Financial institutions face mounting pressure to disburse loans quickly while maintaining accuracy and compliance. Teams spend countless hours manually reviewing applications, verifying documents, and disbursing approved loans – creating significant delays between approval and actual fund transfer to customers.

Key Questions for Financial Leaders:

- What is your average time between loan approval and disbursal?

- How many applications face delays in fund transfer due to manual verification?

- What percentage of your team’s time is spent on pre-disbursal checks?

Modern financial institutions are transforming their operations through consumer loan disbursal automation. This AI-powered approach reduces the time between approval and fund transfer from days to hours, while maintaining strict compliance standards.

What is Consumer Loan Disbursal automation?

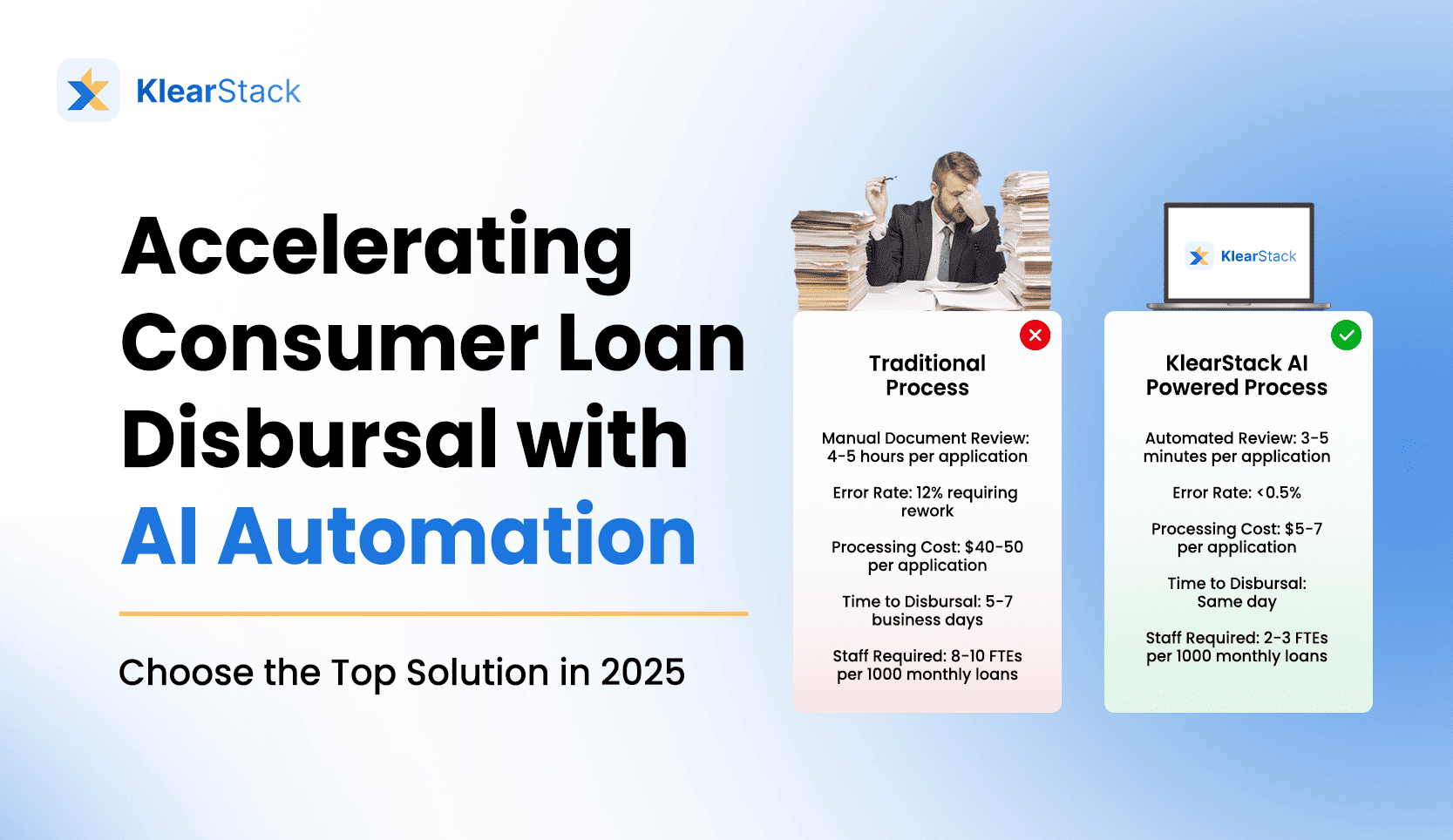

The traditional loan disbursal process involves multiple manual steps after loan approval – from final document verification to fund transfer initiation. Automating consumer loan disbursal with AI creates an intelligent system that handles these final stages automatically, ensuring quick and accurate fund transfer to approved applicants.

