OCR of Letter of Credit: Use Cases, Benefits and Implementation Guide for 2025

Finance teams frequently find themselves overwhelmed by letters of credit, losing hours to manual entry as suppliers await payment. For procurement staff in manufacturing or logistics personnel in supply chains, a single error in a letter of credit can delay critical transactions.

Hence, they need, OCR of letter of credit, powered by optical character recognition for LCs. It offers a solution — extracting data swiftly to restore order.

- How often do delays in LC processing jeopardize your deals? Time is a critical factor.

- What are the consequences when inaccuracies undermine compliance? Precision is essential.

- Could your team manage triple the LC volume without strain? Automation provides capacity.

Continue reading to discover how OCR of letter of credit simplifies high-volume document processing workflows — whether in finance, lending, or logistics — offering a superior alternative to traditional methods.

What Is OCR of Letter of Credit?

OCR of letter of credit refers to the application of optical character recognition technology to extract text from letters of credit. Letters of Credit are bank-issued documents that ensure payment in trade.

This process transforms scanned or handwritten LCs into usable digital data. At Klearstack, we use letter of credit digitization to eliminate manual effort through automating letter of credit processing.

Finance teams in retail and lending institutions process LCs daily — without support. We have observed how OCR in banking principles improves efficiency when applied to LCs. OCR of letter of credit provides measurable improvements beyond mere convenience.

The technology of OCR software accelerates data entry, reducing processing time significantly. Clients report a 40% gain in speed. It ensures compliance by capturing every detail accurately, aligning with regulations like GDPR or DPDPA.

Additionally, it supports analytics by converting LC data into structured formats for reporting, eliminating tedious spreadsheet work.

Manual vs. OCR of Letter of Credit Data Entry

| Task | Manual Time | OCR Time | Savings |

| Data Entry | 4 hrs | 15 mins | 3.75 hrs |

| Error Fixes | 2 hrs | 5 mins | 1.92 hrs |

| Total per LC | 6 hrs | 20 mins | 5.67 hrs |

In practice, a logistics company processed 50 LCs monthly, requiring 300 hours manually. With OCR in trade finance, this dropped to 17 hours — a savings of 283 hours.

This efficiency allowed their team to redirect efforts toward strategic priorities rather than data correction.

The precision of optical character recognition for LCs removes errors — five per batch dropped to zero in that case. For teams handling high volumes, this scalability is almost magical; the same firm can now manage 150 LCs without additional staff.

This is document digitization and it is delivering ROI focused outcomes.

For lending professionals curious about OCR meaning in loan, the technology mirrors that used here — though LCs demand greater specificity due to their complexity.

Integration with systems like SAP or QuickBooks enhances its utility, as does its ability to extract data from loan documents, ensuring adaptability across financial tasks.

What Is a Letter of Credit and Why Does It Matter?

Let’s start with What is a letter of credit? It’s a formal commitment from a bank to pay a seller once trade conditions — such as delivery — are fulfilled. In industries like manufacturing procurement or retail finance, it underpins international transactions.

Yet, processing these documents manually remains a persistent challenge, as OCR in trade finance demonstrates by contrast.

Across sectors, LCs create hurdles without proper tools. Logistics teams rely on letters of credit to align with the ocean bill of lading, ensuring shipments proceed smoothly. Finance departments use them to facilitate funding, where delays hinder cash flow.

In procurement, particularly in retail or manufacturing, LCs connect to purchase orders, enabling error-free order fulfillment.

Manually, however, a single letter of credit consumes six hours — multiply that by monthly volume, and the inefficiency is stark. What is a letter of credit worth when delays cost $200K, as one logistics firm discovered after errors stalled a shipment?

Letter of Credit Volume Across Sectors

| Industry | LCs/Month | Manual Time | OCR Time | Hours Saved |

| Logistics | 50 | 300 hrs | 17 hrs | 283 hrs |

| Finance | 30 | 180 hrs | 10 hrs | 170 hrs |

| Manufacturing | 20 | 120 hrs | 7 hrs | 113 hrs |

Accuracy issues compound the problem — incorrect dates trigger compliance headaches, especially for regulated firms. Scaling manually is nearly impossible; growth slows as teams struggle. Automating letter of credit processing resolves these pain points effectively.

