Vendor Reconciliation in Accounts Payable: Full Process, Benefits, and How to Automate It

A McKinsey report estimates that over 25% of accounts payable teams face recurring errors due to manual reconciliation. These inaccuracies, often minor line-item mismatches, can lead to major cash flow disruptions and unnecessary vendor disputes.

- What happens when your vendor’s records don’t match your books?

- How often are businesses overpaying due to unverified balances?

- Can automation help identify discrepancies before they cause financial damage?

In this blog, we break down the complete process of vendor reconciliation, highlight its operational value, and explain how automation solutions like KlearStack can simplify the process.

Key Takeaways

- Vendor reconciliation checks if your payables match vendor records.

- It helps avoid duplicate payments, missed invoices, and fraud.

- Regular reconciliation improves audit readiness and vendor trust.

- Credit notes and discrepancies are resolved before payments go through.

- Automation reduces errors and saves your AP team’s time.

What Is Vendor Reconciliation in Accounts Payable?

Vendor reconciliation is the process of comparing internal payment records against vendor-issued statements. This ensures that both parties agree on what is owed and what has been paid.

This process verifies every line item, invoice amount, and payment made over a defined period. Any mismatches like unaccounted credit notes or double payments, are flagged and fixed before month-end closing.

In accounts payable (AP), this is a key task that directly influences how cash flow and vendor relations are handled.

Why Does Vendor Reconciliation Matter?

Financial Accuracy

Vendor reconciliation helps keep financial reports clean. Even a small mismatch can lead to overstated liabilities or unnoticed overpayments.

Fraud Detection

Incorrect entries, whether intentional or not, are easier to catch with a structured reconciliation process.

Vendor Trust

A vendor who gets paid the right amount on time is more likely to extend better credit terms or priority fulfillment.

Compliance and Auditing

Regulatory bodies require clean audit trails. Reconciliation provides documented proof that all entries are accurate and verified.

Together, these outcomes help maintain a strong AP ledger and reduce unnecessary costs.

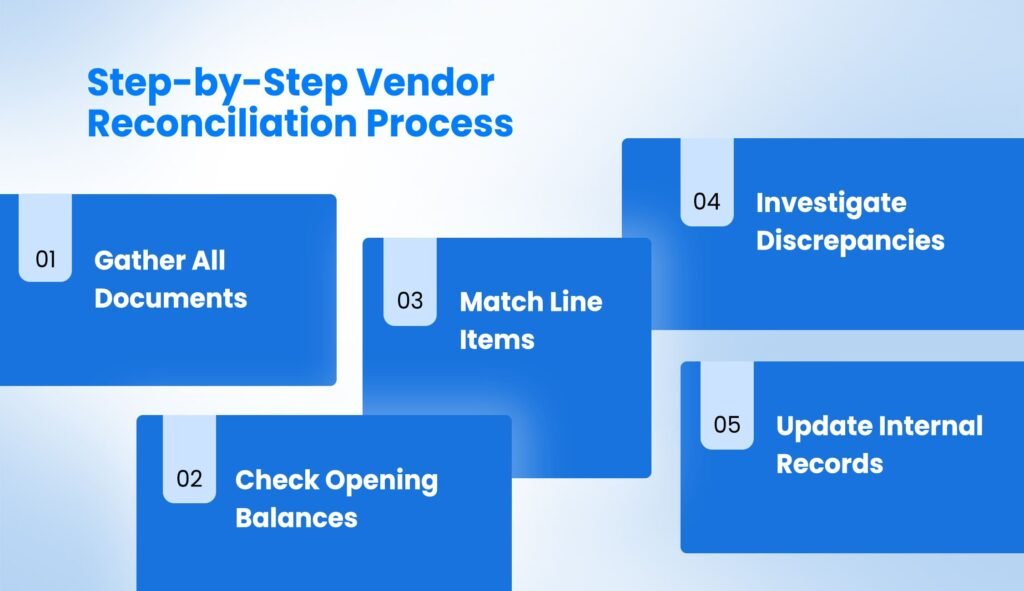

Step-by-Step Vendor Reconciliation Process

Step 1: Gather All Documents

Before you begin, you’ll need:

- Vendor statement for the current period

- Purchase orders

- Invoices issued by vendors

- Credit notes or discounts

- Internal AP ledger and payment logs

This documentation forms the base of the reconciliation.

Step 2: Check Opening Balances

Compare the opening balance on the vendor’s statement to the closing balance in your ledger from the last month. These should match. If they don’t, the problem could stem from missing entries or prior unresolved discrepancies.

Step 3: Match Line Items

Each entry on the vendor statement should match your invoice and ledger record:

- Invoice Number

- Amount and Currency

- Tax Breakup

- Payment Status

This confirms whether payments have been recorded correctly.

