Whether you’re involved in commercial insurance, dealing with complex policies, or seeking to streamline your insurance operations, ACORD 125 has a role.

It can offer several benefits to your business like improving the quality of insurance documentation, reducing risks, and enhancing operational effectiveness.

What is ACORD 125?

ACORD 125 is a standardized insurance form that collects and records essential information about insurance policies, coverage details, and other relevant data.

Who utilizes ACORD 125 and Why?

ACORD 125 is utilized by insurance carriers, agents, underwriters, and regulators to streamline policy documentation and communication. It is a structural template ensuring accuracy, efficient processing, and compliance within the insurance industry.

Related Content:

What is Acord 126? How to Complete ACORD 126 & Automate Its Processing?

What information does ACORD 125 contain?

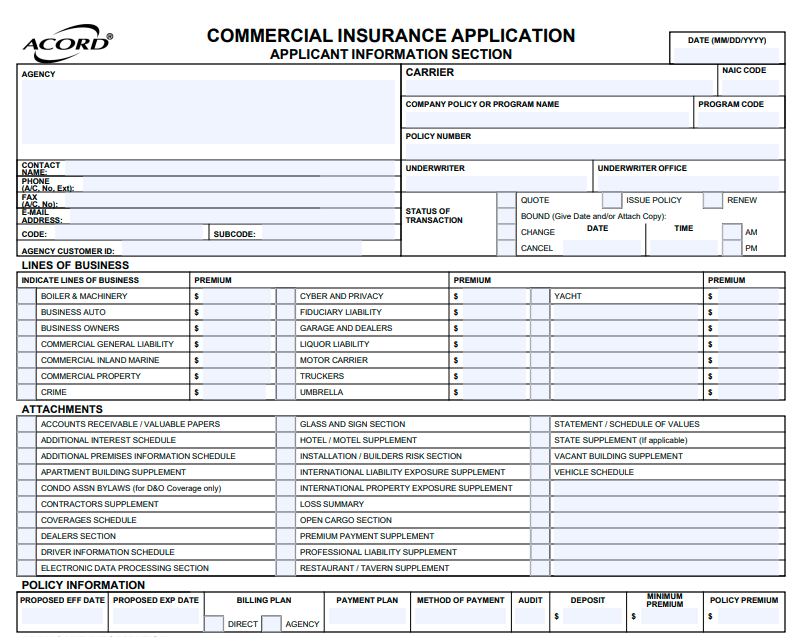

Image Source: ACORD 125

Acord 125 includes details such as the policy number, effective and expiration dates, insured party’s contact information, coverage specifics, billing details, and data related to claims, disputes, and underwriting considerations.

Download ACORD 125 Form PDF fillable version here

Here’s a breakdown of the specific information that ACORD 125 contains:

| Section | Element | Explanation |

| Policy Details Section | Policy Number | A unique identifier for the insurance policy. |

| Effective Date | The start date of the policy’s coverage. | |

| Expiration Date | The end date of the policy’s coverage. | |

| Program Name | The name associated with the insurance program. | |

| Transaction Status | The current stage of the policy (e.g., New or Renewal). | |

| Insured Information Section | Contact Details | Information about the insured, including contact info. |

| Prior Carrier Info | Details about the previous insurance carrier. | |

| Billing Plans | How the premium will be paid (installments or lump sum). | |

| Payment Methods | Preferred payment methods for the insurance premium. | |

| Coverage Information Section | Lines of Business | Specific types of coverage included in the policy. |

| Premises Information | Details about the insured location or property. | |

| General Information | Additional policy-related information. | |

| Specific Policy Questions | Yes/no answers to policy-related questions. | |

| Claims and Disputes Section | Filing Claims | Guidance on reporting insurance claims. |

| Settling Disputes | How disputes between insurer and insured are resolved. | |

| Policy Duration and Renewals | Information on policy duration and renewal processes. |

Benefits of Using ACORD 125

ACORD 125 is extremely helpful in automating the way that the insurance sector works. Unlike the traditional methods where data was recorded manually—this form benefits in terms of reduced delays, faster processing, and easy extraction of insurance data.

- 99% Accuracy: Since insurance policies are recorded in a standardized format—there’s no chance of human errors taking place.

- Convert to Multiple Formats: Convert insurance data into your preferred file format, be it PDF, Excel, PNG, or others.

- Reduced Delays: Because of its predefined fields and structured template, policy-related tasks are carried out more smoothly and with fewer delays. Data is automatically extracted from files and processed, without the need of human intervention.

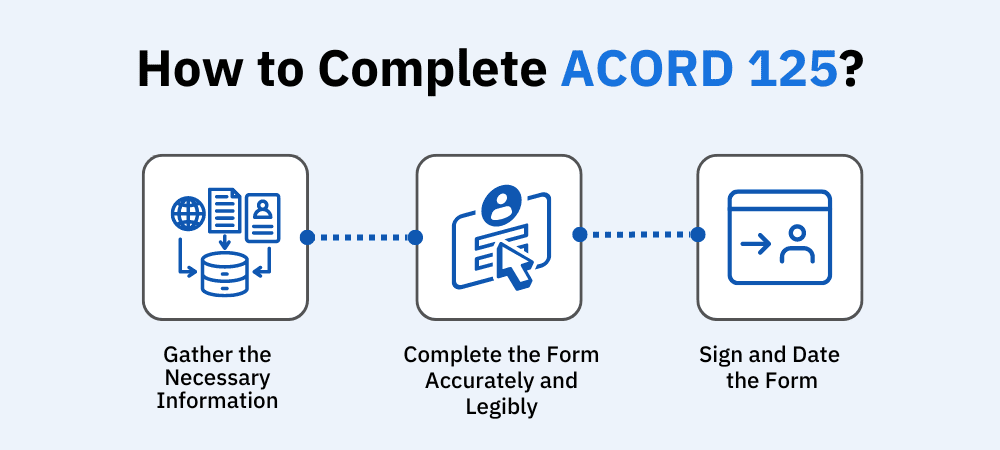

How to Complete ACORD 125?