Key Automation Points:

- Pre-disbursal Document Verification: Automatic final check of required documents

- Compliance Validation: Real-time verification of regulatory requirements

- Fund Transfer Initiation: Automated processing of approved disbursals

Core Disbursal Components

Consumer loan automation using AI combines multiple technologies specifically for the disbursal phase. These systems verify final documentation, initiate fund transfers, and maintain detailed audit trails automatically.

Technical Elements:

- Smart Verification: Final document and detail confirmation

- Automated Fund Release: Systematic transfer initiation

- Real-time Status Tracking: Instant updates on disbursal progress

Disbursal Integration

Automated consumer loan disbursal systems connect seamlessly with existing banking infrastructure. This integration ensures smooth fund transfers while maintaining security protocols and compliance requirements.

System Features:

- Banking System Integration: Direct connection to fund transfer systems

- Compliance Tracking: Automated regulatory adherence verification

- Audit Trail Creation: Detailed documentation of each disbursal step

Financial institutions implementing consumer loan disbursal automation create streamlined operations that balance speed with security, setting new standards for modern lending operations.

Why automate Consumer Loan Disbursal?

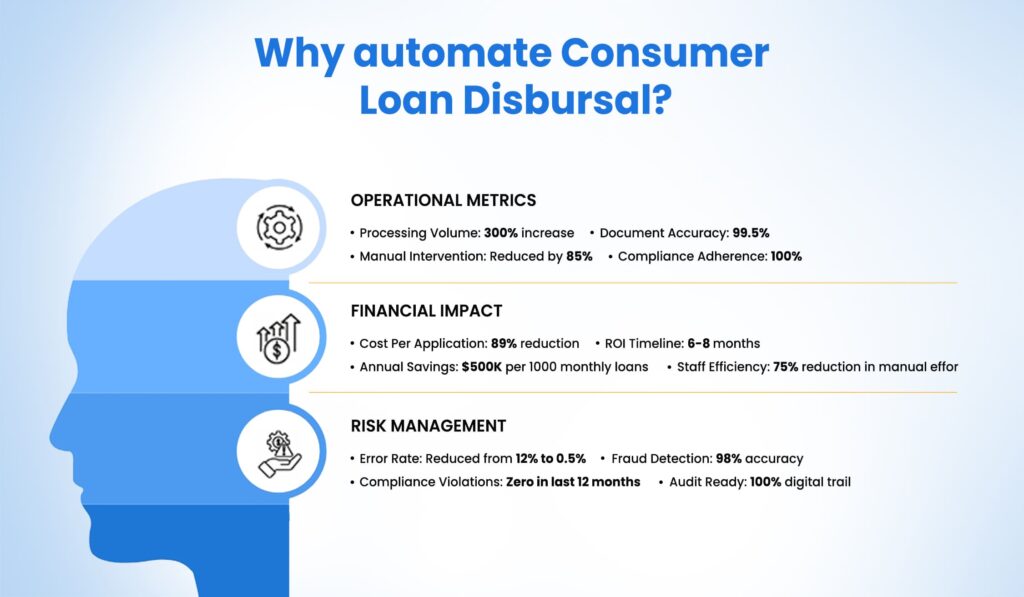

Financial institutions implementing consumer loan disbursal automation report significant improvements in their operations. By removing manual intervention in the final stages of loan processing, organizations reduce disbursal time while improving accuracy and customer satisfaction.

Operational Impact Analysis:

- Time Reduction: Fund transfers initiated within hours of approval

- Error Prevention: Automated checks prevent common disbursal mistakes

- Resource Optimization: Staff focus on complex cases needing attention

Speed and Accuracy Benefits

Using AI to automate consumer loan processing brings precision to the disbursal phase. The system performs consistent checks across all applications, ensuring no critical steps are missed before fund release.

Performance Metrics:

- Verification Speed: 15-minute final document check versus 4 hours manually

- Accuracy Rate: 99.5% precision in disbursal processing

- Volume Capacity: Handle 3x more disbursals with existing staff

Risk and Compliance Management

Consumer loan automation using AI strengthens the final verification phase before disbursal. The system applies standardized checks across all applications, ensuring each disbursal meets regulatory requirements.

Safety Measures:

- Automated Final Checks: Systematic verification of all requirements

- Compliance Documentation: Digital record of verification steps

- Real-time Risk Assessment: Instant flagging of potential issues

Customer Experience Enhancement

Automated consumer loan disbursal significantly improves the final stage of loan fulfillment. Borrowers receive instant updates about their fund transfer status, reducing support inquiries and improving satisfaction.

