Batch Invoice Processing: A Complete Guide to OCR Automation and Implementation in 2025

According to a recent study by Ardent Partners, companies spend an average of $10.08 to process a single invoice, with manual processing costing up to $15 per invoice. For businesses processing thousands of invoices monthly, these costs add up quickly.

The adoption of OCR technology in intelligent document processing has grown by 34% in the past year alone, as reported by MarketsandMarkets Research.

Your finance team may be facing these common challenges:

- Are your AP staff spending hours manually entering invoice data instead of focusing on high-value tasks?

- Do invoice errors frequently disrupt your payment cycles and vendor relationships?

- Is delayed data capture preventing you from making timely financial decisions?

This guide explores how batch invoice processing, particularly when enhanced with OCR technology, addresses these challenges. We’ll examine both traditional batch processing methods and advanced OCR-powered solutions to help you make informed decisions for your business.

Key Takeaways

- OCR-powered batch processing achieves up to 99% data extraction accuracy, minimizing manual verification needs and costly errors.

- Modern OCR systems require no templates, adapting to diverse invoice formats without setup delays.

- Integration with existing ERP and accounting systems creates end-to-end automation that can cut total processing costs.

- The ROI for OCR-based batch processing typically becomes positive within 3-6 months of implementation.

- Training employees on new batch processing systems takes just 2-3 hours, with full proficiency achieved within one week.

What is Batch Invoice Processing?

Batch invoice processing refers to the practice of grouping and processing multiple invoices at once, rather than handling them individually. This approach turns what would be repetitive, singular tasks into a more efficient bulk operation.

Traditional invoice processing methods require staff to handle each document separately, manually entering data fields, checking for accuracy, routing for approvals, and filing records.

This one-by-one approach consumes valuable time and introduces numerous opportunities for human error. Many organizations are now implementing automated invoice processing to address these challenges.

Manual vs. Automated Batch Processing

| Aspect | Manual Batch Processing | Automated Batch Processing |

| Data Entry | Staff manually inputs information from multiple invoices | System automatically extracts data from invoice batches |

| Time Required | Hours or days depending on invoice volume | Minutes, regardless of batch size |

| Error Rate | 4-6% on average | Less than 1% |

| Cost Per Invoice | $9-$15 | $2-$4 |

| Approval Workflow | Physical routing or email chains | Automated routing with electronic approvals |

| Processing Capacity | Limited by staff availability | Virtually unlimited |

OCR-enabled batch processing takes automation a step further by using Optical Character Recognition technology to “read” invoice documents. The system can identify and extract key information from invoices regardless of format, layout, or whether they’re digital files or scanned paper documents.

This technology eliminates manual data entry entirely. Your team simply needs to scan paper invoices or upload digital files, and the OCR software handles the rest.

Understanding OCR Technology in Invoice Processing

OCR (Optical Character Recognition) technology transforms printed or handwritten text from images into machine-readable data. In batch invoice processing, OCR functions as the digital eyes that read and interpret information from multiple invoice documents.

Basic OCR systems work by analyzing the shapes of characters and converting them into text. However, modern invoice processing OCR has evolved significantly beyond simple character recognition.

The technology has advanced to a point where users can extract data from PDF invoices of varying qualities with high accuracy rates.

The evolution of OCR for invoice processing has three key stages:

- Basic OCR: Converts printed text to digital text with limited accuracy

- Template-Based OCR: Uses predefined templates to locate specific data on standardized invoices

- Intelligent OCR: Uses AI and machine learning to understand document context, adapt to various formats, and extract data without templates

Modern intelligent OCR systems employ several AI technologies to enhance accuracy:

- Machine Learning: The system improves its recognition capabilities over time by learning from corrections and new invoice formats

- Natural Language Processing: Helps understand the context of text to properly identify invoice elements

- Computer Vision: Analyzes document layout to identify data fields even when formats change

Effective data automation in OCR systems enables them to continuously improve without constant human intervention. This adaptive capability is essential for handling the diverse invoice formats businesses receive.

