Optical Character Recognition (OCR) in mortgage underwriting automates document processing by converting text into digital data. According to Deloitte, automated solutions can reduce underwriting time by up to 70% and significantly lower errors.

- Are manual processes causing delays and inaccuracies in your mortgage lending?

- Do compliance issues arise due to human data-entry mistakes?

- Is your underwriting team overwhelmed by paperwork?

OCR makes document processing faster and adds precision to mortgage lending, all while reducing costs and making operations more profitable.

Key Takeaways

- Structured data from OCR improves analytics, risk management, and customer satisfaction.

- Step-by-step implementation ensures smooth integration into existing processes.

- OCR integration with loan origination systems creates an end-to-end digital mortgage process.

- Automated data extraction helps lenders meet strict regulatory requirements and avoid compliance penalties.

What is OCR Mortgage Underwriting?

OCR (Optical Character Recognition) in mortgage underwriting is a technology that identifies and converts text from scanned mortgage documents or images into machine-readable, digital text.

Mortgage underwriting OCR works by scanning documents, recognizing text patterns, and transferring that information into a format computers can use for analysis.

It automates data extraction from forms like pay stubs, bank statements, tax returns, and identity verification documents. OCR software reduces manual entry, speeds up loan related procedures, and handles borrower data.

How OCR Works in Mortgage Document Processing

OCR technology transforms mortgage document processing through several key steps that convert paper or PDF documents into useful digital information. This process makes data extraction quick and reliable for mortgage lenders.

Document Capture

The process begins with digitizing paper documents using scanners or importing existing digital files. Mortgage documents come in many forms – from typed loan applications to handwritten notes and bank statements.

High-quality scanning helps ensure the OCR system can read the text correctly.

OCR software works best with clear, well-lit images. Many modern systems can also handle documents captured by mobile phones, making it easy for borrowers to submit information. The capture stage sets the foundation for all the processing that follows.

Image Preprocessing

Before text extraction begins, OCR systems clean up document images to improve recognition accuracy. This step is vital for mortgage documents that may be faxed, photocopied, or of poor quality.

The preprocessing includes removing spots and marks, fixing rotated pages, adjusting brightness and contrast, and making text stand out from the background.

Such adjustments help the OCR engine identify characters correctly, especially in documents with complex layouts like tax returns or bank statements.

Text Recognition and Extraction

Once images are prepared, the OCR engine identifies and extracts text from the documents. It analyzes shapes in the image and matches them to known text patterns and characters.

Modern OCR uses neural networks and machine learning to recognize text even when fonts vary or handwriting is present.

For mortgage documents, OCR extracts key information such as:

- Borrower names, addresses, and contact details

- Income figures from pay stubs and tax returns

- Bank account information and transaction details

- Property values and descriptions

- Credit scores and history

This extraction happens automatically, without typing or manual data entry. The OCR system can process multiple pages simultaneously, greatly reducing the time needed to handle mortgage applications.

Data Validation and Verification

After extraction, mortgage OCR systems validate the data to ensure accuracy. They check for expected patterns in fields like Social Security numbers, verify calculations, and flag potential errors for human review.

Advanced OCR systems compare extracted data across multiple documents to find inconsistencies. For example, they might verify that income stated on a loan application matches what appears on pay stubs and tax returns. This cross-validation helps prevent fraud and ensures data integrity.

Benefits and Importance of OCR in Mortgage Underwriting

Mortgage underwriting depends on careful review of various documents to assess a borrower’s financial health. The large number and variety of these documents, along with the complexity of mortgage data extraction, often overwhelm underwriters.

Keeping such issues insight, OCR in mortgage underwriting provides the following benefits –

Improved Accuracy & Reduced Errors

Manual data entry errors can result in compliance penalties and financial loss. OCR systems achieve accuracy rates of up to 99%, significantly reducing these risks.

Error-free data extraction helps lenders avoid costly mistakes and streamline mortgage data extraction processes.

Faster Decision-Making & Processing

OCR-powered systems process documents rapidly, reducing mortgage loan approval times from days to minutes. Faster underwriting decisions improve borrower experiences and provide lenders a competitive advantage.

Improved Compliance & Fraud Detection

Compliance is essential in mortgage lending. OCR solutions automate document verification and regulatory reporting. Additionally, integrated AI detects irregularities and possible fraud in applications, strengthening risk management and compliance.

Significant Cost Savings & Scalability

Automated mortgage document processing decreases operational costs by minimizing manual labor. OCR technology scales easily, handling increased document volumes without additional staffing.

