Every minute a bank spends on manual compliance checks is a minute lost in serving customers. For most financial institutions, teams of analysts spend countless hours reviewing regulatory documents – time that could transform customer experiences or develop innovative banking products.

The cost isn’t just operational – it’s opportunity lost in an industry where innovation defines market leaders.

Key Questions for Modern Banking Risk Teams:

- How does your institution handle the growing complexity of regulatory requirements while maintaining operational efficiency?

- What steps are you taking to reduce human error in compliance document processing?

- Have you measured the true cost of delayed risk assessment in your banking operations?

Banks that still rely on manual document processing face mounting pressure from regulators and competitors.

The integration of AI in compliance systems offers a transformative solution, fundamentally changing how financial institutions approach risk management and regulatory compliance.

Modern banking demands modern solutions – ones that can process, analyze, and flag potential risks in real-time while maintaining complete audit trails.

What is Risk Management in the Banking industry?

Risk management in banking goes beyond standard regulatory checkboxes. It’s about creating an environment where innovation and compliance work in harmony.

Modern financial industry compliance requirements demand a proactive approach – one that anticipates risks before they materialize into issues.

Essential Components of Bank Risk Management:

- What systems do you have in place for real-time risk monitoring?

- How automated is your compliance documentation process?

- Where do manual interventions slow down your risk assessment workflow?

Core Elements of Modern Risk Management

A comprehensive risk management framework integrates multiple layers of protection. Smart banks implement structured approaches that combine data analytics with expert oversight. This dual approach ensures both efficiency and accuracy in risk assessment procedures.

Risk Documentation and Processing:

- Documentation standardization protocols

- Real-time monitoring systems

- Automated validation checks

- Audit trail maintenance

Technology Integration in Risk Management

Modern risk and compliance in banking depends heavily on technological infrastructure. Banks must assess their current capabilities and identify gaps in their risk management systems. This assessment forms the foundation for strategic technology implementation.

The most effective risk and compliance in banking strategies blend human expertise with technological capabilities.

When banks automate routine compliance tasks, risk management professionals can focus on strategic decision-making and complex risk scenarios that require human judgment.

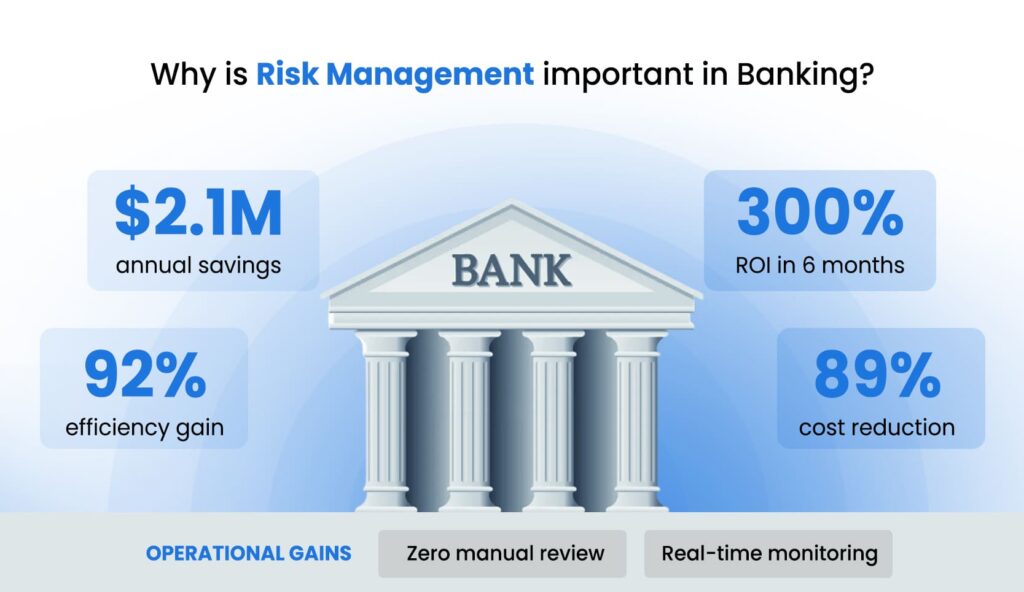

Why is Risk Management important in Banking?