How OCR Works in Batch Invoice Processing

- Document Capture: Invoices are scanned or uploaded in batches

- Image Preprocessing: System adjusts images to optimize text recognition (deskewing, contrast adjustment)

- Text Recognition: Core OCR engine identifies and extracts text from the document

- Field Identification: AI algorithms determine which text belongs to which invoice fields (invoice number, date, line items, totals)

- Data Verification: System checks extracted data for accuracy using validation rules

- Data Export: Verified data is transferred to accounting or ERP systems

Modern OCR systems can handle various document types, from perfectly formatted digital invoices to poorly scanned handwritten notes. The technology can also extract data from tables, recognize line items, and even identify and extract information from supporting documents attached to invoices.

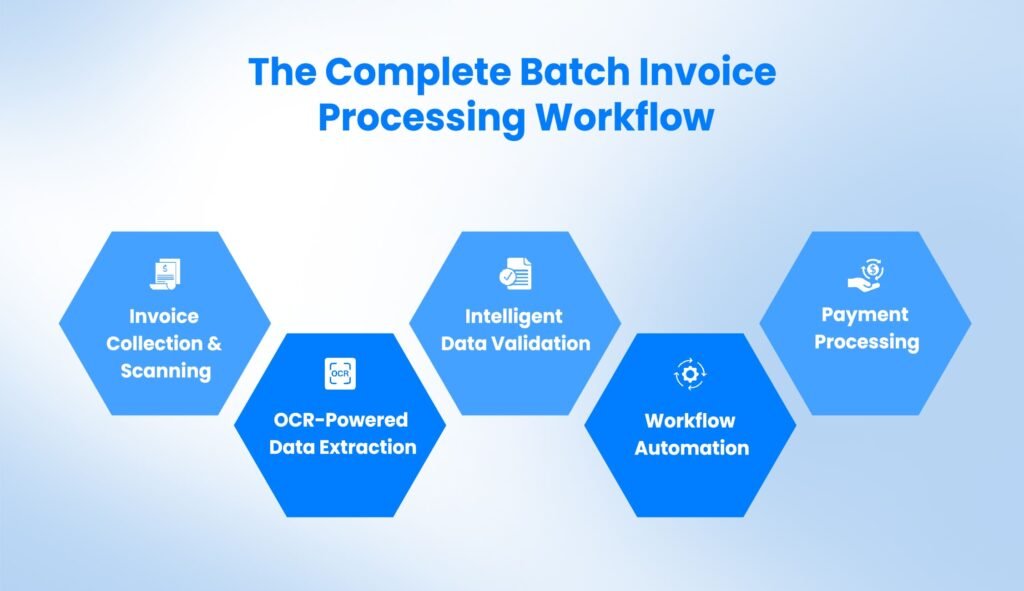

The Complete Batch Invoice Processing Workflow

A well-designed batch invoice processing system creates a seamless flow from receipt to payment. Here’s how a modern, OCR-enhanced workflow operates:

1. Invoice Collection & Scanning

The process begins with gathering invoices from various sources. These may arrive through:

- Email attachments (PDF, Word, or image files)

- Vendor portals

- Paper mail

- EDI (Electronic Data Interchange)

- Fax

Paper invoices are scanned in batches using document scanners or multifunction devices. Many organizations implement mailroom scanning to digitize invoices immediately upon arrival.

Key Process Enhancement: Modern systems support multi-channel invoice receipt, automatically routing all formats into a single processing queue.

2. OCR-Powered Data Extraction

Once digitized, the OCR engine processes the batch of invoices to extract key data fields:

- Vendor information (name, address, tax ID)

- Invoice details (number, date, due date)

- Line items (description, quantity, unit price)

- Tax amounts

- Total amounts

- Payment terms

Key Process Enhancement: Advanced OCR systems don’t require template setup. They adapt to each vendor’s format automatically, even recognizing and correctly processing invoices never seen before. Organizations often implement document digitization as a first step before implementing OCR-powered extraction.

