Due diligence checking is the assessment of a person, business, or transaction to identify risks, liabilities, and compliance issues before a decision is made.

According to Bain & Company’s Report, poor due diligence is often cited as a primary reason for deal failures. Nearly 60% of executives attribute unsuccessful deals to inadequate diligence that fails to identify critical issues.

This isn’t a formality. It’s a legal and financial necessity.

- Are you verifying only what is easy to access instead of what is critical to know?

- Can your due diligence process detect compliance risks before they affect your bottom line?

- Is your system capable of adapting to varied document types, jurisdictions, and real-time regulatory changes?

Due diligence checks are applicable in various sectors apart from banking. Whether it’s a new investment, business acquisition, or regulatory KYC requirement — this guide will tell you how to manage the process from start to finish.

Key Takeaways

- Due diligence checking is used in investments, banking, business deals, and regulatory processes.

- It involves document review, risk assessment, verification, and legal checks.

- Financial, legal, operational, and commercial checks are the four primary categories.

- Enhanced Due Diligence (EDD) applies in high-risk or politically exposed scenarios.

- Modern due diligence uses automation, analytics, and AI to improve accuracy and speed.

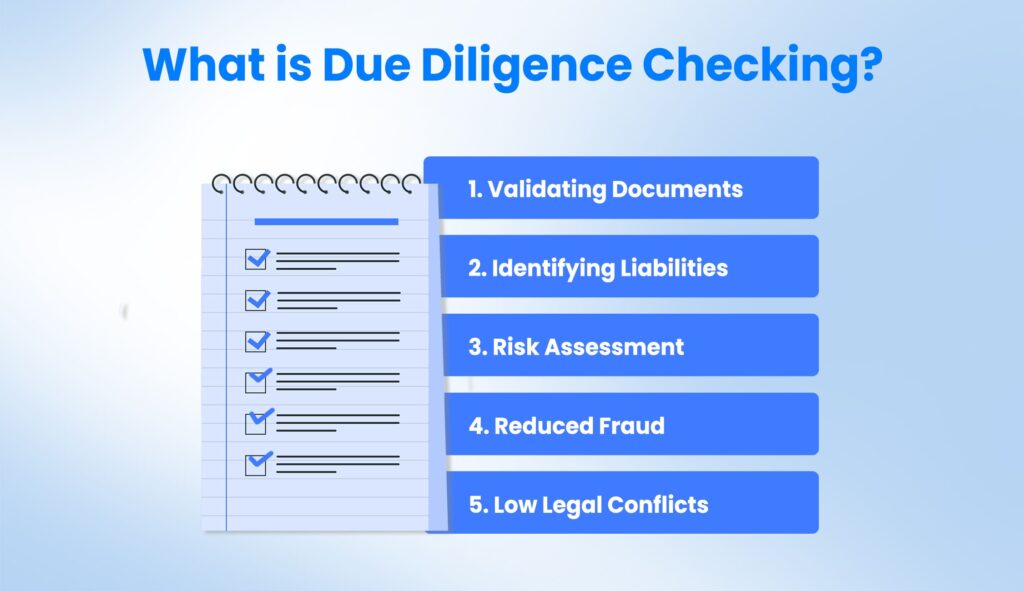

What is Due Diligence Checking?

Due diligence checking is the formal process of evaluating a business, entity, or transaction before finalizing an agreement. It includes validating documents, identifying liabilities, and assessing risks that could affect future outcomes.

This practice is central in mergers, partnerships, regulatory compliance, and banking transactions. A proper due diligence process reduces exposure to fraud, errors, or legal conflicts. It also enables more confident planning based on verified facts.

Purpose and Benefits of Due Diligence

The main purpose of due diligence is to prevent unwanted errors in financial or business transactions. A strong due diligence process ensures that the stakeholders have full clarity on legal risks, financial history, and operational health.

Businesses often depend on it for:

- Identifying liabilities before acquisitions or mergers

- Verifying a third-party vendor’s compliance history

- Assessing legal or reputational risks in cross-border transactions

The outcome is a stronger negotiation position and fewer regulatory issues after signing a deal.

Due diligence checking allows financial teams to evaluate every variable before entering into agreements. Whether it’s a merger, vendor onboarding, or investment opportunity, businesses need to validate data from multiple angles before committing resources.

It can be of great importance in high-value deals or cross-border engagements where legal, financial, or reputational risks exist.

Banks or Financial institutes also rely heavily on due diligence for client onboarding and anti-money laundering (AML) purposes. Inaccurate checks can result in regulatory violations or legal exposure.

For example, failure to detect politically exposed persons (PEPs) in time will result in scrutiny from global compliance bodies and lead to penalties.

Besides risk mitigation, it also improves transparency and accountability in transactions. It leads to greater trust between stakeholders.

