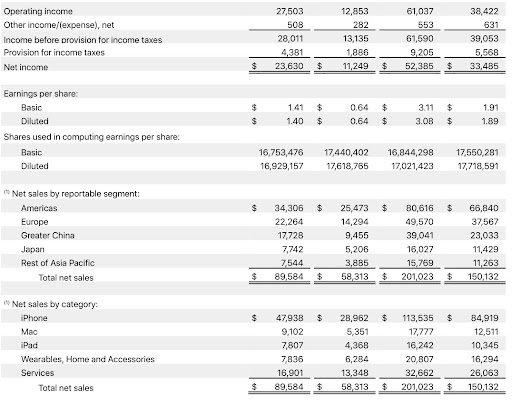

What is a Statement of Operations?

A statement of operations is a financial document that highlights a company’s financial details like overall revenues, operating expenses, cost of goods sold, operating profit, and its net income (loss).

Why is a Statement of Operations Important?

A statement of operations is important to make smart decisions. It shows where you stand financially, helps you plan ahead, and lets you adjust strategies for a brighter financial future.

Organizations can analyze their financial health, make strategic moves, and ensure steady progress through a Statement of Operations. It reveals how much money comes in through revenues and uncovers the money going out through expenses like operations and goods costs.

Difference Between an Operating Statement and an Income Statement

- The statement of operations focuses on the main money activities of a business—how much comes in and goes out in everyday operations.

- The income statement presents a broader financial snapshot, encompassing various revenue sources and costs beyond core operations.

Components of an Operating Statement or Statement of Operations

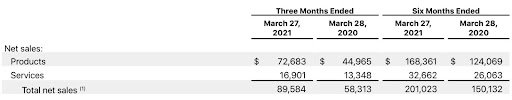

Section #1: Revenue

Revenues, often referred to as income or sales, represent the total amount of money a business earns from its primary activities.

This includes money generated from selling products, providing services, and any other sources of incoming funds.

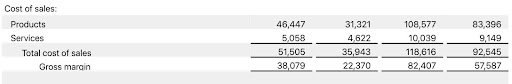

Section #2: Costs of Goods Sold

The cost of goods sold (COGS) represents the direct expenses incurred to produce goods or services.

These expenses encompass materials, labor, and overhead costs directly associated with manufacturing or delivering the products or services the business offers.

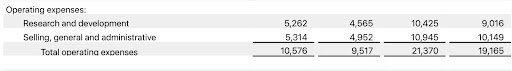

Section #3: Operating Expenses

Operating expenses include a range of ongoing costs that are necessary to keep a business operational.

These costs cover a variety of areas, such as employee salaries, rent, utilities, marketing expenses, office supplies, and other administrative costs.

Section #4: Operating Profit (Loss)

Operating profit, also known as operating income or operating loss, is the difference between total revenues and total operating expenses.

This figure indicates the profitability of a business’s core operations before considering non-operating items.

Section #5: Non-Operating Expenses

Non-operating expenses refer to costs that are not directly tied to the regular operations of the business.

These expenses can include interest payments on loans, taxes, and other costs that don’t directly relate to producing goods or services.

Section #6. Net Income (Loss)

Net income, also known as net profit or net loss, is the final result after all revenues, costs, and expenses—both operating and non-operating—are considered.

It provides a comprehensive view of the overall financial performance of the business during a specific period.

