Accounts payable reconciliation is the process of ensuring your company’s payables match what vendors say you owe. If your records and vendor statements differ, payments can be delayed — or worse, duplicated.

According to Ardent Partners’ 2023 report, over 60% of businesses struggle with AP visibility, often leading to missed payments and reconciliation errors. Vendors expect accurate remittance, and finance teams must identify mismatches before they turn into larger problems.

- Why do AP teams catch duplicate invoices only after audits?

- What causes mismatched balances even when systems look correct?

- Can automation solve reconciliation faster than spreadsheets?

This blog addresses all of the above. You’ll learn the exact steps, common challenges, and key metrics to monitor for better accounts payable reconciliation.

Key Takeaways

- Accounts payable reconciliation matches vendor statements with your internal records to verify payment accuracy.

- Regular reconciliation prevents duplicate payments, identifies billing errors, and helps detect potential fraud.

- The basic process includes gathering documents, checking opening balances, matching line items, and resolving discrepancies.

- Implementing standardized procedures and using digital tools significantly improves reconciliation efficiency.

- The ideal reconciliation frequency depends on transaction volume: monthly for small businesses, weekly for larger operations.

- Three-way matching (purchase order, receipt, invoice) provides the most accurate verification method.

What is Accounts Payable Reconciliation?

Accounts payable reconciliation is the process of comparing your internal payment records with vendor statements to verify accuracy and identify discrepancies. This accounting procedure ensures that what you believe you owe vendors matches what they claim you owe them.

The purpose of accounts payable reconciliation serves as a mechanism that helps maintain accurate books.

By regularly reconciling accounts payable, businesses can identify issues such as duplicate invoices, missing credits, or unauthorized charges before they cause significant problems.

This process typically involves comparing multiple documents: vendor statements, internal accounts payable ledgers, invoices, purchase orders, and payment records. The goal is to match each transaction across these various sources and ensure they all tell the same story.

8 Steps to Effective Accounts Payable Reconciliation

Here’s how a finance team typically performs AP reconciliation from start to finish.

Step 1: Collect All Relevant Documents

Documents required include:

- Supplier statements

- Purchase orders

- Vendor invoices

- Payment receipts

- Credit/debit notes

These should all reflect the same accounting period. Otherwise, differences may appear.

Step 2: Check Opening Balance

Begin by comparing the opening balance in your AP ledger to the vendor’s closing balance from the previous period.

If mismatched, stop here. Find the last period where both balances matched and start reconciliation from that point.

Step 3: Verify Vendor Invoices

Now match invoice numbers, dates, and amounts. Flag if:

- Invoices are missing or entered incorrectly

- There are duplicate invoice numbers

- Terms or amounts don’t match

Each discrepancy here can lead to payment or reporting errors.

Step 4: Match Payments with Invoices

Compare payment records against open invoices. Issues to look for:

- Payments not recorded in AP

- Invoices marked paid but funds never sent

- Overpayments due to duplicate invoices

This step ensures your books reflect actual remittances.

Step 5: Identify and List Discrepancies

Discrepancies often come from:

- Human entry errors

- Payment dates falling in different periods

- Missing approval or unprocessed credit notes

Create a report listing all mismatches and categorize them by type.

Step 6: Investigate and Resolve Mismatches

Reach out to vendors for clarification. Check:

- Unposted receipts in GRIR

- Deleted or corrected invoices

- Stalled invoice approvals

Update internal records once you confirm the resolution source.

Step 7: Reconcile and Approve

Prepare a final reconciliation sheet. Attach evidence and send for internal sign-off. This helps auditors understand past adjustments.

Store the summary securely for future audits.

Step 8: Repeat Monthly or More Often

Large businesses with frequent transactions should do this weekly. Smaller firms can do monthly.

Routine checks reduce the backlog of issues and simplify closings.

Why is Accounts Payable Reconciliation Important?

The importance of accounts payable reconciliation is not limited to bookkeeping. It has multiple benefits that impact your entire business operation.