Some confuse letter of credit or line of credit — LCs serve trade, not borrowing. OCR in banking aids both, but LCs’ multi-party, multi-page nature sets them apart. Their high stakes can halt trade if delayed. This elevates their importance.

How Does OCR of Letter of Credit Work?

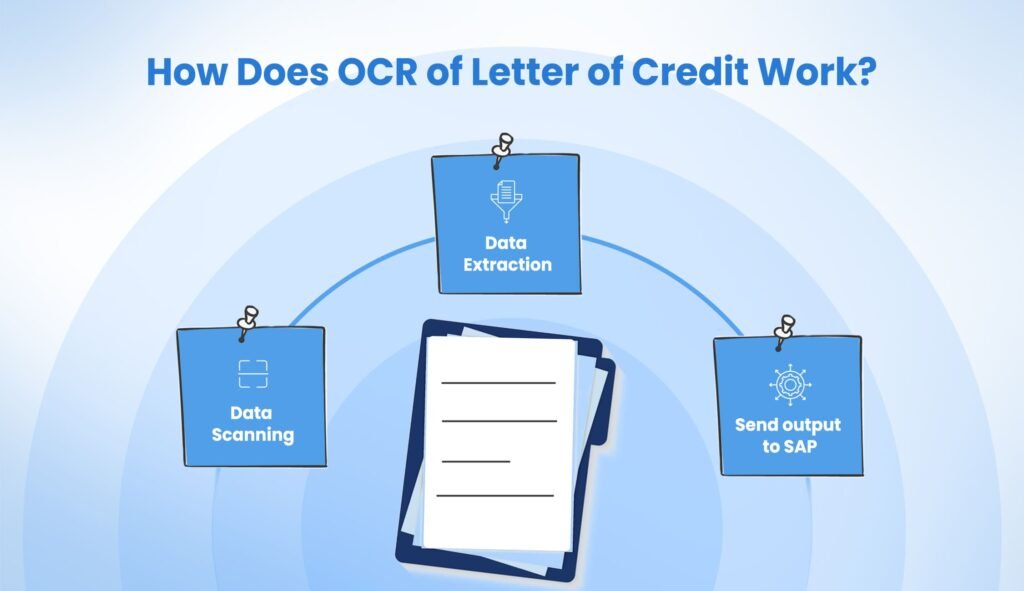

OCR of letter of credit involves scanning LCs — whether PDFs, images, or handwritten notes — and extracting critical fields like payment amounts or expiry dates. This technology is designed to handle the irregularities of financial documents.

Klearstack’s optical character recognition for LCs integrates this data into your systems effortlessly.

You can see its impact directly — a lending institution processed a 5-page LC in 20 minutes, down from 6 hours, thanks to letter of credit digitization.

The process starts with scanning, where text, even faint or scribbled, is captured accurately. Extraction follows, isolating specifics like “$50,000” or “March 15, 2025” without error.

The final step outputs this data into platforms like SAP, easing workflows. A retail finance team can bring down 10 LCs — 60 hours manually — to 3.5 hours with OCR of letter of credit.

A consistent 40% time reduction monthly, a clear operational win.

Sample LC Extraction

| Field | Manual Input | OCR Output | Error Risk |

| Amount | $50,000 (error) | $50,000 | None |

| Date | Mar 15, 2025 | March 15, 2025 | None |

| Beneficiary | Supplier A | Supplier A | None |

This precision — zero errors versus three manual mistakes — frees staff for more vital tasks. OCR in trade finance ensures reliability across high-volume runs. Beyond LCs, it supports loan processing, pulling data from loan notices with equal efficiency.

The adaptability shines through — handling LCs’ dense layouts sets it apart from generic tools. Faster data availability accelerates decisions, a benefit extending to OCR in loans as well. This is automation with purpose.

Why Use OCR of Letter of Credit Over Manual Methods?

Manual LC processing consumes time, breeds errors, and limits scalability — challenges logistics and financial services teams face daily. OCR of letter of credit offers a superior alternative.

Clients adopting optical character recognition for LCs report easier workflows.