Whether you’re an insurance professional or a client, it is essential to understand how to complete the ACORD 125 form accurately.

Here’s a step-by-step guide to Fill Out ACORD 125.

Download ACORD 125 Form PDF fillable version here

Step 1: Gather the Necessary Information

Collect all relevant policy details, like:

- Policy number,

- Effective date,

- Expiration date, and

- Program name

Ensure you have the insured party’s:

- Contact information,

- Prior carrier details, and

- Billing preferences

Step 2: Complete the Form Accurately and Legibly

- Fill in the required fields on the form. Use legible handwriting or, if possible, type the information to minimize the risk of errors.

Step 3: Sign and Date the Form

- Once all required information is provided, sign the form to authenticate its accuracy. Include the current date to indicate when the form was completed.

Additional Tips for Completion of Acord 125

There are three concise additional tips for completing the form:

- Review for Accuracy: Double-check all information for accuracy and consistency before finalizing the form.

- Prioritize Legibility: Ensure neat and legible handwriting or consider typing the information for clarity.

- Consider Digital Solutions: Explore digital platforms for streamlined and error-reducing form completion and storage.

Importance of ACORD 125

- Ensures legal compliance with policy terms and regulatory requirements.

- Safeguards policyholders and insurance company staff by providing clear policy terms.

- Simplifies dispute resolution, and reduces potential conflicts by maintaining a standardized record of policy details.

How to Automate ACORD 125 Processing?

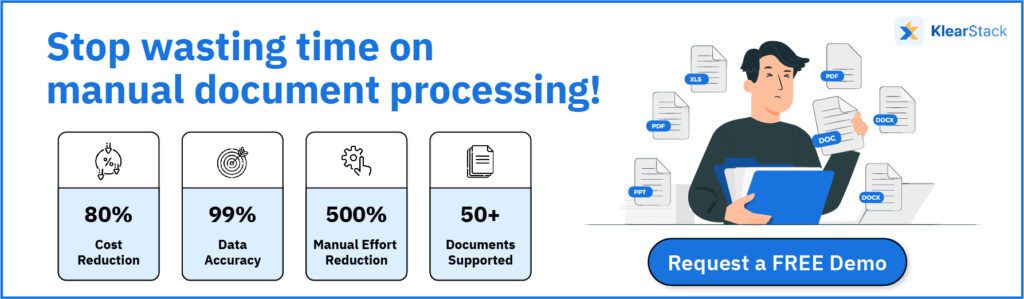

To automate ACORD 125 processing, consider leveraging advanced solutions like KlearStack.

KlearStack offers powerful data capture and automation tools that can digitize these forms. It can extract data with precision using OCR technology, implement smart filters, enable batch processing, and seamlessly integrate with your insurance workflow.

Here’s How to Automate ACORD 125 Processing with KlearStack:

Step One: Digitize ACORD 125 Forms

Scan or convert paper-based ACORD 125 forms into digital formats (PDF, image files, etc.).

Step Two: Implement KlearStack’s OCR Technology

Utilize KlearStack’s advanced Optical Character Recognition (OCR) technology to accurately extract text and data from these digital forms.

Step Three: Apply Smart Filters

Implement KlearStack’s smart filtering system to categorize and organize the extracted data for efficient processing.

Step Four: Integrate Pre-trained KlearStack APIs

Seamlessly integrate KlearStack’s pre-trained APIs into your automation workflow to automate data validation and verification processes.

Step Five: Store Data Securely

Store the processed data securely in a database or cloud storage, ensuring easy retrieval and reference.

Step Six: Integrate with Your Workflow:

Integrate KlearStack’s automated processing into your existing insurance workflow or management systems.

Benefits of Automation

KlearStack guarantees the following benefits:

- Enhanced Efficiency: Streamline your processes, reduce manual tasks and accelerate data processing.

- Error Elimination: Minimize human errors, ensure data accuracy and reliability.

- Format Versatility: Handle various document formats.

- Data Validation: Ensure the quality and consistency of extracted information.

Conclusion

When you process these insurance forms using KlearStack, you can turn your insurance operations stress-free. KlearStack’s automation elevates the overall quality of data, compliance, and communication that you require within your insurance business.

To witness firsthand how KlearStack’s Document Automation Process can improve your insurance forms processing, we invite you to explore the platform’s capabilities and benefits through KlearStack’s free trial demo version.

Experience the power of automation and set your insurance processes on a path toward enhanced performance and accuracy.

FAQs on ACORD 125

ACORD 126 involves policy details like the policy number, effective date, and expiration date, along with endorsement specifics such as changes to coverage, premium adjustments, and agent details. These elements are crucial for documenting policy modifications accurately.

ACORD stands for “Association for Cooperative Operations Research and Development.” It is an organization that develops and maintains standardized forms and data standards for the insurance industry.

ACORD proof of coverage is a document often used to demonstrate evidence of insurance coverage. It may include policy details, effective dates, and other relevant information to verify insurance status.

ACORD 125 primarily documents policy details and information, while ACORD 126 is specifically designed for recording endorsements or changes to existing policies. They serve different purposes within the insurance documentation process.