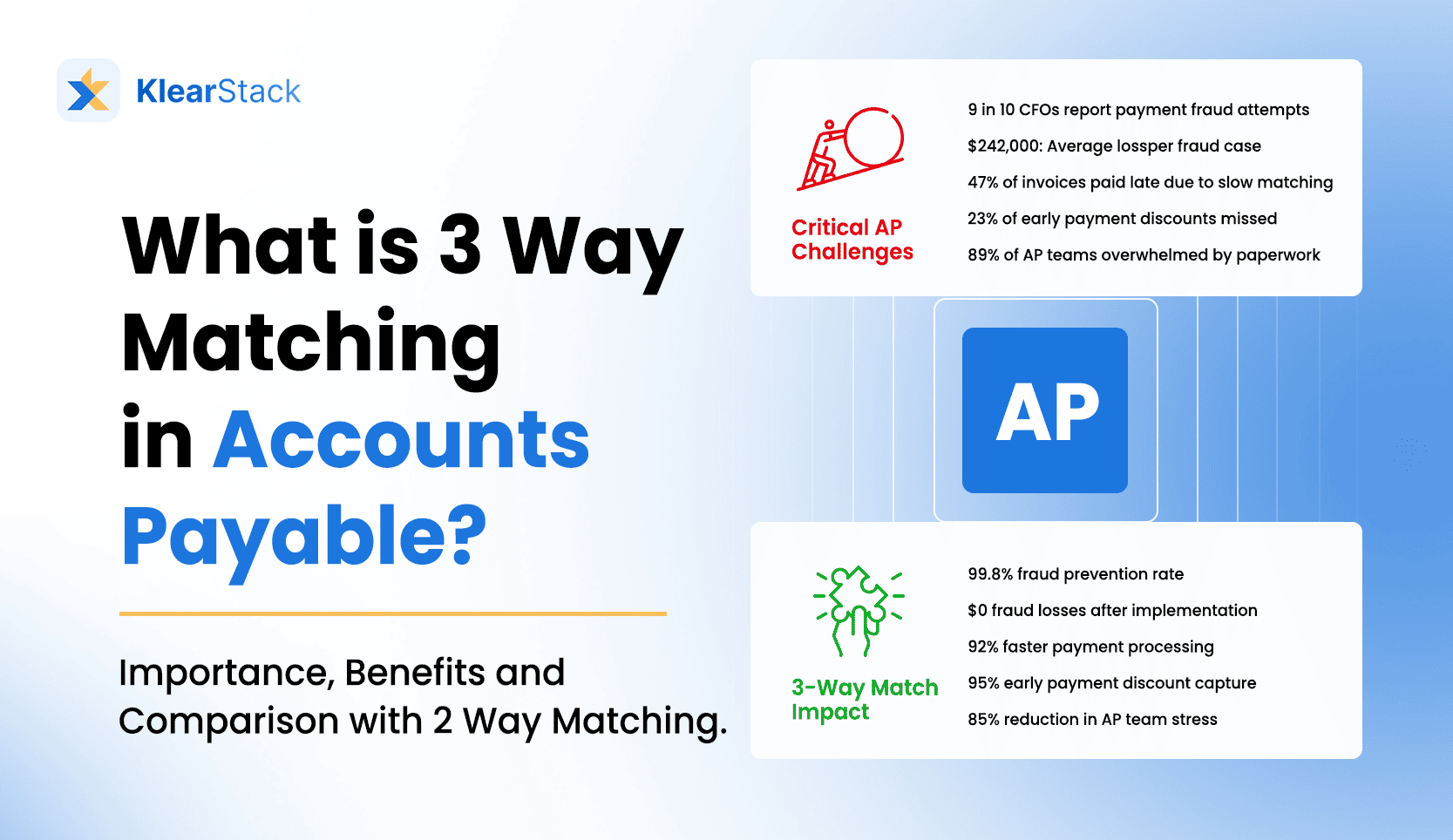

Processing hundreds of invoices while maintaining accuracy? It’s a task, and not an error free one for the record. For accounts payable (AP) teams, this is a daily activity. Manual invoice processing often leads to payment discrepancies, missed deadlines, and costly duplicate payments. A bundle of issues that can disturb too many processes.