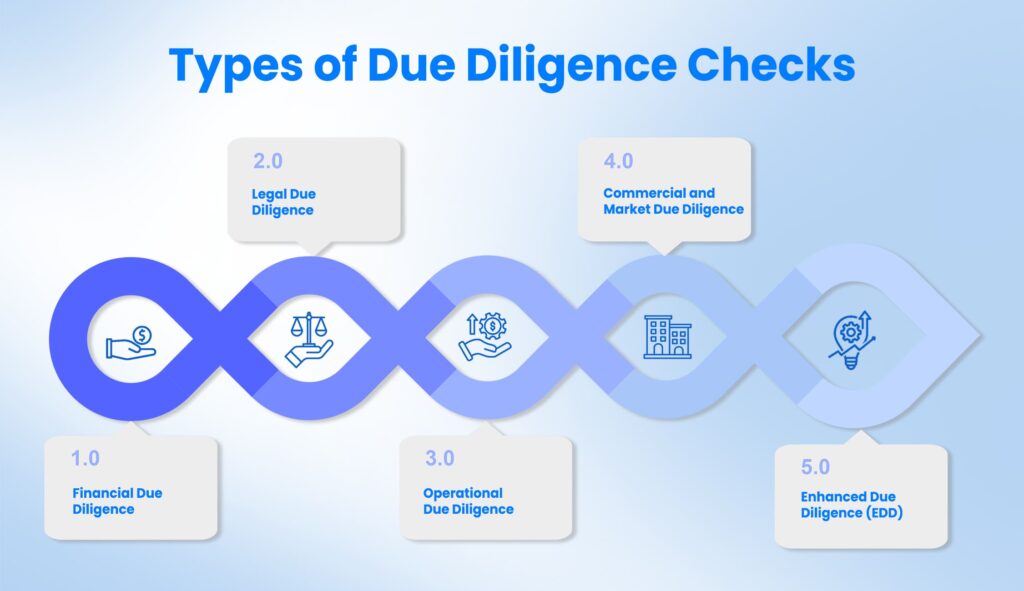

Types of Due Diligence Checks

V3: Types of Due diligence Checks – create a unique infographic. Something that has icons in a connected circle. Create a chain-like circle with the following components:

- Financial Due Diligence

- Legal Due Diligence

- Operational Due Diligence

- Commercial and Market Due Diligence

- Enhanced Due Diligence (EDD)

Due diligence isn’t one-size-fits-all. Different contexts require different layers of checks, often grouped into the following categories:

Financial Due Diligence

This involves verifying all financial records, liabilities, and revenue claims. Audited statements, tax filings, and loan agreements are reviewed to confirm accuracy and detect any red flags.

Key areas include:

- Profit and loss consistency over time

- Undisclosed liabilities

- Credit agreements and capital structures

Financial due diligence checking focuses on understanding the economic health of a business. It uncovers hidden financial risks, verifies the legitimacy of reported figures, and ensures that liabilities are transparent.

In high-risk sectors like lending or fintech, such verification is used to avoid investment fraud or asset overstatement. Document classification of different customer profiles becomes easier as well.

Legal Due Diligence

Legal checks confirm that the company or entity complies with local and international laws. The process also uncovers past or pending litigation, disputes, or compliance failures.

Areas include:

- Licensing and registration documents

- Pending lawsuits or regulatory actions

- Contract obligations and third-party agreements

Legal due diligence checking identifies contractual obligations, intellectual property rights, and regulatory filings. It prevents the transfer of hidden legal burdens during acquisitions or partnerships.

Companies often use this step to confirm enforceability of key contracts, lease agreements, or supplier obligations.

Legal compliance becomes especially important when the target entity operates across multiple jurisdictions. Non-compliance in one market can halt operations globally.

Due diligence helps verify the authenticity of registrations and reveal prior warnings or legal disputes that may have reputational or financial consequences.

Operational Due Diligence

Operational checks analyze how the company functions internally. The goal is to understand risks tied to workforce, logistics, and internal systems.

Focus areas:

- Employee records and HR policies

- Equipment and asset tracking

- Workflow efficiency and gaps

Operational due diligence helps assess how scalable and sustainable the internal structure of a company is. Buyers or partners analyze the quality of the workforce, the efficiency of logistics systems, and the resilience of technology infrastructure.

For example, outdated machinery or unstructured HR processes may become barriers to growth post-acquisition.

It also includes reviewing dependencies on key individuals, vendor relationships, and process standardization. In business continuity planning, operational due diligence determines whether the company can manage disruptions without long downtimes.

Documenting and evaluating these processes upfront reduces surprises after ownership transfer.

Commercial and Market Due Diligence

This checks how competitive and viable the business is in its industry. It includes brand perception, market size, and growth potential.

