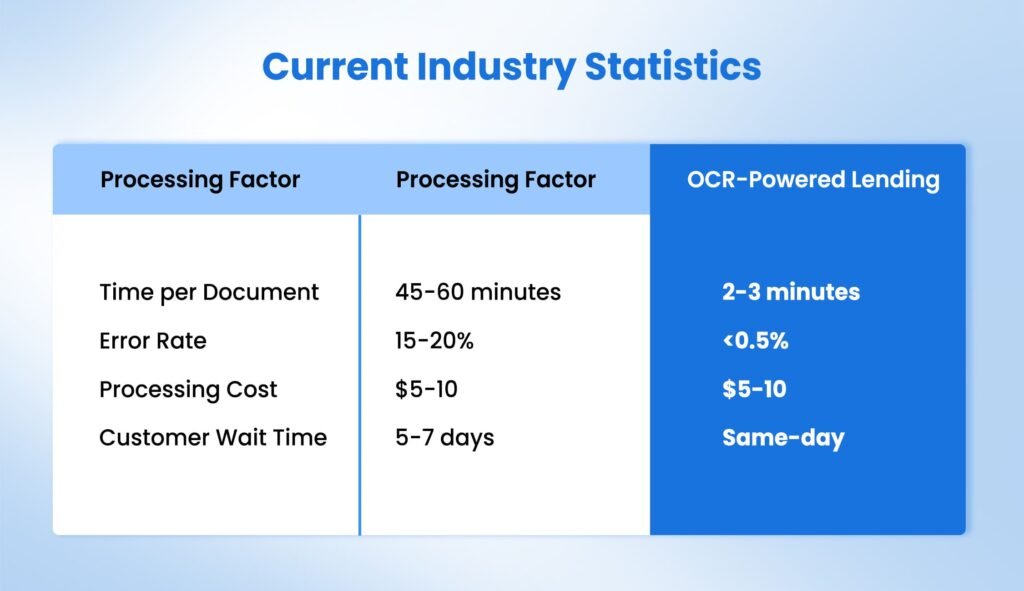

Current Industry Statistics

Key Takeaways

- AI detects irregularities in financial statements and flags compliance issues automatically

- Pattern recognition improves over time – the system learns from each processed document

- Pre-processing steps ensure quality: Format standardization and document classification happen first

- OCR validates data accuracy through automated checks, reducing manual review needs

- Modern systems create complete audit trails – tracking every document touch and modification

- Connect your tools: Link OCR with your existing lending and banking platforms

What is Lending Document OCR?

OCR technology in commercial lending offers precise text recognition and data extraction from various lending documents. This automated document processing system reads, extracts, and validates information.

It can scan loan applications, financial statements, and supporting materials. The lending document automation process works with both digital and scanned physical documents, making it adaptable for different institutional needs.