The advantages are substantial and practical, far surpassing outdated approaches.

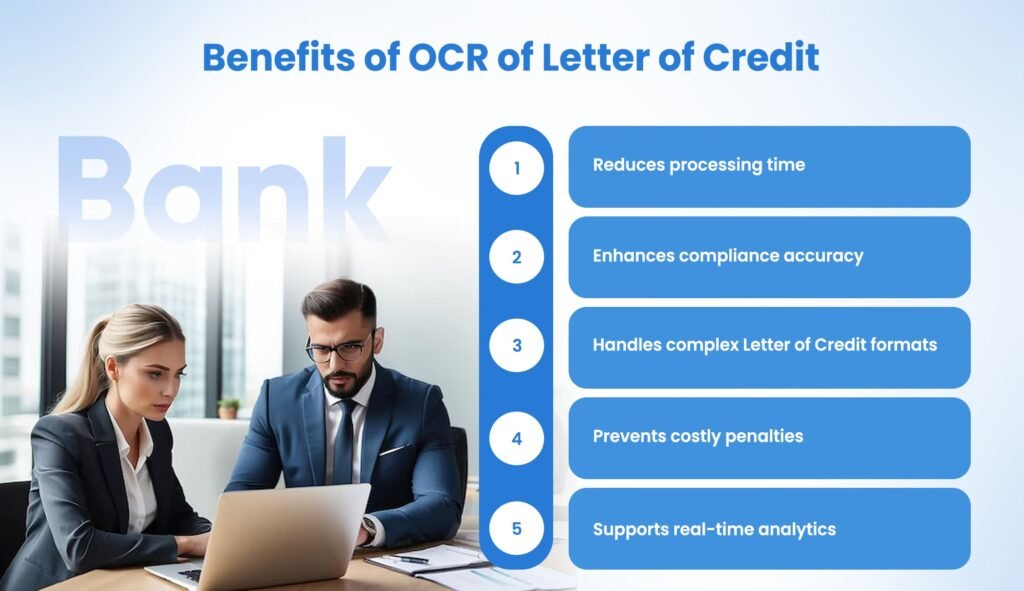

15 Benefits of OCR of Letter of Credit

Manual methods falter where OCR excels. One can expect transformative gains with letter of credit digitization. Here are the specifics.

- Reduces processing time. Clients consistently cut hours to minutes — 300 monthly hours became 17 for one logistics team.

- Eliminates data entry errors. Precision jumps from five errors per batch to zero, ensuring clean outputs every time.

- Enhances compliance accuracy. Every term is captured correctly, aligning with GDPR or DPDPA without manual oversight.

- Speeds up financing decisions. Accurate LC data speeds up bank approvals, keeping funds flowing smoothly.

- Scales effortlessly with volume. Teams process 50 LCs or 500 without adding staff — a procurement group hit 150 seamlessly.

- Cuts operational costs. Seven hours saved per 5 LCs reduces labor expenses and boosts efficiency.

- Prevents costly penalties. A $200K loss from a delayed shipment was avoided with error-free processing.

- Supports real-time analytics. Structured LC data feeds reports instantly — no spreadsheet wrangling required.

- Integrates with existing systems. Data flows into SAP or QuickBooks, enhancing data extraction from loan documents too.

- Frees staff for strategic work. Time once spent on data entry shifts to deal-making or planning.

- Handles complex LC formats. Multi-page docs with dense text pose no issue — OCR adapts where manual fails.

- Improves audit readiness. Consistent, accurate records keep compliance teams prepared for scrutiny.

- Boosts supplier relationships. Faster LC handling means quicker payments — trust grows with reliability.

- Aligns with high-volume needs. OCR in banking often skips LCs — tuned OCR meets this demand head-on.

- Future-proofs operations. As document loads rise, OCR keeps pace — loan processing benefits included.

