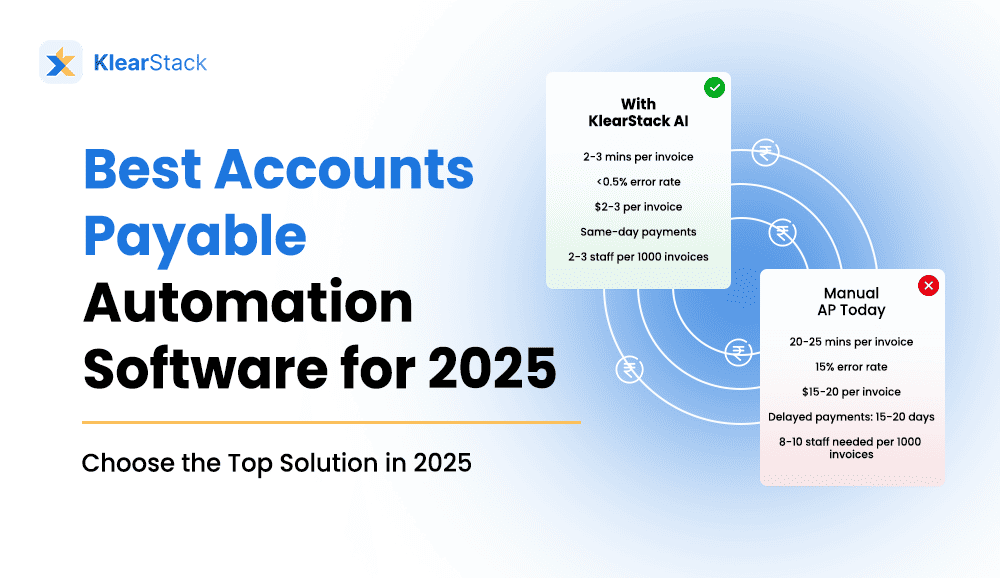

Managing thousands of monthly invoices with a manual process creates costly bottlenecks in your accounts payable department. AP teams waste valuable hours on data entry, while delayed approvals strain vendor relationships and impact your bottom line.

Key Accounts Payable Challenges:

- What’s the true cost of manual invoice processing for your organization?

- How many early payment discounts did your team miss last quarter?

- Are approval delays affecting your supplier relationships?

Modern accounts payable automation software transforms this complex process into a streamlined operation. KlearStack’s AI-powered solution processes invoices with 99% accuracy, reducing processing costs while maintaining compliance standards.