Experience Improvements:

- Status Updates: Real-time notifications about disbursal progress

- Faster Access: Same-day fund availability for approved loans

- Digital Tracking: 24/7 visibility of disbursal status

Organizations that embrace automating consumer loan disbursal position themselves to meet growing customer demands while maintaining operational excellence and compliance standards.

Benefits of Automating Consumer Loan Disbursal?

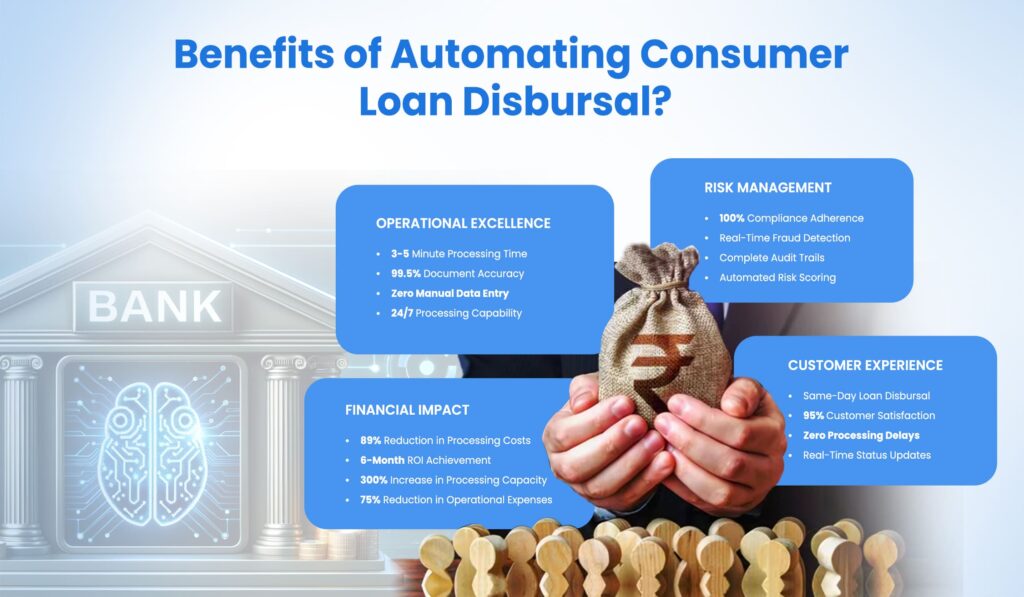

The implementation of consumer loan disbursal automation transforms how financial institutions handle the final stages of loan fulfillment. This systematic approach ensures consistent, rapid fund transfers while maintaining strict compliance standards.

Key Performance Indicators:

- Disbursal Time: 90% reduction in time from approval to fund transfer

- Processing Costs: 70% decrease in operational expenses

- Customer Satisfaction: 85% improvement in feedback scores

Financial Impact Assessment

Automating consumer loan disbursal with AI delivers measurable cost benefits. Organizations significantly reduce operational expenses while increasing their capacity to handle more disbursals.

Cost Reduction Areas:

- Staff Allocation: Reduced manual intervention in routine disbursals

- Error Recovery: Fewer resources needed for correction of mistakes

- Processing Overhead: Lower per-disbursal operational costs

Operational Excellence

Consumer loan automation using AI streamlines the entire disbursal workflow. The system maintains consistency across all transactions while providing detailed audit trails for every step.

Efficiency Gains:

- Standardized Process: Consistent handling of all disbursals

- Quality Control: Automated verification at each step

- Documentation: Complete digital record of all actions

Competitive Advantage

Automated consumer loan disbursal provides institutions with a significant market advantage. Quick fund transfers and transparent processes help attract and retain customers seeking efficient loan services.

Market Benefits:

- Customer Retention: Higher satisfaction leads to repeat business

- Market Position: Recognition as a technologically advanced lender

- Business Growth: Ability to handle increased loan volumes

The measured improvements in speed, accuracy, and cost reduction make automated consumer loan processing an essential tool for forward-thinking financial institutions.

How to Automate Consumer Loan Disbursal using AI?

