Multiple operational challenges have overburdened the insurance sector’s form-processing workflows. For instance, Intelligent document processing (IDP) becomes complex with irregular forms from different channels. Teams manually process insurance forms. Document automation is a game changer for the Insurance sector.

Intelligent document processing insurance is a futuristic approach as it helps solve the problem of extracting unstructured data required for insurance claims.

Manually verifying data is complex and error-prone. It usually involves cross-referring multiple applications. Manually processing insurance forms increases costs and hampers the staff’s morale and productivity.

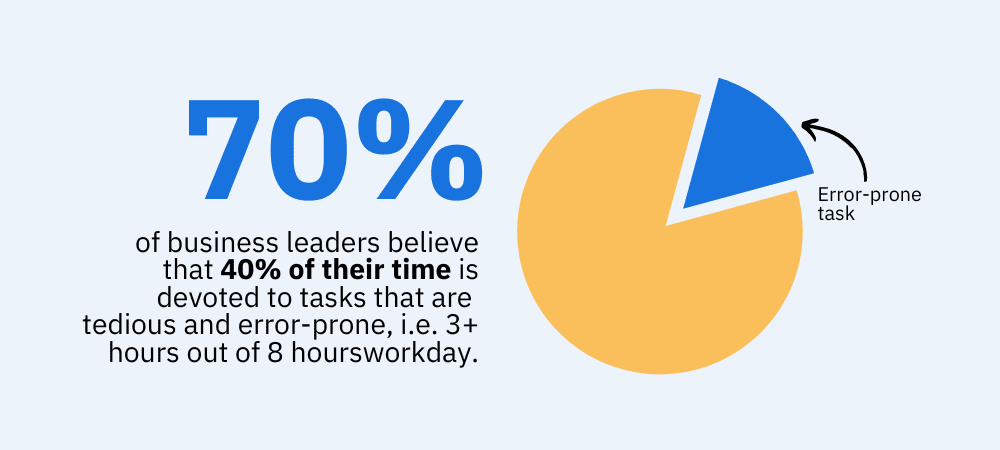

According to WorkMarket’s 2020 In(Sight) Report: “What AI and Automation Really Mean For Work. “70% of business professionals reported spending at least 40% of their time on routine tasks. These tasks included searching, modifying, and sending documents.

Hence, organizations constantly look for ways to streamline operations. Something that saves time and reliability on manual processes for tasks about documentation.

This holds especially true in the insurance sector. For a highly regulated market, insurance companies must deliver large volumes of error-free policies and contracts.

KlearStack’s intelligent document processing tool is transforming the insurance business significantly.

Automation takes place for every document, from the initial application to underwriting, reinsurance, and claims processing. With KlearStack IDP, you can extract meaningful information without defining rules or templates, including PDFs, images, or emails.

Insurance companies are embracing document automation to increase their efficiency. Document processing allows insurance companies to drastically improve profit margins. It also delivers a higher level of customer service that builds trust.

For decades, insurers have been at the forefront of technology adoption. Driven by their aspirations to manage risk, acquire new clients, and enhance existing customer experiences.

Insurance companies have increased their influence through various inorganic acquisition routes.

In addition, insurance companies have vertically integrated their products and services. Healthcare industry stakeholders grow their customer base with the added benefit of IDP and automating documentation.

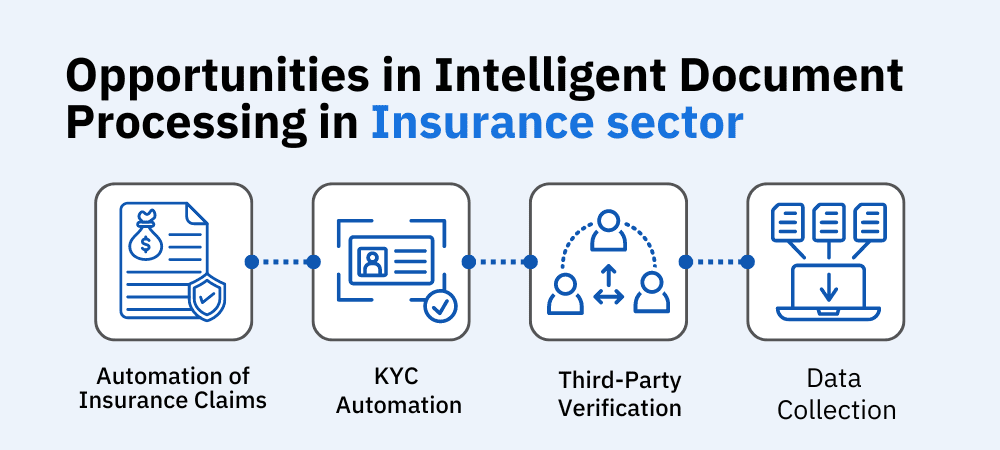

Opportunities in Intelligent Document Processing for the Insurance sector

1. Automation of Insurance Claims

Intelligent Document Processing helps insurance companies automate new claims. It helps route it to the right user, thus enhancing turnaround time and accuracy.

As for authorization letters for the hospital, which form an integral part of insurance claims, healthcare is file-intensive. This will address unstructured data costs while improving data integrity and customer experience.

2. KYC Automation:

To ensure the insurance companies know who their customers are, they have to identify them; for this, insurance companies can use KYC procedures. KYC automation requires a list of documents that need verification for the insurance company to proceed. Here, IDP makes this process much faster.

On top of that, insurance companies have to be compliant with the anti-money laundering regulations for their specific area.

3. Third-Party Verification:

Insurance claims must be verified from multiple sources by fetching relevant documents. Insurance companies can use RPA bots to fetch third-party information via document chasing.

On receiving these documents, IDP can auto-read them, process them, and classify them. Thus, insurance companies can take incomplete claim processing to closure with IDP.

Moreover, insurance companies can verify information on licenses, registrations, etc., by extracting data from them through Intelligent Document Processing. The extracted information can be used to conduct third-party verification from databases and public websites.

4. Data Collection:

Data collection is an integral part of the insurance business. However, it often faces hurdles because of manual processing, low accuracy, and slow speed.

Intelligent document processing can improve accuracy, consistency, and compliance during data collection and collation in a secure digital environment. Insurance companies can additionally increase the speed of execution and customer satisfaction.

Benefits of Intelligent Document Processing in Insurance

The advantages of the Intelligent document processing insurance sector include –

- Customer onboarding:

Create insurance offers and contracts with zero friction and save time. This helps many insurance companies enhance their consumer experience. Thus, it leads to precious word-of-mouth marketing.

- Accuracy & Precision:

Analysis of incoming documents takes place at the front end of the inbox through IDP at the most relevant point. Make unstructured documents available in structured form.

- Internal operations:

Not only do the customers benefit from the IDP, but insurance employees also. By automating the previously tiring and cumbersome document processing, they can take care of things where their expertise lies.

Integrating intelligent document processing is a great opportunity for the insurance sector to improve its performance. It empowers businesses to convert unstructured documents into readable form.

Conclusion

Highly structured data can be generated using the right tools. Insurance companies are presenting a lot of unstructured data to customers. The integration of Intelligent Document Processing can help insurance companies improve this situation.

KlearStack’s AI-driven OCR and Intelligent Document Processing (IDP) tool can turn any unstructured data into a systematic format.

Before placing the order, you can book a free demo.

You can automate data extraction and document processing from unstructured, semi-structured, or complex documents. This helps to drive operational efficiencies and realize economies of scale.