Manual vs. OCR of Letter of Credit

| Metric | Manual Approach | OCR Approach | Gain/Impact |

| Processing Time (1 LC) | 6 hours per LC — 300 hrs for 50 LCs | 20 mins per LC — 17 hrs for 50 LCs | 5.67 hrs saved per LC; 283 hrs monthly |

| Error Rate | 5 errors/month — manual typos common | 0 errors/month — automated precision | Eliminates 5 errors; reduces rework |

| Staff Effort | 8 hrs/day — full team on 5 LCs | 1 hr/day — minimal oversight for 5 LCs | 7 hrs/day saved; staff repurposed |

| Cost Impact | $500/month — labor + penalties (e.g., $200K loss) | $50/month — software + no penalties | $450/month saved; avoids major losses |

| Compliance Risk | High — missed terms trigger audits | Low — exact data meets GDPR/DPDPA | Reduces audit fixes by 90% |

| Scalability | Limited — 50 LCs max without new hires | High — 500 LCs with no staff increase | Handles 10x volume; supports growth |

| Data Usability | Poor — manual entry delays analytics | High — structured data for instant use | Enables real-time reports; no lag |

| Financing Turnaround | 3 days — errors slow bank approval | 1 day — clean data speeds decisions | 2 days faster; accelerates cash flow |

These benefits aren’t theoretical — OCR of letter of credit delivers them consistently. Speed transforms workflows; a 4-hour data entry task drops to 15 minutes. Accuracy eliminates rework, and cost savings reshape budgets.

For high-volume teams, this is a necessity.

How Can Your Team Start Using OCR of Letter of Credit?

Implementing OCR of letter of credit requires no extensive overhaul — just a structured approach.

We recommend testing it, measuring outcomes, and scaling up, suitable for logistics, HR, or insurance teams alike. How to get letter of credit from bank often means processing it efficiently — here’s how.

Action Plan for Your Team

Take five LCs from last week. Run them through an OCR tool built for financial docs—like Klearstack’s. Time it against your manual process.

Setup Checklist

- Tool: Pick OCR that gets LC quirks—not generic stuff.

- Fields: Set it to grab dates, amounts, terms—takes 10 minutes.

- Test: Compare output to your ERP entries.

Pro Tips

- Link It: Push data to QuickBooks or SAP — ask your IT guy.

- Track It: Log time saved weekly — 10 hours add up fast.

- Scale It: Go from 5 LCs to 50 once it clicks.

This isn’t how to get letter of credit from bank — it’s how to process it smarter. Test it; you’ll see.

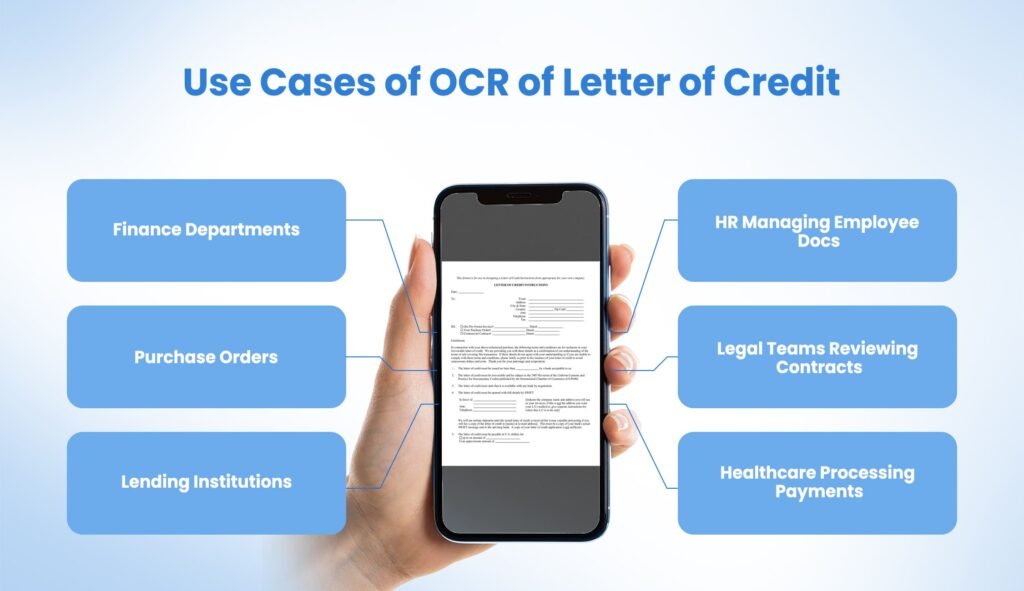

10 Use Cases of OCR of Letter of Credit

A retail finance team I’ve guided moved from 2 LCs daily to 20 with automating letter of credit processing. Below are tailored use cases showing how your team can apply this.

