What is Straight Through Processing in Insurance: Benefits and Implementation for 2025

If you work in insurance, you already know how your company handles millions of documents every single year. Every claim form, policy application, and underwriting decision creates a paper trail that someone needs to process, review, and file away. But does this give rise to the need of straight through processing in insurance?

McKinsey research indicates that up to 95% of property and casualty policies could undergo straight through processing without underwriter involvement, representing a massive automation opportunity.

You might be wondering:

- How can insurance companies reduce processing times from days to minutes while maintaining accuracy?

- What happens when manual workflows create bottlenecks that frustrate customers and increase operational costs?

- Why are leading insurers investing heavily in automation technologies to stay competitive in 2025?

The insurance industry stands at a turning point where straight through processing (STP) offers solutions to these pressing challenges. Advanced technologies like artificial intelligence and machine learning now make it possible to automate complex insurance workflows that previously required extensive human intervention.

Companies implementing STP alongside intelligent document processing report significant improvements in processing speed, cost reduction, and customer satisfaction while maintaining the accuracy and compliance standards essential to insurance operations.

Key Takeaways

- Straight through processing allows insurance workflows to complete automatically from start to finish without manual intervention

- STP significantly reduces processing times from days to minutes for routine claims and policy applications

- Implementation requires careful integration with existing systems and staff training on new automated workflows

- Leading insurers achieve higher customer satisfaction and operational cost savings through STP adoption

- AI and machine learning technologies power the accuracy and decision-making capabilities of modern STP systems

- Success depends on starting with high-volume, standardized processes before expanding to complex cases

What is Straight Through Processing in Insurance?

Straight through processing in insurance refers to the complete automation of insurance workflows from initial customer contact to final resolution. This technology allows insurance processes like claims handling, underwriting, and policy issuance to execute without human intervention.

Unlike traditional processing that requires multiple manual touchpoints, STP creates a continuous digital workflow that handles routine tasks automatically.

Modern STP implementations use artificial intelligence and machine learning to make processing decisions that previously required human expertise.

These systems use automated data extraction to evaluate risk factors, determine coverage eligibility, and calculate premiums. They even approve or deny applications based on predefined criteria and learned patterns from historical data.

Traditional vs. STP Processing Models

The following section will cover a broad overview of the basic differences between traditional models that require manual handling against STP models.

Traditional Manual Processing:

- Document receipt and manual sorting

- Data entry by administrative staff

- Review by multiple specialists

- Manual decision-making processes

- Physical file routing between departments

STP Automated Processing:

- Automatic document capture and classification

- Intelligent data extraction using OCR and AI

- Real-time decision-making through algorithms

- Instant routing to appropriate systems

- Digital workflow management with audit trails

This transformation creates a more agile, responsive insurance operation that can adapt to changing customer expectations and market demands.

How Straight Through Processing Works in Insurance Operations?

Understanding STP implementation requires examining both the technical architecture and operational workflows that make automation possible.

Technical Architecture Overview

A deeper look into the architectural blueprint of STP in insurance operations will help us understand the mechanism of this model’s efficiency.

Data Input Layer:

- Multi-channel document capture (email, web portals, mobile apps)

- OCR technology for physical document conversion supporting document digitization workflows

- API connections for real-time data feeds

- Integration with third-party data sources

Processing Engine:

- Rule-based decision trees for standard cases

- Machine learning models for complex pattern recognition

- Risk assessment algorithms utilizing document fraud detection capabilities

- Fraud detection capabilities

STP insurance systems operate through interconnected technology layers that work together seamlessly. The process begins with document-ingestion where optical character recognition (OCR) technology converts physical documents into digital data.

Advanced AI document analysis algorithms then analyze this information to understand context and extract meaningful data points.