Example of an Operating Statement

Operating Statement

Year Ended December 31, 2021

Revenues

Sales Revenue: $500,000

Service Revenue: $100,000

Total Revenues: $600,000

Cost of Goods Sold

Cost of Goods Sold: $200,000

Gross Profit: $400,000

Operating Expenses

Salaries and Wages: $150,000

Rent Expense: $30,000

Utilities Expense: $15,000

Advertising Expense: $20,000

Depreciation Expense: $10,000

Total Operating Expenses: $225,000

Operating Profit (Loss): $175,000

Non-Operating Expenses

Interest Expense: $5,000

Total Non-Operating Expenses: $5,000

Net Income: $170,000

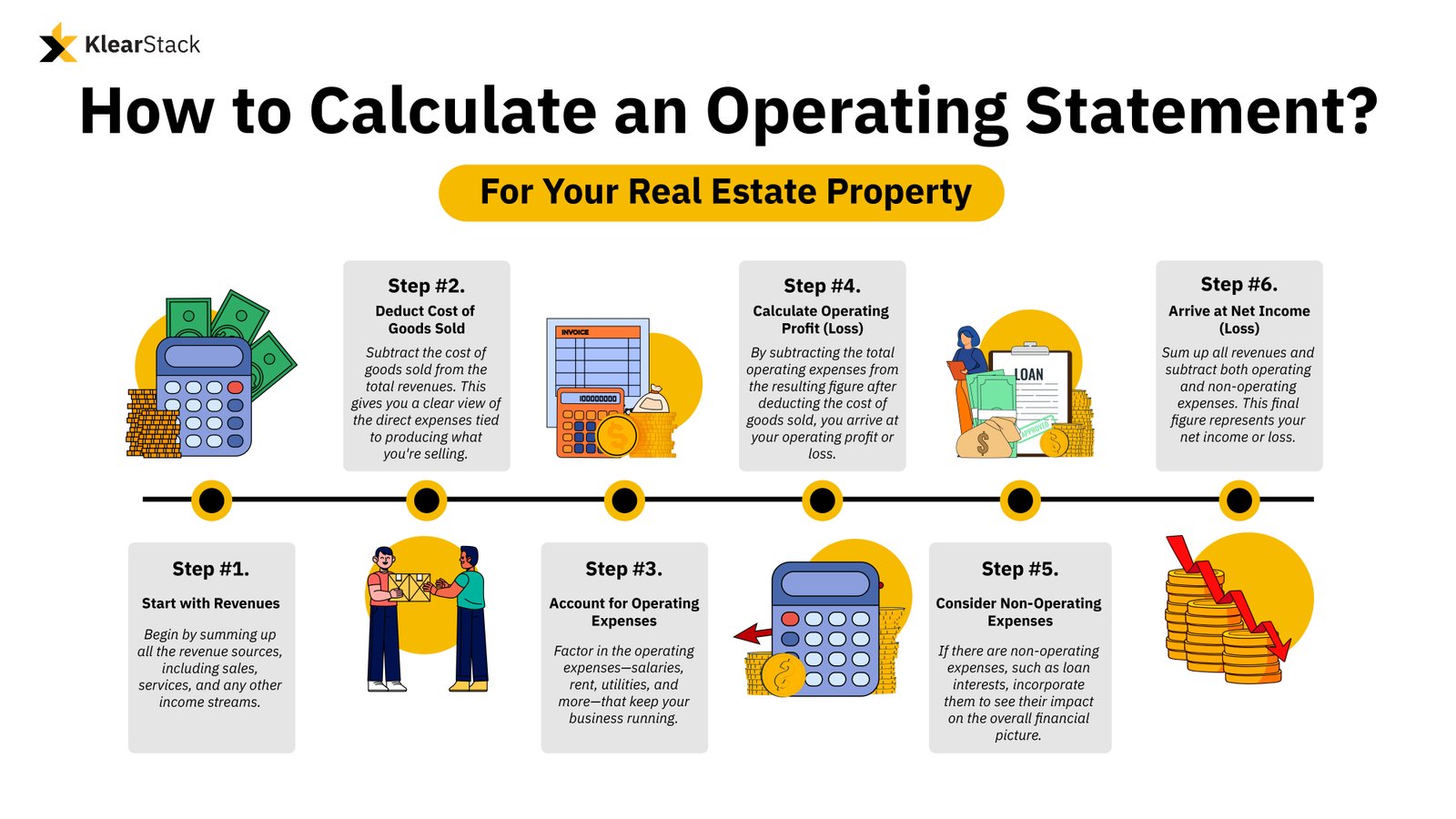

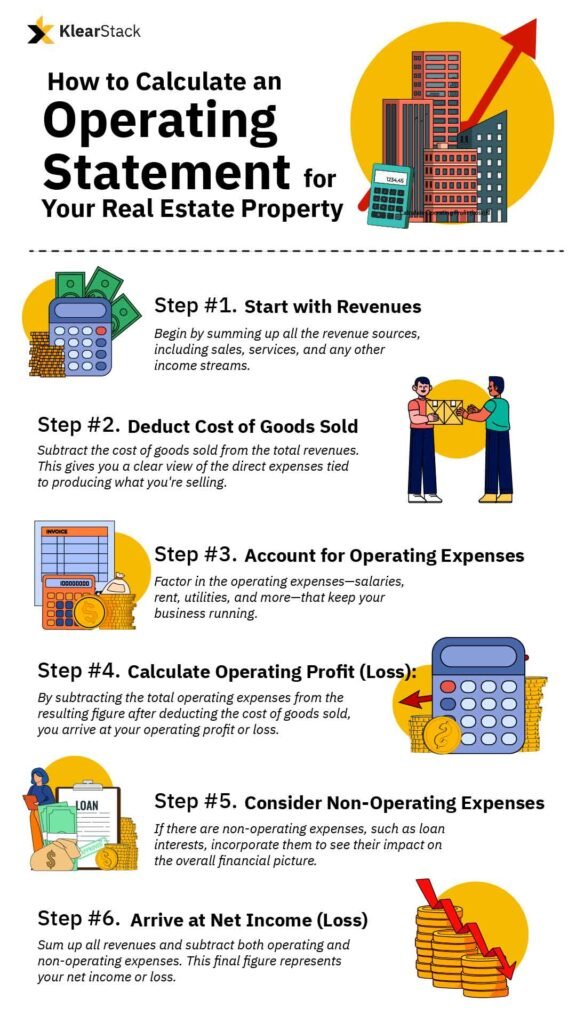

How to Calculate a Statement of Operations?

Example of How to Calculate a Statement of Operations

| Steps | Example Scenario |

| Step 1: Start with Revenues | Imagine you run a bakery. Your total revenue sources include sales from bread, pastries, and cakes, adding up to $10,000. |

| Step 2: Deduct Cost of Goods Sold | Your cost of goods sold for producing these baked goods amounts to $3,000. Subtract this cost from your total revenue: $10,000 – $3,000 = $7,000. |

| Step 3: Account for Operating Expenses | Your operating expenses include employee salaries, rent, utilities, and other costs totaling $4,000. |

| Step 4: Calculate Operating Profit (Loss) | Subtract the operating expenses from the figure you obtained after deducting the cost of goods sold: $7,000 – $4,000 = $3,000. This is your operating profit. |

| Step 5: Consider Non-Operating Expenses | Let’s say you have interest expenses on a loan, amounting to $500. Deduct this from your operating profit: $3,000 – $500 = $2,500. |

| Step 6: Arrive at Net Income (Loss) | Sum up all revenues ($10,000) and subtract both operating and non-operating expenses ($4,000 + $500): $10,000 – ($4,000 + $500) = $5,500. This is your net income. |

Benefits & Challenges of Using Statement of Operations

| Benefits | Challenges |

| Provides insights into financial performance, revenues, and expenses | Requires accurate and consistent data collection |

| Identifies trends in revenue generation and cost management | Interpretation may be complex for non-financial experts |

| Facilitates informed decision-making regarding strategies | Dependent on the accuracy of financial data |