3. Intelligent Data Validation

After extraction, the system validates data accuracy through:

- Mathematical checks (line items sum to totals)

- Cross-referencing with purchase orders and receiving documents

- Comparison with vendor master data

- Duplicate invoice detection

- Tax calculation verification

When discrepancies are detected, the system flags them for human review, showing the specific fields that need attention rather than requiring a review of the entire invoice.

Effective data parsing is vital for this validation process, as it structures the extracted information into formats that can be easily validated against business rules.

Key Process Enhancement: Machine learning algorithms continuously improve validation accuracy by learning from previous corrections.

4. Workflow Automation

Validated invoices automatically enter approval workflows based on predefined rules:

- Invoices matching POs with received goods may be approved automatically

- Non-PO invoices route to appropriate approvers based on amount, department, or account codes

- Exceptions follow escalation paths when approvals are delayed

Approvers receive notifications and can review and approve invoices from any device. Digital audit trails capture every action in the approval process.

Key Process Enhancement: Conditional logic automates routing decisions, reducing manual intervention and accelerating approvals.

5. Payment Processing

Approved invoices are scheduled for payment according to terms or cash optimization strategies:

- Payment files are generated for banking systems

- Payment status updates automatically sync with accounting systems

- Vendors receive payment notifications

- Payment records are archived with the original invoice data

Key Process Enhancement: Integration with payment optimization tools helps companies capture early payment discounts or strategically time payments based on cash flow.

This end-to-end workflow reduces a process that once took weeks to mere days or even hours. The OCR-enabled batch approach means your AP team can process hundreds or thousands of invoices in the time it previously took to handle dozens.

Benefits of OCR-Enhanced Batch Invoice Processing

Organizations implementing OCR-enhanced batch processing report significant improvements across multiple performance metrics. Here’s how this technology delivers measurable benefits:

Time Savings

Manual invoice processing typically requires 8-9 minutes per invoice. OCR-powered batch processing reduces this to seconds per invoice, resulting in:

- 80-90% reduction in processing time

- 65% decrease in invoice cycle time from receipt to payment

- 3-4 hours daily saved per AP staff member

This resulted in: One manufacturing client processing 5,000 monthly invoices reduced their AP processing time from 160 hours to just 20 hours per month.

Error Reduction

Human data entry typically has a 4% error rate. OCR systems achieve up to 99% accuracy, delivering:

- 93% fewer payment errors

- 86% reduction in vendor disputes

- 91% decrease in duplicate payments

Consequences included: A healthcare provider eliminated $42,000 in annual overpayments by catching duplicate invoices and math errors through automated validation.

Improved Cash Flow Management

Faster processing creates more control over payment timing:

- 94% decrease in late payment penalties

- 54% increase in captured early payment discounts

- 47% improvement in cash flow forecasting accuracy

This resulted in: A retail chain captured an additional $78,000 in early payment discounts during the first year after implementation.

Cost Efficiency

The total cost impact goes beyond simple processing time:

- 60-80% reduction in processing costs per invoice

- 45% lower audit preparation time and costs

- 75% decrease in document storage costs

Consequences included: A distribution company reduced their cost per invoice from $14.38 to $2.56, saving over $200,000 annually.

Enhanced Compliance and Audit Trails

Digital processing improves regulatory compliance and security:

- 100% digital audit trail for every invoice

- 86% faster response to audit requests

- 73% decrease in compliance-related exceptions

This resulted in: A financial services firm reduced audit preparation time from 3 weeks to 3 days while improving their compliance rating.

Handling of Multi-Format Invoices

Modern OCR systems adapt to any invoice format:

- Process images, PDFs, Word documents, and HTML emails

- Handle scanned paper, digital files, and structured EDI

- Extract data regardless of layout, language, or table structure

Consequences included: A global company processing invoices from 26 countries in 8 languages automated 94% of their invoice processing without needing to standardize vendor formats.