Think about these questions:

- How much time does your AP team spend cross-referencing purchase orders, receiving reports, and invoices?

- What’s the real cost of payment errors and fraud risks in your current verification process?

- Could your AP team handle twice the invoice volume without adding headcount?

3 way matching in accounts payable is a syncronised verification method that can validate payments easily. The accounts payable 3 way match process compares 3 documents — the purchase order, receiving report, and vendor invoice. For verifying accounts payable invoice processing – the ap three way match system is perfect. It can prevent fraud and ensure accurate payments, in a timely fashion.

Key Takeaways

3 way matching in accounts payable is a way to maintain payment accuracy. It can prevent fraud through systematic verification. This method compares purchase orders, receiving reports, and invoices.

- Implement automated verification tools to reduce processing time from days to minutes while maintaining accuracy rates above 99%

- Focus the accounts payable 3 way match process on high-value purchases. Using detailed verification adds most value

- Build custom validation rules. Consider factors like payment terms and industry requirements

- Measure success through specific metrics: processing time, cost per invoice, error rates, and early payment discount capture

- Document your verification procedures clearly and train teams on exception handling

- Monitor and adjust matching thresholds based on supplier performance and transaction patterns to optimize the verification process

What is 3 Way Matching in Accounts Payable? A Verfication System to End Payment Errors

The accounts payable 3 way works on confirmation. Basically, like a match system – it verifies three documents. These documents include the original purchase order (PO), the receiving report or goods receipt note (GRN), and the vendor invoice.

The process can make Accounts payable systems spot discrepancies before payments leave your account.

Key Elements of AP Three Way Match:

- Purchase Order (PO): Contains agreed pricing, quantities, and terms with vendors

- Receiving Report: Documents actual goods or services received

- Vendor Invoice: Shows final amount requested for payment by supplier

3 way matching in accounts payable starts when your team receives an invoice. First, they check if the PO details match the invoice items and pricing. Next, they verify these against the receiving report to confirm you got what you ordered.

This is a fluent system. It can spot issues like incorrect quantities, pricing mismatches, or missing items.

Consider These Verification Points:

- Item descriptions and specifications

- Unit prices and total amounts

- Delivery dates and quantities

- Payment terms and conditions

- Tax calculations and additional charges

What is three way matching in accounts payable? In the simples words: it’s your defense against payment errors. The process creates multiple checkpoints where your team can catch suspicious errors before they prove to be costly.

When handling huge volumes of documents – this can be the most helpful process.

Why is 3 Way Matching Important in Accounts Payable? Defend Against Payment Frauds

The importance of 3 way matching in accounts payable can be concluded from the above sections itself. It has financial controls, protects your organization from payment fraud and ensures reliability.

When processing numerous transactions, business will find this useful for maintaining financial accuracy.

Essential Control Points:

- Data consistency across all procurement documents

- Early detection of pricing discrepancies and quantity mismatches

- Prevention of unauthorized or fraudulent payments

- Compliance with internal and external audit requirements

What is three way matching in accounts payable if not a one-way defense mechanism? When implemented correctly, the accounts payable 3 way match process can create stronger vendor relationships without compromising security.

Your AP team can quickly identify and resolve issues, reduce payment cycles and improve cash flow management.

Financial Impact Considerations:

- Cost savings from prevented duplicate payments

- Reduced time spent on payment investigations

- Better vendor relationships through accurate payments

- Improved audit trails for compliance purposes

The ap three way match system provisions documented proof of payment validity. This comes particularly handy during audits. When investigating disputed payments, or when training new team members – it becomes very easy.

By standardizing verification procedures, your AP department builds a consistent payment process.

This section illustrates how 3 way matching can be useful for an effective accounts payable operation. Its importance grows as organizations scale their operations.

When to use 3 Way Matching? Simple Implementation Guide

Understanding what is 2 way and 3-way matching in accounts payable will help you with identification process of verification. 3 way matching in accounts payable works well for most purchases. But, certain situations require more thorough verification process.

High-Value Purchase Scenarios:

- Capital equipment acquisitions

- Bulk raw material orders

- Long-term service contracts

- Custom manufactured items

- Multi-component deliveries

The accounts payable 3 way match is much more useful when dealing with complex procurement scenarios. For instance, manufacturing companies ordering custom components need this detailed verification to ensure specifications match across all documents.