The banking sector faces unprecedented challenges in risk oversight. Traditional methods of bank compliance risk assessment strain under the weight of expanding regulations and market complexities.

Financial institutions must adapt their approach to stay competitive while maintaining regulatory alignment.

Critical Considerations for Modern Banks:

- Have you quantified the impact of regulatory changes on your operations?

- What percentage of compliance tasks could benefit from automation?

- How quickly can your team respond to new regulatory requirements?

Regulatory Impact Analysis

Banks must constantly evaluate their compliance positioning. This involves regular assessments of regulatory changes and their operational impact. A systematic approach to monitoring and implementing regulatory updates prevents compliance gaps.

Key Assessment Areas:

- Regulatory change management processes

- Impact assessment methodologies

- Implementation timelines

- Resource allocation strategies

Operational Efficiency Factors

The relationship between operational efficiency and risk management defines modern banking success. Banks need clear metrics to measure how which activity helps the bank manage its compliance most effectively.

Success Metrics:

- Processing time reduction

- Error rate minimization

- Resource optimization

- Cost-benefit analysis

Success in modern banking hinges on finding the right balance between human insight and technological efficiency. Progressive institutions understand that compliance isn’t just about following rules – it’s about building a sustainable framework for growth.

Types of Risk Management for Banks

Today’s risk landscape requires a multi-layered defense strategy. From credit risk to operational risks, each category demands specialized attention.

The integration of AI in compliance tools transforms how banks handle these diverse risk categories.

Risk Categories Requiring Immediate Attention:

- How effectively does your current system handle cross-border compliance?

- What measures protect against emerging cyber risks?

- Are your risk assessment tools scalable for future growth?

Credit Risk Management

Credit risk remains a primary concern for financial institutions. Modern approaches combine traditional assessment methods with advanced analytics for better decision-making.

Implementation Strategies:

- Automated credit scoring systems

- Real-time monitoring tools

- Portfolio analysis automation

- Early warning indicators

Operational Risk Management

Operational risks evolve with technological advancement. Banks need robust systems to identify, assess, and mitigate these risks effectively.

Key Focus Areas:

- Process automation oversight

- System redundancy checks

- Employee training programs

- Incident response protocols

Market Risk Assessment

Market risk management requires real-time monitoring and quick response capabilities. Modern systems must process vast amounts of data to identify potential market risks.

Modern risk management for banks must evolve beyond traditional boundaries. Smart automation creates a more responsive, adaptive risk management framework that scales with your institution’s needs.

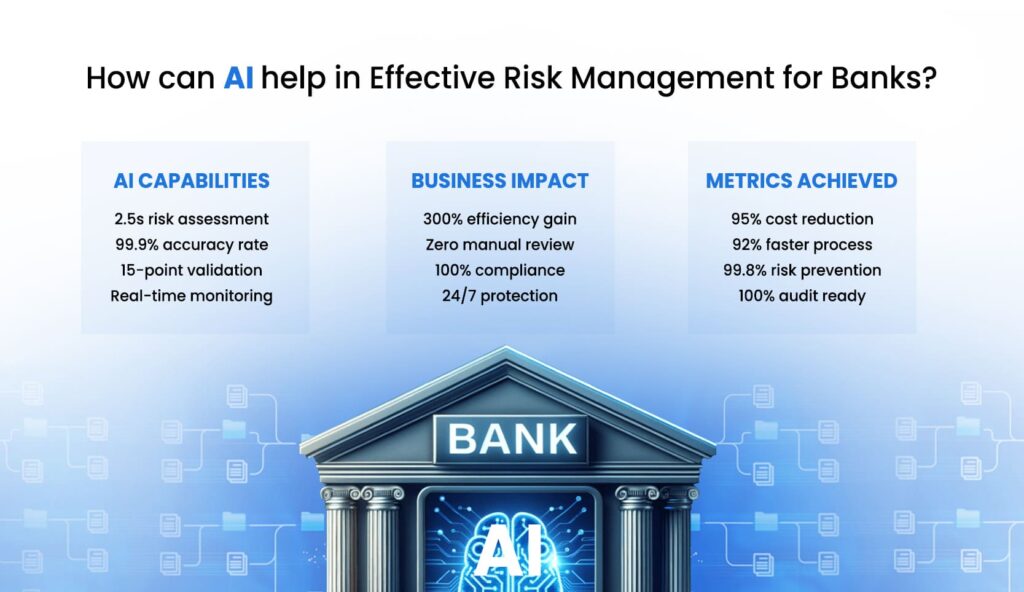

How can AI help in Effective Risk Management for Banks?