Batch Invoice Processing Applications Across Industries

Batch invoice processing delivers benefits across various business functions and industries. The flexibility of OCR-enabled solutions means they can be adapted to multiple document-intensive processes.

1. Accounts Payable Management

Challenges:

- High-volume vendor invoice processing

- Complex approval hierarchies

- Matching invoices to purchase orders and goods received

- Managing vendor payment terms and discounts

How OCR-enhanced batch processing helps: OCR technology extracts line-item details from invoices and automatically matches them against purchase orders and receiving data. The system identifies discrepancies like price variances or quantity mismatches without manual comparison.

A manufacturing company processing 8,000 monthly invoices reduced their matching exceptions from 35% to just 7% after implementing OCR-batch processing with three-way matching. Their AP team now focuses on resolving legitimate issues rather than data entry.

2. Billing and Client Invoicing

Challenges:

- Creating and distributing invoices to multiple clients

- Tracking sent invoices and payment status

- Managing recurring billing cycles

- Customizing invoice formats for different clients

How OCR-enhanced batch processing helps: While traditional batch invoicing creates outgoing invoices, OCR technology adds value by capturing client payment details from remittance advices and check stubs. The system automatically reconciles payments with outstanding invoices.

A professional services firm used batch processing to generate 1,200 monthly client invoices in 3 hours instead of 3 days. The OCR component then processed incoming payments, reducing receivables reconciliation time by 60%.

3. Expense Management

Challenges:

- Processing employee expense reports with multiple receipts

- Enforcing expense policy compliance

- Reconciling corporate card statements

- Tracking expense approvals across departments

How OCR-enhanced batch processing helps: OCR technology reads receipt details from expense reports, validating them against company policies. The system can detect policy violations like exceeding meal limits or submitting duplicate expenses.

A technology company with 500 traveling employees implemented OCR batch processing for expense reports. Their finance team now processes 1,500 monthly expense reports in a single day rather than throughout the month, while policy compliance improved by 42%.

4. Supply Chain Documentation

Challenges:

- Processing shipping manifests and bills of lading

- Reconciling goods received with orders

- Managing customs documentation

- Tracking proof of delivery documents

How OCR-enhanced batch processing helps: OCR technology extracts data from various supply chain documents, linking related information across multiple forms. The system can connect shipping notices with goods received and vendor invoices. For international shipments, ocean bill of lading processing can be integrated into the same workflow, creating a comprehensive supply chain document management solution.

A logistics company processes 3,000 shipping documents daily using OCR batch processing. Their document processing time decreased by 75%, while data accuracy improved by 68% compared to their previous manual process.

Key Considerations for Implementing OCR-Powered Batch Processing

Successful implementation of OCR-enhanced batch invoice processing requires attention to several critical factors. Understanding these considerations helps ensure your project delivers maximum value.

1. Data Management Requirements

Problem: Poor data quality and management can undermine even the most advanced OCR system. Inconsistent vendor information, unclear data standards, and fragmented document storage make automation difficult.

Solution: Establish clear data governance policies before implementation. Start by standardizing vendor master data, defining key fields for extraction, and determining how exceptions will be handled. Create a centralized document repository with appropriate retention policies and security controls.

Companies with well-organized vendor master data achieve 30% higher automation rates than those with inconsistent records. Begin with a data cleanup initiative to standardize vendor naming, remove duplicates, and verify tax identification numbers.

2. OCR System Reliability and Accuracy Standards

Problem: Not all OCR technologies deliver equal results. Basic systems may struggle with poor-quality scans, unusual fonts, or complex table structures, requiring excessive manual verification.

Solution: Define clear accuracy requirements and test thoroughly with your actual invoice samples. Look for systems that combine multiple AI technologies and offer confidence scoring to flag uncertain extractions. Establish an accuracy baseline before implementation and track improvement over time.

