Countless hours spent poring over passports, driver’s licenses, utility bill – the risk of human error circling over every check. Not to mention the potential for fraud and the ever-increasing regulatory pressures.

It’s enough to make any business owner want to tear their hair out!

Automated document verification software is here to rescue you from the stress of manual paperwork. This innovative technology uses advanced algorithms and artificial intelligence to verify the authenticity of documents in a fraction of the time it takes a human.

With the right software, you can:

- Increase accuracy and reduce errors

- Improve efficiency and speed up onboarding

- Enhance security and prevent fraud

- Reduce costs and save valuable time

- Improve compliance with KYC/AML regulations

This blog will guide you through choosing the perfect document verification software for your business. We’ll provide a checklist of features, compare top solutions, and help you avoid common mishaps.

Why You Need an Automated Document Verification Software?

Think about your current document verification process. Is it:

- A Bottleneck to Onboarding? Do new customers or employees face frustrating delays waiting for manual verification? Slow processes lead to lost customers and a poor first impression.

- A Drain on Your Resources? Are your employees bogged down with tedious paperwork, diverting their time and energy from more valuable tasks? This manual effort significantly impacts productivity and costs.

- A Security Nightmare? Are you worried about the increasing risk of fraud and identity theft? Manual verification leaves your business vulnerable to sophisticated forgeries and security breaches.

- A Compliance Headache? Are you struggling to keep up with ever-changing KYC/AML regulations? Non-compliance leads to hefty fines and reputational damage.

- A Barrier to Growth? Is your current process scalable? As your business expands, manual verification becomes a major obstacle to efficient growth and expansion.

If you answered “yes” to any of these questions, it’s time to find a document verification solution that actually addresses your needs.

The right automated document verification software will:

- Transform onboarding into a seamless, frictionless experience.

- Free up your team to focus on strategic initiatives, not paperwork.

- Provide a robust defense against fraud and identity theft.

- Simplify compliance and ensure you meet regulatory requirements.

- Empower your business to scale efficiently and securely.

Don’t just settle for any software – choose a solution that solves your challenges.

6 Best Automated Document Verification Software

While several players exist in the automated document verification market, choosing a solution that suits your specific needs is important.

Here’s a brief overview of some leading providers:

1. KlearStack

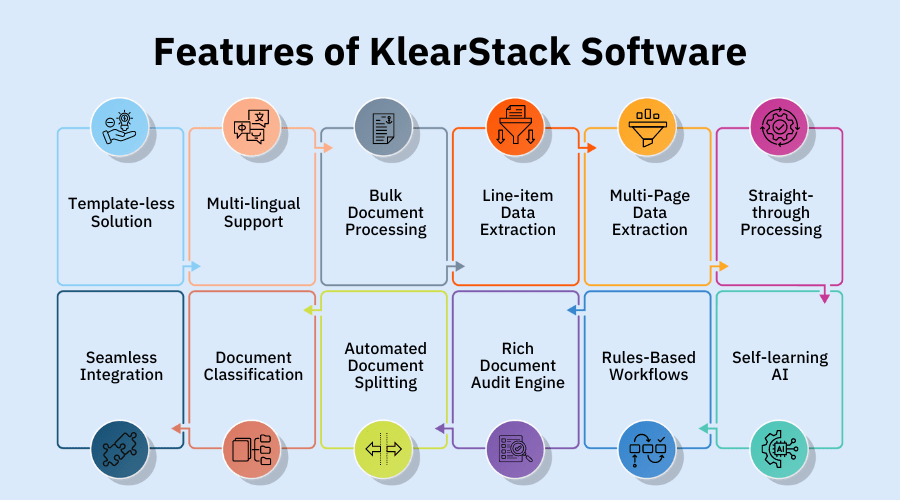

KlearStack offers a robust suite of features designed to streamline your document verification processes and enhance security:

- Advanced Audit Rules: Configure a wide range of audit rules, from simple to complex, to ensure thorough and accurate verification.

- Unmatched Fraud Detection: KlearStack’s AI-powered algorithms effectively identify tempered and fraudulent documents, protecting your business from identity theft.

- Complex Conditional Mapping: Easily transform data at the extraction stage with complex conditional mapping, ensuring data integrity and accuracy.

- Reconciliation Checks: Define reconciliation checks to verify data integrity and minimize errors.

- API and Data Source Integration: Connect KlearStack with external data sources via API to enrich your identity verification process.

- Unwavering Compliance: Rest assured that your data is handled with the utmost security. KlearStack is compliant with the highest privacy standards, including AICPA SOC and GDPR.

- Effortless Efficiency: Save up to 95% of manual effort by automating your document verification workflows.

- Comprehensive Verification: KlearStack checks all documents and fields, ensuring complete and accurate identity verification.

- Boost Compliance: Increase compliance rates to nearly 100% with KlearStack’s robust features and adherence to industry standards.