Prevents Costly Errors

Regular reconciliation helps catch errors before they become expensive problems.

Duplicate payments are among the most common and costly errors prevented by reconciliation. Without proper verification, your company might pay the same invoice twice, especially when vendors send duplicate copies or when multiple departments process the same bill.

Reconciliation also catches missed discounts, incorrect charges, and mathematical errors that can add up to significant amounts over time. Finding these errors during reconciliation allows you to correct them promptly and avoid financial losses.

Improves Cash Flow Management

Effective accounts payable reconciliation provides a clear and accurate picture of your outstanding obligations. When you know exactly what you owe and when payments are due, you can plan your cash outflows more effectively.

This visibility helps prevent cash shortages by ensuring you’re not surprised by unexpected payment obligations. It also helps identify opportunities to take advantage of early payment discounts when your cash position allows.

Reconciliation reveals any delays in recording payables that might distort your cash flow projections. By ensuring all obligations are properly recorded, you get a true picture of your financial position at any given time.

Builds Stronger Vendor Relationships

Consistent, accurate payments build trust with your vendors. When vendors receive the correct payment amounts on time, they develop confidence in your business as a reliable partner.

Vendors consider payment accuracy and timeliness when evaluating their customer relationships. Vendors who trust you are more likely to offer favorable terms, respond quickly to urgent requests, and work with you during challenging times.

Reconciliation helps ensure that any payment disputes are identified and addressed promptly, preventing them from escalating into serious issues that damage vendor relationships.

Quick resolution of discrepancies shows vendors that you value accuracy and fairness.

Enhances Fraud Detection and Prevention

Regular reconciliation creates a system of checks and balances that helps detect and prevent fraud. By comparing vendor statements with internal records, you can identify unauthorized or suspicious transactions before significant losses occur.

Fraudulent activities such as phantom vendor schemes, where payments are made to fake vendors, often come to light during thorough reconciliation processes. Similarly, reconciliation can reveal employee fraud schemes involving altered payment amounts or diverted funds.

The simple knowledge that all transactions will be reconciled serves as a deterrent to potential fraudsters. When employees know that discrepancies will be identified and investigated, they’re less likely to attempt fraudulent activities.

Ensures Accurate Financial Reporting

Accounts payable reconciliation ensures that the liabilities reported on your financial statements are accurate and complete. This accuracy is essential for both internal management decisions and external reporting requirements.

Inaccurate accounts payable figures can distort your balance sheet and income statement, leading to flawed analysis and decisions. Reconciliation helps prevent these inaccuracies by ensuring that all legitimate payables are recorded and any errors are corrected.

For publicly traded companies, accurate financial reporting is a legal requirement with potential penalties for material misstatements. Regular reconciliation helps meet these compliance obligations by verifying the accuracy of reported liabilities.

Operational Challenges in AP Reconciliation

Despite being a structured process, AP reconciliation is rarely smooth. Let’s look at the hurdles.

Inconsistent Formats Across Vendors

Some vendors send statements in PDF, others in Excel or even paper. Normalizing these formats wastes time.

Without a common format, automation tools also struggle.

Missing or Partial Invoice Details

Invoices lacking PO numbers or item-wise breakdowns cause confusion during matching. This is common with one-off vendor payments.

High Transaction Volumes

In high-growth companies, reconciling 200+ invoices weekly is common. Manual methods break under this pressure.

Discrepancies are either missed or delayed.

Duplicate or Double Payments

Fatigue-driven errors lead to entering the same invoice twice. If not caught in reconciliation, businesses may overpay.

Communication Delays with Vendors

Even if a mismatch is detected, resolution takes time if vendors don’t respond promptly. Lack of assigned points-of-contact (POCs) adds to the delay.

Metrics to Monitor in Reconciliation

Tracking KPIs helps spot inefficiencies and improve the process over time.