Set a minimum acceptable accuracy threshold of 90% for initial implementation, with planned improvements to 97%+ as the system learns. Request performance guarantees in vendor contracts tied to accuracy rates with your specific documents.

3. Integration with Existing Systems

Problem: Standalone OCR solutions create data silos if they can’t effectively communicate with your ERP, accounting, or payment systems.

Solution: Prioritize solutions with pre-built connectors for your primary business systems. Evaluate API capabilities for custom integrations. Map data fields between systems to ensure proper synchronization, and decide whether OCR extracted data should update master records or only transaction data.

The most successful implementations use bi-directional integration, where master data from ERP systems helps validate OCR extractions, while OCR data flows back to update transaction records. Begin with a detailed integration workshop involving both your OCR vendor and ERP team.

4. Customization for Various Invoice Formats

Problem: Vendor invoices come in countless formats, from simple to complex. Traditional template-based systems require extensive setup for each variation.

Solution: Select a self-learning OCR system that doesn’t rely on rigid templates. Modern AI-based solutions can identify invoice fields based on context rather than fixed positions. Plan for a training period where the system learns from corrections to continuously improve recognition.

Organizations with diverse supplier networks should prioritize “zero-template” OCR solutions that can process new invoice formats without configuration. One retail business reduced implementation time by 74% by choosing a template-free system for their 1,200+ vendors.

5. Training the OCR System

Problem: Even AI-based OCR systems have a learning curve. Initial accuracy may not meet expectations until the system is properly trained.

Solution: Establish a formal training protocol using a representative sample of your invoice types. Allocate time for system training before full deployment, and create a feedback loop where exceptions improve the system’s learning. Document recognition patterns that cause problems for targeted improvement.

Plan for a 4-6 week training period where AP staff verify OCR results and correct errors, enabling the system to learn from these corrections. One manufacturing company improved extraction accuracy from 82% to 97% after a six-week supervised learning period.

6. Employee Adoption and Change Management

Problem: Technical implementation often succeeds while user adoption fails. Staff accustomed to manual processes may resist new workflows.

Solution: Involve end-users from the beginning of the project. Create clear process documentation with visual guides, and provide hands-on training sessions. Identify and empower internal champions who can support their peers. Communicate the benefits for employees, not just the organization.

Include AP staff in solution selection and design to increase buy-in. Focus training on exception handling rather than routine processing, emphasizing how automation elevates their role from data entry to analysis and problem-solving.

Overcoming Common Challenges in OCR Batch Processing

Even with the best planning, OCR batch processing implementations face several common challenges. Understanding these obstacles and their solutions helps ensure your project’s success.

1. Handling Non-Standard Invoice Formats

Challenge: Some vendors use unusual layouts, fonts, or design elements that confuse OCR systems. Handwritten notes, stamps, or marks on invoices can further complicate processing.

Solution: Implement a pre-processing stage that normalizes document formatting. Modern OCR solutions include image enhancement functions that remove noise, adjust contrast, and optimize documents before text recognition. For consistently problematic vendors, create vendor-specific processing rules.

A healthcare system with hundreds of small suppliers implemented a supplier portal that standardized incoming invoices while giving vendors greater visibility into payment status. Vendors who continued sending paper invoices had their documents routed through enhanced pre-processing.

2. Managing Poor Quality Scans

Challenge: Faxed invoices, low-resolution scans, or documents with coffee stains and fold marks can significantly reduce OCR accuracy.

Solution: Establish scanning quality standards and train mailroom staff accordingly. Deploy image enhancement algorithms that automatically detect and correct issues like skewed images, low contrast, or background noise. For problematic image sources, specialized techniques to extract text from image files can be employed to improve recognition rates. Create exception processes for documents below minimum quality thresholds.

| Quality Issue | Technical Solution | Process Solution |

| Skewed images | Automatic deskewing | Train scanning staff on proper document feeding |

| Low contrast | Contrast enhancement | Replace worn scanner components |

| Small font size | Resolution enhancement | Request electronic invoices from problematic vendors |

| Background patterns | Pattern removal algorithms | Configure scanners to optimize for text, not images |

3. Extracting Data from Complex Tables

Challenge: Line-item details in tables with merged cells, multiple columns, or unusual structures often cause extraction errors.