The Proof is in the Performance: Why Leading Organizations Choose KlearStack

KlearStack isn’t just a promising solution; it’s a proven performer. Leading organizations around the world trust KlearStack to streamline their document verification processes, improve accuracy, and reduce risk.

Here’s what KlearStack’s clients are saying:

KlearStack streamlined our invoice reconciliation and data integration, boosting efficiency and accuracy. Their exceptional support and adaptable platform are invaluable. Highly recommended for enhancing data processing.

Chief Operating Officer

Tradewinds Intl

We are pleased to inform you that our experience with KlearStack SaaS has been good. The solution has enabled us to streamline our document processing workflows, resulting in increased operational efficiency and reduced manual errors.

Digital Transformation Head

A large Indian bank

KlearStack has enabled us to significantly streamline our Accounts Payable Invoice processing operations. We are now able to focus our attention on more value added activities due to significant productivity improvements.

Accounts Payable Head

A Global Fortune 50 Manufacturing Enterprise

KlearStack SaaS delivered as promised. It integrated smoothly into our workflow, offering solid efficiency and support. As a procurement manager, it’s been a reliable tool, allowing us to focus on core tasks.

Procurement Manager

Leading Hospitality Group

KlearStack made a noticeable difference in our logistics operations. Its integration was straightforward, cutting down processing times and errors. As a supply chain director, it’s become a practical asset in our quest for efficiency.

Supply Chain Director

Global Logistics Firm

KlearStack simplified our compliance management. Its AI technology boosted accuracy and compliance adherence, making regulatory tasks more manageable. As a compliance officer, it’s a tool I trust for staying on top of requirements.

Compliance Officer

Financial Services Firm

Beyond testimonials, KlearStack’s success is evident in its:

- Proven Scalability: KlearStack boasts an 80% improvement in team productivity and 300% faster loan processing.

- Cost Reduction: KlearStack helps reduce costs by up to 80%.

- Operational Efficiency: KlearStack increases operational efficiency by up to 500%.

- Accuracy: KlearStack delivers up to 99% accuracy with its self-learning AI.

- Seamless Integrations: KlearStack offers open RESTful APIs and pre-built connectors for SAP, QuickBooks, and more.

- Security and Compliance: KlearStack ensures the security and privacy of your data with ISO 27001 certification and SOC 2 compliance.

- Industry Recognition: KlearStack is an AICPA SOC, GDPR, and NASSCOM-certified member.

- Strategic Partnerships: KlearStack is a member of LEGLO and GLOBAL SUMMIT.

To see KlearStack in action, explore our detailed case studies showcasing real-world results.

KlearStack Handles ALL Your Documents

KlearStack isn’t just limited to bank statements. It can process a wide variety of financial documents, including:

- Bank statements (in any format)

- Invoices

- Receipts

- Purchase Orders

- Identity Cards

- Credit card statements

- Deposit slips

- Checks

- Expense reports

- Many other documents

This versatility makes KlearStack a truly comprehensive solution for automating your financial data extraction and reconciliation needs.

2. Trulioo

Key Features: Global identity verification, KYC/AML compliance, fraud prevention, AML watchlist screening.

Pricing: Pay-as-you-go pricing based on API calls.

Best For: Businesses with global operations and a need for robust KYC/AML compliance solutions.

3. Onfido

Key Features: AI-powered identity verification, document verification, facial recognition, fraud detection.

Pricing: Varies by volume and features; offers a free trial.

Best For: Businesses seeking a balance of robust features, user experience, and scalability.

4. Jumio

Key Features: Identity verification, KYC, AML compliance, fraud detection, biometric authentication.

Pricing: Varies by solution and volume; contact for a quote.

Best For: Businesses needing a comprehensive solution with a strong focus on security and compliance.

5. ID.me

Key Features: Digital identity verification, identity proofing, authentication, fraud prevention.

Pricing: Varies by solution and volume; contact for a quote.

Best For: Government agencies, healthcare providers, and businesses with high security and compliance needs.

7. Veriff

Key Features: AI-powered identity verification, document verification, facial recognition, video verification.

Pricing: Pay-as-you-go pricing based on API calls; volume discounts available.

Best For: Businesses with high volumes of online transactions and a need for robust fraud prevention.

What to look for in Your Document Verification Solution?

Choosing the right document verification software can be overwhelming. To simplify your decision, consider these essential factors:

Choosing the right document verification software can be overwhelming. To simplify your decision and ensure you select a solution that meets your specific needs, consider these essential factors:

- Accuracy and Reliability:

- Does the software use advanced artificial intelligence and machine learning algorithms for accurate identity verification? Look for digital identity verification solutions with a proven track record.

- What is the software’s accuracy rate in detecting fraudulent documents and preventing identity theft?

- Does the software offer real-time verification and feedback, ensuring online document verification is efficient and reliable?

- Speed and Efficiency:

- How quickly can the software process documents? Fast processing times are essential for efficient KYC solutions and AML solutions.

