Banks face mounting pressure to stay compliant with evolving KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Traditional manual KYC processes are no longer cutting it. They’re slow, inefficient, and prone to errors, costing your BFSI institution valuable time and resources.

But what if there was a way to streamline KYC compliance, reduce risk, detect frauds and enhance the customer experience all at once? Automated KYC verification, is the latest KYC technology that’s transforming how banks onboard and manage customers. It automates the entire process of KYC, right from documentation to verification.

In this blog post, we’ll explore how to automate KYC verification process, the challenges of manual KYC checks, the benefits of automation, and how KlearStack can help your bank thrive with its robust automation capabilities.

What is Automated KYC Verification and How it works?

Automated KYC verification leverages technology to streamline the process of verifying KYC identities and assessing risk. Instead of relying on manual document checks and data entry, automated solutions use advanced KYC technologies like Artificial Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR) to automate tasks such as:

- KYC Identity verification: Automatically verifying customer identities and conducting due diligence against official databases and documents.

- Document processing: Extracting key information from documents like passports and driver’s licenses.

- Risk assessment: Analyzing customer data to identify potential risks and flag suspicious activity.

- Ongoing monitoring: Continuously monitoring customer activity for any changes that may require further review.

- Global KYC Compliance: Complying with gepgraphy specific regulations and detecting frauds to meet KYC and AML regulations.

By automating these tasks, banks significantly reduce the time and resources required for KYC compliance, while improving accuracy and efficiency.

The Hidden Costs of Manual KYC Verification Processes

Let’s face it, KYC compliance can feel like a never-ending uphill battle. Manual processes are often bogged down by tedious paperwork, time-consuming checks, and the risk of human error.

- Lengthy onboarding times: Manually verifying customer identities and documents takes days, even weeks, leading to frustrated customers and lost business opportunities.

- High operational costs: Manual processes require significant manpower, which translates to increased expenses for your institution.

- Increased risk of fraud: Human error leads to overlooking crucial details, making your bank vulnerable to fraud and financial crime.

- Difficulty keeping up with regulatory changes: KYC and AML regulations are constantly evolving, making it challenging to stay compliant with manual processes.

- Strained customer relationships: Lengthy onboarding processes and intrusive verification methods negatively impact the customer experience.

If these challenges resonate with you, you’re not alone. Banks of all sizes struggle with the complexities of KYC compliance.

Automated KYC Verification Rescues your Bank from KYC Chaos

Instead of drowning in a sea of paperwork, your compliance team effortlessly navigates the KYC process. Onboarding new customers takes minutes, not weeks. Your staff is freed from tedious manual tasks, allowing them to focus on higher-value activities. And the risk of errors and fraud? Significantly reduced.

This is what automated KYC solutions offer. They act like a precision scalpel, cutting through the complexity and inefficiency of traditional KYC processes. Here’s how:

- Onboarding at Warp Speed: Automated systems can verify customer identities and documents in a flash, accelerating the onboarding process and leaving your customers delighted.

- Cost Savings that Wow: By automating manual tasks, banks can significantly reduce labor costs and free up valuable staff time for more strategic initiatives. Think of it as a bonus for your bottom line.

- Accuracy is King: Automated systems minimize the risk of human error, ensuring more accurate data and reducing the likelihood of fraud. Sleep soundly knowing your bank is protected.

- Compliance? No Sweat: Automated KYC verification solutions can be easily updated to reflect the latest regulatory changes, ensuring your bank remains compliant. Say goodbye to compliance headaches!

- Happy Customers, Happy Bank: Streamlined onboarding processes and reduced friction create a more positive experience for your customers. Build loyalty and watch your business grow.

Why Ignoring Automated KYC Verification Can Hurt Your Bank

Clinging to outdated manual KYC processes is like driving a horse-drawn carriage in a Formula 1 race. You’re simply not equipped to compete. Ignoring automated KYC verification can lead to:

- Lost Business Opportunities: Lengthy onboarding processes frustrate potential customers and drive them to your competitors who offer faster and more seamless experiences.

- Increased Compliance Costs: Manual processes are more prone to errors, which can lead to hefty fines and penalties for non-compliance.

- Open Doors for Financial Crime: Without the advanced security features of automated solutions, your bank becomes more vulnerable to fraudsters and money launderers.

- Damaged Reputation: Negative customer experiences and security breaches can tarnish your bank’s reputation and erode customer trust.

- Missed Opportunities for Innovation: Manual KYC processes tie up valuable resources that could be used for innovation and growth initiatives.

Don’t let your bank fall behind.

KlearStack Delivers Many Perks with Automated KYC

While solving your KYC problems is a major win, Leading automated KYC verification solutions like KlearStack go beyond the basics and bring even more to the table. Think of it as a bonus round of benefits that can transform your banking operations:

- Enhanced Due Diligence: KlearStack dives deep into customer profiles, analyzing data from various sources to provide a comprehensive risk assessment. This helps you identify potential red flags and make informed decisions with confidence.

- Improved Fraud Prevention: KlearStack’s AI-powered engine continuously monitors customer activity and transactions, detecting suspicious patterns and preventing fraud in real-time. Protect your bank and your customers.

- Increased Efficiency Across the Board: KlearStack automates tedious tasks, freeing up your compliance team to focus on what matters most: building customer relationships, developing new products and services, and driving innovation.

- Regulatory Reporting Made Easy: KlearStack generates detailed audit trails and reports, making it easier to demonstrate compliance with regulatory requirements.

- Better Customer Experience, More Business: KlearStack’s streamlined onboarding process and frictionless experience create happy customers who are more likely to sing your praises. Boost your bank’s reputation and attract new business.