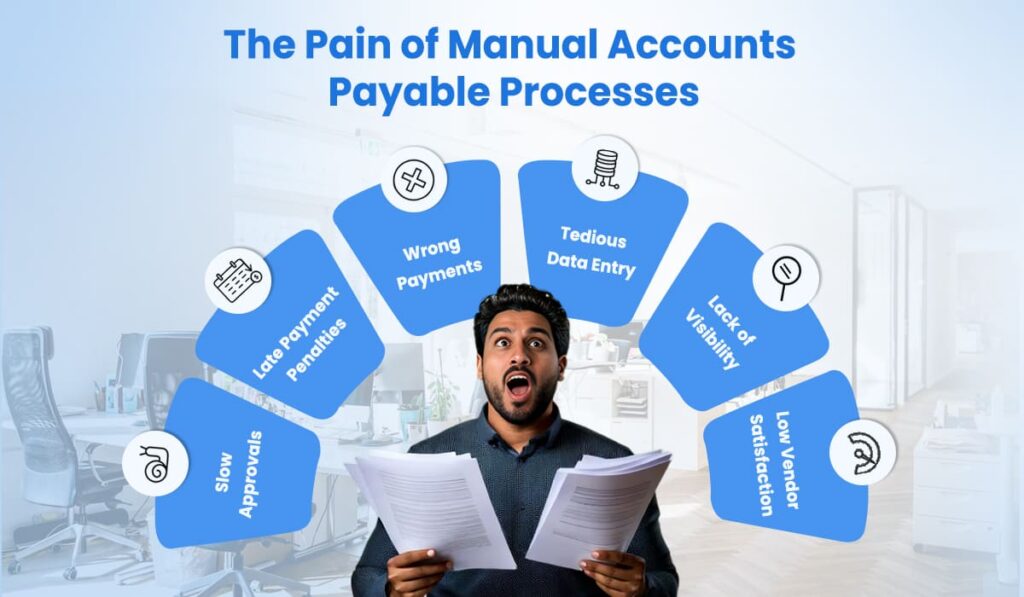

The Pain of Manual Accounts Payable Processes

A mountain of paperwork is actually a productivity killer. Manual accounts payable processes are filled with inefficiencies that cost businesses time, money, and peace of mind.

1. Slow Approvals: Stalled Invoices, Missed Discounts, Frustrated Vendors

Chasing down approvals feels like a wild goose chase. This leads to delayed payments, missed early payment discounts, and strained vendor relationships. Studies show that manual approval processes can take anywhere from 10 to 20 days!

2. Late Payment Penalties: Eating Profits and Damaging Your Reputation

Timely payments are essential. But manual processes make it easy to miss deadlines, resulting in costly penalties that impact your bottom line and damage your reputation with vendors.

3. Wrong Payments: Incorrect Reconciliation Leads to Costly Errors

Manually matching invoices and payments is a recipe for disaster. Typos and incorrect coding can lead to overpayments, underpayments, and a whole lot of headaches.

4. Tedious Data Entry: Wasted Time and Increased Risk of Errors

Manually entering data from invoices is a mind-numbing, error-prone task. It’s a massive time waster that prevents your AP team from focusing on more strategic activities.

5. Lack of Visibility: Flying Blind with Your Finances

Paper-based AP processes make it difficult to track spending, identify cost-saving opportunities, and manage cash flow effectively. It’s like trying to navigate without a map.

6. Low Vendor Satisfaction: Slow Payments and Errors Strain Relationships

Late payments and payment errors severely damage your vendor relationships. This leads to less favorable terms, supply chain disruptions, and even refusal to do business with you.

How KlearStack Automates and Streamlines AP

KlearStack offers a powerful antidote to manual AP headaches. This AI-powered accounts payable automation software streamlines every step of your AP process, from invoice capture to payment reconciliation.

Meet Emily, the Accounts Payable Clerk: Emily spends hours each day manually entering invoice data, chasing approvals, and reconciling payments. Errors are frequent, and she’s always stressed about meeting deadlines. KlearStack has been a game-changer for her. With automated invoice processing and data extraction, she’s eliminated manual data entry and reduced errors significantly. Automated workflows ensure timely approvals, and she no longer dreads the end-of-month reconciliation process.

Meet David, the Accounts Payable Supervisor: David oversees a team of AP clerks and is responsible for ensuring accuracy and efficiency. He was frustrated with the slow approval process, the lack of visibility into invoice status, and the difficulty in enforcing compliance. KlearStack has provided him with the tools he needs to streamline the entire AP workflow, improve team productivity, and ensure adherence to company policies. The comprehensive audit trail and log of approvals give him complete confidence in the process.

Meet Robert, the Finance Director: Robert needs accurate, real-time financial data to make informed decisions. But with manual AP processes, he’s always playing catch-up. KlearStack’s real-time dashboards and reporting tools provide him with the insights he needs to manage cash flow, track spending, and optimize the company’s financial health. He also values the detailed audit trail for compliance and the clear communication channels with suppliers for quick resolution of discrepancies.

Meet Maria, the Controller: Maria is responsible for the company’s financial reporting and internal controls. She was concerned about the risk of fraud and errors associated with manual AP processes. KlearStack’s robust security features and automated reconciliation capabilities have given her peace of mind. She can now trust the accuracy of the financial data and focus on strategic analysis instead of firefighting.

Meet Sarah, the CEO of a Growing Retail Business: Sarah is focused on scaling her business and improving efficiency. Manual AP processes were creating bottlenecks and hindering growth. With KlearStack, her AP department is now a well-oiled machine. Invoices are processed quickly and accurately, approvals are streamlined, and payments are always on time, strengthening vendor relationships and improving the company’s reputation.

