![What is Automated Document Verification? Automated vs Manual Document Verification [2025]](https://lightgrey-antelope-914579.hostingersite.com/wp-content/uploads/2025/02/Enhancing-Banking-Processes-with-Automated-Document-Verification.png)

Organizations lose an estimated 5% of revenue to fraud each year, with $3.1 billion in total losses documented in the latest Association of Certified Fraud Examiners 2024 Report to the Nations. The need for Automated document verification systems in such organizations increases by the hour.

Financial institutions face mounting pressure to verify identities faster while detecting sophisticated forgeries. Traditional manual processes, unlike modern intelligent document processing systems, struggle to keep pace with digital transaction growth.

Automated document verification addresses these operational challenges directly. Modern AI systems process documents within seconds rather than hours. They detect fraud patterns that human reviewers often miss. Regulatory compliance becomes consistent and auditable across all verifications.

Critical questions facing organizations today:

- Can your verification process handle increasing transaction volumes?

- Are manual checks exposing your business to preventable fraud risks?

- Do compliance bottlenecks slow customer onboarding unnecessarily?

The operational gap between manual and automated verification continues expanding. Businesses need solutions that balance processing speed, security measures, and customer experience. Automated systems provide this balance through intelligent technology integration.

Key Takeaways

- AI-powered systems detect document forgeries that human reviewers consistently miss

- Processing speeds improve dramatically from hours to seconds with automated verification

- Fraud detection accuracy increases substantially through machine learning algorithms

- Regulatory compliance becomes standardized and automatically documented

- Customer abandonment rates drop with faster verification processes

- Implementation costs decrease over time despite initial technology investment

- Document coverage expands to support global identity formats automatically

What is Automated Document Verification?

Automated document verification uses AI and machine learning to authenticate identity documents without human intervention. The technology validates document authenticity, extracts data accurately, and detects potential fraud in real-time processing. Modern systems rely on advanced what is data extraction techniques to process various document types instantly.

Government-issued IDs, passports, driver’s licenses, and utility bills all undergo identical rigorous verification. The technology adapts to different formats and security features automatically. Document digitization serves as the foundation for these verification processes, enabling digital transformation across industries.

Core Technology Components used in this technology:

Optical Character Recognition (OCR): Extracts text from document images with high precision. Advanced algorithms read both printed and handwritten information accurately across multiple languages.

Computer Vision: Analyzes visual elements like photos, logos, and security features. The technology identifies document layouts and validates visual consistency patterns.

Machine Learning: Improves fraud detection through pattern recognition capabilities. Algorithms learn from new document types and emerging fraud techniques continuously.

Database Integration: Cross-references extracted data against trusted information sources. Real-time validation ensures information accuracy and consistency checks.

The technology processes documents from global markets. Template-free processing eliminates pre-configuration requirements for new document types. Self-learning capabilities improve accuracy with each verification cycle.

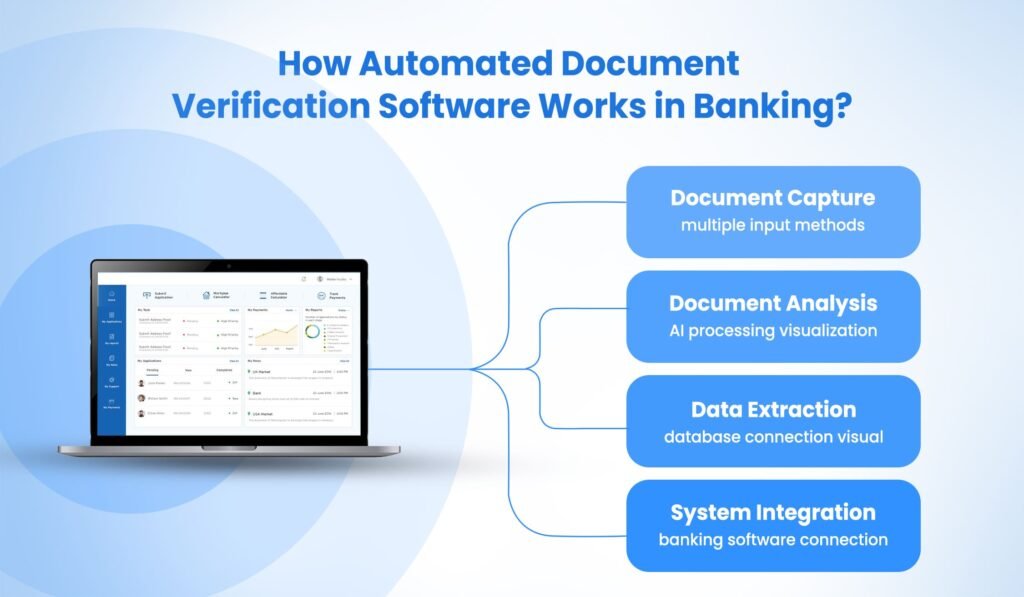

How Automated Document Verification Software Works?

Automated Document Verification can be broken down 5 Core steps. It starts with Document Capture and Ends at Validation Decision.