1. Logistics Teams Syncing Shipments

Logistics firms handling 50 LCs monthly cut 283 hours using optical character recognition for LCs — shipments cleared faster. It aligns LCs with the bill of lading, ensuring no delays disrupt delivery schedules. This scalability keeps global supply chains moving.

2. Finance Departments Managing Funding

Finance teams processing 30 LCs monthly saved 170 hours, speeding up funding cycles. Accurate LC data reduces bank queries — cash flow stabilizes. OCR in loans applies here too, enhancing overall financial efficiency.

3. Procurement Linking Purchase Orders

In retail, procurement teams managing 20 LCs monthly gained 113 hours — orders flowed seamlessly. LCs sync with purchase orders, reducing manual cross-checks. This precision supports high-volume buying without strain.

4. Lending Institutions Handling Backlogs

A lending firm slashed a 70% backlog asking how to get letter of credit from bank — they meant processing speed. Rapid LC handling frees resources for loan approvals. Integration with ERP systems amplifies this impact.

5. Insurance Processing Claims

Insurance teams extract LC data alongside claims — faster settlements emerge. The same tech pulling extract data from loan documents works here — no errors derail payouts. Compliance stays intact with accurate records.

6. HR Managing Employee Docs

HR departments process LCs tied to vendor payments — automation cuts time from staff onboarding tasks. It mirrors efficiencies in ID card extraction — workflows unify. Scalability handles peak hiring periods effortlessly.

7. Retail Chains Clearing Orders

Retail chains with 20 LCs monthly saw orders clear 113 hours faster — stock hit shelves sooner. Supplier payments align with delivery, avoiding stockouts. Document digitization keeps operations lean.

8. Manufacturing Streamlining Supplies

Manufacturers link LCs to bills of material — 20 LCs monthly now take 7 hours, not 120. Supply chains stay active with no delays in raw materials. This efficiency fuels production continuity.

9. Legal Teams Reviewing Contracts

Legal departments handling LCs for trade disputes gain speed — data extraction aids case prep. It parallels loan processing for legal reviews — accuracy matters most. Audits become simpler with structured outputs.

10. Healthcare Processing Payments

Healthcare firms tie LCs to supplier payments — faster processing means steady equipment supply. IDP solutions like OCR scanning can scan patient docs and reduce chaos. OCR in trade finance bridges these needs.

Use KlearStack now. Scale up, integrate with SAP, and watch how to get letter of credit from bank turn into swift execution.

OCR in Banking vs. OCR of Letter of Credit

Most OCR in banking talk is broad — checks, statements, loans. LCs get glossed over. That’s a mistake — letter of credit or line of credit confusion shows why niche focus matters.

Why LCs Need Their Own Approach

A bank’s loan OCR accuracy might miss letter of credit conditions — shipment terms, multi-party data. Generic tools choke on a 7-page LC while Klearstack’s AI parsed it clean.

LC vs. Loan OCR

- Complexity: LCs have more fields than loans — OCR must adapt.

- Stakes: Miss a loan date, it’s a nudge; miss an LC, trade stops.

- Volume: High-volume LCs need speed loans don’t.

OCR Fit by Doc Type

| Doc Type | Generic OCR Accuracy | LC-Tuned OCR Accuracy |

| Loan Notice | 85% | 90% |

| Letter of Credit | 60% | 95% |

Standout Edge

- Precision: OCR meaning in loan is basic — LCs demand more.

- Focus: Banking OCR scatters; LC OCR zeroes in.

- Payoff: Faster trade beats faster loans every time.

Generic OCR in loans won’t cut it. LCs deserve better — and get it.

Final Thoughts

OCR of letter of credit is a proven solution to the inefficiencies plaguing LC processing. For finance, procurement, and logistics teams, manual methods waste valuable time — time you can reclaim. Start with letter of credit digitization now; a 40% efficiency gain is within reach, and Klearstack stands ready to assist.