Solution: Choose OCR systems with specialized table recognition capabilities. These advanced algorithms identify table structures regardless of design and maintain relationships between cells. For complex documents, implement targeted verification of table data while auto-approving header information.

A distribution company with detailed product invoices created a two-tier verification process. Header data (dates, invoice numbers, totals) was fully automated, while a simplified line-item interface allowed quick verification of extracted product details, cutting verification time by 83%.

4. Training Requirements for Optimal Accuracy

Challenge: Initial OCR accuracy may disappoint if systems aren’t properly trained with organization-specific documents.

Solution: Develop a structured training program using a representative sample of your invoice population. Include examples of every major vendor format and document type. Implement a continuous learning loop where verification corrections feed back into the OCR engine to improve future accuracy.

A manufacturing firm achieved 99% accuracy by implementing a three-phase training approach:

- Initial training with 500 historical invoices from top vendors

- Supervised operation for four weeks with all corrections feeding the learning engine

- Continuous improvement where monthly exception reviews identify recognition patterns for targeted enhancement

How to Choose the Right OCR-Enabled Batch Processing Solution

Selecting the optimal OCR batch processing solution requires evaluating several key factors. This methodical approach helps ensure your chosen system will meet both current needs and future requirements.

Evaluation Criteria

| Criteria | Questions to Ask | Importance |

| Recognition Accuracy | What accuracy rates does the system achieve with invoices similar to yours? Does accuracy degrade with poor quality scans? | Critical |

| Learning Capability | Does the system improve through use? How quickly does it adapt to new invoice formats? | High |

| Integration Options | Does it connect seamlessly with your ERP/accounting systems? Are APIs available for custom integrations? | Critical |

| Scalability | Can it handle your peak invoice volumes? Will performance degrade as volume increases? | Medium-High |

| User Interface | Is exception handling intuitive? Can approvers use mobile devices? How easy is configuration? | Medium |

| Deployment Options | Is cloud, on-premise, or hybrid deployment available? Does this align with your IT strategy? | Medium |

| Security & Compliance | How is data protected? Does it meet your industry compliance requirements? | High |

| Vendor Stability | How long has the vendor existed? What is their customer retention rate? Do they have clients similar to your organization? | Medium |

OCR-Specific Features to Evaluate

When comparing OCR technologies, look beyond basic recognition capabilities to these differentiating features:

- Template-Free Processing: Can the system process new invoice formats without configuration?

- Learning Capability: Does accuracy improve through normal use and corrections?

- Field-Level Confidence Scoring: Does the system indicate confidence levels for each extracted field?

- Language Support: Can it handle multiple languages if needed for your business?

- Line-Item Extraction: How accurately does it capture detailed line items, not just header data?

- Handwriting Recognition: If applicable, can it process handwritten notes or approvals?

For financial institutions with specialized document needs, OCR in banking requires additional features for compliance and security. Consider these specific requirements if your organization operates in the financial sector.

Implementation Timeline Expectations

A typical OCR batch processing implementation follows these phases:

- Discovery & Planning (2-4 weeks): Requirements gathering, system selection, project planning

- Technical Integration (2-6 weeks): System installation, integration with existing systems

- Configuration & Training (3-4 weeks): System configuration, OCR training with invoice samples

- Pilot Phase (2-4 weeks): Limited production use with close monitoring and adjustment

- Full Deployment (1-2 weeks): Complete rollout and transition to operational support

Total implementation time typically ranges from 10-20 weeks depending on complexity, integration requirements, and organizational readiness.

