Insurance Document Automation: Complete Guide to Reduce Costs and Improve Efficiency

If your insurance company is still buried in paperwork and manual data entry, you’re bleeding money and risking compliance. Manual processing of thousands of claim forms, policies, and reports daily is error-prone and expensive. This is where our guide on Insurance Document Automation comes in handy.

In fact, 83% of insurers say automation is now critical to improving customer experience.

This guide will show how insurance document automation can stop the paper chase, reduce operational costs, and supercharge efficiency. We’ll cover what it is, why it’s important, how it works, the benefits, challenges, and how to choose the right solution.

Key Takeaways

- Automating insurance document workflows helps increase processing speed, reduce operational costs, and improve accuracy

- AI-powered technologies like OCR and NLP extract critical insurance data from documents quickly

- Cloud-based automation solutions easily scale to handle large document volumes during peak seasons

- Automated workflows ensure compliance by enforcing validation rules, securing sensitive data, and maintaining audit trails

- Insurance document automation integrates smoothly with existing claims management and policy administration systems

What is Insurance Document Automation?

Insurance document automation refers to using technology, like AI and OCR, to manage, process, and organize insurance documents without manual effort. It streamlines tasks by automatically extracting data, validating information, classifying documents, and routing them to the right process.

Benefits of Automated Insurance Document Processing

Automating document workflows in insurance delivers a wide range of benefits. Let’s break them down:

- Increased efficiency & speed: Tasks like sorting incoming claims, extracting policy data, and routing files take seconds. This helps insurers respond faster and handle more volume without increasing headcount.

- Reduced costs: By offloading repetitive work to automation, insurers cut labor, admin, and storage costs. In fact, KlearStack has helped insurers reduce policy processing costs by up to 80%.

- Improved accuracy: OCR and AI can reach 90-95% accuracy on typed text. Validation rules help catch issues early, reducing downstream errors.

- Better customer experience: Automation enables accurate, faster claims that lead to happier customers. In fact, Gartner’s 2023 survey states that 83% of insurance CIOs say improving customer experience is a top reason for adopting automation.

- Enhanced compliance & auditability: Automation makes audits faster and helps meet standards like HIPAA, GDPR, and ISO 27001.

- Scalability & agility: Cloud-based systems handle surges smoothly and adapt fast to changes, without retraining your team. Plus, the automated software integrates with core systems like Guidewire, Duck Creek, or custom claims platforms to sync data across workflows.

- Improved decision making: Automation turns unstructured documents into usable data. This lets you spot risks, detect trends, and trigger business rules instantly.

| Struggling with manual claims processing delays and compliance risks? KlearStack can help tailor a solution for your needs, reduce your workload, cut costs, and let you focus on what matters — your customers and growth. |

Key Data Points for Extraction from Insurance Documents

Insurance documents contain a goldmine of data. Let’s break down the exact data points insurers need and how automation gets them instantly:

- Policyholder details: Names, addresses, contact info, and personal identifiers (e.g. DOB, SSN) from applications and policy forms.

- Policy numbers & coverage details: Policy ID, coverage limits, deductibles, endorsements, and riders listed on policy docs.

- Premium and payment info: Premium amounts, billing dates, payment status, and account numbers on statements or invoices.

- Claim information: Claim numbers, incident dates, descriptions of loss, claimed amounts, and involved parties from claim forms.

- Loss estimates & adjuster notes: Appraisal values, repair estimates, and adjuster comments in claims documentation.

- Underwriting data: Risk factors, health info, inspection reports, and background check data in underwriting files.

- Compliance & KYC data: IDs, signatures, notarizations, and regulatory form fields (e.g. AML checks, sanction screening data).

Technologies Behind Insurance Document Automation

Modern document automation for insurance is a combination of advanced technologies that enable end-to-end automation. The main ones include:

1. Optical Character Recognition (OCR)

OCR converts scanned paper or image text into machine-readable text. For insurers, it can digitize everything from old policy documents to incoming claim forms. Advanced OCR can even handle different fonts and layouts.

2. Natural Language Processing (NLP)

NLP enables the system to understand context and meaning from text. It can read an unstructured accident description paragraph and extract key facts, or determine email intent. For example, a customer email saying “I moved, update my address”.