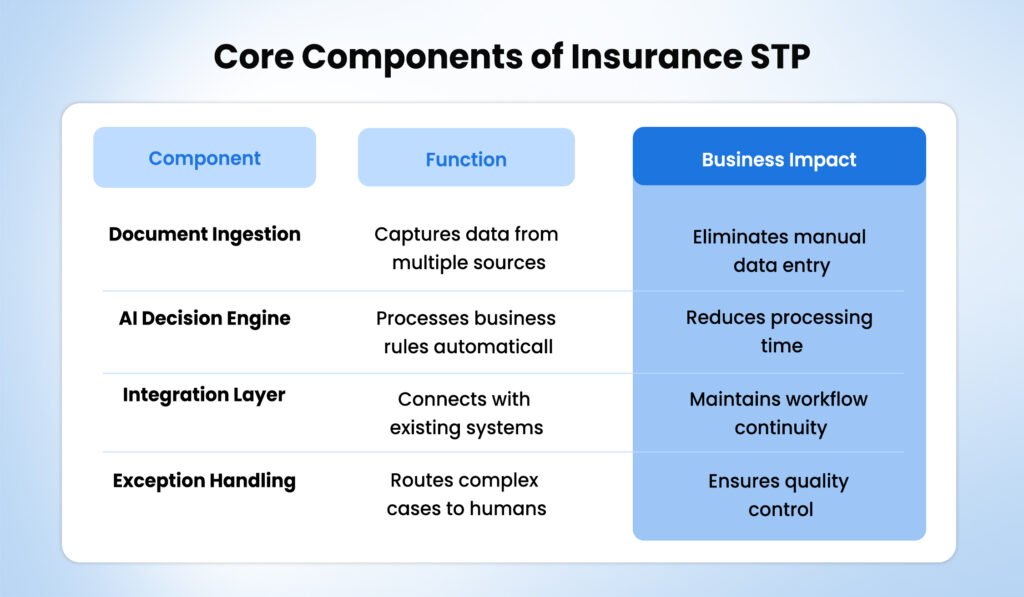

Core Components of Insurance STP

The foundation of STP lies in its ability to process various document types through advanced data extraction capabilities and data inputs:

Workflow Automation Stages

The stages of STP automation in the entire workflow can be summed up in 3 Key phases, They are primarily Classification, Business Rule Implementation, and Output generation. In detail, these stages are:

Stage 1: Document Classification and Data Extraction

The system automatically identifies document types and extracts relevant information through sophisticated OCR software. This includes policy applications, claim forms, medical records, and supporting documentation that require advanced data capture capabilities.

AI algorithms understand document structure and can handle variations in format and layout.

Stage 2: Business Rule Application

Extracted data flows through predefined business rules that mirror human decision-making processes. The system checks coverage limits, verifies policy status, calculates deductibles, and applies underwriting guidelines automatically.

Stage 3: Decision Processing and Output Generation

Based on rule evaluation, the system makes processing decisions and generates appropriate outputs. This might include claim approvals, policy quotes, coverage confirmations, or exception reports for human review.

Integration capabilities allow STP systems to communicate with existing insurance software platforms. This includes policy administration systems, customer relationship management tools, and financial systems.

Real-time data sharing between these platforms creates a unified processing environment where information flows smoothly without manual data entry or transfer delays.

Benefits of Implementing STP in Insurance Companies

The business impact of straight through processing extends across multiple operational areas, creating both immediate and long-term value for insurance organizations.

Operational Efficiency Gains

STP reduces manual processing time from days to hours for routine insurance tasks. Staff can redirect their focus from data entry work to complex cases that require human expertise and judgment.

Processing Speed Improvements:

- Claims processing: Days to hours reduction

- Policy issuance: Same-day completion for standard applications

- Customer inquiries: Instant response capabilities

- Underwriting decisions: Real-time risk assessment

Resource Optimization: Insurance companies using STP alongside data automation report dramatic reductions in processing times.

Claims that previously took weeks to resolve can now be completed in hours or minutes for straightforward cases. This speed improvement directly impacts customer satisfaction as policyholders receive faster responses and quicker claim settlements.

Financial Performance Impact

STP automation reduces these operational expenses while improving processing capacity without proportional staffing increases.

Cost Structure Analysis:

| Process Area | Manual Cost | STP Cost | Savings |

| Document Processing | High labor intensity | Automated extraction | 60-80% reduction |

| Decision Making | Multiple reviewer time | Instant algorithms | 70-90% faster |

| Error Correction | Rework and delays | Prevention-focused | 50-70% fewer errors |

Manual processing requires significant staff time for data entry, document review, and decision-making tasks. STP reduces these labor costs by handling routine work automatically.

Quality and Accuracy Improvements

Automated systems apply business rules consistently and maintain lower error rates through standardized processing approaches.

Consistency Benefits:

- Standardized decision criteria application

- Elimination of human processing variations

- Reduced error rates through automation

- Improved audit trail capabilities

Human processing introduces the possibility of errors through data entry mistakes, oversight, or inconsistent decision-making. Automated systems apply rules consistently and reduce error rates significantly.