| Measures operational efficiency through operating profit (loss) | May not account for all external factors influencing finances |

| Guides resource allocation, goal-setting, and growth strategies | Requires expertise in financial analysis |

| Builds investor confidence through transparent reporting | May not capture non-operating expenses adequately |

| Allows benchmarking against industry peers | Historical data might not predict future financial shifts accurately |

| Supports forecasting of future financial performance | Requires regular updates to remain relevant |

Conclusion

Calculating an operating statement for your property manually can be not only a tedious task, but also costly and time-consuming, due to a large amount of data.

But with KlearStack’s automation tools, you can effortlessly gather, categorize, and calculate the components that shape your financial horizons. The result? Your operating statement is processed with 99% accuracy, saving costs up to 90%.

No more manual data entry, no more sorting through spreadsheets. Automate your operating statement with KlearStack today!

FAQs

An Operating Statement is a financial document that highlights a company’s financial details like overall revenues, operating expenses, cost of goods sold, operating profit, and its net income (loss).

The Operating Statement focuses on property-specific income and expenses, while the Income Statement covers overall entity financials.

An Operating Statement is also known as a Profit & Loss (P&L) statement. Both terms refer to the same financial statement that provides insights into an organization’s revenues, expenses, and resulting profitability or loss over a specific period.

An Income operating statement form is a financial document that outlines an organization’s revenues, expenses, and operating profit or loss for a specific period. It follows a standardized format that includes components such as revenues, cost of goods sold, gross profit, operating expenses, operating profit (loss), non-operating items, and net income (loss).

Another name for an operating statement is an “income statement.” It provides valuable insights into an organization’s financial performance and aids in assessing its profitability and operational efficiency.