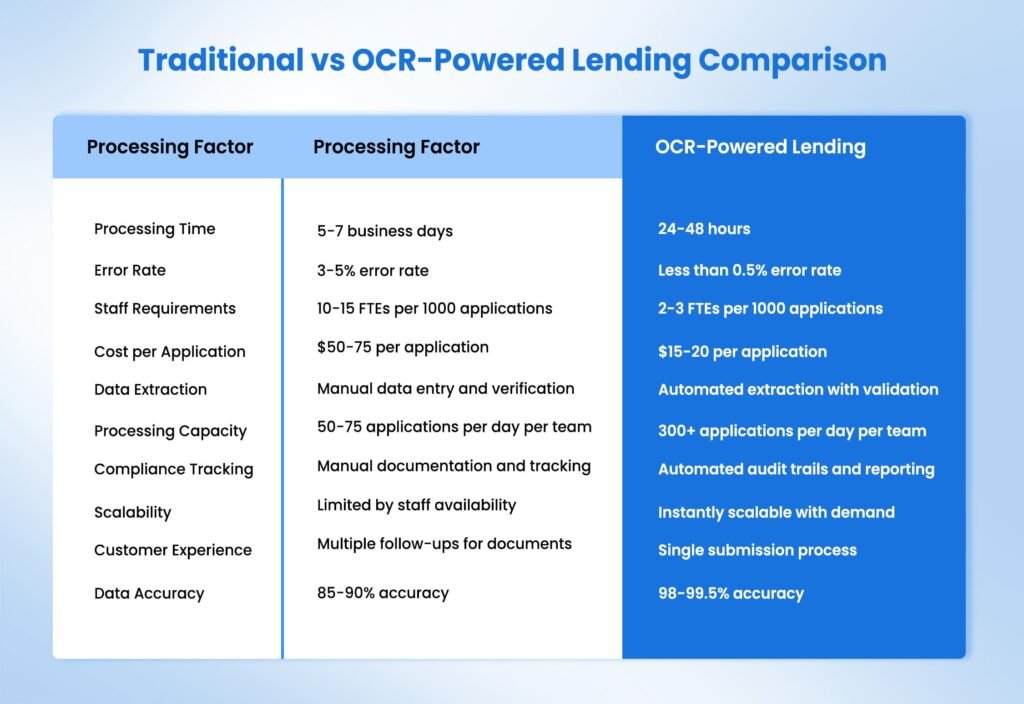

Traditional vs OCR-Powered Lending Comparison

Understanding OCR in Modern Lending

A loan officer at a mid-sized bank once processed 15 applications per day. Today, that same officer handles 150 applications with greater accuracy.

OCR technology in commercial lending has transformed traditional paper-heavy processes into aligned digital workflows. OCR accuracy ensures that these workflows are not hindered due to errors.

These metrics aren’t theoretical. They are a straightforward representation of institutions that have shifted from manual document handling.

Evolution of OCR Technology in Financial Services

Document extraction capabilities have advanced significantly in recent years. Modern loan document verification systems use AI document processing to handle multiple document formats. The intelligent document processing techniques now include:

- Neural network-based text recognition

- Multi-language support for international lending

- Advanced pattern-matching algorithms

Core Components of OCR Systems

Commercial loan processing systems integrate several key technologies:

- Input Processing: Modern document management solutions accept various file formats and qualities. The automated data extraction engine processes both clear and challenging documents effectively.

- Recognition Engine: Machine learning OCR algorithms analyze document structure and content. The system uses intelligent lending automation to identify relevant data points accurately.

- Output Generation: The lending workflow automation creates standardized outputs for direct integration with existing systems. Document verification systems ensure data accuracy through automated validation checks.

Key Business Benefits of OCR in Loan Processing using Lending Document OCR

When measuring ROI, most institutions focus solely on processing speed. However, lending document OCR delivers value across multiple dimensions: risk reduction, customer retention, and competitive advantage in market response times.

Studies show that banks using automated document processing reduce their loan default rates by 25%. This improvement stems from more thorough data analysis, consistent verification processes, and elimination of human oversight errors.

The adoption of OCR technology in commercial lending brings measurable improvements across operations. Organizations using automated document processing report significant gains in overall ROI metrics.

Cost Reduction Analysis

Document extraction technologies reduce operational expenses in several ways. Teams using lending document OCR typically see a 60% decrease in processing costs. The automated data extraction systems minimize:

- Manual data entry hours

- Document handling time

- Error correction expenses

Processing Time Improvements

Loan document verification systems dramatically speed up processing cycles. Financial institutions implementing OCR in loan processing report:

Average processing times drop from 5-7 days to 24-48 hours. The intelligent document processing approach handles multiple applications simultaneously. Modern commercial loan processing methods maintain consistent speeds regardless of volume fluctuations.

Error Reduction Metrics

AI document processing significantly reduces error rates in lending operations. Organizations using lending document automation report:

- 99.5% accuracy in data extraction

- 90% reduction in manual review requirements

- Near-zero systematic errors in document processing

Compliance Enhancement

Document management solutions strengthen regulatory compliance through:

The automated underwriting process creates detailed audit trails. Digital lending process implementations track all document modifications. The lending workflow automation ensures consistent policy application across all transactions.

Customer Experience Improvement

Enterprise lending solutions enhance client satisfaction through faster processing. The end-to-end automation reduces approval waiting times significantly. Studies show that automated document processing leads to:

- 70% faster application responses

- 85% reduction in document-related queries

- Higher customer satisfaction scores

Document Extraction Systems for Loan Processing using Lending Document OCR

Each lending document carries unique challenges – from complex table structures in financial statements to varying formats of identity documents. Modern OCR systems can understand document context and relationships.