Similarly, organizations with multi-location deliveries benefit from the additional receiving report verification.

Critical Implementation Points:

- Orders with specific quality requirements

- Purchases with staged deliveries

- Items with variable pricing

- Services with milestone deliverables

- International shipments

What is three way matching in accounts payable going to add to your process? For high-volume routine purchases, like office supplies or standard inventory items, you might consider simpler verification methods.

However, the ap three way match eases up the process of dealing with new suppliers, unusual purchases, or items with strict quality requirements.

Your organization’s size, industry, and transaction complexity will decide when to implement this verification method. You just have to balance verification process with operational effectiveness.

2-Way vs 3-Way Matching: Detailed Comparison | ROI Analysis for Businesses

Understanding what is 2 way and 3-way matching in accounts payable will also help you choose when to use what. Each method has it’s own benefits based on your business needs and transaction types.

Selection Criteria to Consider:

- Transaction volume and value

- Available AP staff resources

- Industry compliance requirements

- Supplier relationship complexity

- Internal control needs

The accounts payable 3 way match offers more diverse verification, while 2-way matching prioritizes speed. Your choice depends solely on your need for verification and balanced efficiency.

5 Benefits of 3 Way Matching in Accounts Payable: Measurable Business Impact

The accounts payable 3 way match process is beneficial in multiple ways. Let’s examine each benefit that makes this verification method a go-to choice.

Fraud Prevention and Risk Reduction

3 way matching in accounts payable creates multiple checkpoints. This can catch suspicious patterns. Your AP team can spot unusual pricing changes, quantity mishaps, or unauthorized purchases before they impact your finances.

Collectively this can reduce fraud risks by up to 80% compared to basic verification methods.

Cost Savings Through Error Prevention

What is three way matching in accounts payable’s impact on your bottom line? Upto 30-40% reduction in payment errors after implementation. Because of it’s preventive approach, you catch duplicate payments, pricing errors, and quantity mismatches that drain resources.

Improved Vendor Relationships

The ap three way match system makes stronger supplier partnerships through consistent, payments. When vendors receive correct payments on time, they’re more likely to offer favorable terms and prioritize your orders.

This is very helpful for your long-term goals.

Enhanced Audit Readiness

Having three matching documents creates a clear audit trail. This is immensely useful for internal and external auditors. Your team spends less time preparing for audits because the verification process automatically documents each step.

Guess what? This can save upto 15-20 hours per audit cycle.

Streamlined AP Operations

Accounts payable 3 way match eases verification steps. This changes the way training and processing times proceed. You can expect 25% faster invoice processing after proper implementation.

Implementation Considerations:

- Start with high-value transactions

- Train staff thoroughly on procedures

- Document verification steps clearly

- Monitor and measure results

- Adjust processes based on feedback

From preventing fraud to improving vendor relationships, each advantage will contribute towards your financial prowess.

Automating 3 way Matching in Accounts Payable: Scaling Without Headcount

Manual 3 way matching in accounts payable takes good amount of time and resources. AP teams often spend hours comparing documents. This means: processing delays and missed discounts.

Automation replaces this with speed and precision. Easiest way to improve efficiency.

How Automation Transforms AP Matching:

- Instant document comparison and validation

- Real-time exception flagging

- Automated routing for approvals

- Digital audit trail creation

- Customizable matching rules

The accounts payable 3 way match becomes even better because of automation. Modern AP systems extract data from purchase order (POs), receiving reports, and invoices automatically. This reduces manual data entry by 90%

It also speeds up processing times from days to minutes.

Key Implementation Steps:

- Document your current matching workflow

- Define custom matching rules

- Set up exception handling procedures

- Train staff on the new system

- Monitor accuracy rates

What is three way matching in accounts payable look like in automated systems? The ap three way match process runs continuously in the background. It compares documents as they arrive.

Your team only needs to review exceptions, focusing on resolving remnant issues. No need to stress about routine matching.

Automation Success Metrics:

- Processing time reduction

- Cost per invoice

- Exception handling speed

- Payment accuracy rates

- Discount capture rates

Automated matching improvises how AP teams operate. It allows them to process more invoices without adding staff. Your organization gains accuracy, speed, and better control over the payment process.