3. Robotic Process Automation (RPA)

RPA is like software bots that perform repetitive tasks. In document automation, it can move a digitized document through an approval workflow or copy data from one system to another. It also mimics what a human would click or type.

4. Intelligent Document Processing (IDP)

An IDP platform uses machine learning to classify documents (knows the difference between a claim form vs. a police report) and extract the needed data.

It even learns from corrections over time. And is often pre-trained on insurance document types, so it knows where to find the “Policy Number” on various ACORD forms.

5. Machine Learning & AI

ML algorithms learn patterns from historical documents.

For example, an AI model can learn to detect fraudulent claims by recognizing patterns (like similar phrases or excessive amounts) across thousands of past fraud cases. It also helps improve extraction accuracy — the more documents processed, the smarter the model gets at reading even messy inputs.

How Does Insurance Document Automation Work?

Insurance document automation takes a document from “received” to “processed and in system” through a series of intelligent steps. Here’s the step-by-step workflow:

1. Document ingestion

First, the modern automation system collects documents from various sources and formats, such as scanned paper forms, emailed PDFs, mobile uploads, faxed images, or digital forms submitted via portals.

It supports multiple input channels, including:

- Drag-and-drop uploads

- Email inbox integration

- API-based form submissions

- Scanner connections

2. Classification & routing

Next, the system classifies the document type. Is it a claim form, an ID proof, a medical report, a policy application? AI models analyze layouts and keywords to sort them automatically.

Say it sees a form with fields like “Patient Name” and “Diagnosis.” The system knows this is likely a medical claim attachment and routes it accordingly — e.g., to the claims processing queue or a specific department).

3. Data extraction (OCR/NLP)

OCR/ICR engines read the text on the document. Then NLP and template-free data parsing come in to pull out structured information.

For instance, from a home insurance claim, the system might extract: Policy #, Date of Loss, Property Address, Damage Description, Claimed Amount, etc. If it’s an unstructured letter, NLP helps find key sentences (like “the roof was damaged in the storm on June 1”).

Good systems use pre-trained models for insurance jargon to improve accuracy.

4. Validation & verification

The extracted data is automatically validated against business rules and internal systems.

For example:

- Is the policy number valid and active?

- Does the claim amount exceed the coverage limit?

- Are mandatory fields like signatures or dates present?

Flagging inconsistencies is crucial for compliance and fraud detection. Often, any fields that the AI is unsure about (below a confidence threshold) are sent to a human review queue. A human processor can double-check and correct data, and the AI learns from those corrections to do better next time.

5. Workflow routing & approval

Next, the system routes the document to the appropriate workflow. Based on the document type and business rules, it might:

- Send a claims form to the adjuster queue

- Route a policy application to the underwriting team

- Flag high-value claims for manual approval

- Trigger notifications or approval steps based on predefined conditions

This ensures that each document reaches the right department or person without delays or manual handoffs.

6. Integration with core systems

After routing, the extracted data and documents are pushed into your existing systems — claims management, policy administration, CRM, or ECM platforms.

Integration can happen through:

- APIs for real-time data transfer

- RPA bots to input data into legacy systems

- Batch exports/imports for scheduled uploads

- Direct database connections for back-end updates

This step ensures that processed documents and data are seamlessly reflected across your internal systems. No duplicate entry or delays.

7. Storage & audit trail

As a back-end step, systems will archive the documents in a secure cloud or on-prem repository, often with audit logs.

Each document is tagged with metadata for easy search and retrieval, like policy number, document type, and processing date. Plus, it can log every action, from who reviewed a field to when a document was accessed.

This is a lifesaver for compliance audits, as you can demonstrate control over document handling.

Integrating Insurance Document Automation into Existing Systems

Modern insurance document automation tools are designed to integrate with your existing IT stack, not replace it. This ensures extracted data and documents flow smoothly across operations, whether your core platforms are cloud-based or legacy.

Common insurance systems that automation connects to:

- Policy Administration Systems (PAS): For creating, updating, and validating policy records.

- Claims Management Systems (CMS): To push claims data, attach documents, and trigger claim workflows.

- Compliance and audit databases: For regulatory reporting, KYC/AML checks, and storing signed disclosures.