A single mortgage application package contains an average of 23 distinct document types. The loan document verification system processes each one differently, applying specific rules and extraction patterns based on document characteristics.

Modern OCR technology in commercial lending handles diverse document categories efficiently. The machine learning OCR systems process multiple document types simultaneously.

Loan Applications

Intelligent document processing extracts key information from:

- Personal identification details

- Employment information

- Financial declarations

- Supporting documentation

Financial Statements

OCR in loan processing accurately extracts data from complex financial documents. The document extraction systems handle:

- Balance sheets and income statements

- Cash flow reports

- Bank reconciliation documents

- Financial projections

The automated data extraction tools maintain accuracy across different statement formats. Machine learning OCR adapts to varying layouts and structures from different accounting systems.

Identity Documents

Document verification systems process multiple ID formats with high precision. The lending document OCR technology accurately reads:

- Government-issued identification

- Business licenses

- Corporate registration documents

- Signatory authorizations

Bank Statements

OCR technology in commercial lending unifies bank statement analysis. The automated document processing system identifies:

- Transaction patterns

- Account balance trends

- Cash flow indicators

- Payment histories

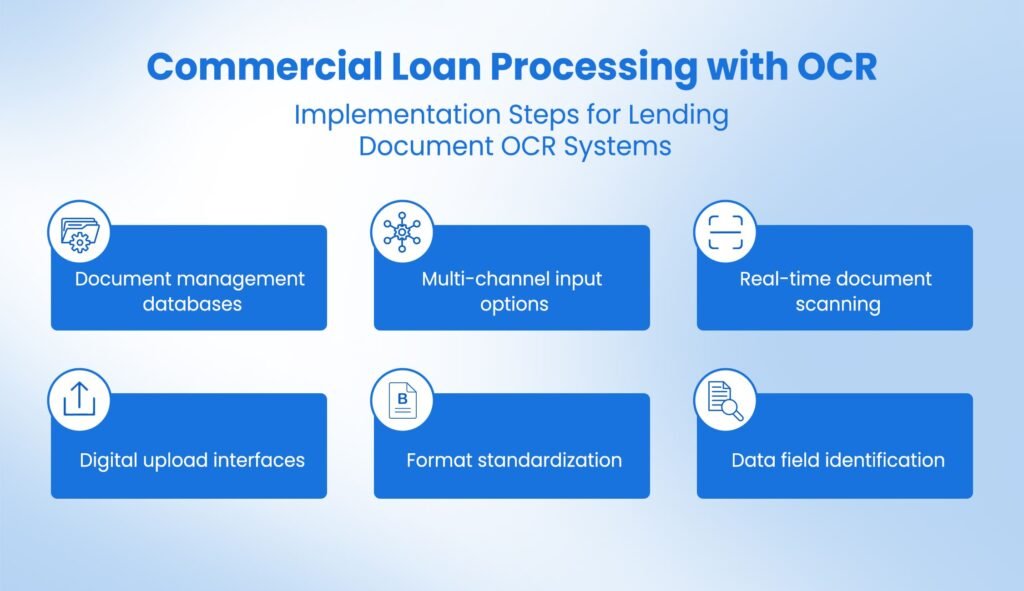

Commercial Loan Processing with OCR: Implementation Steps for Lending Document OCR Systems

Before diving into technical details, consider this: 70% of OCR implementations struggle not because of technology, but due to inadequate process mapping. Successful digital lending process transformation starts with understanding your current workflow bottlenecks.

Most institutions see partial benefits within weeks, but full optimization takes 3-4 months. This implementation timeline allows for proper system training, staff adaptation, and workflow refinement phases.

Technical Setup

The loan document verification process starts with proper system configuration. Enterprise lending solutions require:

System Requirements

- Cloud or on-premise infrastructure

- Secure data storage systems

- Integration capabilities

Integration Considerations

Commercial loan processing systems must connect with:

- Existing lending platforms

- Core banking systems

- Document management databases

- Compliance monitoring tools

Process Flow

The lending workflow automation follows a structured sequence:

Document Capture Methods

- Multi-channel input options

- Batch processing capabilities

- Real-time document scanning

- Digital upload interfaces

Pre-Processing Steps

The intelligent document processing workflow includes:

- Format standardization

- Quality enhancement

- Document classification

- Data field identification

The digital lending process ensures consistent handling across all document types. AI document processing systems apply standardized rules while maintaining flexibility for unique cases.