Why Should You Choose KlearStack for 3 Way Matching in Accounts Payable to Enhance Invoice Processing

Why Should You Choose KlearStack?

The accounts payable 3 way match process transforms with KlearStack’s template-less, AI-powered document processing. Our solution achieves 99.9% accuracy through a multi-stage approach that uses advanced OCR accuracy methods, making document verification effortless for AP teams.

Smart Processing Capabilities:

- Pre-processing stage enhances document quality automatically

- Intelligent classification identifies document types instantly

- Self-learning AI adapts to new layouts without manual training

- Three-layered validation ensures data accuracy

- Business rules engine customizes to your requirements

The 3 way matching in accounts payable becomes truly automated with KlearStack’s straight-through processing. Our AI extracts data from invoices, purchase orders, and receiving reports regardless of format variations, while continuously learning from each processed document.

Advanced Technology Benefits:

- Deep learning models handle changing document layouts

- Natural Language Processing for intelligent field extraction

- Computer Vision technology for superior accuracy

- Automated reconciliation checks

- Complete audit trail maintenance

What sets KlearStack apart? While others rely on templates, our solution offers seamless integration through RESTful APIs with your existing systems — SAP, QuickBooks, and more.

The ap three way match workflow maintains data security and compliance while reducing manual intervention.

Implementation Excellence:

- Rapid deployment with minimal setup

- Open APIs for flexible integration

- Secure document handling

- Continuous AI learning and adaptation

- 24/7 dedicated support

Want to see KlearStack live in action? Book a Free Demo Call Right Away!

Final Thoughts

3 way matching in accounts payable is a verification method that balances thoroughness with efficiency. The accounts payable 3 way match process offers clear advantages: reduced payment errors, stronger fraud prevention, and improved vendor relationships.

Deciding what is three way matching in accounts payable worth comes down to transaction complexity and volume. By implementing this process — especially through automation — AP become more equipped and salient.

Your choice between what is 2 way and 3-way matching in accounts payable will depend on your organization’s specific needs. 2-way matching suits simple and routine purchases.

The ap three way match provides the dynamic verification needed for complex transactions.

By choosing the right verification method and automating where possible, your AP team can handle increasing transaction volumes while maintaining high accuracy rates.

Frequently Asked Questions (FAQs)

FAQ's

What documents are involved in 3-Way Matching?

3-Way Matching involves three key documents to verify payments and prevent discrepancies:

- Purchase Order (PO) – Confirms the order details and pricing.

- Goods Receipt Note (GRN) – Verifies received quantity and condition.

- Invoice – Ensures billed amounts match the ordered and received goods.

Why is 3-Way Matching used in accounts payable?

3-Way Matching prevents overpayments, errors, and fraudulent invoices in accounts payable. It ensures:

- Invoice Accuracy – Matches vendor invoices with received goods and orders.

- Fraud Prevention – Detects unauthorized invoices before payment.

- Compliance – Aligns transactions with company policies and audit requirements.

- Error Reduction – Eliminates duplicate or incorrect payments.

How does 3-Way Matching help prevent fraud in accounts payable?

3-Way Matching adds an extra layer of verification to catch fraudulent activities. It helps by:

- Blocking Fake Invoices – Ensures only valid transactions get approved.

- Preventing Overpayments – Confirms billed amounts match ordered and received goods.

- Detecting Unauthorized Purchases – Flags invoices without corresponding POs.

- Reducing Manual Manipulation – Automates matching for accuracy.

What problems does 3-Way Matching solve in AP?

Accounts payable teams face errors, fraud risks, and inefficiencies that 3-Way Matching helps eliminate. Common problems it solves include:

- Duplicate Payments – Prevents accidental overpayments.

- Mismatched Invoices – Flags inconsistencies between purchase orders and invoices.

- Unauthorized Transactions – Ensures payments match approved purchases.

- Manual Errors – Reduces reliance on human verification.

What are the benefits of 3-Way Matching for businesses?

3-Way Matching improves financial accuracy, strengthens compliance, and enhances vendor trust. Key benefits include:

- Reduced Fraud Risk – Eliminates unauthorized invoices and overpayments.

- Faster Invoice Processing – Automates verification, speeding up approvals.

- Improved Cash Flow Management – Ensures accurate expense tracking.