Better Customer Experience

OCR speeds up loan processing, providing borrowers with faster, stress-free lending experiences. Efficient service encourages customer loyalty and positive reviews.

Better Borrower Experience

The reduced paperwork burden also improves the customer experience. OCR allows lenders to extract data from existing documents rather than asking borrowers to complete multiple forms with the same information.

This convenience factor is becoming increasingly important as borrowers compare lenders.

Better Risk Assessment

OCR gives underwriters faster access to accurate borrower information. This allows for more thorough risk assessments and better-structured lending. By automating data extraction and validation, OCR ensures consistent information quality across all applications.

With accurate data readily available, underwriters can focus on analyzing borrower risk rather than collecting information.

How to Implement OCR in Mortgage Underwriting

Implementing OCR for mortgage underwriting needs the right steps for a smooth transition from manual to automated intelligent document processing. Here’s a step-by-step guide for mortgage lenders looking to add OCR to their operations.

Identify Manual Data Entry Points

Start by mapping your current mortgage process to find where manual data entry happens. Look for tasks like typing information from applications, entering data from bank statements, or transferring information between systems.

These are the areas where OCR will have the biggest impact.

Create a list of all document types you process, noting their volume and complexity. This analysis helps prioritize which documents to automate first, typically starting with high-volume, standardized forms before moving to more complex documents.

Select the Right OCR Solution

Research OCR providers with experience in mortgage lending. Look for systems designed specifically for financial documents rather than general-purpose OCR.

The best mortgage OCR solutions understand loan applications, bank statements, tax forms, and other industry-specific documents.

Consider these key features when evaluating OCR systems:

- Accuracy rates for mortgage documents

- Integration capabilities with your loan origination system

- Security features and compliance certifications

- Ability to handle various document formats and quality levels

- Training and support services

Request demonstrations using your actual mortgage documents to see how each system performs with your specific needs.

Plan for Integration

Develop a clear integration plan for connecting OCR with your existing mortgage systems. Most lenders need OCR to work with their loan origination system, document management platform, and compliance tools.

Work with your IT team or vendor to map data flows between systems. Determine how extracted information will move into your loan processing workflow and what formats are needed. Plan for both successful extractions and exceptions that require manual review.

Test with Real Documents

Before full implementation, test the OCR system with a representative sample of your mortgage documents. Include various document types, quality levels, and edge cases to verify the system’s performance in real-world conditions.

Measure accuracy rates and processing times during testing. Identify any document types that cause problems and work with your vendor to improve recognition. Establish acceptable accuracy thresholds before moving forward with full implementation.

Train Your Team

Prepare your staff for the new OCR system with proper training. Focus on:

- How to scan or upload documents for optimal OCR performance

- Reviewing extraction results and handling exceptions

- Using the verification interface to correct mistakes

- Understanding how OCR fits into the overall mortgage workflow

Include both technical training on the OCR system and process training on the new workflow. Staff need to understand not just how to use the system but how it changes their daily work.

Monitor and Optimize

After implementation, closely track key performance metrics including:

- Document processing times

- Accuracy rates by document type

- Exception rates requiring manual intervention

- Overall loan processing times

Use this data to fine-tune the OCR system and surrounding processes. Most implementations see continuous improvement in the first few months as the system learns from corrections and staff become more comfortable with the new workflow.

Documents Required for Mortgage Underwriting

Mortgage underwriting requires a complete review of various documents to assess a borrower’s financial status. These documents fall into several categories, each serving a specific purpose in the underwriting process.

Income Verification Documents

Income documents show whether a borrower can afford loan payments. These include pay stubs, W-2 forms, tax returns, bank statements, and profit/loss statements for self-employed individuals.

OCR extracts key data like salary, bonus income, and tax withholdings from these documents.

Advanced OCR systems can detect patterns in income history, helping underwriters verify employment stability. They can also identify irregular deposits that might need further explanation. This automated analysis makes income verification faster and more thorough.

Identity Verification Documents

Government-issued IDs, passports, Social Security cards, and residency proofs confirm the borrower’s identity. OCR technology captures data from these documents and compares it across the application to prevent fraud.

Identity verification through OCR also helps lenders meet Know Your Customer (KYC) requirements. The system can flag mismatches in names, addresses, or other personal information that might indicate identity theft or misrepresentation.

Loan Application Documents

The completed loan application, purchase agreements, property appraisals, and title reports provide essential information about the loan and property. OCR helps extract and organize this data for underwriter review.