With KlearStack’s automated KYC verification solution, you can experience all these benefits and more. Our AI-powered platform streamlines KYC compliance, reduces risk, and enhances the customer journey.

KlearStack is the Automated KYC Verification Software You Need

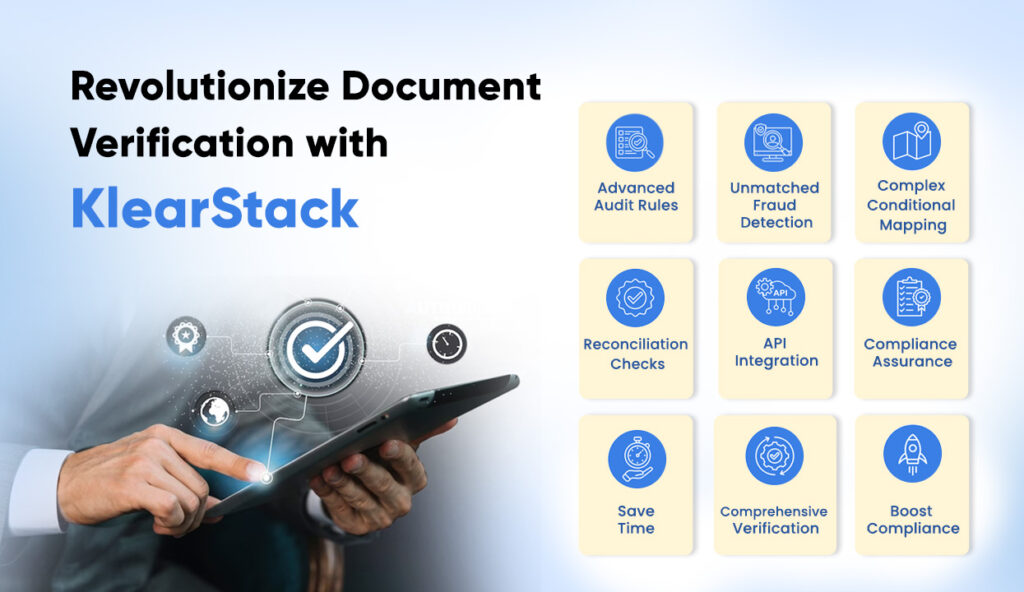

KlearStack offers a robust suite of features designed to streamline your document verification processes and enhance security:

- Advanced Audit Rules: Configure a wide range of audit rules, from simple to complex, to ensure thorough and accurate verification.

- Unmatched Fraud Detection: KlearStack’s AI-powered algorithms effectively identify tempered and fraudulent documents, protecting your business from identity theft.

- Complex Conditional Mapping: Easily transform data at the extraction stage with complex conditional mapping, ensuring data integrity and accuracy.

- Reconciliation Checks: Define reconciliation checks to verify data integrity and minimize errors.

- API and Data Source Integration: Connect KlearStack with external data sources via API to enrich your identity verification process.

- Unwavering Compliance: Rest assured that your data is handled with the utmost security. KlearStack is compliant with the highest privacy standards, including AICPA SOC and GDPR.

- Effortless Efficiency: Save up to 95% of manual effort by automating your document verification workflows.

- Comprehensive Verification: KlearStack checks all documents and fields, ensuring complete and accurate identity verification.

- Boost Compliance: Increase compliance rates to nearly 100% with KlearStack’s robust features and adherence to industry standards.

Why Leading Organizations Choose KlearStack?

KlearStack isn’t just a promising solution; it’s a proven performer. Leading BFSI organizations around the world trust KlearStack to streamline their KYC verification processes, improve accuracy, and reduce risk.

KlearStack’s Client Review:

Beyond testimonials, KlearStack’s success is evident in its:

- Proven Scalability: KlearStack boasts an 80% improvement in team productivity and 300% faster loan processing.

- Cost Reduction: KlearStack helps reduce costs by up to 80%.

- Operational Efficiency: KlearStack increases operational efficiency by up to 500%.

- Accuracy: KlearStack delivers up to 99% accuracy with its self-learning AI.

- Seamless Integrations: KlearStack offers open RESTful APIs and pre-built connectors for SAP, QuickBooks, and more.

- Security and Compliance: KlearStack ensures the security and privacy of your data with ISO 27001 certification and SOC 2 compliance.

- Industry Recognition: KlearStack is an AICPA SOC, GDPR, and NASSCOM-certified member.

- Strategic Partnerships: KlearStack is a member of LEGLO and GLOBAL SUMMIT.

To see KlearStack in action, explore our detailed case studies showcasing real-world results.

KlearStack Case Studies:

- Digitising Banks with Document Automation

- Loan Processing Time Decreased by a Whooping 300%

- Automating AP Invoice Processing for a Fortune 100 Manufacturing Company

KlearStack handles all Banking & Finance documents

KlearStack isn’t just limited to bank statements. It can process a wide variety of financial documents, including:

- Bank statements (in any format)

- Invoices

- Receipts

- Purchase Orders

- Identity Cards

- Credit card statements

- Deposit slips

- Checks

- Expense reports

- Many other documents

This versatility makes KlearStack a truly comprehensive solution for automating your financial data extraction and reconciliation needs.

Don’t Wait, Automate! KlearStack is Your KYC Solution

The writing’s on the wall: manual KYC processes are no longer sustainable for banks that want to thrive in the digital age. Automated KYC verification is what you need, and you need it now for efficiency, reducing risk, and enhancing the customer experience.

With KlearStack, you step into the future of KYC compliance with confidence. Our AI-powered platform offers a comprehensive suite of tools to streamline your operations, protect your bank from fraud, and delight your customers.

Fill the below free demo form and see how we can help your bank achieve its KYC goals.