Examples include:

- Customer retention rates

- Market share data

- Sales and channel performance

Commercial due diligence is conducted to understand a company’s position in the marketplace. This involves reviewing customer satisfaction levels, pricing strategies, marketing channels, and product-market fit.

It gives decision-makers a better idea of revenue predictability and the overall viability of the business model.

Investors often use this to confirm if projected growth plans align with current market conditions. Any mismatch in branding versus customer perception could raise concerns about future performance.

The purpose is to validate assumptions in the business plan and uncover blind spots related to competitors or market saturation.

Enhanced Due Diligence (EDD)

EDD applies when the transaction involves high-risk individuals or entities. This includes politically exposed persons (PEPs), international clients, or unusually large transactions.

EDD requires:

- Sanction list checks

- Source of funds validation

- More extensive background screening

Enhanced due diligence checking is mandatory in scenarios involving elevated financial or compliance risks. Banks and financial institutions are required by regulatory bodies to conduct EDD when customers originate from high-risk countries, have ties to government positions, or deal with complex corporate structures.

EDD also checks for beneficial ownership, source of income, and affiliations with flagged entities. These checks act as barricades against anti-money laundering (AML), counter-terrorism financing (CTF), and tax evasion prevention.

Failing to apply EDD where needed can lead to legal actions and reputational loss.

EDD also ensures that monitoring continues after the initial onboarding. High-risk clients must be observed in real-time for suspicious transaction patterns.

When is Due Diligence Required?

Due diligence is necessary whenever a business or financial commitment involves risk. It includes verifying identities, onboarding partners, and fulfilling compliance protocols.

Banking

Banks use due diligence for KYC compliance. It applies at onboarding, during large fund transfers, and in reviewing dormant account activity.

Mergers & Acquisitions

In M&A, the buyer conducts due diligence to confirm the target company’s financial health, IP rights, debts, and compliance status.

Partnerships and Vendor Deals

New business relationships need background verification. Vendors may undergo legal, operational, or financial due diligence before partnerships are confirmed.

High-Risk Transactions

Deals involving foreign entities or politically exposed persons require Enhanced Due Diligence and ongoing monitoring.

How Does the Due Diligence Process Work?

Every due diligence process follows a basic lifecycle: collect, verify, analyze, and act. The depth of each step depends on risk, deal value, and jurisdiction.

Document Collection

The first step involves gathering all relevant data like financial statements, licenses, contracts, tax returns, ownership structures, etc.

Verification and Risk Assessment

Once documents are collected, each item is verified against public and regulatory databases. Risk scoring systems assess red flags based on transaction type, geography, or entity classification.

Final Decision and Reporting

After risk factors are identified, decision-makers prepare internal reports or submit compliance updates. At this stage, the deal is approved, modified, or rejected.

Due Diligence Checklist for Financial Institutions

A due diligence checklist provides structure to what could otherwise be an inconsistent verification process. Financial institutions deal with large volumes of documentation daily. These documents range from identity records and permits to contracts and ownership disclosures.

Without a standardized checklist, the risk of missing important data increases.

To ensure reliability, each document must be validated against trusted sources. The checklist must cover verification, risk scoring, compliance, and system integrity.

Below is a breakdown of the key checkpoints institutions should include as part of their due diligence process.

Identity & Document Verification

This is the first layer of defense in the customer due diligence process. The goal is to confirm that the individuals or entities being onboarded are real, legitimate, and not associated with any known risks.

Institutions should:

- Check global watchlists including OFAC, UN, and Interpol

- Match uploaded identity documents with government-issued records

- Verify the ultimate beneficial ownership (UBO) structures for business clients

These steps are essential to comply with anti-money laundering (AML) regulations and to prevent onboarding individuals tied to criminal or sanctioned entities.

Risk Scoring & Monitoring

Risk scoring helps prioritize which clients require deeper checks. A dynamic risk engine calculates scores based on the client’s profile, transaction history, and known risk indicators.

Once scored, institutions must:

- Apply tiered verification rules based on the client’s risk category

- Monitor politically exposed persons (PEPs) and high-risk jurisdictions in real time

- Set automated alerts for patterns that deviate from historical behavior

The purpose here is to create a scalable system that adjusts verification intensity based on changing risk factors.

Legal and Compliance Documents

Verification of legal documentation ensures that the institution deals only with entities that meet all regulatory requirements. This includes reviewing business formation records, legal filings, and contract disclosures.

Compliance teams must:

- Validate licenses, registrations, and zoning permits

- Cross-check names against litigation and enforcement databases

- Review customer contracts for any obligations that affect onboarding

This step also confirms that the client’s business activities align with what they claim to be doing. It addresses a key concern in sectors prone to fraud or shell operations.