Step 4: Investigate Discrepancies

Look out for:

- Duplicate payments

- Unrecorded invoices

- Overstated amounts by vendor

- Credit notes not applied

Each mismatch should be reviewed using original documents, such as email threads or scanned invoices.

Step 5: Update Internal Records

After resolving discrepancies, make updates to your AP ledger. In some cases, notify the vendor and request a revised statement.

Reconciliation is not just about correcting past entries; it’s also about preventing future errors.

Data Fields Extracted and Matched in Vendor Reconciliation

During vendor reconciliation, several data fields are reviewed and matched to confirm accuracy across internal and vendor records. These fields help identify duplicate payments, missed invoices, and incorrect balances.

Common data fields include:

- Invoice number and date

- Vendor name and account ID

- Purchase order reference

- Line item descriptions

- Quantity and unit price

- Tax breakdowns and totals

- Credit note amounts

- Payment dates and methods

- Outstanding balances

These values form the basis of comparison when validating vendor statements against your accounts payable ledger.

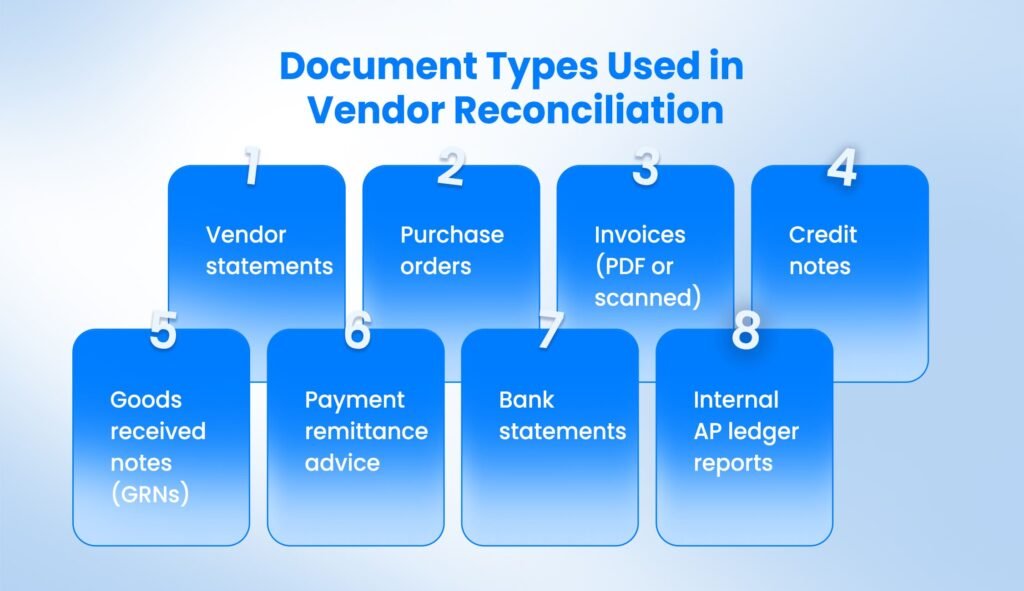

Document Types Used in Vendor Reconciliation

Reconciling vendor accounts requires gathering multiple supporting documents from both internal systems and vendor submissions. Each document offers context that helps confirm whether a payment or invoice entry is valid.

Typical documents include:

- Vendor statements

- Purchase orders

- Invoices (PDF or scanned)

- Credit notes

- Goods received notes (GRNs)

- Payment remittance advice

- Bank statements

- Internal AP ledger reports

Using these documents together allows teams to trace every transaction, adjust entries, and confirm balances before closing the period.

Common Discrepancies in Vendor Reconciliation

Duplicate Payments

One invoice accidentally recorded twice can go unnoticed without reconciliation. This is common when multiple departments handle approvals.

Unapplied Credit Notes

Credit notes are often left unadjusted, making it seem like you owe more than you actually do.

Mistyped Invoice Data

An extra zero or incorrect tax value can cause large mismatches in statements. Regular checks ensure these don’t lead to overpayments or disputes.

How Automation Improves Vendor Reconciliation

Automation tools are designed to replace repetitive, manual checks with consistent, real-time processing. In vendor reconciliation, this means removing delays caused by line-by-line matching and reducing the chance of human oversight.

Systems like KlearStack use pre-trained AI models that recognize key invoice fields, even when formats vary across vendors.

These systems don’t need templates to read documents. They extract details like invoice numbers, line items, tax splits, and credit notes directly from PDFs or scanned copies. This makes them especially useful in businesses dealing with non-standardized invoice layouts or legacy supplier formats.