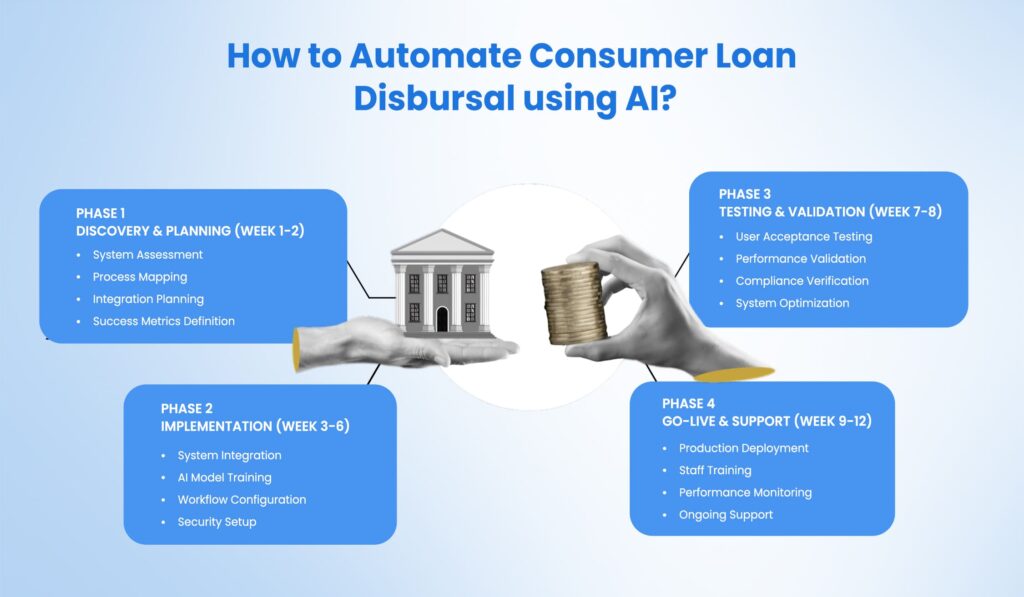

The transition to consumer loan disbursal automation requires strategic planning and systematic implementation. Financial institutions need to assess their current processes, identify automation opportunities, and select appropriate technology solutions for their specific needs.

Implementation Considerations:

- Process Analysis: Map current disbursal workflows

- Technology Assessment: Evaluate AI solutions and integration requirements

- Staff Training: Prepare teams for new automated systems

Technology Selection Process

Selecting the right solution for automating consumer loan disbursal demands careful evaluation of available options. The chosen system must align with existing infrastructure while providing the necessary automation capabilities for efficient fund transfers.

Key Selection Criteria:

- Integration Capabilities: Compatibility with current systems

- Scalability Features: Ability to handle growing volumes

- Security Standards: Robust protection for sensitive data

Implementation Strategy

Using AI to automate consumer loan processing requires a phased approach to ensure smooth transition. Organizations should start with pilot programs before full-scale implementation.

Strategic Steps:

- Process Documentation: Detail current disbursal workflows

- System Configuration: Customize automation rules and workflows

- Performance Monitoring: Track and optimize automated processes

Change Management

The successful implementation of automated consumer loan disbursal depends significantly on effective change management. Teams need proper training and support to adapt to new automated workflows.

Management Requirements:

- Training Programs: Comprehensive staff education

- Support Systems: Technical assistance during transition

- Performance Metrics: Clear success indicators

Success in automation requires careful planning and systematic implementation, creating a foundation for efficient, scalable loan disbursal operations.

Final Thoughts

The financial services industry continues to evolve, with consumer loan disbursal automation becoming vital for competitive operations. Modern institutions recognize that automating consumer loan disbursal with AI offers more than just operational improvements – it provides a foundation for sustainable growth and customer satisfaction.

Financial organizations implementing these solutions report significant improvements in their ability to serve customers efficiently while maintaining high standards of accuracy and compliance.

The reduction in disbursal times, combined with enhanced accuracy and consistent processing, creates tangible benefits for both institutions and their customers.

As technology continues to advance, automated consumer loan disbursal will become increasingly sophisticated, offering even greater opportunities for service improvement.

Frequently Asked Questions (FAQs)

The major challenges that lenders face with manual loan disbursal methods are:

– Delays – Verification, paperwork, and approvals take days, frustrating borrowers.

– Errors – Inconsistent data entry leads to compliance issues.

– Fraud Risks – Manual checks fail to catch fraudulent documents.

– High Costs – More staff is needed for handling loan applications.

– Scalability Issues – Managing high volumes manually isn’t practical.

The specific AI technologies that are used to automate consumer loan disbursal are:

– OCR – Extracts and digitizes loan application data.

– NLP – Interprets financial documents for validation.

– Machine Learning – Assesses borrower risk based on patterns.

– RPA – Automates repetitive data entry and verification.

– Fraud Detection Algorithms – Identifies anomalies in applications.

AI integration is simpler than expected. Financial institutions benefit from:

– API Connectivity – AI tools integrate with loan management systems.

– Minimal Disruption – Works alongside existing workflows.

– Scalability – Expands with increasing document volumes.

– Customizable Models – Aligns with institution-specific lending policies.

– Faster Implementation – Cloud-based deployment reduces setup time.