- Customer Relationship Management (CRM): To update customer records and track interactions.

- Enterprise Content Management (ECM): For secure document storage and retrieval.

Common Challenges in Insurance Document Processing

Despite the benefits, implementing insurance document automation isn’t without challenges. It helps to understand common pain points and how they’re addressed:

| Challenge | Solution |

| High volume & variety of documents: Insurers handle a wide range of formats — applications, claims, invoices, emails, scanned photos, legal forms. Manual sorting is chaotic and time-consuming. | Intelligent classification using AI and layout recognition: Template-free extraction allows systems to process new or unstructured documents by context. Cloud scalability supports high-volume processing. |

| Manual data entry errors: Typos in fields like policy numbers can lead to mismatched records or compliance issues. Repetitive entry increases human error. | Automated data capture and real-time validation rules: These eliminate most human errors. The system flags low-confidence or inconsistent data for review. Continuous learning improves accuracy over time. |

| Regulatory compliance & security: Sensitive insurance documents contain PII/PHI. Risk of non-compliance or data breaches, especially with cloud-based tools. | Compliance-focused design: Choose vendors that follow ISO 27001, SOC 2, HIPAA standards. Use role-based access controls, data encryption, and consider on-prem or private cloud deployments. Run pilots in secure sandboxes to build trust. |

| Ready to reduce insurance document processing costs by 80% and boost efficiency by 5X? KlearStack can help you turn the daunting paperwork mountain into a smooth, automated flow of information. Check detailed Case Study here! |

Choosing the Right Insurance Document Automation Solution

With many vendors in the market, it’s important to evaluate document automation solutions on several key criteria to ensure they meet your needs. Here’s what to consider:

| Features | What to look for |

| Security | – End-to-end encryption (in transit + at rest)- Role-based access controls- Audit trails- SOC 2/ISO 27001/HIPAA certifications- On-prem/private cloud options |

| Integration | – API support for core systems (Guidewire, Duck Creek, Salesforce)- RPA for legacy tools- Prebuilt connectors- Batch upload/download support |

| Compliance | – Built-in regulatory checks (KYC, FATCA, AML)- E-signature readiness- Document retention policy configuration- Searchable audit logs |

| Scalability | – Cloud-based processing with auto-scaling- Ability to handle large document volumes concurrently- Flexible rule setup for different insurance lines. |

You must also:

- Score vendors on features, security, integration, compliance, and scalability.

- Run a Proof of Concept (POC) with 2–3 vendors using real documents.

Involve IT and business users; IT checks tech fit, business checks usability. - Pick insurance-savvy vendors to reduce setup time and boost accuracy.

- Plan for scale — start small, but choose a platform that can grow with you.

- Avoid tool silos and prefer platforms that work across departments.

- Ask for case studies from similar insurers to gauge results.

Insurance-specific requirements checklist

Use this checklist to ensure the solution is built for insurance operations; not just generic document processing:

- Supports ACORD forms and insurance claim packets

- Recognizes insurance-specific terms and data fields (e.g., policy number, coverage type, loss details)

- Can extract structured and unstructured data from multi-page submissions

- Handles handwritten claim statements and medical notes using ICR

- Allows document tagging by policy, claim, customer ID, or underwriting file

- Includes fraud pattern detection and risk scoring options

- Maintains compliance with region-specific regulations (e.g., NAIC, FCA, APRA)

- Offers role-based dashboards for underwriters, claims managers, and compliance teams

- Provides fallback queues for human review with confidence scoring

- Scalable for spikes during catastrophes, open enrollment, or regulatory deadlines