Step 1: Document Capture

Users upload or scan identity documents through mobile applications or web interfaces. Quality assessment algorithms ensure clear images for accurate processing. The system provides guidance to capture optimal document images through advanced how to extract text from image capabilities.

Step 2: Data Extraction

AI algorithms extract relevant information from scanned documents systematically. OCR technology reads text while computer vision analyzes visual elements. Multi-language support handles documents from international markets, while data parsing ensures structured information processing.

Step 3: Authenticity Analysis

Security features undergo detailed algorithmic examination. Watermarks, holograms, and specialized inks receive automated verification. Document layouts compare against authentic templates automatically.

Step 4: Fraud Detection

Machine learning algorithms identify potential forgeries through pattern analysis. Pixel-level examination detects digital alterations and inconsistencies. Suspicious formatting patterns trigger automated alert systems.

Step 5: Validation Decision

Systems provide instant verification results for processing decisions. Verified documents proceed automatically through business workflows. Flagged cases route to human reviewers for additional assessment.

Processing completes within seconds for standard documents. Complex cases requiring manual review maintain complete audit trails. Real-time decisions support immediate business process continuation.

Benefits of Automated Document Verification

Improved Processing Speed

Manual verification requires hours or days per document review. Automated systems complete comprehensive checks within seconds. Processing capacity scales without proportional staff increases. Round-the-clock operation supports global business requirements.

Financial institutions report significant reductions in verification timeframes. Customer onboarding processes accelerate substantially. Transaction processing removes traditional operational bottlenecks.

Enhanced Fraud Detection

AI identifies sophisticated forgeries with consistent accuracy. Human reviewers miss subtle manipulation indicators regularly. Machine learning adapts to emerging fraud techniques continuously. Pattern recognition improves with increased data exposure.

Security measures strengthen without impacting legitimate customer experiences. False positive rates decrease through intelligent algorithm refinement.

Cost Reduction Benefits

Labor costs decrease substantially over implementation periods. Training requirements minimize for verification staff roles. Error correction expenses drop significantly with automated accuracy, particularly when organizations implement comprehensive data automation strategies across their operations. Operational efficiency gains compound annually.

Initial technology investments typically demonstrate positive returns. Scalability eliminates traditional hiring and training constraints.

Consistent Compliance

Regulatory requirements receive automatic adherence across all verifications. KYC and AML standards apply uniformly without variation. Audit trails generate automatically with complete documentation. Standard processes reduce compliance risk exposure.

Regulatory updates integrate seamlessly into existing workflows. Risk management improves through systematic process application.

Superior Customer Experience

Verification completes remotely without physical office visits. Processing happens instantly rather than business day delays. Mobile-friendly interfaces support modern user expectations. Customer abandonment rates decrease with streamlined processes.

Digital-first approaches align with current market demands. User satisfaction improves with faster, more convenient verification.

Scalability Advantages

Volume increases don’t require proportional staff growth planning. Geographic expansion happens without physical presence requirements. Peak processing periods handle automatically without service degradation. Technology infrastructure adapts to business growth seamlessly.

Applications Across Industries

Few common Industries where Automated Document Verification systems can be implemented are:

Financial Services

Banks utilize automated verification for account opening and loan processing workflows. KYC compliance happens instantly with comprehensive documentation standards. Anti-money laundering checks integrate seamlessly into existing systems, especially when combined with ocr in banking solutions for enhanced document processing.

Major financial institutions report significant onboarding process improvements. Customer acquisition costs decrease through efficient verification processes, while automated invoice processing streamlines backend operations. Regulatory confidence increases with consistent compliance documentation.

Healthcare Systems

Patient identity verification protects sensitive medical information access. Insurance claims processing accelerates through automated identity checks. HIPAA compliance maintains through secure data handling protocols.

Medical facilities reduce administrative burden substantially. Patient experience improves with faster registration processes. Fraud prevention protects valuable healthcare system resources.

Travel and Hospitality

Passport verification streamlines border control and airport processes. Hotel check-ins become contactless and operationally efficient. Age verification supports regulatory compliance automatically.

Airlines integrate verification into mobile check-in system workflows. Customer satisfaction improves with reduced wait times. Security measures strengthen without compromising user convenience.

E-commerce Platforms

Age-restricted product sales require instant identity verification. Account creation becomes frictionless yet secure for users. Payment fraud decreases through reliable identity confirmation.

Online retailers experience reduced chargebacks and transaction disputes. Customer trust increases with visible security measure implementation. Regulatory compliance supports global market expansion efforts.

Government Services

Citizen identity verification supports digital service delivery initiatives. Benefits distribution becomes secure and operationally efficient. Voter registration processes improve through automated identity checks.

Public sector efficiency gains directly benefit citizen service quality. Cost savings redirect resources toward core government functions. Digital transformation accelerates with reliable verification infrastructure.

Manual vs Automated Document Verification: A Detailed Analysis

Let us understand in deep what are the core differences between Manual and Automated Document Verification.

Current State of Manual Verification

Bank employees handle thousands of documents through traditional verification methods. This approach requires significant time investment and careful attention to detail.