Advanced Document Management Solutions for Lending Document OCR

Traditional OCR reads documents; modern systems interpret them. Machine learning OCR now detects irregular patterns in financial statements, flags potential compliance issues, and learns from each processed document.

AI and ML Integration

OCR technology in commercial lending keeps evolving through advanced AI capabilities. Modern lending document OCR systems learn from each processed application, improving accuracy over time.

These intelligent document processing solutions adapt to new document formats without manual reconfiguration.

Financial institutions using automated document processing report significant improvements in recognition accuracy. The system processes complex documents while maintaining high precision rates. Key advantages include:

- Pattern recognition in varied document layouts

- Automatic field identification and extraction

- Continuous learning from corrections

Intelligent Data Extraction

Document layouts and structures remain consistent across different sources. The automated data extraction tools maintain accuracy while processing high volumes. This lending document automation approach ensures reliable results across all document categories.

Interestingly, the document extraction process combines multiple technologies. Machine learning OCR handles diverse document types with increasing precision. The system analyzes:

Pattern Recognition

Commercial loan processing benefits from advanced pattern recognition capabilities. The loan document verification system identifies:

The document management solution learns from historical data patterns. Each processed document improves the system’s recognition capabilities. Organizations report 95% accuracy in identifying and categorizing new document types.

OCR in Loan Processing: Industry Applications for Lending Document OCR Solutions

Different lending sectors present unique document processing challenges. A retail bank handles thousands of identical loan applications, while a commercial lender reviews complex, non-standardized financial statements.

OCR in loan processing adapts to both scenarios.

Commercial loan processing teams report that 40% of their time went to document organization before automation. Modern document extraction systems now automatically classify, sort, and prioritize documents based on loan type and urgency.

Commercial Lending

OCR in loan processing transforms commercial lending operations. Large-scale lending institutions process loads of documents daily through automated underwriting systems. The digital lending process reduces processing times while maintaining accuracy.

Business teams report significant improvements in

- Application processing speed

- Document verification accuracy

- Customer response times

Small Business Loans

Enterprise lending solutions adapt to small business documentation needs. The lending workflow automation handles various document combinations efficiently.

These automated document processing systems scale with business growth. The document verification system maintains consistent performance regardless of volume fluctuations.

Organizations see improved efficiency in processing diverse document types from small businesses.

Consumer Lending

Lending document OCR transforms personal loan processing workflows. The automated data extraction system handles high-volume consumer applications efficiently.

Modern document management solutions adapt to various personal lending scenarios.

Financial institutions report these key improvements in consumer lending:

- 75% faster application processing

- Improved accuracy in income verification

- Consistent credit assessment workflows

The digital lending process maintains high accuracy while handling diverse consumer documents. OCR technology in commercial lending extends its benefits to consumer applications through standardized processing approaches.

Mortgage Processing

The document extraction capabilities excel in complex mortgage applications. Machine learning OCR handles the extensive documentation requirements of mortgage lending.

Mortgage lenders using intelligent document processing report significant efficiency gains. The loan document verification process reduces traditional mortgage processing times by 60%.

These improvements stem from automated handling of extensive documentation requirements.

Automated Document Processing for Lending Document OCR Systems: Compliance and Measures

Financial regulators issued $5 billion in fines last year for documentation errors. Automated document processing systems create a digital shield – tracking every document touch, validating data accuracy, and maintaining comprehensive audit trails.

Beyond basic data extraction, loan document verification systems actively monitor regulatory requirements. The system flags potential compliance issues, tracks documentation completeness, and generates required reporting automatically.

Data Security Measures

OCR in loan processing includes robust security protocols. The document management solution implements:

- End-to-end encryption

- Access control systems

- Data privacy safeguards

- Regular security audits

Regulatory Compliance Features

Commercial loan processing requires strict adherence to regulations. The lending document automation system ensures:

The automated underwriting process maintains detailed compliance records. Enterprise lending solutions track all document modifications and access attempts. This systematic approach helps organizations meet regulatory requirements while maintaining processing efficiency.