1. Reconciliation Cycle Time

Time taken to complete each reconciliation cycle. Shorter cycles reduce period-end stress.

2. Accuracy Rate

Percentage of reconciliations without errors or reversals. A key metric for audit readiness.

3. Resolution Time for Discrepancies

How long it takes to resolve each issue after detection. Delays here can impact vendor payments.

4. Outstanding Mismatches

Track how many issues remain unresolved beyond the reporting period. This reflects internal gaps.

5. Cost Per Reconciliation

Time and resource cost per cycle. High values signal inefficiencies in document gathering or approval.

Manual vs Automated Reconciliation

Manual reconciliation depends on printed statements, Excel sheets, and human cross-verification. It’s slow and error-prone.

Comparison Table: Manual vs Automated Reconciliation

| Feature | Manual Reconciliation | Automated Reconciliation |

| Speed | Takes hours or days to complete | Completes in minutes with batch processing |

| Accuracy | Prone to human error, oversight, and fatigue | Achieves up to 99% accuracy in data matching |

| Scalability | Limited by staff capacity and manual review time | Scales easily with transaction volume |

| Discrepancy Detection | Errors may go unnoticed without double checks | Flags mismatches instantly and categorizes them |

| Data Input | Requires manual entry from PDFs, Excel, or paper | Extracts data automatically from multiple file formats |

| Audit Trail | Requires separate documentation and manual notes | Maintains automatic digital trail with version history |

| System Integration | Not integrated with ERP or accounting software | Seamlessly integrates with ERP, AP, and accounting tools |

| Cost Efficiency Over Time | Labor-intensive and cost increases with volume | One-time setup, then saves time and labor consistently |

| Real-Time Reporting | Reporting lags behind due to delayed inputs | Provides real-time visibility into AP health |

| Team Productivity | Teams spend time on data entry and matching | Frees staff for higher-value financial tasks |

This comparison shows how manual reconciliation may work in low-volume cases, but automation is the only sustainable path for growing businesses.

Best Practices for Accounts Payable Reconciliation

These five best practices will help transform your accounts payable reconciliation into an efficient process that adds value to your business.

- Standardize Your Process

Create a consistent, documented procedure for reconciliation that anyone can follow. This approach reduces errors and improves efficiency across your team.

Develop a detailed checklist that outlines each step in the process. This guide helps staff avoid missing critical steps during reconciliation.

Assign clear roles and responsibilities to everyone involved. When each person knows their specific duties, the process flows more smoothly.

- Implement Three-Way Matching

Three-way matching verifies three key documents: purchase orders, receiving reports, and vendor invoices. This confirms you ordered items, received them properly, and were billed correctly.

This practice prevents paying for unordered or undelivered items. It also catches pricing differences between what was agreed upon and what was billed.

The additional verification points significantly reduce payment errors and fraud risk, providing stronger financial controls than simpler methods.

- Set Clear Invoice Priorities

Establish processing priorities based on due dates and early payment discount opportunities. This ensures time-sensitive items are handled first.

Create a systematic approach for handling incoming invoices, such as a dedicated email for electronic invoices and a scanning protocol for paper documents.

Implement a tracking system for invoices moving through approval and payment. This identifies bottlenecks and prevents documents from getting lost.

- Maintain Regular Reconciliation

Match your reconciliation frequency to your transaction volume. High-volume operations may need weekly checks, while smaller businesses can reconcile monthly.

Regular reconciliation prevents discrepancies from accumulating and becoming harder to resolve. When issues are caught early, they’re easier to fix.

Consider implementing continuous reconciliation for high-volume accounts by reconciling smaller batches throughout the period rather than waiting until month-end.

- Leverage Digital Tools

Use automation software to match invoices, purchase orders, and receiving documents. This technology dramatically reduces manual effort and human error.

Electronic document management systems make it easy to retrieve all needed documents instantly. This eliminates time wasted searching for paper files.