Manual Process Workflow

Document handlers follow specific steps for each verification task. The process includes physical document inspection and data entry.

Staff members check multiple document features manually. This includes watermarks, signatures, and security elements.

Automated Verification Innovation

Modern automated systems transform traditional verification processes. These solutions integrate advanced technologies for improved accuracy.

Technology Integration

- AI-powered document analysis

- Machine learning pattern recognition

- Optical character recognition capabilities

| Aspect | Manual Document Verification | Automated Document Verification Software |

| Processing Time | • Minutes to hours per document • Queue-based processing • Subject to working hours | • Seconds to minutes per document • Simultaneous processing • 24/7 operation |

| Accuracy | • Prone to human error • Inconsistent across verifiers • Fatigue affects quality • Subject to oversight errors | • Consistent accuracy rates • Standardized verification process • No fatigue-based errors • Systematic error checking |

| Cost Structure | • Fixed labor costs • Training expenses • Overtime costs • Infrastructure costs | • Initial setup investment• Scalable pricing models• Reduced labor costs• Maintenance fees |

| Scalability | • Linear relationship with workforce• Limited by hiring/training• Physical space constraints• Geographic limitations | • Exponential scaling capability• No physical limitations• Quick deployment• Location-independent |

| Security | • Physical document handling• Manual access logging• Human oversight required• Limited audit trails | • Digital security protocols• Automated access logging• Multi-factor authentication• Complete audit trails |

| Compliance | • Manual compliance checking• Risk of oversight• Time-consuming updates• Documentation challenges | • Automated compliance checks• Real-time regulation updates• Standardized documentation• Built-in compliance rules |

| Data Management | • Manual data entry• Physical storage needs• Limited searchability• Basic reporting capabilities | • Automated data extraction• Digital storage solutions• Advanced search functions• Comprehensive reporting |

| Integration | • Separate workflow• Manual data transfer• Limited connectivity• Process gaps | • API integration options• Automated data flow• System interconnectivity• Seamless workflows |

| Error Resolution | • Manual investigation• Time-intensive corrections• Inconsistent tracking• Limited prevention | • Automated error detection• Quick resolution paths• Systematic tracking• Preventive measures |

| Customer Experience | • Longer wait times• In-person requirements• Limited accessibility• Traditional experience | • Quick turnaround• Remote verification• 24/7 accessibility• Modern digital experience |

Implementation Considerations

Banks must evaluate several factors when choosing verification methods.

Strategic Questions:

- What training requirements exist for each method?

- How do integration needs affect current systems?

- What scalability options support future growth?

The decision impacts long-term operational efficiency.

Why Choose KlearStack for Document Verification?

Modern businesses require reliable document verification solutions that meet current operational demands. Traditional verification methods cannot adequately address contemporary market requirements. KlearStack transforms how organizations approach identity verification processes.

Advanced Processing Capabilities:

- Template-free technology adapts to any document format automatically

- Self-learning AI algorithms improve accuracy with each verification cycle

- End-to-end automation reduces manual intervention requirements significantly

Proven Performance Features:

- Process high document volumes daily with consistent accuracy standards

- Handle any document type without template configuration requirements

- Achieve industry-leading extraction accuracy across all document categories

Your verification requirements demand intelligent automation solutions. KlearStack provides advanced OCR capabilities with continuous learning. The system improves continuously through document processing experience.

Key Technical Advantages:

- Intelligent field extraction from varying document layouts

- Automated data validation across multiple document types

- Secure processing meeting banking industry security standards

Effective verification requires intelligent solution architecture. KlearStack significantly reduces document processing time while improving accuracy rates.

Ready to transform your verification processes? Book a Free Demo Call today.

Conclusion

Automated document verification represents a transformative approach to identity validation in the digital age. By combining AI, machine learning, and computer vision technologies, these systems deliver verification that is faster, more accurate, and more secure than traditional manual processes.

- Implementation reduces verification times by up to 95% while improving accuracy rates

- Operational costs decrease by 40-70% through reduced manual review requirements

- Customer abandonment rates typically fall by 30-60% with streamlined verification

- Fraud detection improves by 35-50% through advanced AI-powered analysis

- Regulatory compliance becomes more consistent and documentable

For organizations managing identity verification at scale, automated document verification isn’t just a technological upgrade it’s a strategic necessity in a digital-first world where customers expect instant service without sacrificing security.

FAQs on Automated Document Verification

Automated systems analyze security features invisible to human observation. AI algorithms detect pixel-level alterations and pattern inconsistencies systematically. Machine learning capabilities improve detection accuracy with each document processed.

Modern platforms support government IDs, passports, driver’s licenses, and utility bills comprehensively. Advanced systems handle extensive document variations from global markets. International coverage includes documents from numerous countries and jurisdictions.

Most standard documents receive verification results within seconds of submission. Complex cases requiring additional review complete within minutes typically. Processing speed remains consistent regardless of document volume or processing time.

Leading systems include built-in compliance features for major privacy legislation requirements. Data minimization, consent management, and secure storage operate automatically. Regular system updates ensure ongoing regulatory requirement adherence.