Automation helps by:

- Matching invoices with statements across systems without manual input

- Flagging mismatches such as duplicate payments or missing credits in real time

- Centralizing documents so users can search and cross-reference instantly

- Syncing ledger updates with ERPs like SAP, Tally, and QuickBooks without re-entry

Instead of checking each record, finance teams can focus on reviewing flagged discrepancies.

The system handles the scanning, mapping, and validation across payment records and vendor reports. This leads to faster approvals and fewer corrections post-payment.

Most importantly, automated reconciliation doesn’t rely on memory or manual logs. It creates consistent validation across vendors, ensures audit traceability, and maintains a high level of accuracy in every reconciliation cycle.

How Often Should Vendor Reconciliation Be Done?

The frequency of vendor reconciliation depends on how often transactions occur with a vendor. Higher frequency means more chances for discrepancies, which makes regular checks more important.

Setting a fixed schedule helps accounts payable teams stay ahead of errors and avoid last-minute surprises at period-end closings.

Businesses with large vendors or high monthly billing should perform reconciliation every month. This prevents small mismatches from accumulating and affecting month-end reports.

For vendors with lower transaction volumes, a quarterly cycle is often enough to maintain accuracy without overloading the team.

Recommended schedules based on vendor type:

- Monthly: For vendors with frequent transactions or high invoice volumes

- Quarterly: For vendors with occasional services or limited engagement

- Annually (Year-End): For preparing accurate reports for audits and tax compliance

These intervals aren’t just about frequency they’re also about financial control. Timely reconciliation allows the finance team to validate liabilities, plan payouts, and identify anomalies early.

Following this rhythm ensures that vendor accounts reflect true balances across months, quarters, and fiscal years.

Challenges in Manual Vendor Reconciliation

Manually reconciling vendor accounts may seem manageable early on, but it quickly becomes a bottleneck as the business scales. Each additional vendor or invoice adds more time to the process.

Without automation, the accuracy of reconciliation depends entirely on how carefully each entry is reviewed and that’s a risk for most teams.

One major issue is the time required to gather and cross-reference documents. Vendor statements, invoices, payment logs, and credit notes often live in different formats and systems.

Reviewing each record for matching values can take hours, especially when inconsistencies are found.

Common manual reconciliation problems include:

- Time delays due to manual tracking and checking across systems

- Missed discrepancies like duplicate entries or missing invoices

- Disorganized records that make it hard to retrieve past data when needed

These problems grow with each new vendor added to the system. Even a single missing document or error in data entry can lead to overpayment, incorrect reporting, or vendor disputes.

When done without structure or system support, manual reconciliation slows financial workflows and affects reporting timelines.

Why Should You Choose KlearStack?

Vendor reconciliation doesn’t have to be a time-heavy or error-prone task. With KlearStack, it becomes a controlled, data-backed workflow.

KlearStack simplifies the process in 3 ways:

1. Smart Document Processing

- Template-Free: No format restrictions, even for scanned statements.

- AI-Powered Matching: Matches line items across invoices, credit notes, and vendor statements.

- Auto-Classification: Detects and categorizes every page of multi-document submissions.

2. Real-Time Discrepancy Resolution

- Pre-trained Models: Handle invoices, ledgers, and credit notes across industries.

- Audit Trails: Every reconciliation is logged for later review.

- Live Accuracy Checks: Warns users of outliers, missed invoices, or duplicated payments.

3. Easy Integration with Your AP Stack

- ERP Compatibility: Connect with Tally, SAP, QuickBooks, or Oracle

- Dashboard View: See what’s pending, approved, or flagged

- Automation Controls: Decide which invoices go through human review

Vendor teams save time. Finance leaders save money.

Ready to automate your vendor reconciliation? Book a Free Demo with KlearStack

Conclusion

Vendor reconciliation plays a key role in maintaining financial accuracy. It helps prevent overpayments, reduces the risk of invoice fraud, and ensures that outstanding balances reflect actual obligations. When done regularly, it supports better cash flow planning and simplifies internal audits by keeping records clean and consistent.

Manual processes, however, often lead to delays and missed discrepancies. Automation changes that by offering real-time validation, centralized document access, and integration with your existing finance tools.

With systems like KlearStack, reconciliation becomes a reliable part of your accounts payable workflow — one that scales with your business and reduces the risk of financial misstatements.

FAQs on Vendor Reconciliation in Accounts Payable

Vendor reconciliation in accounts payable means checking vendor statements with internal payment records for accuracy.

You reconcile a vendor account by comparing invoices, payments, and statements to fix any mismatches.

Vendor reconciliation flags mismatched invoices or totals, which may indicate fraud or billing errors.

Vendor reconciliation should be done monthly for high-activity vendors and quarterly for smaller accounts.