Technology Components Powering STP Insurance Solutions

Modern straight through processing relies on sophisticated technology stacks that integrate multiple advanced capabilities into cohesive automation platforms.

Artificial Intelligence and Machine Learning Foundations

AI serves as the decision-making brain of STP systems, enabling intelligent processing that goes beyond simple rule following.

Core AI Capabilities:

- Pattern Recognition: Identifies similarities between cases for consistent handling

- Risk Assessment: Evaluates multiple data points to determine approval likelihood

- Fraud Detection: Spots suspicious patterns that might indicate fraudulent activity

- Predictive Analytics: Forecasts claim costs and processing complexity

Machine learning algorithms analyze historical insurance data to identify patterns and predict outcomes. These models can assess risk factors, detect fraud indicators, and determine appropriate processing paths for each case.

Document Processing and Data Extraction Technologies

The ability to accurately extract information from diverse document types forms the foundation of effective STP implementation.

Advanced Processing Capabilities:

- Optical Character Recognition (OCR): Converts scanned documents into searchable text with applications ranging from invoice OCR to complex medical records

- Intelligent Character Recognition (ICR): Handles handwritten text and forms

- Computer Vision: Analyzes images and photos for damage assessment

- Natural Language Processing: Understands context and meaning within documents

OCR technology forms the foundation for converting paper documents into digital data. Advanced natural language processing capabilities allow systems to understand context within documents, not just extract text.

Computer vision technologies can analyze images from claims, such as damage photos, to assess severity and estimate repair costs automatically.

Integration and Workflow Management Systems

STP platforms require robust connectivity with existing policy administration systems, CRM tools, and financial platforms. API connections and workflow management capabilities determine how smoothly data flows between systems without manual intervention.

System Architecture Components:

- API-based connections for real-time data sharing

- Workflow engines that route cases through appropriate processing steps

- Exception handling mechanisms for complex case escalation

- Audit trail capabilities for regulatory compliance

Modern STP platforms include robust integration capabilities that connect with existing insurance software systems. API connections allow real-time data sharing between platforms while workflow management tools route cases through appropriate processing steps.

These systems can handle exceptions by automatically escalating complex cases to human reviewers when needed.

Common Insurance Processes Suitable for STP Implementation

Different insurance processes offer varying levels of automation potential based on their complexity, standardization, and regulatory requirements.

High-Automation Potential Processes

Standardized, high-volume insurance processes with clear business rules offer the strongest automation opportunities. Personal lines applications and routine claims demonstrate the highest success rates for complete STP implementation.

Personal Lines Policy Processing

Auto and home insurance applications follow predictable workflows that align well with automated processing capabilities. Standard coverage requests with routine risk assessments can progress from application to policy issuance automatically.

Ideal Characteristics:

- Standardized application formats

- Clear underwriting guidelines

- Limited complexity factors

- High volume processing needs

Policy application processing works well with STP for standard personal lines insurance. The system can verify applicant information, check credit scores, assess risk factors, and generate quotes automatically.

Simple life insurance applications with standard health questions and coverage amounts can often be approved and issued without underwriter review.

Property Damage Claims

Straightforward property claims with clear documentation and standard repair costs work effectively with automated processing. Cases with obvious liability and damage within normal ranges qualify for complete STP handling.

Automation-Friendly Features:

- Photo-based damage assessment

- Standardized repair cost databases

- Clear coverage determination rules

- Predictable processing workflows

Claims processing for property damage represents another strong STP use case. When customers submit claims with photos and documentation,

AI systems powered by insurance document automation can assess damage severity, verify coverage, and approve payments for straightforward cases.

Auto insurance claims with clear liability and standard repair costs frequently qualify for full STP handling.

Moderate-Automation Potential Processes

Commercial underwriting and large claims require human expertise for complex risk evaluation and detailed investigation. These processes benefit from partial automation while maintaining human oversight for nuanced decision-making.

| Process Type | Automation Level | Key Considerations |

| Commercial Underwriting | Partial | Complex risk factors require human expertise |

| Large Claims | Limited | High-value cases need detailed investigation |

| Specialty Insurance | Selective | Unique coverage terms limit standardization |

Customer Service and Support Functions

Routine policyholder inquiries about coverage details, payment questions, and policy changes consume significant staff resources. Automated systems can handle standard requests instantly while routing complex issues to human representatives.