By automatically pulling data from these documents, OCR ensures consistency throughout the application. It can identify discrepancies that might otherwise go unnoticed, such as property address variations or purchase price inconsistencies.

Credit History Documents

Credit reports from major bureaus (Equifax, Experian, and TransUnion) show the borrower’s credit history, accounts, payment record, outstanding debts, and credit score. This information helps assess creditworthiness and debt management ability.

OCR systems can extract credit information and integrate it with other application data to calculate key ratios like debt-to-income. This data automation saves underwriters hours of manual calculations and reduces the risk of arithmetic errors.

Challenges and Solutions in OCR Adoption

Document Quality Issues

Poor-quality scans and unclear text can reduce OCR accuracy. Use OCR solutions with built-in image enhancement features to handle these issues automatically.

Diverse Document Formats

Mortgage documents vary widely in layout and style. Choose AI-powered OCR software capable of handling diverse and unstructured document types without template setup.

Security and Data Protection

Mortgage documents contain sensitive information. Select OCR technology with robust encryption, secure storage, and access controls to protect borrower data.

Integration with Existing Systems

Integrating OCR with existing LOS or accounting software may present challenges. Select OCR providers offering seamless integration and excellent technical support.

Practical OCR Use Cases in Mortgage Underwriting

Document Verification and KYC

OCR automatically extracts and verifies borrower identity details against government databases, enhancing KYC processes.

Credit Scoring and Risk Management

Automated extraction from credit reports and financial documents helps underwriters assess borrower creditworthiness rapidly and accurately.

Fraud Detection

OCR integrated with AI can identify discrepancies or document manipulations, significantly reducing mortgage fraud.

Document Classification

OCR software is also used for document classification. It indexes mortgage documents automatically, improving organization and retrieval.

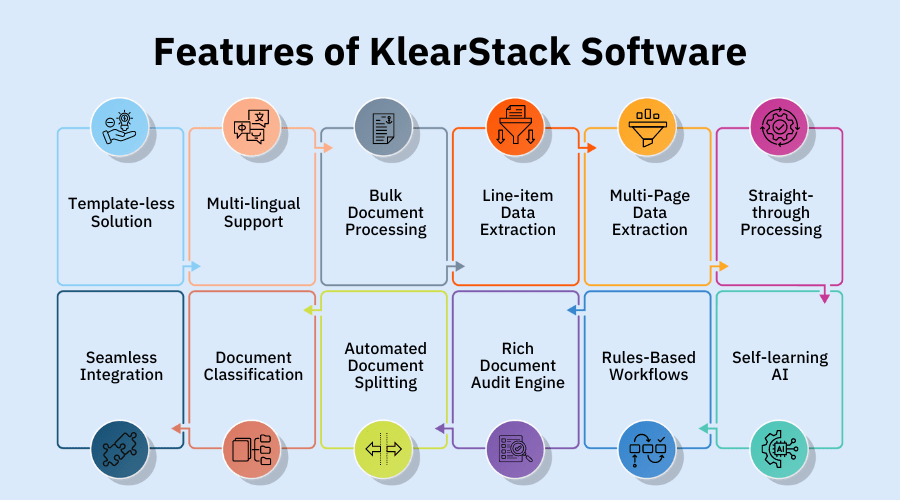

Why Should You Choose KlearStack?

KlearStack offers advanced OCR solutions tailored specifically for mortgage underwriting. Its technology provides up to 99% accuracy and significantly reduces operational costs.

Key KlearStack Advantages:

- Template-free extraction that adapts to any document layout

- AI-based self-learning for continuous accuracy improvements

- Real-time data validation and fraud detection

- Seamless integration with existing mortgage processing software

Mortgage lenders using KlearStack experience quicker processing, reduced risks, and substantial cost savings.

Conclusion

OCR in mortgage underwriting transforms loan processing by automating document handling. Adopting OCR provides lenders with:

- Dramatically improved accuracy and compliance

- Significant cost savings and better scalability

- Improved fraud detection and risk management

- Faster decision-making, boosting customer satisfaction

OCR transforms mortgage lending from a paper-heavy process to an automated schema. This shift helps lenders compete in a challenging market and meet customer expectations for quick, accurate loan processing.

Frequently Asked Questions

OCR Mortgage Underwriting automates data extraction from scanned mortgage documents, improving accuracy and efficiency.

OCR achieves up to 99% accuracy, greatly reducing errors in mortgage document processing.

OCR software integrates smoothly with most loan origination systems, simplifying implementation and usage.

OCR automates accurate data reporting, ensuring lenders consistently meet regulatory requirements.