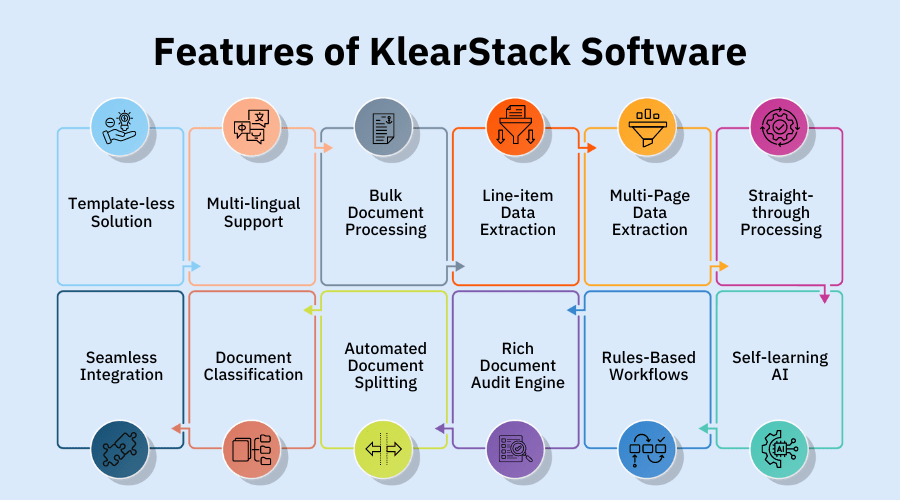

Why Should You Choose KlearStack for Accounts Payable Reconciliation?

Accounts payable reconciliation demands precision and efficiency to prevent costly errors. Your current manual process likely takes hours or days to complete each month.

KlearStack transforms this critical financial task with AI-powered automation that reduces errors and saves time.

Solutions That Matter:

- Template-free document processing that handles any vendor statement format

- Intelligent data extraction that captures all invoice details with up to 99% accuracy

- Automated three-way matching between purchase orders, receipts, and invoices

- Built-in exception handling that flags discrepancies for review

KlearStack delivers measurable results for accounts payable teams.

The system continuously learns from your data, improving accuracy with each document processed.

Our platform integrates with your existing accounting software, ensuring smooth data flow between systems. This integration eliminates manual data entry and provides real-time visibility into your accounts payable status.

You can verify vendor statements against your records with just a few clicks.

Key Processing Capabilities:

- Intelligent data extraction from any document format

- Automated matching of vendor statements with internal records

- Exception handling that identifies discrepancies for review

- Digital audit trail that documents all reconciliation activities

KlearStack helps you build stronger vendor relationships through accurate and timely payments.

Ready to transform your accounts payable reconciliation process?

Conclusion

Effective accounts payable reconciliation forms the backbone of sound financial management for businesses of all sizes. The process does more than just match numbers — it protects your company from errors, fraud, and damaged vendor relationships.

- Prevents revenue loss of 3-5% from payment errors and fraud

- Improves cash flow management through accurate payment tracking

- Strengthens vendor relationships with consistent, accurate payments

- Creates audit-ready financial records that support business decisions

When implemented with the right mix of standardized procedures, regular schedules, and appropriate technology, accounts payable reconciliation becomes a strategic advantage rather than an accounting burden.

The time invested in proper reconciliation pays dividends through better financial control and reduced risk.

FAQ on Accounts Payable Reconciliation

Most businesses should reconcile accounts payable monthly. Companies with high transaction volumes may need weekly reconciliation. The frequency should allow enough time to identify and correct errors before they affect financial statements.

The most common discrepancies include missing invoices, duplicate payments, and pricing errors. Timing differences between when payments are sent and recorded also cause many reconciliation issues.

Partial automation is possible with modern software that matches invoices to statements. Human review remains necessary for handling exceptions and investigating complex discrepancies that require judgment.

Three-way matching verifies purchase orders, receiving documents, and invoices align before payment. This method catches errors early and prevents paying for unordered or undelivered items, making reconciliation more accurate.