Automated Service Capabilities:

- Policy information inquiries

- Payment processing and scheduling

- Coverage change requests

- Claims status updates

Customer service inquiries about policy changes, payment questions, and coverage details can be handled through automated systems.

Similar to how automated invoice processing handles accounts payable workflows, chatbots and virtual assistants powered by AI can access policy information, process routine changes, and provide immediate responses to common questions.

Implementation Challenges and Solutions for Insurance STP

Successfully deploying straight through processing requires addressing multiple technical, organizational, and regulatory challenges that can impact project success.

Legacy System Integration Complexities

Modern insurance companies often operate on technology infrastructure built over decades, creating significant integration challenges.

Common Legacy System Issues:

- Data Format Incompatibilities: Older systems use proprietary data formats

- Limited API Capabilities: Legacy platforms lack modern integration options

- Processing Speed Constraints: Older hardware cannot handle real-time processing demands

- Security Vulnerabilities: Aging systems may lack current security standards requiring comprehensive financial services compliance measures

Integration Solutions:

- Middleware Platforms: Create translation layers between old and new systems

- Gradual Migration Approaches: Phase implementation to minimize disruption

- Hybrid Processing Models: Combine automated and manual workflows during transition

- API Development: Build custom interfaces for legacy system connectivity

Many insurance companies operate on decades-old core systems that weren’t designed for modern integration. These legacy platforms often require custom development work to connect with STP solutions.

Successful implementations typically involve gradual integration approaches that maintain existing functionality while adding automated capabilities incrementally.

Change Management and Staff Training Requirements

Human factors often present greater challenges than technical implementation issues.

Staff Adaptation Challenges:

- Resistance to workflow changes

- Fear of job displacement through automation

- Learning curve for new technology interfaces

- Quality control concerns with automated decisions

Training and Support Strategies:

- Comprehensive Education Programs: Explain STP benefits and career development opportunities

- Hands-On Learning Experiences: Provide practical training with real system interfaces

- Ongoing Performance Support: Offer continuous assistance during transition periods

- Role Redefinition: Help staff understand how their responsibilities will evolve

Employees accustomed to manual processes need comprehensive training on new automated systems. Effective change management programs include clear communication about STP benefits, hands-on training sessions, and ongoing support during the transition period.

Regulatory Compliance and Audit Considerations

Insurance regulators maintain strict oversight of processing decisions, especially those affecting consumer outcomes.

Compliance Requirements:

- Decision Transparency: Ability to explain automated decision logic

- Audit Trail Maintenance: Complete documentation of processing steps

- Data Privacy Protection: Secure handling of sensitive customer information

- Regulatory Reporting: Automated generation of required compliance reports

Compliance Solutions:

- Explainable AI Systems: Use algorithms that can provide decision reasoning

- Comprehensive Logging: Record all system actions and decision points

- Regular Compliance Testing: Validate system behavior against regulatory requirements

- Documentation Standards: Maintain detailed system operation documentation

Insurance regulators require detailed documentation of decision-making processes, especially for claims and underwriting decisions.

Just like how OCR in banking maintains strict audit trails for financial compliance, STP systems must maintain comprehensive records showing how automated decisions were made.

Compliance teams need access to system logic and decision criteria to demonstrate regulatory adherence during examinations.

Why Should You Choose KlearStack for Straight Through Processing?

Insurance companies need reliable automation solutions that handle diverse document types and complex processing requirements.

Traditional document processing systems often struggle with the variety of forms, policies, and claims documentation that insurance companies manage daily.