Other Documents Processed by KlearStack

While KlearStack excels at automating AP processing, its capabilities extend far beyond that. KlearStack’s intelligent document processing (IDP) platform can handle a wide range of document types, including:

- Invoices

- Receipts

- Purchase Orders

- Identity Cards

- Credit card statements

- Deposit slips

- Checks

- Expense reports

- Bank statements (in any format)

- Many other documents

This versatility makes KlearStack a comprehensive solution for automating your financial data extraction needs.

How KlearStack Elevates Your AP Process

While KlearStack certainly delivers on its promise of increased efficiency, its benefits extend far beyond simply speeding up tasks. By automating and streamlining your accounts payable process, KlearStack empowers your business to:

1. Improve Compliance and Reduce Risk: Manual AP processes are prone to errors and inconsistencies, which lead to compliance issues and even legal trouble. KlearStack helps you stay on the right side of regulations with:

- Automated data validation: Ensures accuracy and reduces the risk of human error.

- Detailed audit trails: Provide a comprehensive record of every transaction for easy tracking and compliance audits.

- Role-based access control: Restricts access to sensitive information, minimizing the risk of fraud.

2. Gain Greater Visibility into Spending: KlearStack provides a clear, real-time view of your AP data, enabling you to:

- Track spending patterns: Identify areas where you can reduce costs and optimize your budget.

- Monitor invoice status: Stay on top of payments and avoid late fees.

- Analyze vendor performance: Make informed decisions about supplier relationships.

3. Strengthen Vendor Relationships: Timely and accurate payments are essential for building strong vendor relationships. KlearStack helps you:

- Pay vendors on time, every time: Avoid late payments and maintain a positive reputation.

- Resolve discrepancies quickly: Communicate clearly with vendors and address issues proactively.

- Negotiate better terms: Leverage your improved payment history to secure more favorable terms.

By going beyond basic automation, KlearStack elevates your entire AP process, leading to improved financial health, reduced risk, and stronger business relationships.

Why Leading Companies Choose KlearStack for Account Payable Automation

KlearStack isn’t just a promising solution; it’s a proven performer. Leading companies around the world trust KlearStack to streamline their account payable processes, improve accuracy, and reduce delays.

But don’t just take our word for it. Here’s what our clients are saying:

Beyond testimonials, KlearStack’s success is evident in its:

- Proven Scalability: KlearStack boasts an 80% improvement in team productivity and 300% faster loan processing.

- Cost Reduction: KlearStack helps reduce costs by up to 80%.

- Operational Efficiency: KlearStack increases operational efficiency by up to 500%.

- Accuracy: KlearStack delivers up to 99% accuracy with its self-learning AI.

- Seamless Integrations: KlearStack offers open RESTful APIs and pre-built connectors for SAP, QuickBooks, and more.

- Security and Compliance: KlearStack ensures the security and privacy of your data with ISO 27001 certification and SOC 2 compliance.

- Industry Recognition: KlearStack is an AICPA SOC, GDPR, and NASSCOM-certified member.

- Strategic Partnerships: KlearStack is a member of LEGLO and GLOBAL SUMMIT.

To see KlearStack in action, explore our detailed case studies showcasing real-world results.

- Digitising Banks with Document Automation

- Loan Processing Time Decreased by a Whooping 300%

- Automating AP Invoice Processing for a Fortune 100 Manufacturing Company

Automate Your AP Process Faster without Error, and No Late Payment Penalties

Manual accounts payable processes are a thing of the past. With KlearStack’s accounts payable automation software, you can say goodbye to slow approvals, late payment penalties, and costly errors.

By automating your AP workflow, you’ll:

- Save time and money: Eliminate manual data entry, reduce errors, and free up your team for more strategic tasks.

- Improve accuracy and compliance: Ensure accurate data capture, reconciliation, and adherence to regulations.

- Strengthen vendor relationships: Pay vendors on time, every time, and build trust through clear communication.

KlearStack: Smarter AP automation software for a smarter business. Schedule a demo call today.