Audit Trail Capabilities

The document verification system creates comprehensive audit trails. Every step in the lending workflow automation receives proper documentation. Organizations can:

- Track document modifications

- Monitor user access patterns

- Generate compliance reports

- Review processing decisions

Lending Document OCR Automation: KlearStack AI and Future of OCR in Loan Processing

Current OCR technology in commercial lending represents just the beginning. New AI models like KlearStack demonstrate up to 99% accuracy in reading handwritten notes, extracting data from photos of documents, and processing multiple languages simultaneously.

The integration of blockchain with lending document OCR opens new possibilities for document verification.

Financial institutions that used KlearStack report 80% faster processing times with document related management.

OCR technology in commercial lending continues to evolve. Modern lending document OCR systems incorporate:

- Advanced AI capabilities

- Improved recognition accuracy

- Broader document support

Why Should You Choose KlearStack for OCR in Loan Processing?

Check out our Features in one-go. KlearStack can do all this and more without manual intervention.

OCR-Powered Lending: Implementation Success Strategies

The struggle with change management during automation projects is still at large for most banks. Successful lending document automation requires equal focus on technology implementation and staff adaptation.

The document management solution should complement existing workflows, not disrupt them. Organizations achieving the best results follow a phased approach: starting with simple documents, proving value, then expanding to complex processes.

Common Challenges and Solutions

Organizations implementing lending document OCR face several annoying hurdles. The document extraction process requires more systematic execution. Understanding common challenges helps ensure successful automated document processing implementation.

Key Challenge Areas

- System Integration Complexities

- Data Migration Requirements

- Staff Training Needs

- Process Adjustment Periods

Machine learning OCR implementation succeeds with proper preparation. The loan document verification system needs a more calculated approach in longterm usage.

Tips for Successful Deployment

The intelligent document processing systems are somewhat fragile in integration. Commercial loan processing improvements depend on:

- Structured Implementation Approach

A planned implementation will make the integration easier. You can plan it in the following steps:

- Phased rollout strategy

- Clear milestone definitions

- Regular progress monitoring

- Staff Engagement

Document management solutions work best with trained teams. The lending workflow automation requires proper user preparation. Organizations should focus on:

- Comprehensive training programs

- Regular feedback sessions

- Performance monitoring systems

- Change Management Strategies:

OCR technology in commercial lending transforms existing workflows. The digital lending process might demand change management. Successful automated data extraction implementation depends on this at dynamic levels.

Organizations report smoother transitions when following structured change management. The automated underwriting process benefits from clear communication and stakeholder involvement.

The automated document processing results demonstrate clear ROI. Banks report significant gains across all operational metrics.

Conclusion

Financial institutions adopting lending document OCR report substantial operational improvements.

The automated document processing systems prove their worth through measurable efficiency gains and error reduction. OCR technology in commercial lending continues to mature, offering increasingly sophisticated solutions for document handling challenges.

Key Implementation Insights:

- Select systems matching your specific lending workflows

- Begin with high-volume document types for maximum impact

- Monitor and measure performance metrics consistently

- Train teams thoroughly on new digital processes

The future of document extraction shows promising advancements in accuracy and capability. Machine learning OCR systems process lending documents with increasing precision and speed. Organizations formulating these solutions position themselves higher in customer value and KPI reports.

Next Steps to Consider:

- Assess your current document processing drawbacks

- Calculate potential ROI for your institution

- Review vendor capabilities and integration requirements

- Plan a phased implementation approach

Think of this implementation as an investment. Your next step: evaluate your current processes and identify where automated document processing can deliver the most value.

FAQ’s on Lending Document OCR

Lending Document OCR is an AI-driven technology. It extracts, processes, and validates data from loan-related documents. The documents include mortgage applications, tax statements, pay stubs, and bank statements. It converts scanned images and PDFs into machine-readable text, automating loan processing workflows.

OCR in loan processing speeds up approvals by automatically extracting and validating borrower data. It reduces errors, eliminates manual data entry, and ensures compliance.

Lending Document OCR can process:

– Loan application forms

– Bank statements & credit reports

– Income verification documents (pay stubs, tax returns, W-2s)

– Mortgage underwriting documents

– KYC & identity verification records

OCR technology in commercial lending simplifies operations by automating document-heavy workflows. It reduces processing time, prevents fraud, enhances regulatory compliance, and improves loan decision accuracy.