- Does it offer batch processing capabilities for high-volume verification needs? This is crucial for businesses dealing with a large number of documents.

- Can it integrate with your existing workflows and systems to streamline your identity verification process?

- Security and Compliance:

- What security measures are in place to protect sensitive data during online document verification?

- Does the software comply with relevant regulations (KYC, AML, GDPR)? Ensure your chosen solution helps you meet KYC compliance requirements.

- Does it offer audit trails and reporting features for enhanced transparency and accountability?

- Supported Document Types:

- What types of documents can the software verify (e.g., passports, driver’s licenses, ID cards)?

- Does it support international documents for global businesses and diverse customer bases?

- Can it handle various document formats (e.g., images, PDFs, scans) to ensure flexibility in document verification?

- Integration and Scalability:

- Does the software integrate with your existing CRM, onboarding platforms, or other business systems? Seamless integration is key for optimal efficiency.

- Is it scalable to accommodate your future growth? Choose a solution that can adapt to your evolving document verification needs.

- Does it offer API access for custom integrations and greater flexibility?

- User Experience:

- Is the software user-friendly and easy to navigate, ensuring a smooth document verification process for both your team and your customers?

- Does it offer a mobile-friendly interface for convenient access and verification on the go?

- Does it provide clear instructions and helpful support resources to assist users with document verification?

- Pricing and Support:

- What pricing models are available (e.g., subscription, pay-per-use)? Choose a model that aligns with your budget and usage patterns.

- Does the vendor offer reliable customer support and technical assistance to help you with any document verification challenges?

- Are there training resources or onboarding programs available to ensure a smooth implementation of the document verification software?

Why the Wrong Software Can Hurt Your Business?

Choosing the wrong document verification software can have far-reaching consequences for your business. Here’s how a poor fit can impact your operations and your bottom line:

- Risk It All – Face Fraud Head-On with the Wrong Software If your software fails to detect a fraudulent document, you could onboard a customer with a fake identity, exposing your business to fraud, financial loss, and reputational damage.

- Drown in Delays – Watch Your Productivity Plummet with Slow Software Software that struggles to handle your document volume or has slow processing times will create bottlenecks, frustrate customers, and lead to missed opportunities.

- Frustrate Everyone – Drive Customers Away with a Clunky User Experience A clunky interface can frustrate your team and your customers, leading to increased support requests, lower adoption rates, and a negative brand perception.

- Become an Easy Target – Risk a Data Breach with Weak Security Inadequate security measures can leave your business vulnerable to data breaches and cyberattacks, resulting in the loss of sensitive data, regulatory fines, and a damaged reputation.

- Face the Fines – Fall Out of Compliance with Outdated Software If your software doesn’t keep pace with evolving KYC/AML regulations, you could face hefty fines and legal challenges.

- Integration Breakdown – Create Workflow Chaos with Incompatible Systems Software that doesn’t integrate seamlessly with your existing systems can cause workflow disruptions, data silos, and increased manual effort.

- Blow Your Budget – Unexpected Costs That Drain Your Resources Beyond the initial purchase price, consider the ongoing costs of maintenance, support, and upgrades. The wrong software can lead to unexpected expenses and a poor ROI.

By carefully considering your needs and using the checklist provided earlier, you can avoid these pitfalls and choose a document verification solution that drives efficiency, security, and growth.

Automate with the Best: Why Should You Choose KlearStack?

Document verification has become a core component of security, compliance, and customer experience. As we’ve explored, choosing the right software can make all the difference.

But why settle for just any solution when you can have the best?

Instead of struggling with complex regulations and tedious paperwork, you will have a trusted partner by your side – KlearStack.

- No more endless checklists: KlearStack ensures compliance with ease, so you can breathe easy knowing you’re protected.

- No more second-guessing: Their AI-powered accuracy gives you complete confidence in your verification results.

- No more wasted time: KlearStack automates the process, freeing your team to focus on strategic initiatives.

KlearStack is more than just software; it’s peace of mind. It’s the assurance that your business is secure, compliant, and operating at peak efficiency.

Schedule a Free Demo Call with KlearStack today.

FAQs for Best Automated Document Verification Software

Document verification technology uses software to automate the process of verifying the authenticity and accuracy of documents by comparing them against reliable sources and identifying inconsistencies.

AI-powered document verification uses machine learning algorithms to analyze and verify documents by comparing them against reliable sources and identifying inconsistencies or discrepancies.

Automated document verification utilizes software to streamline the process, extracting data, checking for inconsistencies, and verifying against authorized databases, reducing manual effort and errors

To check document authenticity, examine security features like watermarks and microprinting, and verify against official records or use verification tools to compare against known genuine documents.

Automated document verification software increases efficiency, reduces errors, enhances security, provides faster processing, and lowers costs compared to manual verification methods.

Written by

Vamshi Vadali