ROI Calculation Framework

Calculate the return on investment by comparing these factors:

Costs:

- Software licensing or subscription fees

- Implementation services

- Internal IT and project management time

- Training and change management

- Ongoing support and maintenance

Benefits:

- Labor cost reduction (hours saved × hourly cost)

- Error reduction (cost of errors × reduction percentage)

- Early payment discount capture

- Late payment penalty avoidance

- Improved cash forecasting value

- Audit and compliance cost reduction

Most organizations achieve positive ROI within 3-6 months of full deployment. A mid-sized company processing 5,000 invoices monthly typically saves $20,000-$35,000 monthly after full implementation.

Why Should You Choose KlearStack?

Finance teams face constant pressure to process more invoices with fewer resources while maintaining accuracy. Your current document processing systems might struggle with invoice variety or require extensive manual intervention. KlearStack transforms how your organization handles batch invoice processing through advanced OCR and AI technologies.

KlearStack’s batch invoice processing solution uses template-free, AI-powered technology to automatically extract data from any invoice format with minimal setup. Our system adapts to your specific needs rather than forcing you to change your processes.

Solutions That Matter:

- Template-free processing that adapts to any invoice format without configuration

- Self-learning AI that improves with each document processed

- End-to-end automation from document capture through payment approval

- Advanced data validation reducing exception handling by up to 90%

Proven Performance in Financial Processing

- Processing Speed: Handle 10,000+ invoices daily with consistent accuracy

- Multi-Format Support: Process any document type without template training

- Accuracy Guarantee: Achieve 99% extraction accuracy across all documents

Your invoice processing workflow needs intelligent automation that actually works in real-world conditions. KlearStack’s OCR-powered system learns from each invoice it processes, continuously improving validation accuracy without requiring IT intervention.

Key Processing Capabilities:

- Intelligent field extraction regardless of invoice layout

- Automated three-way matching between invoices, POs, and receipts

- Secure document handling meeting banking and financial standards

Smart businesses need smart batch processing solutions. KlearStack reduces your document processing time by 80% while improving accuracy and control.

Ready to transform your batch invoice processing? Book a Free Demo Call!

Conclusion

Batch invoice processing, particularly when enhanced with OCR technology, represents a significant opportunity for financial efficiency and accuracy. The ability to process multiple invoices simultaneously with minimal manual intervention addresses the core challenges of modern accounts payable departments.

The business impact of implementing these solutions extends beyond mere cost savings. Effective document archiving becomes an additional benefit, as processed invoices are automatically stored in searchable digital formats that facilitate easy retrieval for audits or reference.

- Finance teams can focus on analysis and strategy rather than data entry

- More timely payments improve vendor relationships and negotiating position

- Better visibility into invoice status enhances cash flow management and planning

- Reduced error rates minimize disruptions and strengthen financial controls

As we move through 2025, organizations that leverage OCR-enhanced batch processing gain a competitive edge through greater financial agility. The technology has matured to a point where implementation risks are minimal while benefits are substantial and quickly realized.

For businesses still relying on manual or semi-automated processes, the question is no longer whether to implement batch invoice processing, but how quickly it can be deployed to start capturing these advantages.

FAQs

Traditional batch invoice processing groups invoices for better handling but still requires manual data entry or template-based capture. OCR-powered batch processing uses intelligent character recognition to automatically read and extract data from invoices regardless of format.

OCR technology improves accuracy by eliminating manual data entry errors. Modern OCR systems combine multiple AI technologies including machine learning and natural language processing to understand document context and verify data integrity.

OCR batch processing can handle virtually any invoice format, including paper documents, PDFs, email attachments, faxes, and images captured by mobile devices. Advanced systems process structured data (EDI, XML), semi-structured documents (typical invoices), and unstructured content (emails, letters).

Batch invoice processing improves cash flow through faster invoice processing, more timely payments, and better financial visibility. By reducing invoice cycle times from weeks to days or hours, you gain more control over payment timing.