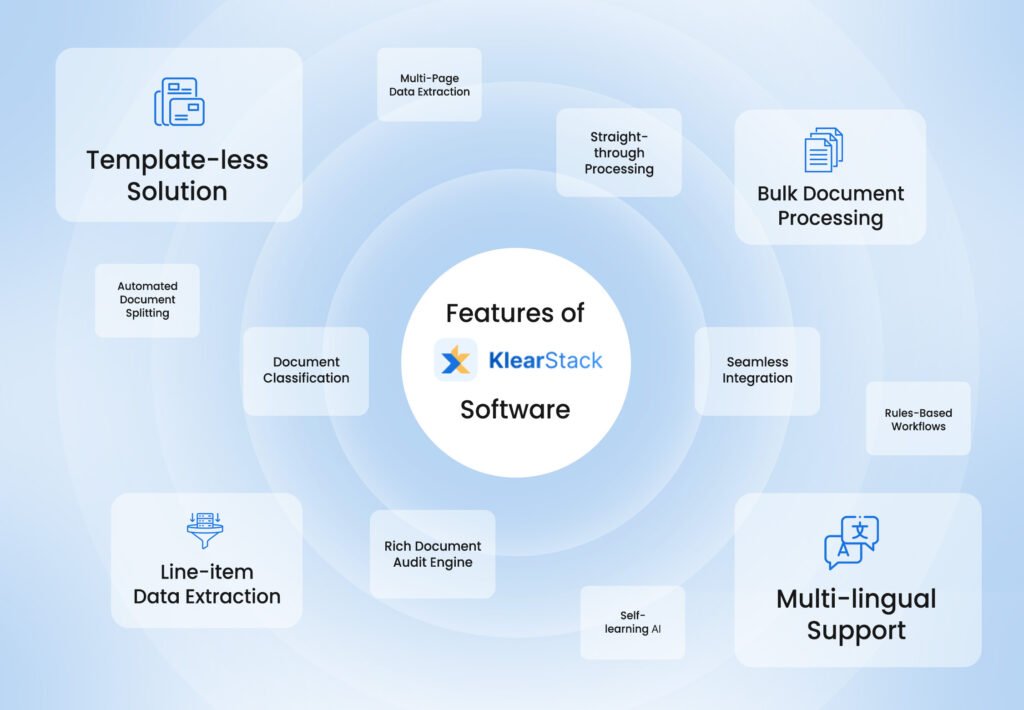

Why Should You Choose KlearStack?

Insurance operations run on paperwork. And manually handling these slows down claims processing, increases the risk of human error, and delays customer service.

KlearStack eliminates these inefficiencies by automating insurance document workflows end-to-end.

Advanced document processing capabilities:

- From structured forms to unstructured PDFs and scanned images, KlearStack consistently delivers over 98% accuracy.

- The more documents it processes, the better it gets at understanding insurance-specific formats, terminology, and logic

- Automatically routes claims, endorsements, and policy updates to the right department based on document content

- KlearStack meets strict compliance standards including HIPAA, SOC 2, and GDPR

Proven enterprise performance:

- Turnaround times are drastically reduced as documents are ingested, validated, and routed in real time

- Automated workflows reduce the need for large back-office teams. This helps insurance firms control operational expenses without compromising on service quality

- Whether it’s open enrollment season or a post-disaster claims surge, it handles high document volumes without bottlenecks

KlearStack integrates smoothly with policy admin systems, CRMs, and claims platforms, so your workflows stay connected. Plus, your teams stay focused on delivering fast, accurate service to policyholders.

Want to step into the future where AI and automation handle the documents, while you handle the business of insurance? Book a demo today.

Conclusion

We’re in 2025, an era where digital convenience is expected. Automating your insurance document workflows is a direct way to modernize your operations and meet those expectations.

So, if you haven’t started on this journey, now is the time. It’s a win-win for everyone: faster service for customers, lower costs and error rates for the company, and less drudgery for employees.

FAQs on Insurance Document Automation

Yes. Modern systems use Intelligent Character Recognition (ICR) and machine learning to process handwritten fields with up to 85–90% accuracy. They continue improving as more data is processed.

Automation can cut processing costs by up to 80% and reduce manual effort significantly. Most insurers see ROI within 6-12 months, especially when starting with high-volume workflows like claims or policy intake.

Automation enforces rules consistently — checking for required forms, validating data, logging every action, and securing documents with encryption and access control. This helps meet standards like HIPAA, ISO 27001, and SOC 2.

4. What types of insurance documents can be automated?

Multiple types of insurance documents can be automated like:

Claim forms and supporting documents

Policy applications and schedules

Underwriting files (e.g., inspection reports, health records)

KYC and compliance documents

Customer correspondence and emails

Invoices, receipts, and payment confirmations