Technology Readiness

In an automated document processing environment, systems must be capable of handling documents securely and consistently. This ensures that compliance requirements are not compromised during scale.

Verification systems should:

- Accept only tamper-proof formats with audit trails

- Maintain logs for each document’s processing and reviewer actions

- Support version control for updated documents and re-submissions

Technology-readiness is often overlooked in due diligence, but it plays a vital role in maintaining long-term compliance and audit readiness.

Challenges in Due Diligence Implementation

Manual due diligence processes fail to keep up with high volumes, especially in banking and finance. Teams struggle to review varied documents accurately and in time.

Manual Verification Delays

Paper-based or PDF document reviews slow down onboarding. Delays can result in lost opportunities or compliance fines.

Compliance Risks

Non-standardized checks mean higher chances of missing red flags. Institutions risk audit failures and penalties.

Resource Allocation

Teams spend hours on repetitive verification. This reduces their ability to focus on complex cases that require human oversight.

Legacy Systems

Older systems lack flexibility to integrate AI-based verification or real-time data analytics.

Due Diligence Across Industries

While banking drives most automation in this space, other industries are also adopting structured due diligence verification processing.

Finance and Banking

Used for KYC, AML, cross-border transfers, and loan risk assessments.

Real Estate

Verifies land titles, ownership structures, and mortgage histories before closing deals.

Startups and Venture Capital

Investors use due diligence to evaluate business models, team credibility, and IP ownership.

Healthcare and Pharma

Used to verify clinical trial documentation, regulatory certifications, and supplier licenses.

Risks of Skipping Due Diligence

Skipping verification steps can leave companies exposed to fraud, legal disputes, or poor deal outcomes.

- Missed liabilities or unrecorded debts

- Failure to detect fake documentation or identities

- Regulatory fines from compliance failures

- Reputational damage in case of negative publicity

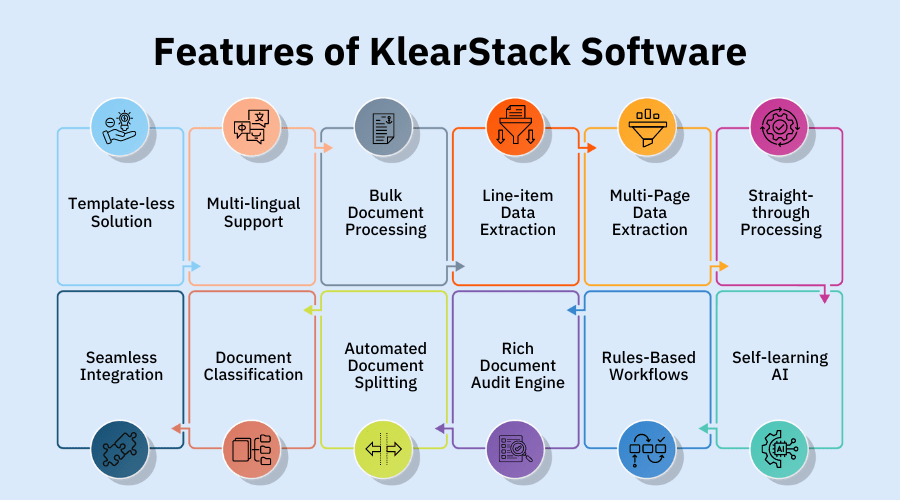

Why Should You Choose KlearStack?

Businesses handling thousands of documents weekly need automation that improves on basic scanning. KlearStack helps institutions manage due diligence checks through high-accuracy document processing.

Core Capabilities:

- Template-free AI that understands any document structure

- Real-time document classification and data extraction

- Automated validation against internal and external data sources

Trusted by Financial Institutions:

- 99% accuracy across multi-format documents

- Handles 10,000+ verifications daily

- Custom validation flows for EDD or high-risk client types

KlearStack combines intelligent extraction with end-to-end compliance readiness.

Ready to improve your due diligence process?

Conclusion

Due diligence checking isn’t optional anymore. It’s a legal and financial checkpoint that ensures decisions are based on truth, not assumptions.

- Identify hidden risks before signing deals or onboarding clients

- Reduce manual document review time by up to 80%

- Improve compliance audit readiness with AI-powered verification

- Use Enhanced Due Diligence to manage high-risk profiles

Without structured due diligence, businesses leave themselves vulnerable. With the right systems, the process becomes faster, more accurate, and far more scalable.

FAQ on Due Diligence Checking

Due diligence helps assess risks, verify facts, and ensure the decision is based on real data.

How does enhanced due diligence differ from standard checks?

Enhanced due diligence involves deeper checks for high-risk clients, including sanction list scans and source verification.

You’ll need tax returns, audited statements, credit agreements, and revenue data.

It’s required before finalizing a deal to verify liabilities, ownership, and financial health.