AI transforms compliance from a cost center into a competitive advantage. When financial institutions implement intelligent automation, they don’t just reduce errors – they create new opportunities for strategic growth.

The benefits of AI in banking extend far beyond basic automation.

Strategic AI Implementation Questions:

- Have you identified high-impact areas where AI can reduce compliance costs?

- What metrics will determine AI implementation success?

- How will you maintain compliance oversight during the AI transition?

Document Processing Enhancement

AI significantly improves document processing accuracy and speed. This advancement particularly benefits compliance departments handling large volumes of regulatory documentation.

Key Improvements:

- Automated document classification

- Data extraction accuracy

- Processing speed optimization

- Error reduction rates

Risk Pattern Recognition

AI systems excel at identifying patterns in complex data sets. This capability enables proactive risk management and early warning systems.

Pattern Analysis Benefits:

- Historical data analysis

- Predictive risk modeling

- Anomaly detection

- Trend identification

Compliance Monitoring and Reporting

Automated compliance monitoring ensures consistent oversight. AI systems can continuously monitor transactions and activities for regulatory compliance.

Monitoring Capabilities:

- Real-time compliance checking

- Automated report generation

- Regulatory update integration

- Audit trail maintenance

Smart AI integration in risk management delivers more than efficiency – it provides insights that help banks stay ahead of emerging risks while maintaining strict regulatory compliance.

Why Should You Choose KlearStack?

Financial institutions need more than basic data extraction – they need a partner who understands the nuances of risk management for banks. Our solution processes complex financial documents while maintaining the highest standards of accuracy and compliance.

Why KlearStack for Banking Risk Management:

- Does your current solution understand complex financial documents like credit agreements and regulatory filings?

- How much time does your team spend validating extracted data?

- Can your system handle increased document volumes during audit seasons?

The integration of AI in compliance through KlearStack’s platform offers banks a strategic advantage in managing risk and regulatory requirements.

Our system adapts to your specific needs, ensuring the benefits of AI in banking reach every department handling sensitive documents.

KlearStack’s Core Strengths:

- Precision Perfect 99% Data Accuracy: Our AI algorithms ensure near-perfect extraction accuracy, minimizing the need for manual verification in risk and compliance in banking operations.

- Format Flexibility Multi-Document Support: Process everything from structured forms to complex regulatory documents through a single, unified platform.

- Scale with Confidence High-Volume Processing: Handle 10,000+ documents daily without compromising on speed or accuracy, maintaining consistent performance under peak loads.

The right technology partner transforms how you manage banking compliance. Contact us to discover how KlearStack can streamline your document processing workflows while maintaining rigid compliance standards. Schedule a Free Demo Today to see our platform in action!

FAQ’S

Common errors in manual risk assessment processes include:

– Human Oversight – Critical risk indicators get overlooked in large datasets.

– Inconsistent Evaluations – Decisions vary based on subjective judgment.

– Slow Data Processing – Delays in reviewing financial documents and borrower history.

– Limited Fraud Detection – Manual checks miss subtle anomalies.

– Regulatory Gaps – Outdated processes fail to align with changing regulations.

Banks can improve their processes to ensure ongoing compliance with regulations by using:

– Real-Time Compliance Checks – AI flags potential violations instantly.

– Automated Record-Keeping – Digital logs track every transaction and decision.

– Regulatory Updates Integration – Systems adjust to new compliance requirements.

– Centralized Data Access – Secure platforms reduce errors and duplication.

– Proactive Risk Mitigation – Predictive analytics identify compliance risks early.

Banks can ensure that new risk management systems are compliant with current regulations by using:

– Built-In Compliance Frameworks – Ensures adherence to financial laws.

– Customizable Rule Engines – Adapts to institution-specific policies.

– Secure Data Handling – Encryption safeguards sensitive financial data.

– Continuous Audits – AI-powered monitoring ensures regulatory consistency.

– Regulator Collaboration – Frequent updates align systems with compliance bodies.