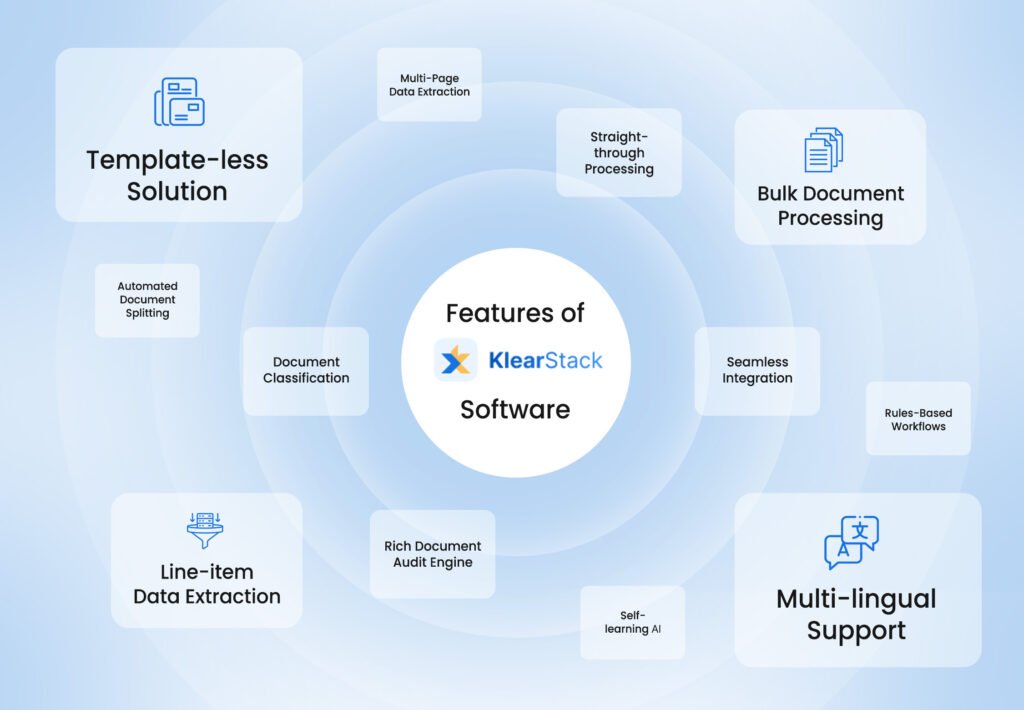

KlearStack transforms how your insurance operations handle document-intensive workflows through intelligent automation.

Advanced Processing Capabilities

Template-free processing adapts to any document format without requiring setup time or ongoing maintenance. These systems handle diverse insurance forms, policies, and claims documentation automatically regardless of layout variations.

Template-Free Processing Solutions:

- Adapts to any insurance document format automatically without setup requirements

- Handles ACORD forms, policy applications, claims documentation, and regulatory filings

- Processes handwritten forms and legacy document formats with high accuracy

- Supports multiple languages and regional document variations

Self-Learning AI Technology: KlearStack’s AI technology improves with each document processed, learning from corrections and adapting to new document types automatically.

The system maintains processing accuracy while handling increasing document volumes and complexity.

Proven Insurance Industry Performance

Leading insurers report specific metrics demonstrating STP’s practical value in real-world implementations. Processing speed improvements, accuracy rates, and cost reduction data validate automation investment decisions and guide expansion strategies.

Processing Capabilities:

- Volume Handling: Process 10,000+ documents daily with consistent accuracy

- Speed Performance: Complete document processing in minutes rather than hours

- Accuracy Standards: Achieve up to 99% extraction accuracy across all document types

- Scalability: Handle peak processing periods without performance degradation

Integration and Compliance Features:

- Seamless API integration with existing policy administration systems

- Built-in compliance controls meeting insurance regulatory requirements

- Secure document handling with complete audit trails for regulatory examinations

- Real-time processing status updates and exception reporting

Smart insurance operations require intelligent document automation that can adapt to changing business needs. KlearStack reduces your document processing time by 80% while maintaining the accuracy and compliance standards essential for insurance operations.

Ready to automate your insurance document processing workflows? Fill the Free Demo Form Now!

Conclusion

Straight through processing represents a fundamental shift in how insurance companies handle routine operations, moving from manual, time-intensive processes to automated, efficient workflows.

The technology offers clear benefits through faster processing times, reduced operational costs, and improved customer experiences that directly impact business competitiveness.

The insurance industry continues moving toward greater automation, and companies that invest in STP technologies now will be better positioned to compete effectively in 2025 and beyond.

FAQs on Straight Through Processing in Insurance

Straight through processing in insurance automates complete workflows from customer input to final resolution. This technology handles claims, underwriting, and policy processing without manual intervention using AI and machine learning.

STP reduces costs by eliminating manual data entry and review tasks. Automated systems process routine cases faster than human staff while maintaining accuracy standards and freeing employees for complex work.

Standard personal lines applications, property damage claims, and routine policy changes work well with STP. High-volume, standardized processes with clear business rules show the greatest automation benefits.

Current STP systems handle straightforward claims automatically but escalate complex cases to human reviewers. AI software solutions like KlearStack can handle more sophisticated scenarios while maintaining quality control standards.